FlatexDEGIRO - A Very Rare Growth Stock Investment From Me

Summary

- I rarely invest in growth stocks, but when I do, I prefer smaller companies in excellent positions, like Seafire AB, a Swedish company in which I made a 400% return on investment.

- This is not my typical investment strategy and because many of my readers would not be able to invest in such companies, I don't cover them often.

- I recently invested in FlatexDEGIRO, an online broker, and plan to expand this investment over time. I see a 100%+ upside here.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Vitezslav Vylicil

Author's Note: This article was published on iREIT on Alpha in early July 2023.

Dear subscribers,

It's very, very rare that you will find me investing in any sort of growth stock. A stock that does not pay a dividend, or the appeal hinging entirely on capital appreciation is not an investment I make lightly, often or without having a clear goal for the position or the company.

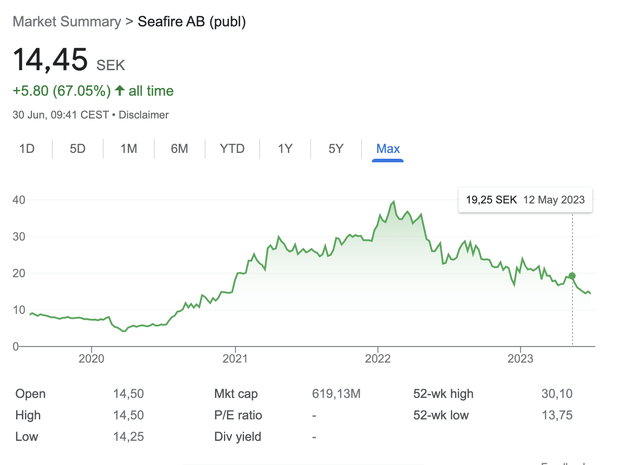

However, typically, when I do growth investments, they tend to be smaller companies in excellent positions. One of the last growth stock investments I made was a small company known as Seafire AB. Not only did I know management, but I had spent years following the company and its strategy. I was confident that an investment would generate triple-digit RoR, and so I bought a modest allocation, around $8000 worth of shares, at near a bottom price. I sold this during tech froth mania.

Seafire Stock (Google Finance)

I ended up making over 400% on the investment. There are a few reasons why you don't see me talking about such investments often, or why you have never seen or heard about this one:

- Seafire is a company that 90%+ of you cannot invest in, it's a Swedish business with less than $80M market cap. It has no ADR.

- Seafire is in no way representative of the investments I make 99% of the time, and starting to showcase such investments might give people the wrong impression about how I invest on a general level.

- It was a small investment.

But I do, at times, invest in growth stocks.

And today, I'm going to show you a recent purchase that I intend to expand upon with time.

flatexDEGIRO (OTCPK:FNNTF) - An online broker with a realistic upside

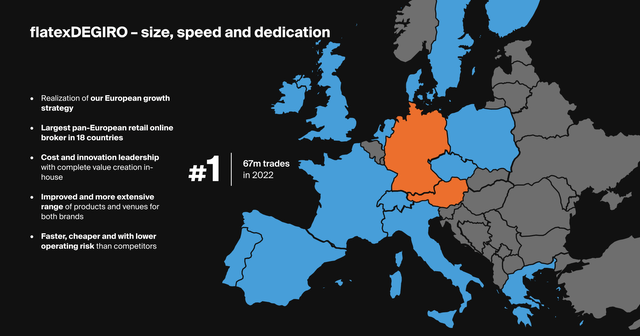

So, many of you may not know this, but Europe is fairly fragmented when it comes to brokerages. There are local big players - we use Nordnet and Avanza in Sweden and Scandinavia in some parts, but there are no Schwabs (SCHW) that have a pan-European coverage, or similar dominance.

