Starbucks: Ample Growth Runway

Summary

- Starbucks should continue to benefit from the steadily expanding coffee industry and favorable customer preferences.

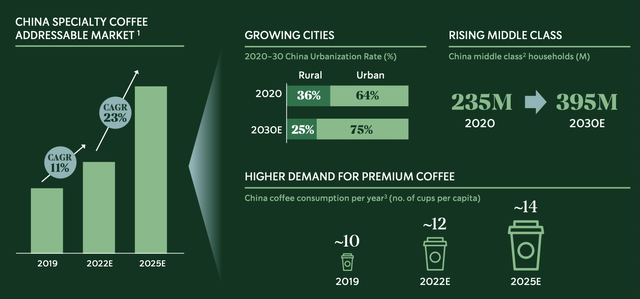

- The company is seeing huge expansion opportunities in China, where coffee consumption is poised to grow amid rising affluence and population.

- It is well-positioned to handle a potential economic downturn, as it has a loyal membership program and a relatively affluent customer base.

- Considering the strong fundamentals, the current valuation should present further upside potential moving forward.

M. Suhail/iStock Editorial via Getty Images

Investment Thesis

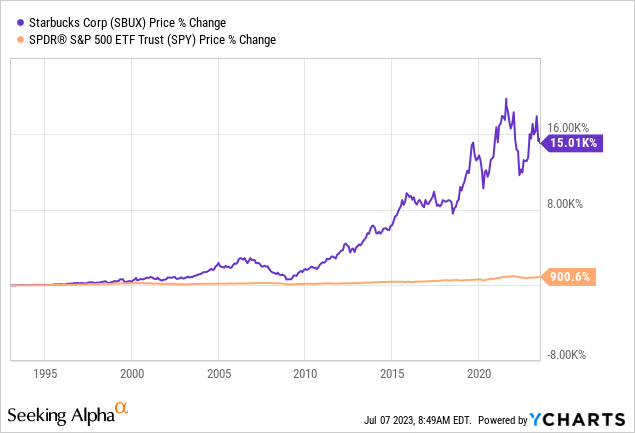

Starbucks (NASDAQ:SBUX) has been an outstanding compounder in the past two decades, and I believe it will continue to deliver great returns in the future. While the company has grown substantially in size, there should still be ample growth runway moving forward. For instance, the recent shift in customer preferences continues to favor higher order value. Its penetration in the international market is also relatively low, which presents further expansion opportunities.

Favorable Trends

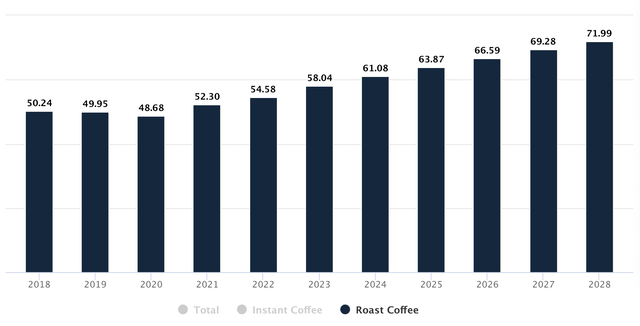

Starbucks is one of the largest coffee shop chains in the world, currently with over 33,000 stores across nearly 90 countries. The company specializes in coffee but has been expanding into other drinks and foods as well. Coffee is a steadily-expanding industry, as its consumption continues to increase. For instance, consumption in the US hit a two-decade-high last year. According to Statista, the market size of roast coffee is forecasted to grow from $58 billion in 2023 to $72 billion in 2028, representing a CAGR (compounded annual growth rate) of 4.4%.

Roast Coffee's Market Size (Statista)

Besides the favorable market trends, customer preferences have also been shifting in favor of Starbucks. For instance, the popularity of cold beverages has been increasing exponentially. According to the company, cold beverages accounted for around 64% of the product mix in 2022, up from just 47% in 2018. The figure can even reach nearly 80% during summer months. This is giving the company a meaningful boost in sales, as cold beverages are generally more expensive than hot beverages. Depending on the region, the price of a frappuccino can be roughly 30% higher than a standard latte or cappuccino.

The adoption of customization and premiumization is also rising quickly, as customers' emphasis on quality and personalization continues to grow. From FY21 to FY22, the sales of modifiers (used for customization) nearly doubled. Outside of coffee, more customers are now ordering food as an add-on, as the company continues to expand its food offerings, especially for breakfast. During the past year, sales of food grew 20%, with over 300 million breakfast sandwiches being sold. I believe these favorable trends should continue to drive the company's sales and average order size.

International Growth

Despite the progress in the past few years, there are still significant expansion opportunities in the international market. For instance, there are over 16,000 Starbucks in the US alone, while international stores combine to only around 19,000. The company is present in over 80 countries, but China continues to be its primary focus. Due to its massive population and growing affluence, the country is the prime location for expansion.

