Icahn Enterprises: 2 More Rate Hikes Could Seal The Deal On The Distribution

Summary

- Icahn Enterprises has moved sideways since our last article.

- Resilient core inflation and a stronger job market likely force more Fed hikes.

- Icahn Enterprises has $3 billion in refinancing needs over the next 3 years, 60% of NAV.

- If you are only playing for the distribution, at least use some protection.

- Looking for option income ideas that focus on capital preservation? I offer this and much more at my exclusive investing ideas service, Conservative Income Portfolio. Learn More »

Neilson Barnard

On our last coverage of Icahn Enterprises L.P. (NASDAQ:IEP) we suggested that a defensive covered call strategy would outperform a buy and hold. We also reiterated that we were not interested in anything but the bonds, and even they still lacked appeal.

If you believe the distribution will be maintained for the next two years, a deep in the money covered call is a "no-brainer". It should outperform the cash secured puts by a mile and likely even the common stock in case of moderate declines. That is how we would play it if we believed the distribution was sustainable. We don't think it is and we would be only interested in the near-term bonds should be get a high enough yield.

Source: Distribution Maintained, But Bonds And Options Are Not Biting

The stock has gone sideways since then. We go over why we think the next leg down should begin soon, and how you can reduce your exposure here if you "just want the distribution".

Yield Bubbles Burst When Risk Free Rates Dial Up

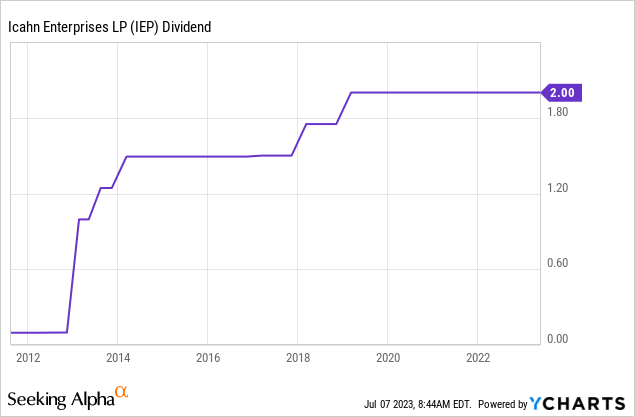

IEP was the ultimate yield chase. The company had maintained a large distribution despite lacking GAAP profits to pay even a third of that over the last decade. These things are sometimes sustainable when the company size is small. Sometimes the distribution is sustainable if the actual paid out distributions in cash are tiny. IEP had both those factors going for it. The key word is "had". Over time, both things have changed.

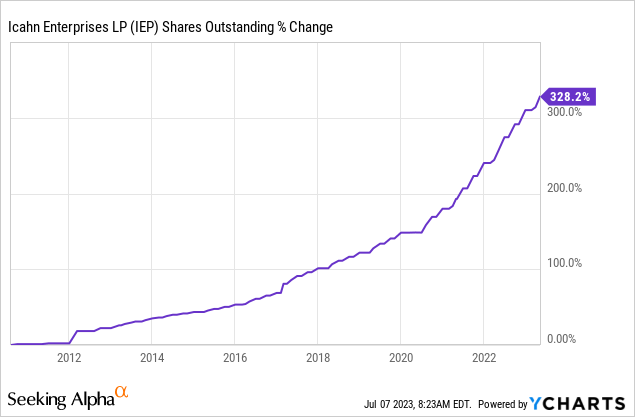

The share count has risen significantly, thanks to many secondary offerings and also due to Mr. Icahn reinvesting his distributions.

Cash payout from actual distributions has also increased as a result of secondary offerings, as those holders are less likely to reinvest. The final kicker here, which might not be common knowledge to all those who got recently involved with the stock, is that the distribution is far higher today than it was a decade back.

So let's put the sum of all of that information together.

In 2010, IEP paid $1.00 of distributions on about 84.7 million units outstanding. Notable here is that Mr. Icahn owned almost all of it.

As of December 31, 2010, affiliates of Mr. Icahn owned 78,454,899 of our depositary units, which represented approximately 92.6% of our outstanding depositary units.

Source: 2010 10-K (linked above)

So your theoretical max cash outlay was $6.2 million for the Non-Icahn portion.

Fast-forward to today, and IEP was paying $8.00 of distributions on 369 million units. Carl Icahn and his affiliates own about 85% of the units at this time. Nonetheless, 55 million units requiring cash of $8 per year works out to over $440 million. So this is the parabola we are referring to. Cash distributions to non-majority unit holder has ballooned from $6.2 million to $440 million. That is 73-fold over 13 years.