European market outperformed and online brokers that manage to show real dominance are, therefore, potentially interesting to me. I like investing in brokers and in stock market operators, as evidenced by my coverage of Deutsche Börse (OTCPK:DBOEY) and similar companies. I "know" that the right company doing on the European continent what IBKR (IBKR) is doing globally, would generate significant profit and returns - and that some areas which are undercover by IBKR, such as Germany, France, and Southern European Countries are ripe for entry.

Therefore, enter FlatexDEGIRO.

The company is the leading and fastest-growing online broker with 16 million customers in 16 countries. Flatex recently purchased DEGIRO, which means that the company with a current market capitalization of less than €1B handles 91M transactions on a yearly basis, or a transaction volume of €350B - and I believe this to be only the beginning.

Flatex IR (Flatex IR)

So - 16 markets, 2.4M customer accounts, 1,300 employees, €40B in assets under custody, and over 65M LTM executed trades make this company what it is. It has an appealing revenue model split between online brokerage, credit/treasury, and IT/services, with brokerage being almost 75% of the company's revenues.

What makes this growth company so much better than others?

What makes me cover such a company like this one?

Profitability.

As I've always said, I focus on fundamentals and value. So let's begin with fundamentals.

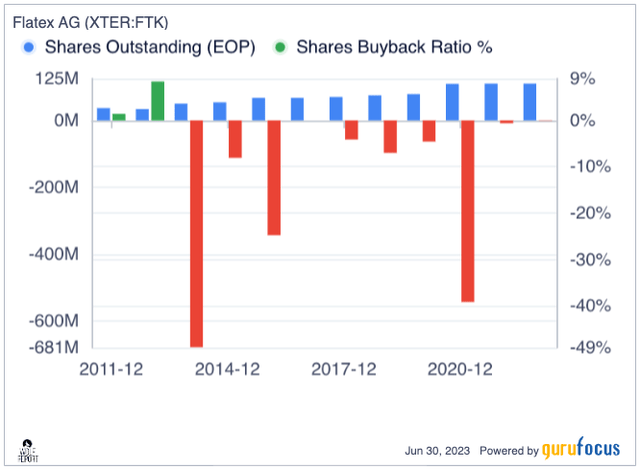

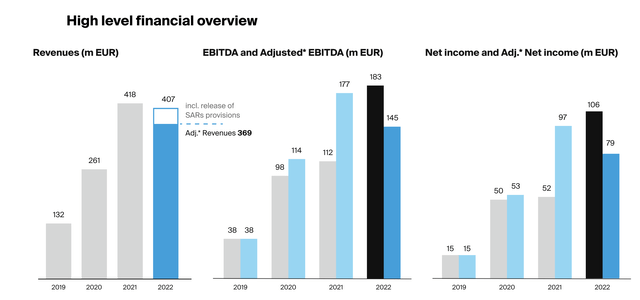

flatexDEGIRO has one of the best ROCE numbers in the industry, and despite its current smaller scale, manages above-average profitability metrics in terms of 67% gross margins, 32% operating margin, and a nearly 19% net margin. The company has an extremely low debt to EBITDA at 0.28x, one of the best in the industry. However, it's also in a position to still issue substantial amounts of common shares at a relatively continual pace.

Flatex SO (GuruFocus)

However, the company has very much a working business model - and that's what I want to see when I invest in a company. It's the bread and butter of investing, and especially in companies that are small and relatively new to the market. There are investors that invest in unprofitable companies hoping for a turnaround, but I am not one of them - not if the profitability issues are well-established.

With this company, despite its size and age, the business is running like a well-oiled machine already, churning out over 20% net margins for the 2022 period.

