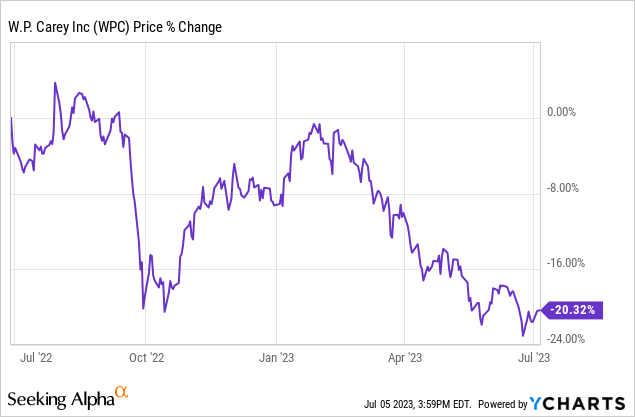

CEO's Call: Seizing The Moment As W. P. Carey Stock Slides 20% With A 6.3% Yield

Summary

- W. P. Carey's stock price has experienced a 20% drop, presenting a significant buying opportunity according to the CEO and investors.

- W. P. Carey's diversified portfolio, with a balance between industrial, warehouse, office, and retail properties, is a key strength. The company has been focusing on growing its industrial and warehouse divisions, which now make up 51% of annualized base rent.

- The company is expected to benefit from inflation-driven rent increases, fueling its same-store growth rates and supporting a strong balance sheet and debt profile.

- While higher interest rates have impacted the stock, recent capital activities and a robust balance sheet provide reassurance for investors.

- With ample liquidity and a favorable valuation of around 12.5x 2023 FFO and a 6.5% yield, W. P. Carey is an attractive investment opportunity poised for future growth.

B4LLS

I strategically began investing in W. P. Carey (NYSE:WPC) and other triple net-lease REITs at the onset of the pandemic, which has proven to be a wise decision. Over time, this particular investment has become one of the top ten positions in my growing dividend portfolio in terms of capital invested.

During the pandemic, I managed to acquire shares of W. P. Carey at various price points, ranging from as low as $40 to as high as $82. These choices have never left me with any regrets. W. P. Carey's remarkable rent collection performance throughout the pandemic, coupled with the company's ability to navigate the challenges posed by COVID-19, have solidified its position and strengthened investor confidence. This enabled the management to focus on continued investments and acquire assets at distressed prices.

Fast forward over three years, and the company is thriving. It has achieved remarkable Q1 2023 FFO and consistently increasing revenues. Despite the company's strong performance, the stock price has experienced a significant decline, dipping below $70. This situation is primarily driven by market overreactions and exaggerated fears regarding the impact of higher interest rates.

Frankly, I never anticipated the stock price to drop below $70 again, unless a major disaster or crisis occurred. However, the current circumstances do not qualify as either. W. P. Carey remains in excellent shape, and the market's reaction seems unjustified given the company's solid fundamentals and growth prospects.

What is going on at W. P. Carey?

W. P. Carey posted a very solid 2023 results with Q1 earnings coming in stronger than expected as FFO reached $1.31 easily beating the estimates by $0.04. FFO rose by $0.02 sequentially but was down $0.04 Y/Y due to lower earnings from investment management.

W. P. Carey maintained its guidance range for 2023 FFO between $5.30 to $5.40, which currently values the company at around 13 times FFO earnings following the stock's dramatic -20% 12M performance.

Portfolio occupancy reached its highest level since 2017 at 99.2%. Impressively, the last time portfolio occupancy dipped below 98% on a full-year basis was more than 10 years ago in 2011 when it was recorded at 97.3%. That is testament to W. P. Carey's strong tenants and management's smart portfolio allocation. Similarly, rent collection, which had been of vital importance during the peak of the COVID crisis, is well above 99% coming in at 99.4% which is even stronger than the 99.3% it recorded for Q4 2022.

