SVIX: Time To Take Profits

Summary

- The -1x Short VIX Futures ETF (SVIX) has returned over 160% since markets bottomed in October 2022, but investors are advised to take profits due to potential risks.

- The SVIX ETF is similar to the defunct VelocityShare Daily Inverse VIX Short Term ETN (XIV), but has measures in place to reduce the risk of a 'Volmageddon' meltdown.

- Despite safeguards, there is a real risk of the SVIX ETF 'blowing up' if the VIX index spikes higher due to its -100% exposure.

TERADAT SANTIVIVUT

The -1x Short VIX Futures ETF (BATS:SVIX) provides -1x short exposure to front-month VIX futures. It is basically a replica of the defunct VelocityShare Daily Inverse VIX Short Term ETN ("XIV"), with some important differences to reduce the risk of a 'Volmageddon' meltdown.

The SVIX ETF has performed very well in the past few months, as equity markets have seemingly brushed off all negative headlines. The SVIX ETF has returned over 160% since markets bottomed in October 2022.

Although shorting VIX futures can still generate positive returns as long as the VIX futures curve remains in contango, I believe it makes sense for investors to take profits on their SVIX holdings. With -100% short exposure, there is a real risk of the SVIX ETF 'blowing up' if the VIX index were to spike higher. We saw a 15% mini-crash on July 6th from a small increase in spot VIX from 14 to 17.

Fund Overview

The -1x Short VIX Futures ETF (SVIX) gives investors exposure to shorting the VIX Index via first and second month VIX futures.

The SVIX ETF tracks the Short VIX Futures Index ("SHORTVOL Index") that expresses the daily inverse performance of a theoretical portfolio of first and second month VIX futures that are rolled daily.

XIV Redux?

The SVIX ETF was launched in March 2022 and structurally, it is very similar to the VelocityShare Daily Inverse VIX Short Term ETN ("XIV") that infamously blew up and was liquidated in 2018's 'Volmageddon' event.

'Volmageddon' was caused by the relative size of the XIV ETN and other short-volatility products getting too big. The XIV ETN operationally have to trade VIX futures at the end of every day to reset the note's short VIX futures exposure for the next day.

However, when the VIX Index spiked on February 5, 2018, the XIV ETN ended up having to buy back massive amounts of VIX Futures as its NAV declined. The problem was especially acute at the end of the day, as XIV's covering squeezed up the price of VIX futures, which caused XIV's NAV to shrink even more, which meant the ETN had to buy more VIX futures to reduce exposure, creating a doom loop.

In order to protect against an XIV-type meltdown, the SVIX ETF proposed limits on how much VIX Futures it can trade in the last 15 minutes of the trading day to 10 percent of the outstanding contracts. The SVIX ETF will also calculate its closing value by using a 15-minute time-weighted average price at the end of each day, instead of using the settlement price of the VIX futures.

This removes the direct linkage between the SVIX ETF and the settlement price of the VIX futures, which, in the manager's view, will reduce the amount of losses the ETF holders will suffer in the event of another volatility spike.

Portfolio Holdings

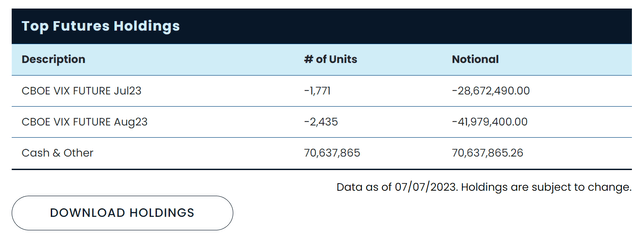

Figure 1 shows the holdings of the SVIX ETF as of July 7, 2023. The SVIX ETF is currently short 40% notional exposure on July VIX futures and 60% notional exposure on August VIX futures.

Figure 1 - SVIX holdings (volatilityshares.com)

Distribution & Yield

The SVIX ETF does not pay a distribution.

Returns

Measured from inception, the SVIX ETF has returned 77.5% total returns compared to the market, as represented by the SPDR S&P 500 ETF Trust (SPY) which has returned -2.2% (Figure 2).

Figure 2 - SVIX has massively outperformed SPY since inception (Seeking Alpha)

In fact, the bulk of SVIX's returns has been delivered after the markets bottomed in October. Measured from October 12, 2022, the SVIX has returned 161.7% compared to SPY's 24.8% (Figure 3).

Figure 3 - SVIX's performance from October 2022 has been especially impressive (Seeking Alpha)

Can Shorting Volatility Work In Low Vol Environment?

