United-Guardian: A High-Risk/High-Reward Investment

Summary

- Volumes are currently depressed due to a stronger dollar, a slow Chinese reopening, and customer destocking.

- The company is highly profitable as it has very high profit margins.

- The balance sheet is robust thanks to the absence of debt.

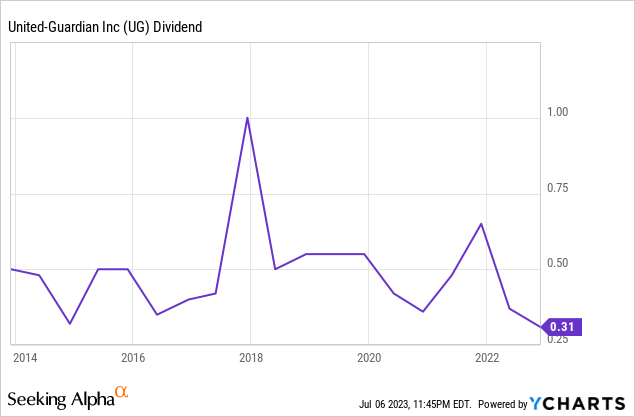

- The current dividend yield is very high, but another potential cut represents a real risk due to lower cash from operations.

- This represents a good opportunity for long-term patient investors with enough appetite for risk.

Anna Tretiak

Investment thesis

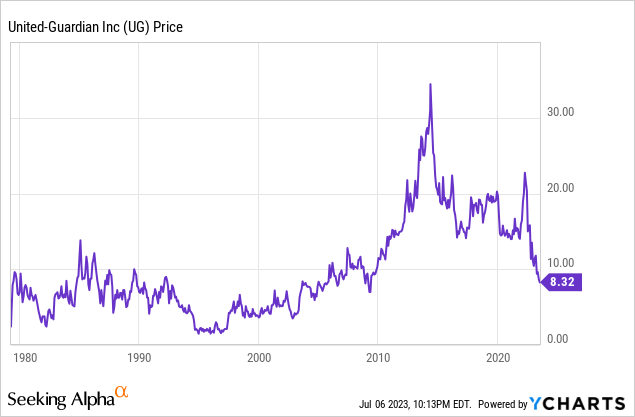

Shareholders of United-Guardian (NASDAQ:UG) have more than enough reasons to be frustrated by its recent performance as the share price has declined by 76% from all-time highs reached in 2014. After a significant decline in net sales in 2020 due to the coronavirus pandemic crisis, they currently remain weak due, in part, to a significant decline in demand from China as the reopening of its economy from self-imposed coronavirus-related restrictions has been much slower than expected. To this, we must add that a stronger-than-usual dollar has made United Guardian's products more expensive abroad, with which they have lost some competitiveness in international markets. Also, customers are emptying their inventories given the growing concerns of a potential global recession as a consequence of recent interest rate hikes to combat high inflation rates around the world.

In my opinion, the stagnant sales of the last few years are the consequence of a high dividend payout ratio as the management has distributed the company's profits among shareholders. Perhaps significant insider ownership has something to do with this, but the story does not end here. In fact, the management recently reviewed the company's current opportunities and didn't find any, but this is not bad in itself. In this sense, it is very important to understand the nature of the company as it is not a growth one but rather a company that operates in very specific and profitable niches that may be subject to periods of high volatility over the years. In this regard, I believe that the current pessimism among investors is opening up a good opportunity for more patient long-term dividend investors as the share price is leaving a very high potential dividend yield on cost and operations remain sustainable thanks to very high profit margins and a debt-free balance sheet.

A brief overview of the company

United-Guardian is a manufacturer of cosmetic ingredients, pharmaceuticals, and medical lubricants, and is currently discontinuing its specialty industrial products business as it only generated 2% of the company's net sales for a long time. The company was founded in 1942 as United International Research and its market cap currently stands at $38 million, which means it has fallen into the nano-cap territory as a consequence of the recent sharp decline in the share price. In this regard, investors should be highly aware of the risks associated with investing in nano-cap companies before doing so. Insiders own a whopping 36.39% of the total number of shares outstanding, which means the management is the main beneficiary of the good performance of the company's share price.

