Lululemon Athletica: Raising My Target Price

Summary

- Lululemon Athletica's stock has risen over 25% since I called it undervalued in March.

- Mainland China remains a huge growth opportunity for the company.

- Upon review, I raise my price target to $450.

jentakespictures

Back in March, I wrote that Lululemon Athletica (NASDAQ:LULU) was one of the best growth stories in the upscale apparel sector and that the stock looked undervalued at current levels. Since then, the stock has risen over 25%, outpacing the approximate 13% gain in the S&P 500. Let’s catch up on the name.

Company Profile

As a reminder, LULU is an upscale athleisure brand that sells athletic apparel and accessories such as yoga pants, tops, shorts, and jackets as well as other items.

It sells its items through company-owned stores as well as its e-commerce website and app. At the end of FQ1, it had 662 stores around the globe. LULU also sell through some other channels, including outlet stores, temporary locations, and wholesale accounts.

The company does not own any manufacturing facilities; however, it does have an in-house team of researchers, scientists, engineers, and designers to help design and create its products.

The company also owns an interactive workout platform through Lululemon studio (Mirror). However, the company is reportedly trying to unload the business, which it bought for $500 million back in 2020.

A Global Expansion Story

In my original article, international expansion was one of the main potential growth drivers I discussed, and on that front the company delivered in FQ1, with international sales up 60% in the quarter. I noted earlier that international sales outside of North America were only 15% of revenue in 2021 and 16% in 2022. However, they were up to nearly 22% of total sales in FQ1.

Much of that can be contributed to LULU’s success in China. Chinese sales climbed 79% to $247.9 million. The rest of the world (ROW) wasn’t too shabby, seeing sales growth of 40% to $183.4 million; however, China continues to be the company’s main international growth driver. The company said it saw a significant acceleration of growth in the country as Covid restrictions eased. The company plans to open between 30-35 international stores this year, with the bulk being in Mainland China.

Increasing brand awareness in China remains a focus, as it was just around 7% the last time the company discussed it at its Analyst Day last year. Discussing increasing brand awareness in China on its FQ1 earnings call, CEO Calvin McDonald said:

“Our go-to-market strategy is about building community relationships in connection locally, either through ambassadors and then with our guests. And that strategy is working incredibly well in China. We've done a number of activations both at the local level, store level as well as larger events. We have a few planned for this summer and into the fall. And those are driving the brand awareness, which I think I've shared with everyone before is in the single digit. So we have a huge opportunity to keep building brand awareness. …. So in addition to the stores, as you mentioned, which are one of our top vehicles to do and achieve brand awareness and consideration, we also activate a number of campaigns and do so locally. So they may take a global campaign and then activate it locally, build upon it. That's the example of the Get Into It campaign that we did globally, which was all around our women's leggings initiative. They also will create a market-specific activation campaign, which we're in right now called Worn By Us, which is a fantastic campaign where they are celebrating and highlighting all the ambassadors that we have relationships with, their favorite products and telling their story of inspiration and how they live a well-being life. And we have many more of those plans. So we definitely invest in campaign and traditional brand marketing in that market to achieve the awareness and consideration opportunity. And leveraging digital, which is a big part of our business. We expanded channels. We have .cn. We have Tmall. We added JD. We continue to innovate and do a variety of initiatives across WeChat, leveraging the WeCom platform for a lot of our one-to-one and one-to-many initiatives and plugging into our community. So there are a lot of exciting things.”

As I’ve noted in some prior articles about upscale brands, the luxury market in China has been seeing a nice rebound. And while the country’s 618 shopping festival was considered to be weak, one area that did perform well was upscale apparel. According to Euromonitor, Mainland Chinese consumers are expected to increase their spending on luxury goods by 42% by 2027 to $632.5 billion. LULU is an upscale brand, so it should partake in this uptrend.

Growing the Men’s business was another area I discussed in my original article, as the company looks to grow the category to $3 billion in sales by 2026. While the Men’s business performed well, up 17% in the quarter, sales did trail the women’s business, which was up 22%, and did slow from the over 27% growth it saw in FY2022. While the slowing growth is not a concern at this point, it is something I’d continue to monitor.

I noted that some analysts had cited potential margin pressure as an area to watch, and while this did show up some in FQ4, it quickly improve in FQ1. In FQ4, gross margins did indeed feel a little pressure dipping -300 basis points to 55.1%. However, they improved 360 basis points to 57.5% in FQ1.

Overall, LULU's overall numbers were solid for Q1. Revenue rose 24% to $2.0 billion, while EPS climbed 54% to $2.28. Both easily topped analyst expectations by $76.5 million and 29 cents, respectively. Same-store sales were up a strong 13%, or 16% in constant currencies.

Looking ahead, the company forecast Q2 revenue of $2.14-$2.17 billion, representing growth of 15-16%, with gross margins improving 200-220 basis points. EPS is projected to be between $2.47-$2.52 . For the full year, it upped its guidance to sales of $9.44-$9.51 billion, representing growth of 16-17%, and EPS of $11.74-$11.94.

Like other retailers, the macro environment remains the biggest risk for LULU. Inflation continues to weigh on consumers a bit, and things like the return of student debt payments and increasing rent could also begin to hamper the consumer. Given its brand power and popularity, it probably will hold up more than most, but these latter two issues likely have some impact on its core demographic. If sales get pressured, this could lead to more discounting and a hit to margins, but it all would start with the macro at this point.

I also noted that I thought the Mirror acquisition was a mistake and that the company will need to be more prudent how it spends it cash. With the company looking to reportedly dump Mirror at low valuation, it also seems to recognize its error.

Valuation

LULU currently trades around 18.8x the FY 2024 (ending January) consensus EBITDA of $2.49 billion and 16.6x the FY25 consensus of $2.82 billion.

It trades at a forward PE of 30.7x the FY24 consensus of $11.92, and 26.7x the FY25 consensus of $13.72.

It’s projected to grow revenue 17% this fiscal year and 13% next fiscal year.

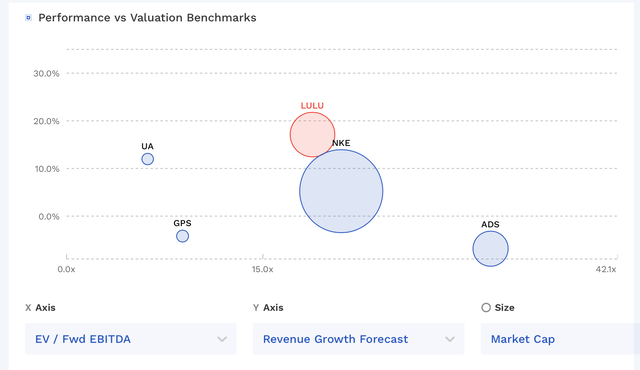

LULU continued trades at discount to rival Nike (NKE), despite its must faster growth.

LULU Valuation Vs Peers (FinBox)

Conclusion

LULU remains one of the best growth brands around, and I see no reason why it should trade at a discount to its larger, slower growth athletic brand peers. International, especially China, is a huge opportunity, while the company remains the go-to brand in women’s athleisure wear. Men’s remains a solid opportunity, although I would keep an eye out on this part of the business, as Q1 did see some slower growth.

Despite the stock’s 25% gain since I first wrote about it, I continue to think the stock has solid upside. Place about a 20x multiple on FY25 EBITDA estimates, which are up since I last looked at the name, and you have a $450 stock. I continue to rate LULU a “Buy.”

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.