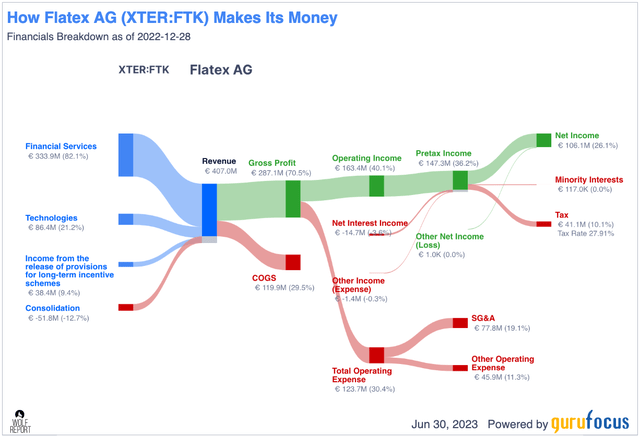

Flatex revenue/net (GuruFocus)

Like any online broker, the company makes money through commissions, margins and trades/interest and fees. Profitability has been a thing for Flatex for several years.

FlatexDegiro IR (FlatexDegiro IR)

As with most brokers, 2021 was the high year with almost 100M transactions and closing in on €44B assets under custody - but the company is still growing, with almost 500 000 net adds in customers during 2022 alone. The company's geographical coverage is very impressive.

FlatexDegiro IR (FlatexDegiro IR)

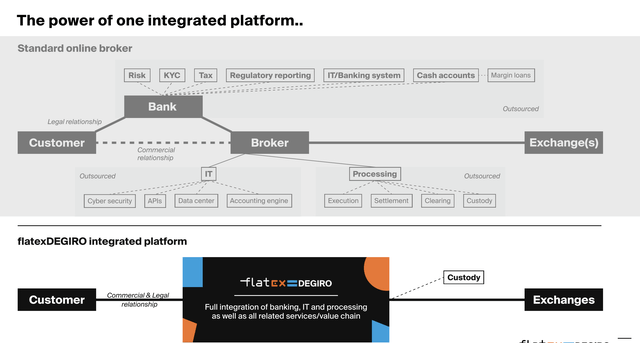

The company is an attempt to bring multiple otherwise complex geographies together - and they're doing this very well thus far. What differentiates the company from other online brokerages is its full integration of banking, IT and processing as well as all related services, compared to a standard broker which needs to have banking contacts, legal relationships, IT and processing relationships in a way that flatexDEGIRO does not have.

FlatexDEGIRO IR (FlatexDEGIRO IR)

This enables scaling and edge when it comes to customers, because it means that partners can integrate seamlessly, including investment banks, ETF providers, fund managers and others, which then have the ability to connect to a wide European customer base. The company has already won a wide variety of awards, meany of them in Germany.

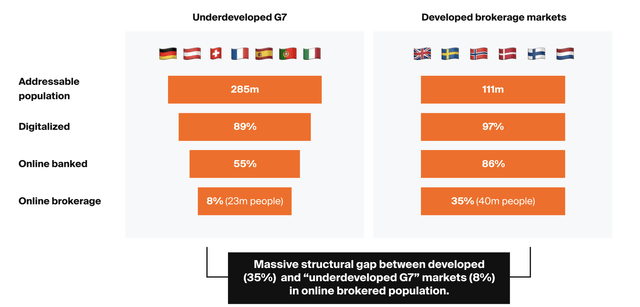

For those of you who do not know this - most of Europe aside from Scandinavia, UK and Netherlands, are extremely underdeveloped in terms of brokers and investment/online brokerages. Only 8% of people in France, Spain, Portugal, Italy, Germany, Austria and Switzerland use online brokerages - 23 million people. In the developed aforementioned markets that number is 40M people, but that's 35% of the total.

