ETF Reliable Retirement Portfolio: 2023 Update And Second-Half Investment Outlook

Summary

- On November 9, 2021, I launched the ETF Reliable Retirement Portfolio.

- Working from various 2022 investment outlooks as well as other research material, I constructed a 16-ETF portfolio that seeks to balance diversity, growth, and current income.

- In this update, I honestly share what went well, and not so well, during the period, including a helpful by-ETF breakout.

- Perhaps even more importantly, I offer my views on the second half of 2023.

Dilok Klaisataporn/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate.)

On November 12, 2021, in conjunction with the Hoya Capital Income Builder (hereafter HCIB) marketplace service, I introduced the ETF Reliable Retirement Portfolio (hereafter ETFRRP).

For tracking purposes, the official inception date of the portfolio was November 9, 2021. The purchase prices used were the closing prices from the previous day, November 8, 2021. We decided on $500,000 as the opening value of the hypothetical portfolio, as we felt this amount perhaps struck a nice median as being representative of an investor who subscribed to a service such as HCIB.

On January 19, 2023, I offered the 2022 Q4 and full-year update on the portfolio, as well as my investment outlook for 2023.

Here is how I summarized that update:

Briefly, as can be seen, Q4 was solid for this fairly conservative portfolio, with a gain of 7.98%. This cut the overall loss for the year to 12.18%, as opposed to the 18.66% YTD loss I reported in Q3. I can accurately report that dividends on the portfolio were $13,006 for calendar-year 2022, or an overall dividend return of 2.60%.

Due to an extended European vacation in April, I was unable to complete the Q1 update that I would have normally provided. However, I have one screen capture showing the ending balance at March 31, 2023, and will briefly reference and incorporate this a little later.

For a complete discussion of the theory behind the initial portfolio construction, as well as the starting balance and positions, please feel free to reference the articles referenced above. In the next section, however, I will offer an abbreviated overview of key data points and concepts to lay a groundwork for the performance update that is ultimately the subject of this article.

Portfolio Structure And Themes

Based on investment outlooks from several reputable sources, here are the key themes that drove portfolio construction.

- A bias toward value stocks in the U.S. - Of late, a relatively small subset of U.S. growth stocks has significantly outperformed virtually every other asset class. Various analyses suggest that value stocks may offer a better risk/reward profile moving forward.

- The return from U.S. equities may be only marginally higher than bonds - Particularly for retirees, finding a solid balance of risk/reward is worthy of consideration. I attempt to find this balance in my portfolio.

- Superior growth opportunities may come from outside the U.S. - A mid-year 2021 update from Vanguard forecast Euro-area stocks as potentially outperforming their U.S. cousins by roughly one-half percent; a range of 2.9% - 4.9% as opposed to 2.4% - 4.4%. And emerging markets offered even higher potential, albeit with more volatility and risk.

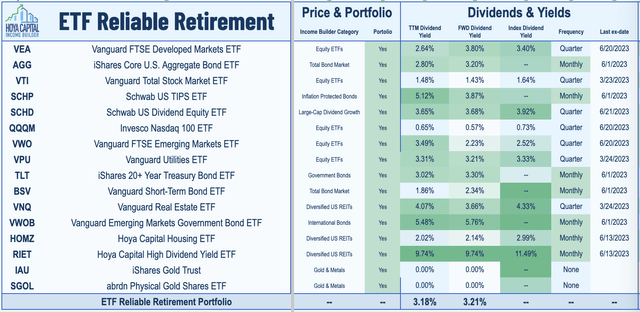

Below, I have reproduced the table of exchange-traded funds ("ETFs") included in the portfolio. However, the weightings are proprietary to subscribers of Hoya Capital Income Builder.

ETFRRP by ETF Monkey (Hoya Capital Income Builder)

At a high level, the portfolio is comprised of five asset classes:

- U.S. Stocks

- Foreign Stocks

- Bonds/TIPS

- Real Estate

- Gold.

As a conclusion to this section, I might note that, while a high dividend level was not the primary focus of this portfolio, 7 of the 14 dividend-producing ETFs pay dividends monthly, with the remaining 7 paying quarterly. The two gold-backed ETFs, of course, pay no dividends.