United-Guardian LOGO (U-g.com)

United-Guardian's products are divided into three categories (apart from the specialty industrial segment that is soon going to be discontinued): Cosmetic Ingredients, which provided 41% of the company's total net sales in 2022 and includes multifactional water-based gel formulations mainly designed to offer sensory enhancement, lubrication, texture, and moisturization to personal care products, Medical Lubricants, which provided 19% of the company's total net sales in 2022 and includes water-based gel formulations mainly designed to offer sensory enhancement and lubrication to medical products, and Pharmaceutical Products, which provided 39% of the company's total net sales in 2022 and includes an FDA approved prescription drug that is used primarily to prevent and dissolve calcifications in urethral catheters, as well as a chlorine-based topical antimicrobial that is also used as a disinfectant, fungicide, and deodorizer. These products are sold to major cosmetic manufacturers, full-line drug wholesalers that sell their products to pharmacies, physicians, and hospitals, and manufacturers and marketers of finished medical products.

Currently, shares are trading at $8.32, which represents a 75.81% decline from all-time highs of $34.40 on May 6, 2014. Undoubtedly, this is a very significant decline that requires an exhaustive assessment of the different aspects of the company, especially in terms of current headwinds, the sustainability of its operations, and long-term growth opportunities.

Net sales remain stagnant due to current macroeconomic headwinds

The company's sales have remained stagnant in recent years, partly because it has dedicated almost all of its profits to paying dividends. After a decline of 23.06% in the personal care business during 2016 due to a regulatory issue in China unrelated to the company's Lubrajel product that required the reformulation of some products in which Lubrajel was used, net sales recovered almost completely by 2019, but the coronavirus pandemic crisis caused another sharp decline of 19.21% during 2020. Although it is true that in 2021 sales recovered as they increased by 26.79%, net sales again declined in 2022 as they decreased by 8.84% compared to 2021.

United-Guardian net sales (Seeking Alpha)

Still, net sales declined by 33.96% during the first quarter of 2023, which suggests the decline is intensifying. This decline is attributable to weakening demand for cosmetic ingredients and medical lubricants, especially in China, partially offset by increasing sales of pharmaceutical and industrial products. Also, customers are emptying their inventories as demand expectations remain pessimistic due to the current macroeconomic landscape marked by consumer losing purchasing power due to inflationary pressures and growing fears of a potential recession as a consequence of recent interest rate hikes, and a stronger-than-usual dollar is also making United-Guardian products less competitive abroad.

Now, the management's hopes lie in the reopening of China, which if progresses would allow a recovery (at least partial) of sales throughout 2023 and beyond. Using 2022 as a reference, around 25% of the company's net sales are provided by foreign operations, but it's important to note that 66% of sales to ASI, which is the largest distributor of United-Guardian, are later sold to foreign countries, especially China, despite being counted as domestic sales.

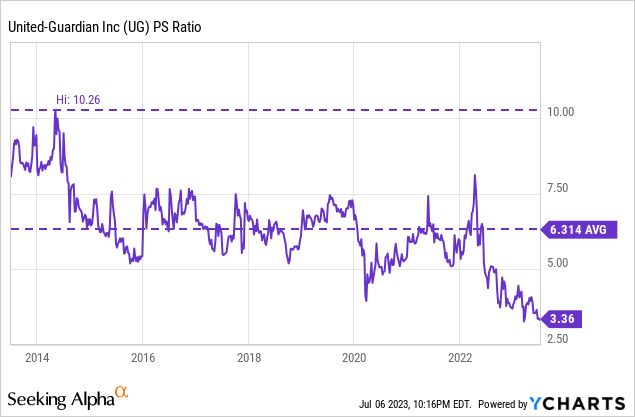

The significant decline in the share price has caused a sharp drop in the P/S ratio to 3.26, which means the company currently generates net sales of $0.31 for each dollar held in shares by investors, annually.

