BlackRock: Buy This Powerful Dividend Growth Stock Now And Thank Yourself Later

Summary

- BlackRock's adjusted diluted EPS payout ratio is likely going to slightly worsen from 55.2% in 2022 to 57.2% in 2023.

- Taking into consideration the challenging environment for asset managers, the company's first quarter was satisfactory.

- The nearly $400 billion in trailing twelve-month capital inflows positions the company to get back on track operationally in 2024 and beyond.

- My inputs into the dividend discount model and discounted cash flows model suggest that shares of the asset manager are discounted by 11%.

- BlackRock's 2.9% dividend yield, high-single-digit annual earnings growth potential, and the potential for valuation multiple expansion could deliver double-digit annual total returns to shareholders in the years to come.

A pile of U.S. currency notes of different denominations. malerapaso

The goal of dividend growth investing is to build a portfolio of businesses that consistently send more cash to shareholders via dividends over the long run. This can be done by selecting dozens of leading businesses throughout a variety of economic sectors.

BlackRock (NYSE:BLK) has earned its status as the most dominant asset manager on the planet. This is why in my portfolio consisting of 100 whole-share dividend-paying stocks, BlackRock comprises 1% of my net annual forward dividend income and is the 33rd biggest dividend stock holding in my portfolio. Let's delve deeper into why I recommend the stock to dividend growth investors and view it as a buy right now.

A Market-Beating Dividend That You Can Trust

Income investors will appreciate BlackRock's 2.92% dividend yield, which clocks in at almost double the 1.56% yield of the S&P 500 index. And the stock's payout looks to be at low risk of being cut.

Even with the significant decline in adjusted diluted EPS in 2022 to $35.36, the adjusted diluted EPS payout ratio remained easily covered. Compared to the $19.52 in dividends per share paid last year, this worked out to a 55.2% adjusted diluted EPS payout ratio for BlackRock.

Analysts expect the company's adjusted diluted EPS to dip a bit further in 2023, hitting a multi-year low of $34.97. Combined with an increase in its dividend per share obligation to $20 for the year, this is expected to raise the payout ratio to 57.2%. But in 2024, analysts are anticipating a nearly 15% jump in BlackRock's adjusted diluted EPS to $40.19. Assuming one more year of modest dividend growth, this will get the payout ratio back around a more sustainable 50% payout ratio.

As BlackRock's fundamentals largely recover alongside the stock market and the economy, analysts are expecting annual adjusted diluted EPS growth to approximate 10% over the next five years. That's why I am confident in reiterating my annual dividend growth forecast of 7.5% for the long haul.

BlackRock Is Still The 800-Pound Gorilla Of Asset Management

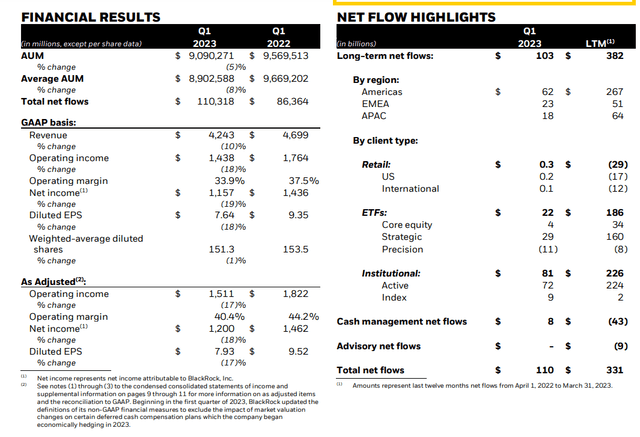

BlackRock Q1 2023 Earnings Press Release

On the surface, BlackRock's financial results for the first quarter ended March 31 were far from impressive. But digging a little deeper, the company demonstrated precisely what arguably makes it the best asset manager in the world.

First, let's start with the bad news: BlackRock's revenue dropped by 9.7% year over year to $4.2 billion for the first quarter. This largely corresponded with the 7.9% decline in average assets under management or AUM to $8.9 trillion in the quarter. The overall decline in financial markets over the year-ago period led the company's AUM lower, which also negatively impacted performance fees during the quarter.

It also shouldn't come as a surprise to learn that BlackRock's adjusted diluted EPS slumped 16.7% lower year over year to $7.93 for the quarter. After years of financially thriving, the company was only able to do so much to cut expenses to compensate for its reduced topline in such a short time. This is why BlackRock's profit margin contracted by 280 basis points in the quarter to 28.3%.

However, there is both good news and great news for the company to ease the pain of the bad news. BlackRock's track record of inspiring confidence in retail investors and institutional investors alike has led to $382 billion in net inflows from Q2 2022 to Q1 2023. This helped to minimize the blow of the downturn in financial markets. As financial markets regain their footing and head toward new all-time highs, so will BlackRock's AUM, revenue, and profits (all details in the preceding three paragraphs sourced from page 1 of 12 of BlackRock Q1 2023 earnings press release).