2023 H1 Update: Where The Rubber Meets The Road

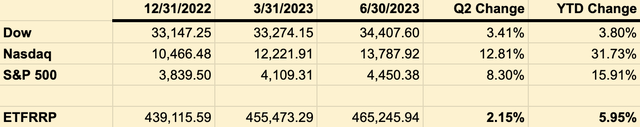

In the graphic below, I offer a comprehensive overview of how the ETFRRP has performed, compared with major U.S. market averages.

ETFRRP by ETF Monkey YTD vs. Market Averages (Author-Generated Spreadsheet)

Briefly, as can be seen, my conservatively-positioned portfolio generated relatively modest returns for the first half of 2023, with an overall gain of 5.95%. As will be detailed in a graphic a bit later in the article, dividends for the portfolio were $5,922 during this period. Thus, the total return of the portfolio was comprised of 4.6% gains and 1.35% dividends.

As a reference point, my personal portfolio had a YTD gain of 5.63% through Q2. This reflects that fact, for better or worse, everything that I write about as well as recommend in this portfolio closely reflects the structure and philosophy of my personal portfolio.

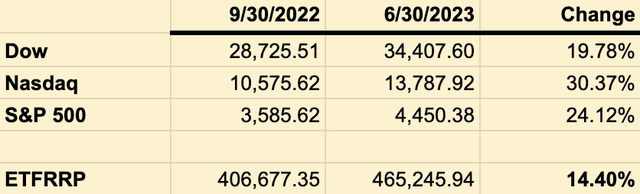

For this report, I decided to include one more reference point for consideration. Generally speaking, U.S. markets established their recent lows roughly the middle of October, 2022. As a result, my Q3 report from last year is of some interest in evaluating how my portfolio has performed since those lows.

ETFRRP by ETF Monkey vs. Market Averages - Since Q3 2022 (Author-Generated Spreadsheet)

With a total return of 14.40% since that point, find myself pleased with those overall results.

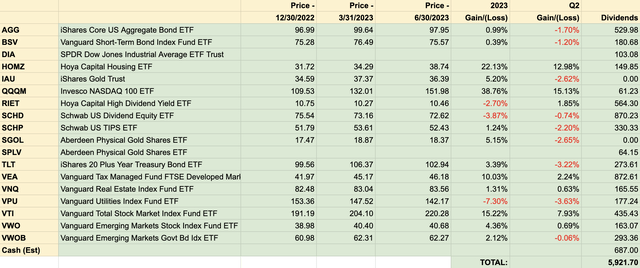

On the other hand, I am not as happy with the relatively modest returns generated by the portfolio during the first half of 2023. As an aid in analyzing this, with the help of GOOGLEFINANCE functions I put together a comprehensive spreadsheet, breaking out the results by ETF. A nice feature of this particular graphic is that it shows both the price action as well as the dividends generated by each ETF. Have a look, and then I will offer just a few brief comments.

ETFRRP - Performance By ETF (Author-Generated Spreadsheet)

If you look down the '2023 Gain/(Loss)' column, it becomes clear why the performance of this well-diversified performance was somewhat mediocre. While the S&P 500 index soared by 15.91% during this period and the Nasdaq index rocketed upwards to the tune of 31.73%, only 4 of the 16 ETFs in the ETFRRP registered double-digit gains. The other 12 ETFs did no better than roughly 5% gains, and 3 actually lost value during the period.

The one major change I made in the portfolio was based on this article I wrote back on January 30. I did an ETF swap in the ETFRRP, replacing Invesco S&P 500 Low Volatility ETF (SPLV) and SPDR Dow Jones Industrial Average ETF (DIA) with Invesco NASDAQ 100 ETF (QQQM) and Schwab US Dividend Equity ETF (SCHD). Interestingly, this decision has turned out to be a mixed bag in terms of performance, at least so far. While QQQM was my #1 performer for the period, SCHD struggled for the first time in quite a long while, actually registering a loss during the period covered by this report.

Finally, interest rate-sensitive asset classes continued to suffer during this period. In general, the ETFs that were by far my worst performers all bore some relation to this factor.

2023 Second Half Investment Outlook

In my last summary of the portfolio, I referenced my article The World Of 4,818 Faces An Uncertain Future, written in August, 2022. In that article, I posited that continuing inflation as well as geopolitical shocks were going to combine to make it challenging for the S&P 500 to regain that all-time high of 4,818, achieved on January 14, 2022.

While this caused the results produced by the ETFRRP to be less than spectacular during the first half of 2023, I continue to believe in the underlying rationale that causes me to position the fund the way I do.