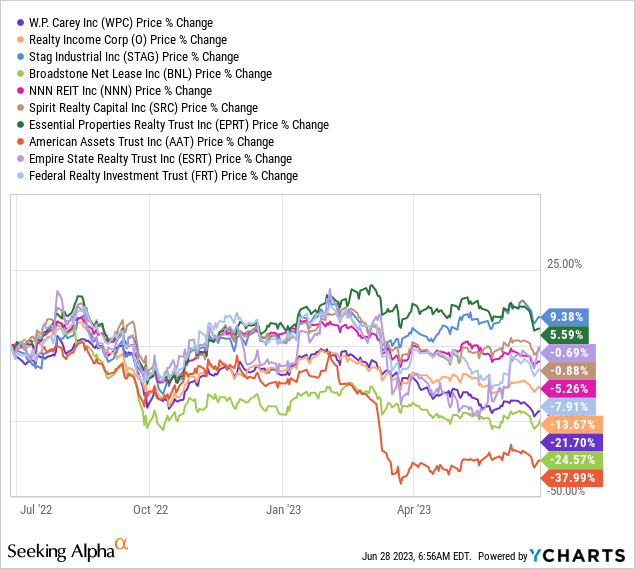

Compared to its peers, W. P. Carey is clearly underperforming and at the very bottom of that list as only BNL and AAT have been performing worse. Interestingly, I find both of these stocks appealing, considering their significantly distressed stock prices. What makes them even more intriguing is the fact that both companies continue to demonstrate robust earnings and other key operating metrics. This situation clearly indicates that the market is presenting abundant and enticing buying opportunities for those who possess the patience to weather the storm and capitalize on these favorable circumstances.

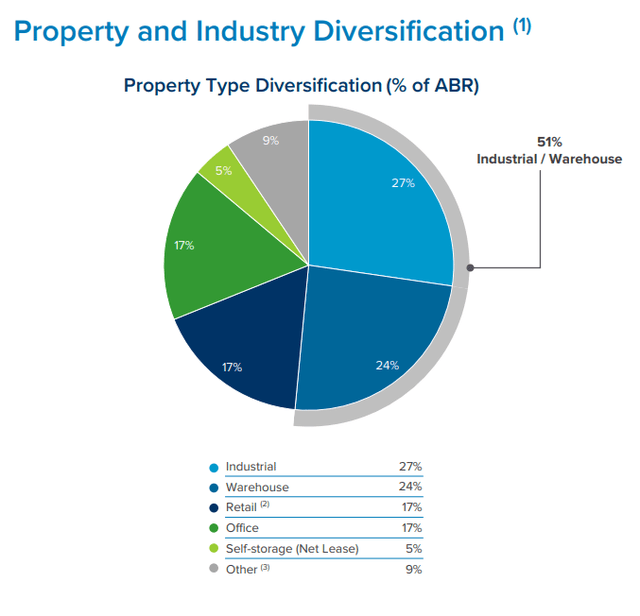

W. P. Carey - Diversification is Key

In my view, W. P. Carey is the most diversified landlord on the market with an almost perfectly balanced portfolio. W. P. Carey has been constantly expanding its property portfolio which currently consists of 1,446 net lease properties, which is up from 1,390 3 quarters ago. In terms of diversification, W. P. Carey's portfolio has almost been equally split among four key property types: Industrial (27%), Warehouse (24%), Office (17%) and Retail (17%). Over the last year, W. P. Carey has made some key strategic decisions regarding its portfolio by focusing on growing its industrial and warehouse divisions.

W. P. Carey Property and Industry Diversification (Investor Relations)

The Industrial/Warehouse cluster sits at 51% of annualized base rent and is the main reason why W. P. Carey mastered the pandemic almost unscathed. Now the upcoming recession will be different from COVID as it will likely lead to a significant decline in consumer spending and while that may impact the expansion in the Industrial and Warehouse segment, this does not mean that W. P. Carey won't continue to collect rent.

Compared to just three quarters ago W. P. Carey made further inroads with developing its Industrial/Warehouse cluster which now for the first time ever exceeded 50% of annualized base rent (ABR) while it has been aggressively scaling down on its Office portfolio.

The CEO is bullish and so am I

Recently, W. P. Carey's CEO Jason Fox was asked by analyst if there is a disconnect between W. P. Carey's stock price and its business fundamentals and Jason Fox gave a very bullish response by stressing that the current weakness in shares represents a "buying opportunity".

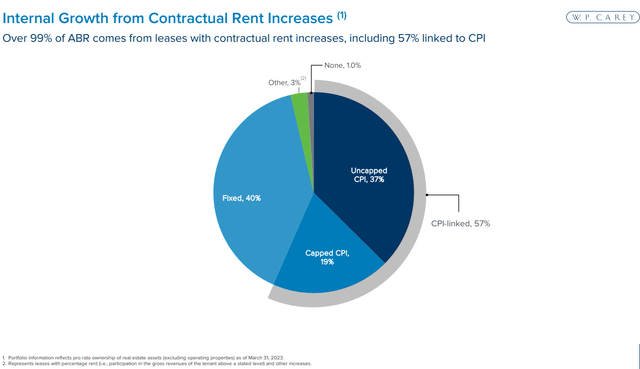

This statement was made at the Nareit REITweek conference in early June and accompanied by further bullish commentary surrounding rent collection and inflation protection.