Recently, I looked at the Simplify Volatility Premium ETF (SVOL) in a low volatility regime and concluded SVOL's strategy of shorting 2nd and 3rd month VIX futures works as long as the VIX curve remains in contango.

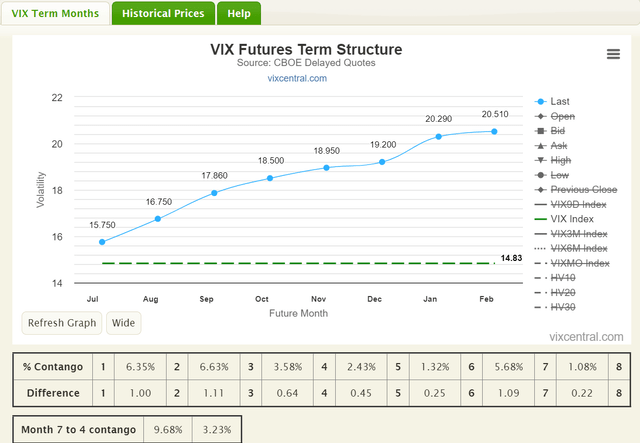

I believe the basic concepts apply to the SVIX ETF. Provided the VIX curve remains in contango, SVIX should continue to generate positive returns since it is short the 1st and 2nd month VIX futures (Figure 4).

Figure 4 - Illustrative VIX curve contango (vixcentral.com)