Risks To Consider

As an asset manager, BlackRock is executing as well as you could hope for in this operating environment. But the company's risks must still be occasionally followed by shareholders to make sure its fundamentals are intact.

One near-term risk that BlackRock is facing is that the market may or may not have bottomed yet. If a worse-than-expected recession does indeed manifest itself in the months ahead, there could be more downside ahead for financial markets beyond what has already been experienced. This would further pressure BlackRock's financial results for the foreseeable future.

The more enduring risk to the company is that as the big dog of its industry, it will always have a target on its back. This means that to deliver strong returns for its shareholders moving forward, BlackRock must never stop innovating and producing competitive investment results for its clients.

An Undervalued Blue Chip Stock

BlackRock is undoubtedly a wonderful business. But for investors looking to buy the stock and achieve optimal results, it's important to not overpay. That is why I will be using two valuation models to establish a fair value range for BlackRock's shares.

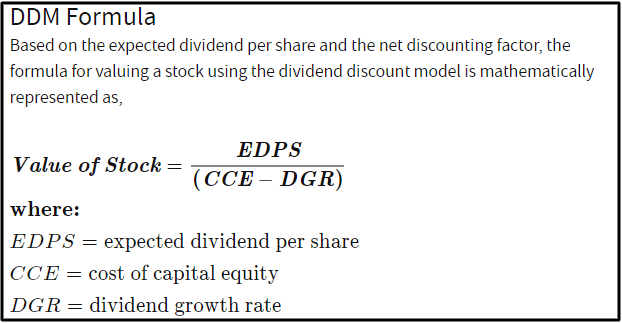

Investopedia

The first valuation model that I'll use to value shares of BlackRock is the dividend discount model or DDM. This consists of three inputs.

The first input for the DDM is the expected dividend per share, which is another term for the annualized dividend per share. At this moment, BlackRock's annualized dividend per share is $20.

The next input into the DDM is the cost of capital equity, which is the annual total return rate required by an investor. My preference as an investor is for 10% annual total returns, so that's what I will use as the input here.

The final input for the DDM is the annual dividend growth rate or DGR over the long term. As alluded to before, this figure will be 7.5%.

Putting these inputs into the DDM, I get a fair value of $800 a share. This indicates that BlackRock's shares are valued at a 14.3% discount to fair value and could provide a 16.8% upside from the current price of $685.21 a share (as of July 7, 2023).

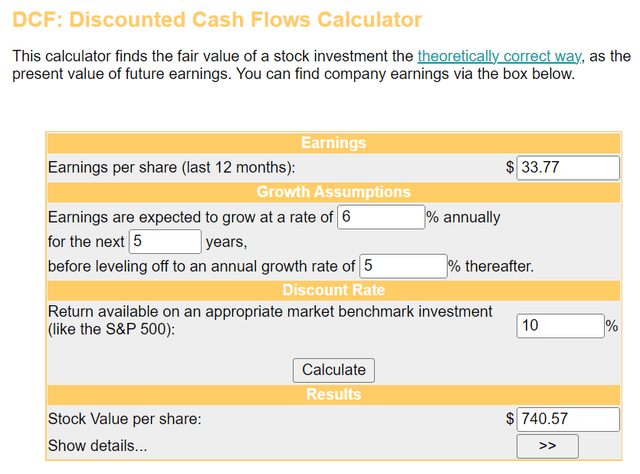

The second valuation model that I will utilize to estimate the fair value of shares of BlackRock is the discounted cash flows or DCF model. The DCF is also comprised of three inputs.

The first input into the DCF model is adjusted diluted EPS. BlackRock has reported $33.77 in adjusted diluted EPS in the past four quarters.

The second input for the DCF model is growth assumptions. I will conservatively assume that BlackRock can compound its adjusted diluted EPS at 6% annually over the next five years and assume a deceleration to 5% thereafter.

The third input into the DCF model is the discount rate, which is an investor's annual total return rate target. I'll again use 10% for this input.

Using these inputs for the DCF model, I arrive at a fair value of $740.57 a share. That implies BlackRock's shares are priced at a 7.5% discount to fair value and may offer an 8.1% capital appreciation from the current share price.

Averaging out these two fair values, I compute a fair value of $770.29. This means that the shares of BlackRock are trading at an 11% discount to fair value and could have a 12.4% upside from the current share price.

Summary: BlackRock Offers Income, Growth, And Value

With 13 consecutive years of dividend growth to its credit, BlackRock is past the halfway mark on its journey to becoming a Dividend Aristocrat. And with the payout ratio poised to improve to a more viable level soon, there should be the ability for dividend growth moving forward. That's especially the case when considering the robust earnings growth estimates that analysts have for BlackRock.

Best of all, the stock looks to be trading at a double-digit discount at the current share price. Overall, BlackRock can provide investors with a nice mix of starting income and future income at an attractive valuation for the distant future.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BLK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.