W. P. Carey - Inflation Protection (Investor Relations)

57% of W. P. Carey's portfolio is indexed to inflation, either capped or uncapped, and that per se already offers a substantial degree of protection against inflation. The Fed has displayed a remarkably aggressive stance regarding its monetary policy by rapidly increasing interest rates. Consequently, it seems that the previously soaring inflation has been effectively curbed, with recent data showing a decline to below 5%. This reduction in inflation is undoubtedly a positive development.

It's worth noting that despite the downward trajectory of inflation, W. P. Carey is poised to continue benefiting from its CPI-linked rent contracts. These agreements operate on a lagging basis, meaning that even as inflation recedes, the company will still enjoy the advantages offered by these arrangements. This characteristic further strengthens the investment case for W. P. Carey, as it provides a measure of stability and insulation from the short-term fluctuations in the inflation landscape.

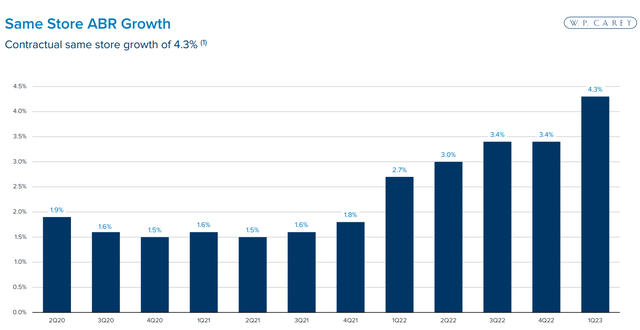

W. P. Carey expects to average around 4% contractual rent growth for 2023 despite inflation coming down which is the highest contractual rent growth in the net lease sector. Furthermore, as stressed above, there is a lag between inflation and rents and thus:

And even though there is evidence that inflation is beginning to cool, inherent lag on which it flows through the rents keep our contractual same-store rent growth at around 4% in 2023 and over 3% in 2024. Keep in mind, this is based on projections of inflation returning to around 2% by the end of next year. So to the extent inflation remains above 2%, our same-store rent growth will also remain elevated.

Source: W. P. Carey Q1/2023 Earnings Call

These would undeniably be two of W. P. Carey's best years ever and the market is 100% not rewarding the company for that.

W. P. Carey - Same Store ABR Growth (Investor Relations)

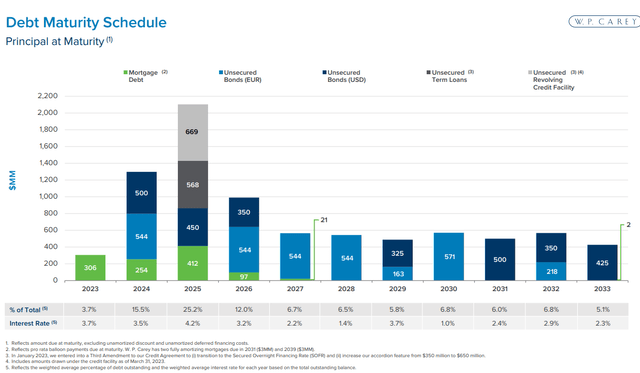

In my view, the most crucial thing right now is to take a good look at the debt profile of REITs and BDCs in order to assess their relative strength in this high-interest environment which we haven't been confronted with for decades. And it is not only the expected peak interest level of around 5% in 2023 which is concerning but also the immense pace at which the Federal Reserve is hiking rates. The Fed caused that situation all by itself as it deemed inflation transitory for many months and was significantly too slow to react to the outbreak of the war and soaring energy prices.

W. P. Carey sports a solid and conservative balance sheet with a manageable debt maturity ladder. However, while only a miniscule 3.7% or a little over $300M of mortgages is due in 2023, W. P. Carey faces significant maturing debt in 2024 and 2025 which together amount to roughly 40% of total debt.

W. P. Carey - Debt Maturity Schedule (Investor Relations)

The probability of W. P. Carey redeeming its debt without significant refinancing is exceedingly low. With the Federal Reserve rates already surpassing 5% and no compelling evidence indicating an imminent pivot by the Fed, it is highly plausible to anticipate that W. P. Carey will need to pursue refinancing options at potentially substantially higher interest rates compared to the current rates of 3.5% for debt maturing in 2024 and 4.2% for debt maturing in 2025.

The precise ramifications of this scenario on W. P. Carey remain uncertain. However, even if interest costs were to increase significantly in the near term, it is important to note that W. P. Carey boasts an exceptionally robust balance sheet. With approximately $1.7 billion in available liquidity at its disposal, the company possesses the means to potentially redeem all of its 2023 and 2024 debt. It is worth mentioning that while this option is available, W. P. Carey is unlikely to pursue it, as the company can achieve higher capitalization rates by adhering to its proven M&A strategy :

We therefore continue to have capital put to work and remain well-positioned to fund the investment volume embedded in our guidance.