Here are just a couple of reasons I believe this to be the case.

First, recent developments continue to point to the belief that the fight against inflation is far from over.

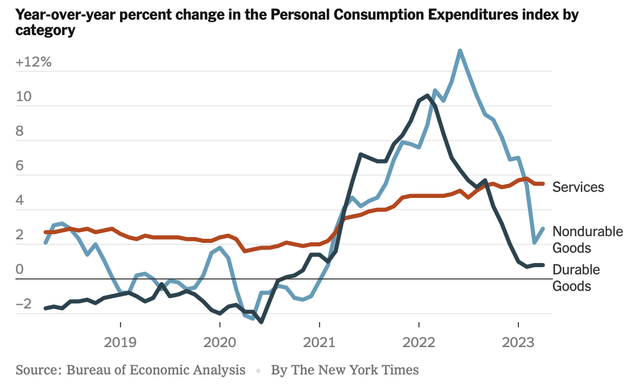

A recent article in The New York Times featured this graphic.

Personal Consumption Expenditures (PCE) Index By Category (The New York Times)

The line to notice is the red line, representing the portion of the PCE index relating to Services. While it is absolutely the case that the Goods portion of the PCE index has experienced declines of late, the Services portion is proving somewhat stubborn. As Jerome Powell has pointed out on multiple occasions, this particular component of inflation can be the hardest to break because wages make up the largest cost in delivering these services. Related to this, wage gains in the most recent jobs reports continue to be strong.

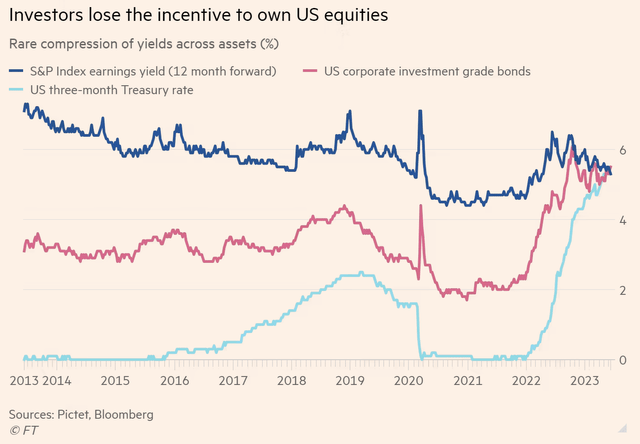

Here's a second reason. The substantial interest rate increases implemented by the Fed over the past year have caused a huge increase in the returns on risk-free cash. Additionally, while these same increases have contributed to the poor price returns on bonds that contributed to the somewhat mediocre performance of the ETFRRP of late, the inverse of that is that the yield on such bonds has risen.

Where does that all leave us? Have a look at this recent graphic.

Yields On US Equities, Cash, and Bonds (Financial Times - Bloomberg)

Essentially, the yields on U.S. equities, cash, and bonds have arrived at a point where they are roughly equivalent at the present time. This may well serve as a headwind with respect to future stock returns.

As a result, my view for the second half of 2023 continues to be that investors-and in particular conservative investors-would do well to stay conservatively positioned and well-diversified.

What are some takeaways?

- Keep a reasonable portion of your portfolio in cash, in order to take advantage of opportunities which may present themselves.

- Decent returns are very likely to be had from bonds, with the best risk/reward profile coming at the short end of the duration spectrum.

- Foreign equities began to awake from slumber during the first half of 2023 and I believe this may well continue. Therefore, maintain a nice balance between global and U.S. equities.

I'll stop there for now. I hope this piece has proved to be of some use, offering a perspective to consider. I'd love to hear from you in the comments below!

ETF Monkey Teams Up With Income Builder

ETF Monkey has teamed up with Hoya Capital to offer the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGG, BSV, DIA, QQQM, RIET, SCHD, SCHP, TLT, VNQ, VTI, VWOB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)

Personally I'll hand pick my portfolio

Cheers

VTV with the addition of VTG which seems to be a good blend. . With a limited selection of holdings, you can not cover the universe but you can create a stable base for your holdings.

For the record, I do already hold IAU and rfi to cover both gold and property. But I think the key for this exercise is to come up with a very limited number of funds so that you are not looking at fifty funds or even twenty all the time. Merely an observation and thank you for the effort. SC