NNN REIT: Buy Before The Fed Hits The 'Permanent' Pause Button

Summary

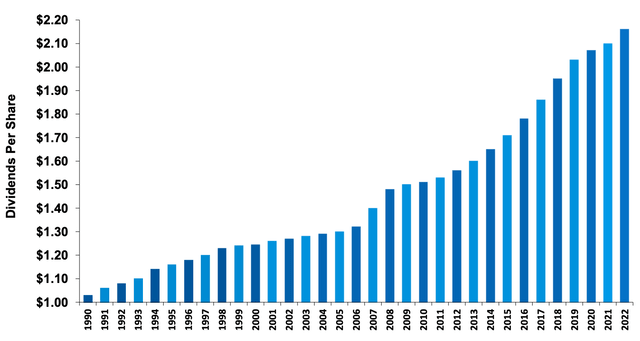

- NNN REIT, Inc. has paid and increased dividends for over 33 years in a row.

- This means that the company is 17 years away from being an elite Dividend King (50+ years in a row).

- It's been rare to find blue-chip REITs offering 5%+ yields, while trading for just 13x forward AFFO estimates.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

frender

This article was published at iREIT® on Alpha on Sunday, July 2, 2023.

Throughout 2023, we’ve seen many of the most popular real estate investment trusts, or REITs, sell off. I’ve been happy to wear my contrarian hat as I pound the table for these long-term buying opportunities.

Looking across the REIT landscape, I’ve highlighted numerous blue-chip opportunities lately that provide not only safe and reliable dividend income, but also double-digit total return prospects.

People often think of REITs as boring, income-oriented investment vehicles. And during many market conditions, it’s true that the majority of returns provided by REITs come from their dividend yields.

But, when the sector is so out of favor and we’re seeing valuation multiples that are well below historical norms, the addition of the multiple expansion via mean reversion component into the total return equation changes the game.

And that’s not just the case for the most popular REITs in the sector.

There are dozens of overlooked companies that offer safe yields, reliable growth, and cheap valuations in today’s market environment.

Today we’ll be discussing one such opportunity: NNN REIT, Inc. (NYSE:NNN).

NNN REIT: An Underappreciated Blue Chip

As my readers know, I have over two decades of experience in the Net Lease REIT sector, having developed dozens of properties for chains such as Advance Auto (AAP), O’Reilly Auto Parts (ORLY), Dollar General (DG), and The Sherwin-Williams Company (SHW).

What I love about Net Lease investing is that there is very little landlord responsibility. Whenever you sign a net-net-net ("NNN") lease contract, your tenant is paying for the taxes, insurance, and maintenance (i.e., snow removal, roof leaks, clogged toilet, etc.).

So, as a landlord of a net lease property, you don’t have to worry about another of the so-called 3 T’s…

- Taxes

- Toilets

- Trash.

The tenant bears all of these responsibilities…

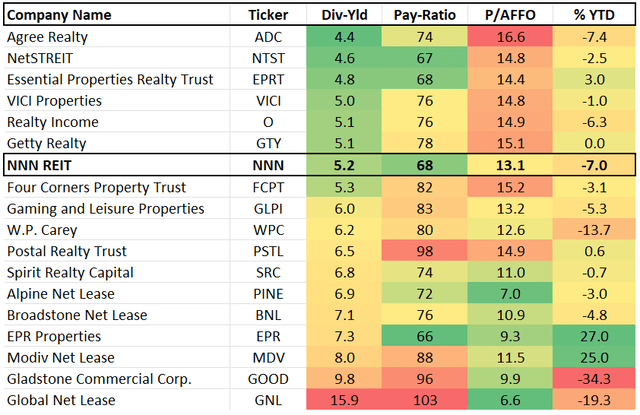

Realty Income Corporation (O) remains our favorite pick in the triple net lease space; this company is down 6.3% on the year, trades at a historically cheap valuation, and offers investors an abnormally large dividend yield.

We like companies like Realty Income and another net lease REIT that we’ve recently put the spotlight on, W. P. Carey Inc. (WPC), because of their well-diversified portfolios (both in terms of geographic diversification due their European investments and their diverse portfolio of tenants and property types which encompass more than just retail square footage).