FlatexDEGIRO IR (FlatexDEGIRO IR)

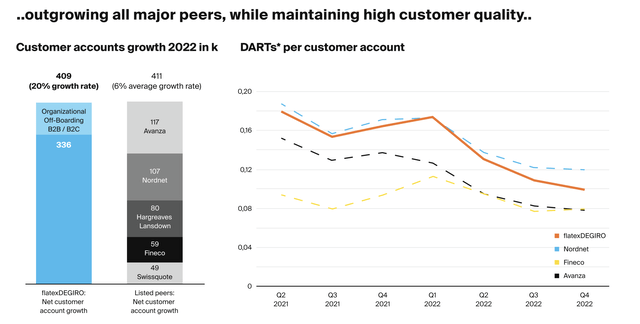

So there is plenty of room to grow for the company. And the wide availability of information and growing interest in investing across Europe makes this the perfect time to go deeper into something like this. We're talking about 285M people, a 100M customer market assuming a LFL penetration to Scandinavia of 35%. The company is already leading the charge a bit with zero commission trading, transparent pricing, and no payment dependency, with its core markets of Netherlands, Germany, and Austria - and the growth markets are leading the charge here with significant account growth that has resulted in outgrowing all major peers.

FlatexDEGIRO (FlatexDEGIRO)

As you can see, my brokerage (Nordnet) is on that list. I myself am not a Flatex customer, because the company doesn't offer me the private banking appeal that Nordnet can - but I am not necessarily the company's target customer. And when it comes to target customers, the company is doing a very good job.

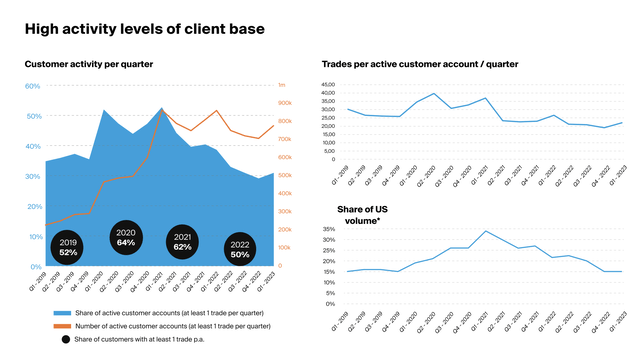

The company has an active client base that's growing, and there's still a lot of room to grow the US volume on the platform.

FlatexDEGIRO IR (FlatexDEGIRO IR)

The company's monthly inflows have stayed very consistent despite ECB rate increases. On the fundamental side, the company is extremely well-capitalized. What do I mean by this?

I mean that flatexDEGIRO has a CET1-requirement of 15.6%, and is close to 20% here, with a leverage ratio of around 6.9%. There has been a recent BaFin audit of the company which required the company to change up some things due to the rapid growth rate.

In 2022, the German Federal Financial Supervisory Authority (BaFin) has conducted a special audit at flatexDEGIRO in accordance with section 44 of the Kreditwesengesetz (KWG - German Banking Act), identifying shortcomings in some business practices and governance, with audit report provided in November 2022.

As a result of the audit, BaFin will, among other things, impose flatexDEGIRO to ensure appropriate business organization and has issued temporary capital surcharges. flatexDEGIRO has immediately initiated various measures to comply with the regulatory requirements within a specified timeframe and will continue to work closely with BaFin. A group-wide regulatory program has been set up at board level and first measures were implemented, including the appointment of Dr. Matthias Heinrich as new Chief Risk Officer at flatexDEGIRO Bank AG as well as organizational changes in the leadership of the internal controls, risk management and regulatory reporting departments.

After some scandals in Germany on the financial side, see Wirecard, german regulatory authorities are working hard to ensure that no such scandals or similar ones are committed with a company where they have supervision. I do not view the current situation, or what is described above as a major or significant risk in any way.

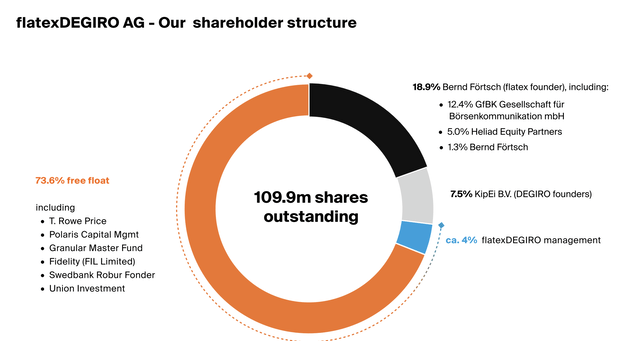

Another positive is the high amount of internal shareholding we find in the company.

