No Boom, No Bust

Summary

- The market now expects the Fed to increase rates once or maybe twice by year-end, followed by an initial cut in rates sometime around March of next year.

- I remain convinced that no further rate hikes are needed. Why? Because although the economy has proved more resilient than the market expected, the inflation fundamentals have not changed.

- Money demand has strengthened due to higher rates, "excess" money supply has declined, commodity prices are weak, inflation expectations remain low (~2.2%), and shelter costs are declining.

nevarpp

Since my last post (6/28), 10-yr Treasury yields have jumped 36 bps, while 1-yr yields rose by only 8 bps. This was driven by some stronger-than-expected economic news that caused the market to postpone its estimate for when the Fed will begin to cut rates.

The market now expects the Fed to increase rates once or maybe twice by year-end, followed by an initial cut in rates sometime around March of next year. I remain convinced that no further rate hikes are needed. Why?

Because although the economy has proved more resilient than the market expected, the inflation fundamentals have not changed: money demand has strengthened due to higher rates, "excess" money supply has declined, commodity prices are weak, inflation expectations remain low (~2.2%), and shelter costs are declining. I've explained all this in posts over the past several months.

What follows are some updated charts which fill in the story:

Chart #1

Chart #1 shows the three major components of the Personal Consumption Expenditures Deflator. On a 6-month annualized basis, the increase in the overall deflator has dropped from a high of 8% last June to 3.4% as of May '23.

Two of its components - durable and non-durable goods - have not increased at all since last June (witness the flatness of the blue and purple lines). This means that the only source of inflation of late has been the service sector, and a major component of that is shelter costs, which are measured with a significant lag and which will almost certainly be subtracting from the official inflation statistics in coming months. See this post for more details.

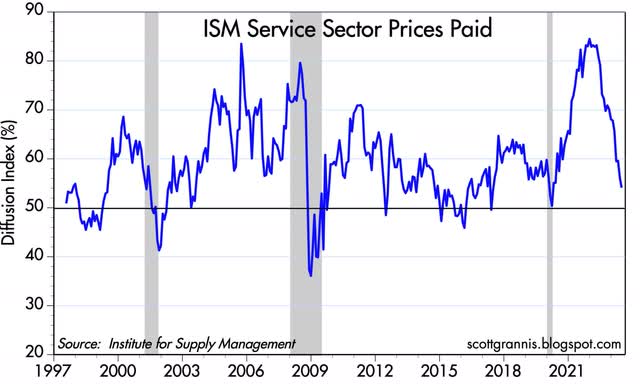

Chart #2

Chart #2 shows that almost 85% of the service sector firms surveyed by the ISM reported paying higher prices early last year, but only 54% are reporting that now - that's very significant.

This information is more timely than that picked up by the PCE deflator, and adds strong support for my belief that overall inflation is almost certain to decline significantly in the months to come. The Fed cannot ignore this for much longer.

Meanwhile, commodity prices have weakened considerably since the Fed began raising rates in March '22. The CRB Raw Industrials index is down 19%, non-energy commodity prices are down 21%, and oil prices are down fully 39%. If you live in the world of commodities, you've been experiencing painful deflation for the past 15 months.

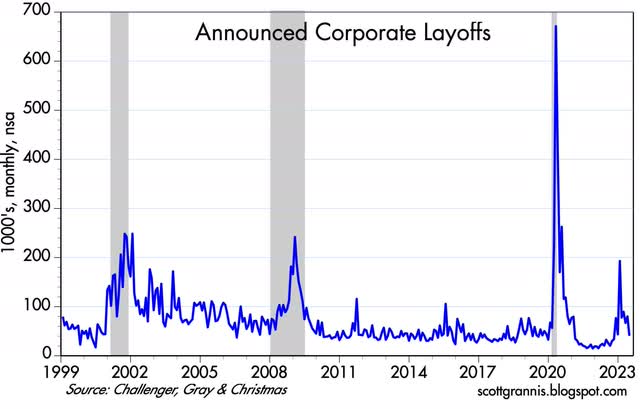

Chart #3

Chart #3 shows a monthly measure of the number of announced corporate layoffs. Here we see a spike beginning in November of last year that has now all but ceased. The source of that spike was almost exclusively the high-tech sector, followed by more recently by the financial sector.

Layoff activity has subsequently subsided to levels that are relatively normal. This was not a precursor of a recession, as many speculated. These are more commonly referred to as "rolling recessions," which hit only parts of the economy, not the whole.

Chart #4

Chart #4 compares the number of job openings in the country to the number of persons who are looking for work. Job openings remain extraordinarily high, and thus indicative of the fact that the fundamentals of the US economy remain healthy. Moreover, swap and credit spreads - key and leading indicators of economic health - remain low.

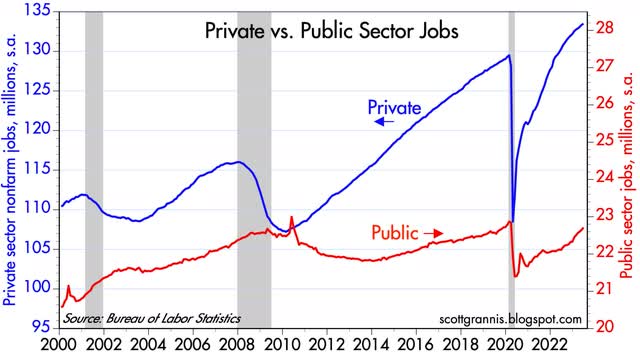

Chart #5

Chart #5 compares the number of jobs in the public and private sectors as of last month. Note that public sector jobs have not increased at all since the end of the Great Recession.

Relative to total employment, public sector payrolls have fallen from a high of 17.6% in mid-2010 to now only 14.5% - a level not seen since 1957. Zero net growth of the public sector alongside significant growth in the private sector is a libertarian economist's dream.

Since private sector jobs are generally more productive than public sector jobs (sorry, civil servants, but it's the truth), this supports the notion that the economy remains fundamentally healthy.

On the other hand, the chart shows that the growth of private sector jobs has been declining of late: the six-month annualized rate of increase in private sector jobs was 4.1% a year ago, and it is now only 2.0%.

That's the sort of growth we saw over most of the 2010-2019 period, and those were years that saw real GDP grow a little more than 2% per year. That's more support for my long-held view that we're in a 2% growth world. It's not very exciting, but it's sure better than nothing.

There is nothing in the stats to support widespread claims that the economy is "running hot." Nothing to suggest that inflation will do anything but decline. Nothing that would justify yet another increase in short-term rates. The Fed is done, but they are loathe to admit it: "once burned, twice shy" as the saying goes.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

Recommended For You

Comments (2)