But, that doesn’t mean that O and WPC are the only companies in the space that we’re bullish on.

Diversification doesn’t only matter in real estate portfolios…it’s also very important that individual investors pay close attention to their asset allocation and avoid taking on too much single stock risk.

And with that being said, we’re happy to highlight another high-quality company from the net lease segment of REITdom which also offers investors an appealing valuation.

For investors who are looking for an American pure play in the retail/discretionary space, we continue to believe that NNN REIT offers an attractive opportunity for income-oriented investors.

NNN REIT is down by 7% on the year.

And yet, the majority of this company’s portfolio is made up of relatively safe and predictable assets.

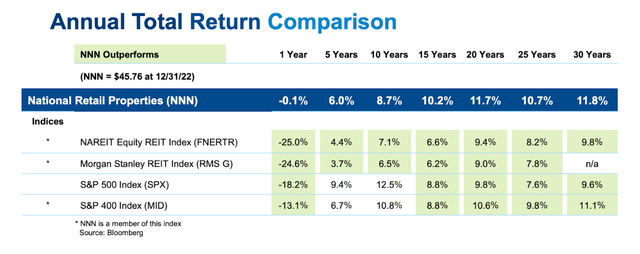

At the end of 2022, NNN shared this graphic with its investors, highlighting the stock’s long-term outperformance metrics (relative to its peers, the REIT sector, and even the broader market).

Data like this probably comes as a surprise to many for the people who view REITs as boring investments only suited for retirees; however, the fact of the matter is, the blue chip names from this sector can compound capital at comparable rates to the best of the best stocks in the entire market.

No, you’d never expect to see an meteoric rise from a name like NNN similar to some of the moves that we’ve witnessed from the artificial intelligence stocks this year; however, I’d argue that net lease REITs are much more predictable over the long-term and therefore, should be much more attractive to risk-averse investors.

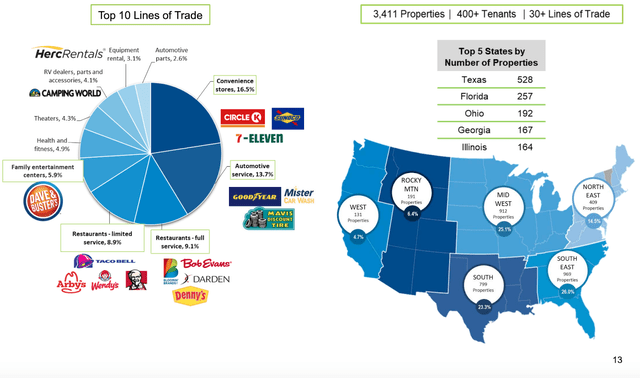

Like the other top net lease REITs, NNN has a strict screening process when it comes to the buildings that it acquires.

The company looks for high traffic locations that are suited for higher quality tenants, resulting in both reliable cash flows and quick re-leases (with rent escalators in place) throughout a wide variety of economic conditions.

This strategy has allowed the company to average 4.6% annual AFFO growth since 2016.

This includes the -10% AFFO growth year that NNN experienced in 2020 during the worst of the COVID-19 pandemic.

And when you look at the top tenants from NNN’s portfolio you’ll see why this company has been so consistent…these are largely household names that aren’t going anywhere, anytime soon.

Yes, NNN has a combined 9.2% exposure to theatres and gyms.

These have been a drag on the company since the pandemic started. And the theater industry is still a tough place to be due to the ongoing struggles that we’re seeing play out at the box office and in the legacy media space at large.

However, the fitness industry has roared back nicely from its pandemic lows and overall, when we look at NNN’s holdings, we remain impressed with the portfolio that this management team has put together.

We’re so impressed that we wouldn’t be totally surprised if other, larger companies (or even the mega-alternative asset managers) begin to kick the tires on this $7.8 billion company as the price continues to fall from an M&A perspective.