FlatexDEGIRO IR (FlatexDEGIRO IR)

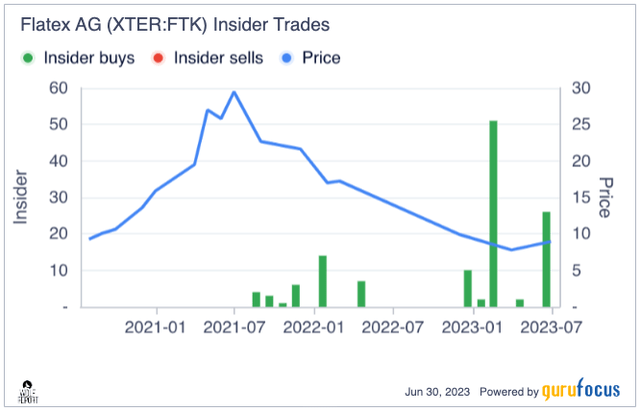

There is a lot of insider activity as of late, with managers buying hundreds of thousands of shares.

Flatex Insider buying (GuruFocus)

As I've said before, this does not mean that the company is automatically a "BUY" or a "SELL", but it does lend some credence to that some view the company as undervalued here.

flatexDEGIRO is a ~€1B market cap Pan-European online brokerage with an excellent market position. It has declined substantially for the past 2 years, and I now view it ripe to invest in, if you're comfortable with the risk/reward ratio - let's clarify this here next.

flatexDEGIRO - Plenty of Upside in the business

I am comfortable, despite it being a growth business, to forecast flatexDEGIRO based on its earnings - not as a typical growth business at a P/S multiple or at a percentage of revenue growth, or revenue multiples. The company has what is my fundamental requirement for investing - and that is profit. It has good profit.

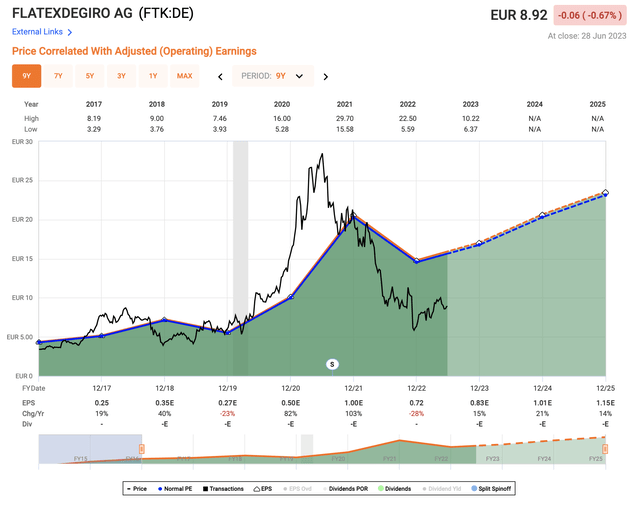

FlatexDEGIRO upside (F.A.S.T graphs)

The company had no business trading at 30-38x P/E which also is why I wasn't interested in the company at the time - and prior to 2021, I viewed as being too new and uncertain.

Now, I view it as being a potential for investing - and a pretty good one, depending on how things go in the near term. With normalization of trading patterns and profit, we should see the company's earnings recover this year - and significantly, with 1Q23 results already confirming at least some of these indications and trends.