This ratio is 48.37% lower than the average of the past 10 years and represents a 66.23% decline from decade-highs of 10.26 reached during 2014, which reflects growing pessimism among investors as they are placing much less value on the company's sales than they used to, in part, due to the lack of perceived opportunities (by the management itself) to give the company a direction from here. Fortunately, the company's profit margins are exceptional despite inflationary pressures and declining volumes as it operates in very specific sectors, so the balance sheet is expected to remain robust despite current headwinds.

Margins are very high and the company is highly profitable

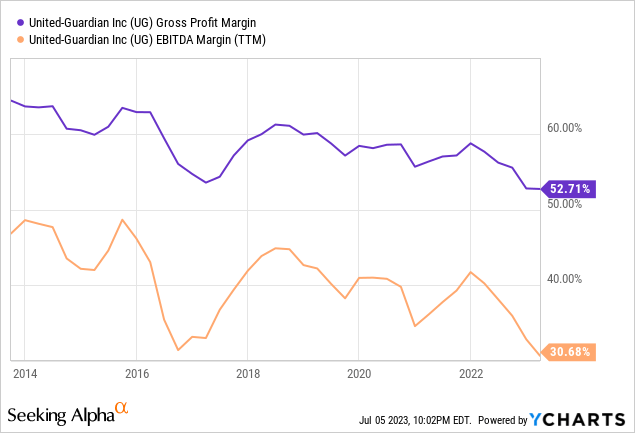

Despite ongoing declining volumes and inflationary pressures, profit margins remain very high as the trailing twelve months' gross profit margin currently stands at 52.71%, and the EBITDA margin at 30.68%.

Still, the trend of the last 10 years has undoubtedly been negative as both gross profit and EBITDA margins used to be at higher levels before the demand crash that happened in 2016, as one can see in the chart above. Nevertheless, both profit margins and EBITDA margins improved during the first quarter of 2023 as they increased to 57.45% and 33.31%, respectively, which means the company remains highly profitable. Furthermore, profit margins should stabilize at higher levels as soon as the Chinese economy fully reopens and volumes return to more usual levels.

Historically, United-Guardian has been a highly profitable company as its products are very specific, and this has made it possible to maintain a debt-free balance sheet and pay very high dividends to shareholders.

The balance sheet is robust

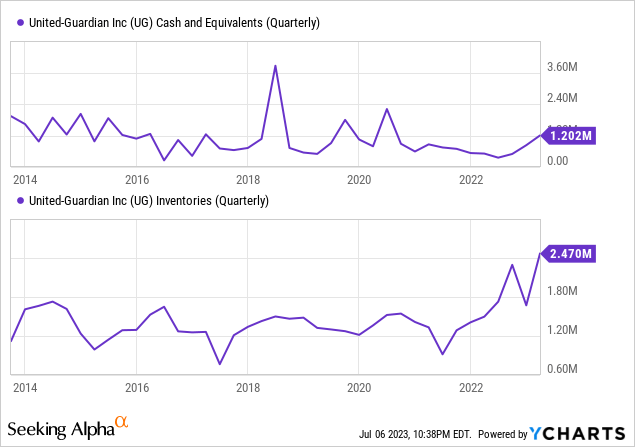

United-Guardian's balance sheet is quite robust thanks to its zero debt, which greatly reduces the risks associated with investing in the company, especially considering its high profit margins. Additionally, both cash and equivalents and inventories have recently improved to $1.20 million and $2.47 million, respectively. These resources together with the cash generated through operations will be essential to face the current headwinds derived from inflationary pressures and a slow reopening in China and a potential recession for which I believe the company is highly prepared as it remains highly profitable.

In this sense, the company pays a semi-annual dividend based on the cash generated from operations and does not make large reserves to invest in growth opportunities or acquisitions, so the company is essentially treated as a cash cow despite its very low market capitalization and the low reach of its products.