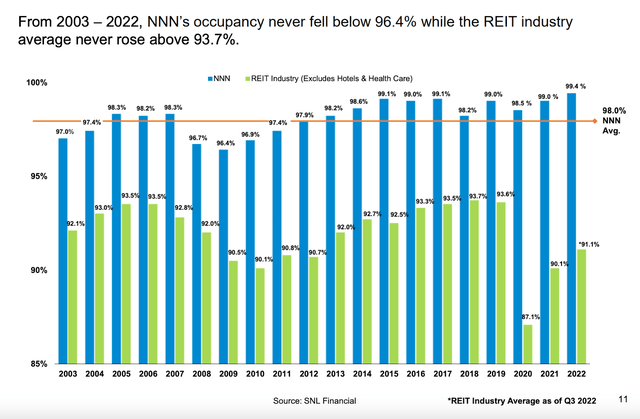

NNN has established itself as a leader in terms of sector-wide occupancy data and to me, occupancy rates and rental collection rates are two of the most important metrics that any REIT investor should track.

Well, if a landlord can’t rent out its building and collect monthly checks then what’s the point, right?

The above average metrics that NNN sports in these two metrics leads me to believe that this company’s portfolio could serve as a ready-made cash flow engine for a larger competitor or alternative asset manager who is sitting on a mountain of dry powder that it wants to make more productive.

Consolidation within the net lease space has been a major theme of my bullish outlook on the industry long-term.

Data shows that the vast majority of commercial real estate in the U.S. is privately owned so there is still a long growth runway for these companies when it comes to acquiring property for their portfolios.

But, for the larger names in the space (such as Realty Income), it’s much easier to move the needle with a large-scale M&A deal than it is to vet 1000’s of individual properties to buy.

At the end of Q1, NNN owned 3,449 properties with an occupancy ratio of 99.4%.

As NNN’s valuation sinks lower (more on this in a moment) the idea of a larger company making an accretive deal here, even with the typical double-digit M&A premium in place, becomes more and more feasible.

NNN set records in 2022 with regard to top and bottom-line results.

And looking at this company’s history, investors shouldn’t have been surprised by that.

NNN has a long history of generating predictable, reliable growth and that trajectory remains in place today.

With regard to predictability, NNN seeks to initiate leases in the 10-20 year range, providing management with a long outlook on cash flows.

Currently, NNN’s average lease duration is 10.3 years.

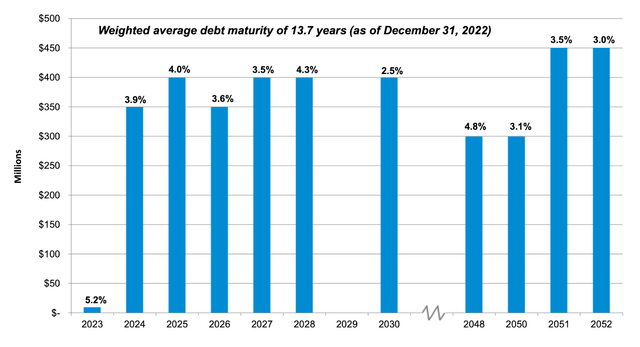

Also, in terms of long-term reliability, NNN also has the longest average weighted debt duration in the industry of 12.9 years.

At the end of its most recent quarter, NNN management noted that it had “no material debt maturities until 2024" and in general, this company’s debt maturity ladder is much more appealing than say, W.P. Carey, which is seeing a significant amount of debt coming due over the next 2-3 years.

We’re always looking to capitalize on irrationally negative sentiment in the market and therefore, NNN shares are a prime candidate.

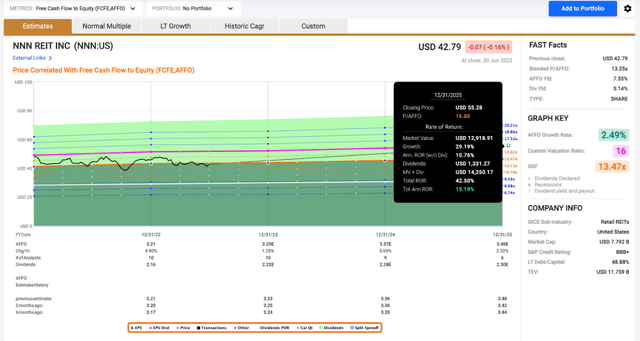

Although NNN shares are down on the year, their fundamentals continue to increase and looking out into the future, the growth outlook remains positive.