According to Starbucks, more regions are now being urbanized and middle-class households are expected to grow from 235 million in 2020 to 395 million in 2030. The company expects this to result in a 5.3% CAGR in the country's coffee consumption, 90 basis points higher than the global growth rate. There are currently around 6,000 Starbucks in China and the company aims to grow the number to 9,000 by 2025, as demand continues to rise. It also hopes to grow its presence from 244 cities to 300 cities. The increasing penetration in China should be a major growth driver in the medium term.

Laxman Narasimhan, CEO, on China's opportunity:

China’s coffee consumption per capita is 12 cups per year, Japan’s is 200 cups, and the US’ is 380 cups. Starbucks’ market will become bigger in the next three years.

Strong Resilience

While the global economy has been moderating amid higher interest rates, I believe Starbucks should show much better resilience compared to other retail companies, unlike most retailers, the company has a strong membership program with over 30 million active members, which significantly increases customer loyalty. Coffee is also considered non-discretionary spending to many customers, especially members. Most of its customers are also relatively affluent, which makes them more immune to an economic downturn.

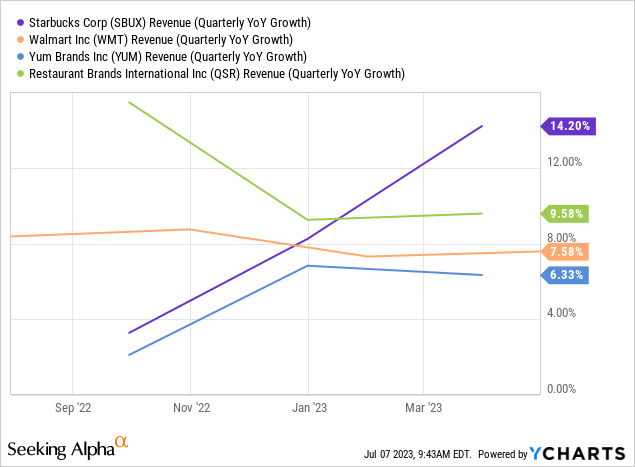

The strength is demonstrated in the latest earnings. Starbucks reported revenue of $8.72 billion, up 14% YoY (year over year) compared to $7.64 billion. Comparable sales were also up 11%, driven by a 6% increase in transactions and a 4% increase in average order value. As shown in the chart below, the company's growth is meaningfully stronger than other major retailers such as Walmart (WMT) and Yum Brands (YUM).

Valuation

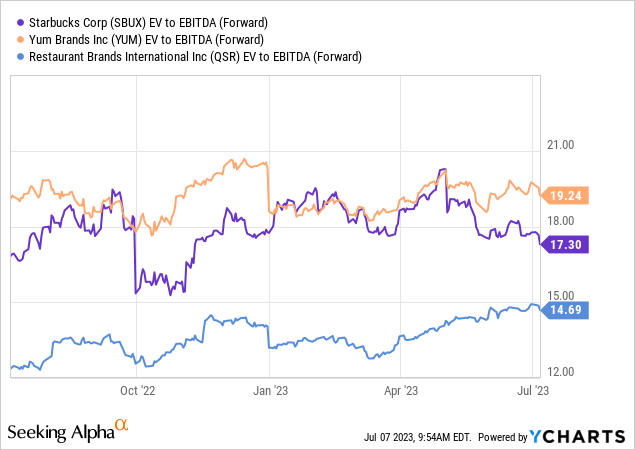

Starbucks' valuation also looks very reasonable in my opinion. The company is currently trading at an EV/EBITDA ratio of 17.3x, which is in line with other restaurant companies such as Yum Brands and Restaurant Brands (QSR), as shown in the chart below. For those who are unaware, Restaurant Brands actually owns Tim Hortons. I believe Starbucks deserves a higher valuation due to its quality and fundamentals. As shown in the chart above, its revenue growth is much stronger than the other two companies. I believe its multiple should eventually catch up to Yum Brands, which should present solid upside potential.

Risk

One notable risk in my opinion is the recent economic developments in China. The country's economy has been surprisingly soft, and the enthusiasm around its reopening news has also faded quickly. For instance, its retail sales have come in below consensus in the past two months. A major part of Starbucks' business depends on China, therefore a slowdown in its economy will likely impact the company's growth. I am not too concerned right now, but it is something worth keeping an eye on in the future.

Investors Takeaway

Overall, Starbucks should have ample growth runway moving forward. The rising coffee consumption trend, favorable customer preference, international growth, and ongoing store expansion should help the company generate a long-term low double-digit revenue CAGR. The global economy is soft, but the company should be well-positioned to handle any temporary turbulence. Considering the strong backdrop, I believe the company should see further multiple expansion opportunities. Therefore, I am initiating my buy rating on Starbucks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.