Source: W. P. Carey Q1/2023 Earnings Call

What's in WPC Stock for Dividend Investors?

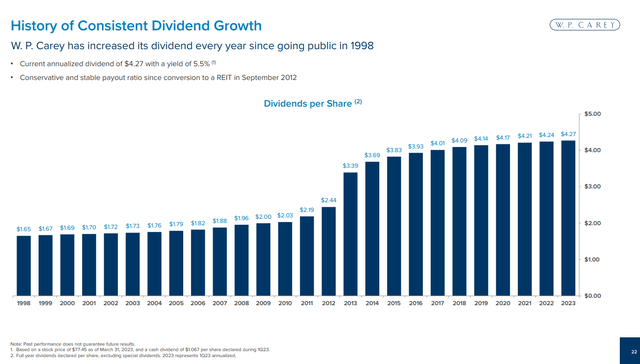

W. P. Carey has a long and strong dividend track record with over 21 years of annual dividend growth and year-long series of quarterly, even if mediocre, dividend hikes since its IPO in the late '90s and is thus closing on joining the illustrious Dividend Aristocrat cycle.

It is one of a very few REITs that was able to maintain its dividend growth streak amid the pandemic. While these dividend raises can only be described as anemic or as a tiny snowflake (it is just 0.2% per quarter), for an investor with many years or decades of investing ahead, even a tiny snowflake can turn into a big snowball, especially when that initial snowflake, the current dividend yield, already starts at close to 6.5%.

W. P. Carey - Dividend History (Investor Relations)

I started my position in W. P. Carey in March 2020 and have been mostly running it on bi-weekly investment plans ever since, as well as opportunistically adding more shares when I had some additional funds available.

The main reason for that anemic dividend growth over the last couple of years is W. P. Carey's relatively high payout ratio which was consistently above 80%. Factoring in the company's 2023 guidance mentioned above, the year-end AFFO payout ratio would drop below 80%. And although management hasn't explicitly communicated any target payout ratio, a level below 80% is certainly more sustainable than what the REIT had managed to achieve in the last couple of years.

This positive development instills confidence in me, as it suggests that dividend growth will regain momentum in the coming year, thus offering a stronger safeguard against inflation. It is noteworthy that since 2014, the annual dividend has only experienced a modest 14% increase in total. Nonetheless, for investors seeking a secure and substantial income, this stock presents an appealing opportunity. As previously mentioned, moving forward, higher inflation is poised to serve as a tailwind rather than a headwind for the company, and there are few dividend-paying companies that can make such a claim.

What's really fascinating about W. P. Carey, however, is how well it puts its diversification to work for investors. For example, it has avoided U.S. retail assets in favor of European retail, because it believes the U.S. has too many stores. And early in the pandemic, it announced plans to buy industrial and warehouse assets. It saw an opportunity to invest in an increasingly important property type while companies were trying to bolster their liquidity in the face of the health scare.

Investor Takeaway

The CEO's perspective aligns with my own, as I also consider the recent 20% decline in W. P. Carey's stock price over the past 12 months as a compelling buying opportunity. Despite its exceptional standing within the triple net lease sector, the stock's performance during this period does not adequately reflect its true value.

Inflation-driven rent increases will continue to propel the company's same store growth rates and provide enough operating leverage to maintain its strong balance sheet and its ability to refinance and service its debt obligations.

Undoubtedly, the stock has been affected by the impact of higher interest rates. However, the 20% correction witnessed over the past year sufficiently accounts for this concern. Recent capital activities undertaken by W. P. Carey further reinforce confidence among investors. The REIT has demonstrated its exceptional access to capital markets by swapping a €500M term loan to 4.34% due April 2026 and well as a September 2022 private placement of €150M of 3.41% senior unsecured notes due 2029 and €200M of 3.7% unsecured notes due 2032.

W. P. Carey is equipped with ample liquidity that it can cautiously and selectively leverage to take advantage of the numerous opportunities that will emerge. The current stock valuation, trading at around 12.5x 2023 FFO and offering an attractive yield of nearly 6.5%, makes it an enticing buy for investors. Personally, I am a satisfied investor and intend to continue my bi-weekly savings plans for the foreseeable future.

All those factors make the stock a strong buy right now and an even stronger buy should it experience further declines in the future.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WPC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not offering financial advice but only my personal opinion. Investors may take further aspects and their own due diligence into consideration before making a decision.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (13)