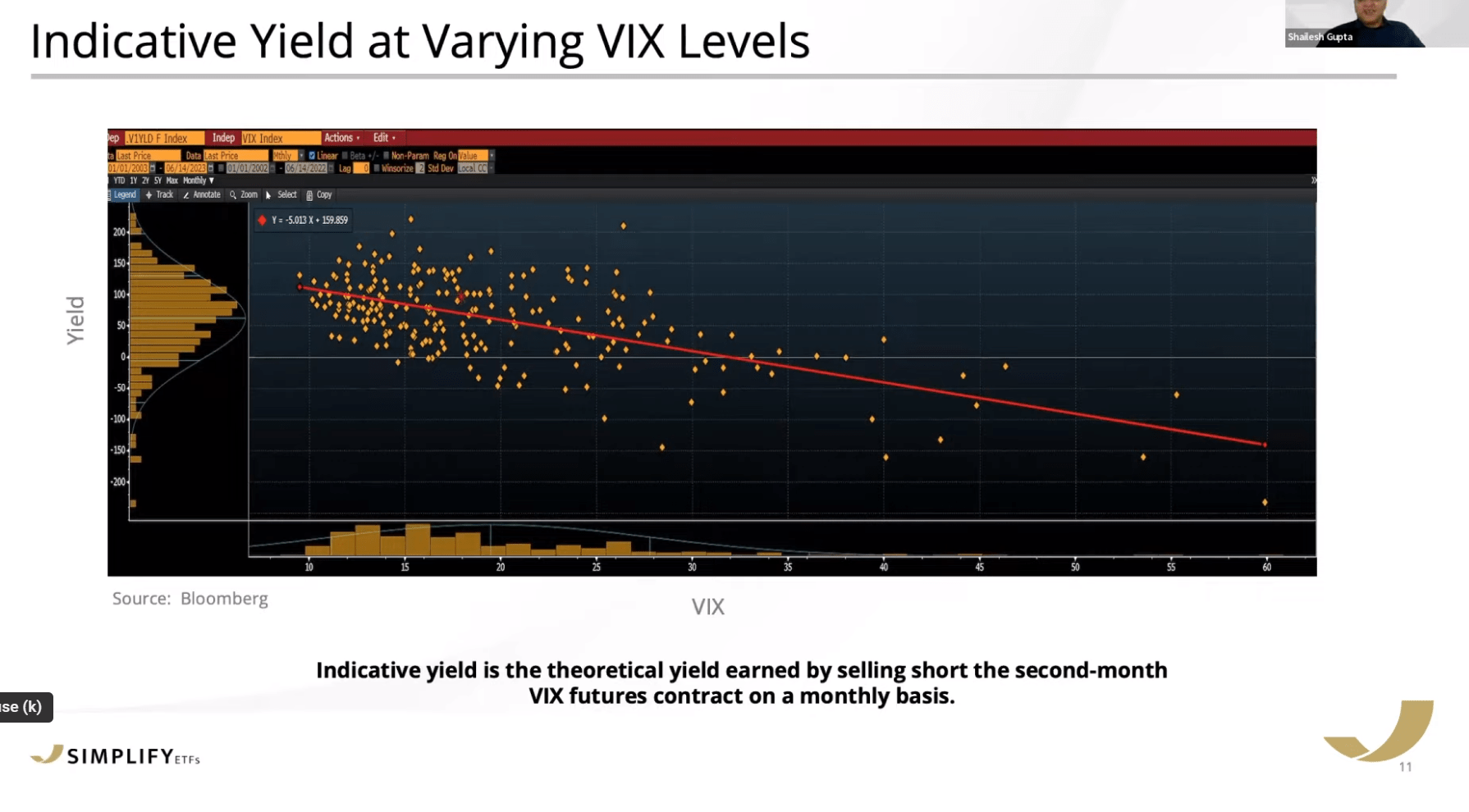

In fact, empirical data from Simplify Asset Management suggest shorting volatility works better the lower the level of spot VIX (Figure 5). According to Simplify's portfolio manager Shailesh Gupta, when absolute volatility is low, investors tend to pay up for 'hedges', which keeps the contango steep and the yields high for short vol strategies.

Figure 5 - Shorting vol generates higher yields in lower VIX environments (Simplify Asset Management)

SVIX At Risk Of Blowing Up

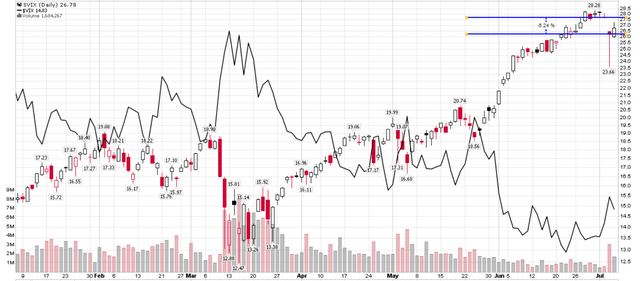

However, in my opinion, the high yield earned by shorting volatility in a low volatility environments could simply be a sign of increased risk. For example, the SVIX ETF lost more than 5% on July 6th when the spot VIX Index jumped from 14.2 to 15.4. At the nadir on July 6th, the SVIX ETF was down by almost 15% as spot VIX had jumped to over 17 (Figure 5).

Figure 6 - Short volatility is risky in current environment (Author created with price chart from stockcharts.com)

So when the spot VIX Index is as low as it is now, investors in short volatility products like the SVIX ETF must be extra vigilant. In fact, after a terrific run from the March regional banking crisis lows of ~$13 / share, the SVIX ETF has more than doubled. Investors currently holding the SVIX ETF may want to take some profits and await a better opportunity to re-enter the short.

SVIX Vs. SVOL

Readers may be wondering, why am I recommending investors take profits on SVIX and not on SVOL? Isn't that a double standard?

The difference between the two funds is their amount of short volatility exposure.

While the SVOL ETF attempts to beta adjust the short volatility exposure to that of the market (i.e. SVOL is only short 20-30% notional), the SVIX ETF is short 100% all the time. Furthermore, when volatility is declining and the trade is working, the SVOL ETF may decide not to 'chase' exposure, and allow a 25% short to run down to 20%. Conversely, the SVIX ETF rebalances every day to be 100% short. Finally, with only 20-30% short exposure, the SVOL ETF is unlikely to 'blow up', even if volatility were to double overnight across the VIX curve. Yes, returns will likely be ugly, but the majority of principal will still be there. However, if volatility were to double overnight, for example, if July VIX were to go from 15.8 currently to 31.6, then there is a real possibility that the SVIX ETF will be completely wiped out, even with the safeguards the manager has put in place.

We already saw a mini crash on July 6th, when the SVIX ETF briefly lost 15% of its value when VIX increased from 14.2 to 17 intraday. It is not hard to imagine some black swan event taking volatility to over 30, and wiping out SVIX unitholders in the process

Therefore, for current unitholders of SVIX, they must personally make the decision to take profits when the risk/reward is no longer favourable.

Conclusion

The SVIX ETF provides -1x short exposure to front-month VIX futures. The SVIX ETF has performed very well in the past few months, as equity markets have seemingly brushed off all negative headlines.

However, with spot VIX currently very low, it may make sense for investors to take profits on their SVIX positions. As we saw briefly on July 6th, there is a real risk of the SVIX ETF 'blowing up' if the VIX index were to spike higher from current levels due to the -100% exposure the SVIX ETF carries.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SVOL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.