The dividend is highly volatile

The company has been paying dividends for 28 consecutive years, but dividend payouts per share declined by 40% in 2022 (compared to 2021) as the company announced a dividend of $0.31 per share in November 2022. Nevertheless, the total payout per share was $0.68 in 2022, so the dividend yield (despite the cuts) is currently at 8.17% considering the current share price of $8.32 and the dividend payout of 2022, which is very generous. Besides, it is common for the dividend to suffer cuts as the management decides the amount based on the performance of the company. Also, I think the risk of a further cut is quite significant right now.

In the next table, I have calculated the sustainability of the dividend over the years by calculating the percentage of cash from operations that is allocated to the dividend payment year after year. In this way, we can see the company's ability to cover the dividend through actual operations.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

Cash from operations (in millions) | $4.5 | $5.2 | $2.3 | $4.0 | $5.0 | $4.5 | $3.6 | $5.3 | $2.5 |

| Dividends paid (in millions) | $3.7 | $4.6 | $1.7 | $4.2 | $4.8 | $5.0 | $3.6 | $5.2 | $3.1 |

| Cash payout ratio | 82% | 88% | 74% | 105% | 96% | 111% | 100% | 98% | 124% |

By looking at the table, one understands the reason for the dividend reduction in 2022. The cash payout ratio reached unsustainable levels in 2017 and the situation worsened in 2022 when it reached 124% despite a 40% reduction in dividends paid. It is important to note that during that year, inventories increased by $0.3 million and accounts payable declined by $0.4 million while accounts payable also declined by $0.4 million. As for the first quarter of 2023, cash from operations was $0.4 million, inventories increased by $0.8 million, and accounts receivable increased by $0.1 million while accounts payable increased by just $0.4 million, so the company continues to be profitable. Even so, it is important that sales partially recover so that the current dividend is sustainable over time as cash from operations is currently very limited.

Risks worth mentioning

Before investing in United-Guardian, it is very important to consider a series of risks that I would like to highlight.

- United-Guardian is a very small company as it falls into the nano-cap category of companies due to its very low market cap of just $38 million, and investing in such small companies that produce such specific products carries a high risk of volatility, both in operations and in the share price, due to low customer and product diversification.

- The reopening of the Chinese economy does not guarantee a full recovery of sales lost since the coronavirus crisis. While hopes are that demand will stabilize at levels above current ones once the Chinese economy fully reopens, the recovery in sales could be less than expected.

- A potential global recession as a result of the recent interest rate hikes would have a significant impact on the company's operations as demand for the company's products could decrease. In a declining volumes scenario, profit margins could also be affected by more unabsorbed labor as has happened every time volumes have decreased. The same risk applies in the event of a recession in China.

- The current dividend, which has suffered a 40% cut, could serve as a reference in terms of a reasonable potential dividend yield on cost. Undoubtedly, this is a very high yield on cost, which reflects the current opportunity to acquire shares at depressed prices. Despite this, this high dividend yield is not without risk since in the short and medium term there is a very high probability of a further cut due to the current global economic uncertainties (and lower cash from operations).

Conclusion

I can say without any doubt that United-Guardian's situation is currently very delicate, but despite this, I do not consider this to be as catastrophic a scenario as it may appear at first glance. Until now, the company has been treated as a cash cow while its operations are actually quite volatile due to the nature of nano-caps as it has a small product offering and customer base.

Currently, the pessimism among shareholders is significantly high as current headwinds are affecting the company's capacity to generate cash from operations. These headwinds include loss of competitiveness due to a stronger U.S. dollar, inflationary pressures, weakening consumer purchasing power, customer destocking, and a slower-than-expected Chinese economic reopening. But despite these headwinds, which are not a few, the company continues to generate positive cash from operations quarter after quarter thanks to its very high profit margins, and its balance sheet is robust thanks to the absence of debt. Furthermore, these headwinds are, in my opinion, of a temporary nature due to their direct link to the current macroeconomic landscape, and therefore, I consider that the current decline of 75.81% in the share price from all-time highs represents a good opportunity for the most patient investors. Even so, the profile of the investor suitable to invest in United-Guardian is one with a high appetite for risk as a potential recession could have a significant impact on the operations of the company, which could lead to another dividend cut.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.