As you can see above, the growth here isn’t fast, but as they say, slow and steady wins the face.

When you combine NNN’s 5%+ dividend yield with its low-to-mid single digit AFFO growth prospects and the potential of mean reversion leading to multiple expansion, this somewhat boring name brings an appealing risk/reward proposition to the table.

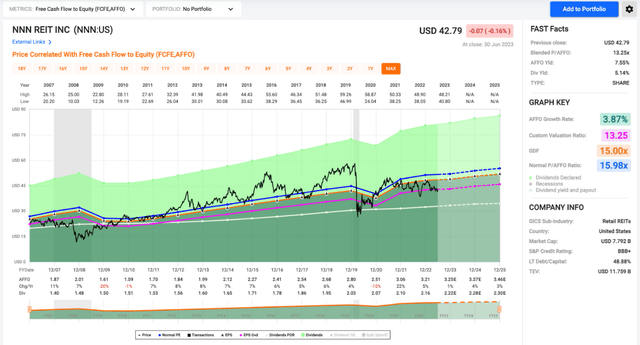

Looking at the graph, you’ll notice that outside of the worst two crashes we’ve seen during the last 20 years (the Great Recession and the Covid-19 bottom), NNN shares have never traded with a lower premium than they do today.

Yes, interest rates are much higher now than they’ve been throughout the last decade; however, we also don’t necessarily believe that rates will stay elevated like this forever.

If the Fed makes a dovish pivot like so many economists/analysts are predicting during the coming year, then beaten-down REITs like NNN will see their valuations soar.

And in the meantime, they’re still growing their sales/earnings and compounding their dividends, so we remain content to allocate capital towards unloved REITs because their long-term outlook is more attractive than the so-called “risk free” assets such as short-term bonds.

In the event that NNN rebounds back up to its long-term P/AFFO average in the 16x range, then these shares offer ~15% total return potential.

Being that we don’t expect to see a severe recession in the short-term, we believe that NNN shares offer an attractive risk/reward balance here.

Sure, it’s possible that NNN could trade down to the 9-10x range like we’ve seen during the last two market crashes (or even lower, if negative sentiment persists); however, that doesn’t seem likely.

To us, the more likely outcome in multiple expansion back up to the 15x-16x area, which implies double digit total returns.

You’re going to be hard-pressed to find any investment grade bonds that offer that sort of compounding potential in the market today.

The Dividend

Last, but certainly not least, let’s talk about the dividend here (since this is what investors will be collecting while they wait for positive sentiment to cause NNN’s multiple to expand).

The company currently yields 5.14%.

NNN has provided investors with 33 years of consecutive dividend raises, meaning that NNN has the third-longest active dividend growth streak in the real estate sector and a streak that is longer than the streaks associated with 99% of all public companies.

NNN’s last dividend raise came in at 3.8% in July of 2022 and we believe that the company is likely to provide another low-single digit raise in July of 2023 as well.

NNN’s 5-year dividend growth rate currently stands at 2.98%.

A 5% yield compounding at a 3% annual rate might not seem exciting at first glance, but what this means is that NNN is protecting its investors’ purchasing power during times of normal (~2%) inflation.

Looking at 2023 AFFO estimates, analysts are calling for a full-year result of $3.25 right now.

Right now, NNN’s annual dividend sits at $2.20.

We expect to see that rise to the $2.24-$2.28 range once the 2023 raise is announced later this month.

And either way, that implies a nice margin of safety relative to the 2023 AFFO estimates…we’re looking at a forward dividend payout ratio of 68.9%-70.2% based upon our estimates.

Conclusion

Historically, it’s been rare to find blue-chip REITs offering 5%+ yields while trading for just 13x forward AFFO estimates.

With that in mind, we believe that NNN is a “Buy” right now.

Currently our “Buy Below” threshold for NNN shares is $48.00.

QR

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 168,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 110,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College, and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of NNN, O, WPC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (26)

smeadcap.com/...