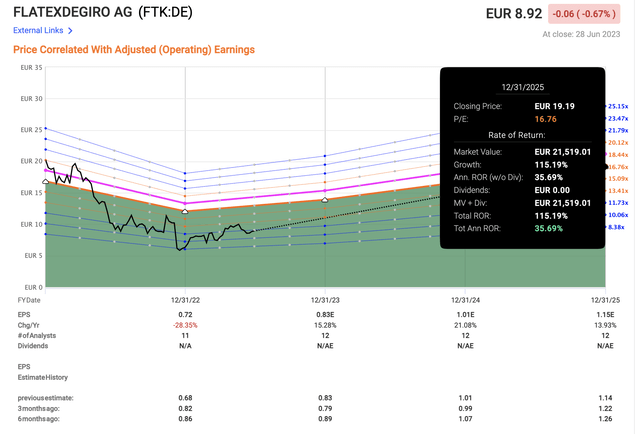

In the case of normalization to a 16-20x P/E, which I view as relevant for a company with these profitability indicators, it's now possible to forecast triple-digit RoR on the basis of a 16.7x P/E for 2025E. I view this as the "base case" here.

FlatexDEGIRO Upside (F.A.S.T graphs)

That upside could go up to 150% if we see the company's normalized premium coming back here. Due to the company's limited age, forecast accuracy is of some concern here - we have a 50% negative miss ratio with a 10% margin of error from FactSet. (Source: F.A.S.T Graphs)

S&P Global street targets are interesting. 11 analysts with an average of €10.93 follow the company, meaning 6 have a "BUY" here with a high of €16.6 and a low of €8.3. But less than a year ago, that same average PT was €32 with 7 out of 9 analysts at a "BUY" or equivalent rating for the company, indicating a lack of long-term view for this company, or substantially deteriorating business conditions. I don't view the latter as being relevant in this company's case - so the simple fact is, the company is being undervalued here, as I see it.

flatexDEGIRO is one of the fastest-growing European brokerages, in a fragmented market where other players have failed to gain traction for years, and where the company doesn't have that much competition in certain markets. I believe Scandinavia will be hard for the company to penetrate - we're already an "Investing" people, and new entrants have a hard time pulling us from our incumbent banks or native brokerages - and these already offer very low commissions.

However, there is a definite case to be made for why the company could do well in the remainder of Europe - and that's what I'm investing in here. I invest in Central European and Western European growth from multiple markets. I view €11 as too low for this company in the long-term.

Based on a combination of adjusted EPS potential, projected FCF, P/S multiples, and what I view as a realistic or even conservative forecast, I would say less than 16-17x P/E is too cheap for this company long term. For 2023E, that means a PT of €16 is the logical way to go here.

That is also where I put my initial price target for FlatexDEGIRO.

Here is my initial thesis on the company.

Thesis

- flatexDEGIRO is a very rare breed - it's a growth company that I consider investable based on solid earnings, a fundamentally sound and profitable business model, good prospective results for 2023-2025E, and good management with a vision of turning this into a leading broker in Europe.

- I'm "on board" with this vision and strategy. And that's where I give the company my rating of "BUY", going in with a PT of €16 and having bought a stake representing 0.15% of my investment portfolio on the private side.

- I expect to own flatexDEGIRO for several years, and eventually seeing triple-digit returns for this investment. This is how I invest in growth stocks - choosing profitable and well-managed companies with what I see as a clear future in a market that's not going anywhere.

Remember, I'm all about:

- Buying undervalued - even if that undervaluation is slight and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn't go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The only scenario where I am "okay" with buying a growth company is when the company is qualitative, safe, cheap, and with a realistic upside. flatexDEGIRO has this, and for those reasons, it's a "BUY".

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management/wealth management for a select number of clients. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FNNTF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks i write about. Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

They are not anymore, and each new article coming out cuts down on that.I am slowly migrating what remains of my Degiro account, because of course transfer fees are ridiculously high, disincentivising a transfer of holdings, so I only close and never open positions there.They will either be relegated to existing accounts and old people that don't know any better, or are going to have to severely slash their commissions, sinking the stock.They offer neither the service and platform to justify fees, nor the cheap (read: zero) rates other brokers have. No competetive advantage, no reason to ever use them.