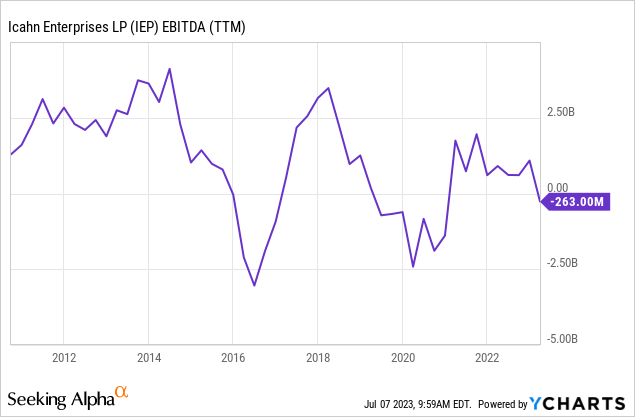

This disturbing trend has occurred at the same time as EBITDA going negative on a consistent basis for IEP. Put the $6 million required in context of the positive $2.5 billion of EBITDA on the left-hand side of the chart and the $440 million on the right-hand side with negative $263 million in EBITDA.

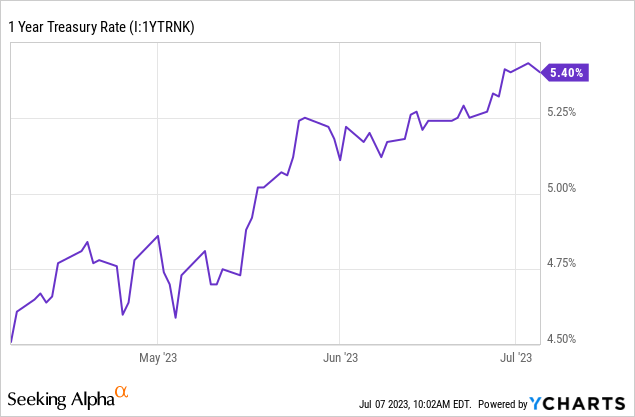

The major issue here, beside the math and the exponentially compounding share count, is the interest rate trajectory. There are many ways to look at the projections over the next year, including Fed Fund Futures and "dot plots" which the Federal Reserve releases. One simple way is to just look at the 1-Year Treasury yield. This is a great pricing indicator of hikes as well as expected cuts, and the market probabilities of all short-term interest changes are incorporated here. Note what has happened over the last 3 months.

That is almost a 1 percentage change in the last 90 days, and this has a lot of bearing on what will happen to that distribution. Risk-free rates are generally the key catalyst to blow up yield bubbles, and we think this is getting into territory which could have the same impact on IEP and many other similar distorted pricings (see here and here).

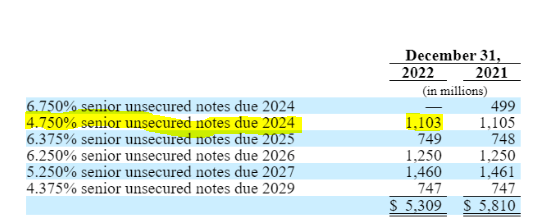

Even from IEP's internal perspective, $3.0 billion needs to be refinanced over the next 3 years, including $1.1 billion in 2024.

IEP- 2022 10-K

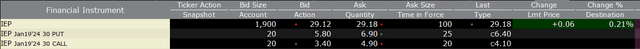

These notes are now yielding way past their coupon rates and trading well under par. Even the September 2024's are yielding 8.5% to maturity.

Interactive Brokers July 7 2023

They are also diverging from the apparent health of the stock.

How To Play

Investors should use the bounce and the collected distribution to consider exiting the stock. The bonds continue screaming in pain, and further hikes will likely make the situation worse. We are also at this stage with high yield bonds in "la-la land" and not pricing in a recession. What happens when we ultimately get into one?

The put-call parity model suggests that you are definitely going to get one more large distribution and then the odds imply a cut for the November payment, by 75% or so.

Interactive Brokers July 7 2023

The above prices also show that if the distribution is maintained, regardless what happens to the stock price, covered calls will vastly outperform cash secured puts. We think Mr. Icahn will ultimately defend the bonds by making the distribution more sustainable. We are betting on a sub 50 cent distribution for either the November 2023 or the March 2024 payment.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (9)

Silver lining is Carl's Jr. is gonna save a bunch on estate taxes.

Maybe that was the game plan lol?

There will be zero problem refinancing debt.

The distribution is almost all in stock, not cash.

The amount of dollars used by the distribution is trivial relative to the company's size.