Starbucks: One Of The Most Attractive Plays In The Sector, But There Are Risks

Summary

- Starbucks has a compelling growth story, with plans to expand its number of locations and replicate its successful formula.

- The company's valuation reflects a 10.7% upside, but there are significant risks, including exposure to China, a new inexperienced CEO, and the threat of unionization.

- The author rates Starbucks as a Buy with a price target of $109.2 per share but advises investors to monitor the company closely for any materializing risks.

jetcityimage

Starbucks (NASDAQ:SBUX) can be the poster child for a successful food service franchise, growing its store count from the first store it opened in 1971, to more than 36,634 locations today. As it opened more and more locations, EPS grew exponentially, and the stock followed. Between 1996-2022, Starbucks' earnings per share grew 95x (33% CAGR), and the stock grew 51x.

Being that opening new locations is the main growth driver for a company like Starbucks, the question that's on investors' minds after years of extraordinary growth is whether or not the growth story is approaching saturation, as Starbucks' worldwide presence is already vast.

So, let's dig deeper into the company's growth prospects and profitability drivers, and see if it's still an attractive growth story.

Note: I recently wrote an article covering another company in the restaurant sector, which is Chipotle (CMG). This article will cover a lot of similar aspects, and I encourage you to read the Chipotle article as well, so you can compare and contrast my views about the companies, and see additional discussion about the restaurant sector.

Company Overview

Starbucks sells handcrafted coffee, tea, and other beverages as well as a variety of high-quality food items through company-operated stores (81.6% of sales), licensed stores (12.6% of sales), and other channels such as grocery retailers (5.8% of sales). The first Starbucks location was opened in Seattle, Washington, in 1971. Now, 52 years later, Starbucks employs 402,000 people, and there are 36,634 Starbucks stores worldwide, 17,979 of them are licensed and 18,655 are co-operated.

The coffee giant operates under three reported segments - North America, which consists of 17,482 company-operated and licensed stores in the U.S. and Canada; International, which aggregates the performance of 19,152 stores, 6,243 of which are located in China; and Other Channels, which includes Seattle's Best Coffee, branded Starbucks and Teavana single-serve products, a variety of ready-to-drink beverages, and other foodservice products. A large portion of the Channel Development business operates through a licensing model under the Global Coffee Alliance with Nestlé (OTCPK:NSRGY), while global ready-to-drink businesses operate under collaborative relationships with companies like PepsiCo (PEP).

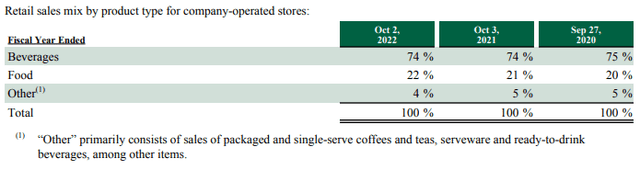

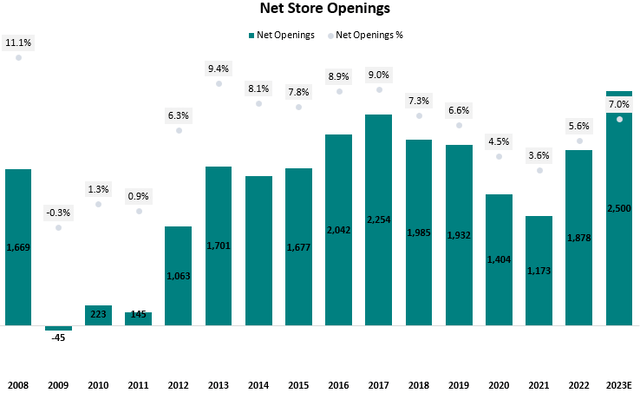

Created and calculated by the author using data from Starbucks financial reports

As we can see, North America is the largest segment, comprising 73% of total revenues and 68% of total operating income. The International segment is second, generating 21% of total revenues and 17% of operating income. Channel Development is the smallest segment, with 6% of total sales and 15% of operating income. However, it's by far the most profitable segment, with a 54.5% EBIT margin, compared to North America's 19.1% and International's 17.0%.

Looking at the company's sales mix, beverages are around 74% of total sales, whereas food is 22%. Other products, which mostly include packaged coffees and teas, ready-to-drink, and serveware, are generating 4% of total sales.

Introduction: Food Chains, The Simplest Growth Formula There Is

Food chains can be amazing businesses, with a clear pathway for profitable growth, as long as they're able to reliably duplicate a successful formula in a large number of locations.

I categorize the food chain growth formula under five simple pillars: Predictability of quality; Recognizability & Customer Loyalty; Disciplined capital allocation; Geographic expansion; and Same-store growth.

The first two pillars are key because they are the drivers of store traffic. Imagine if McDonald's (MCD) used a different logo for every location, and named each location differently. It would lose a whole lot of brand value and destroy the marketing synergies it enjoys as a large franchise. However, being a large and recognized franchise comes with the risk that a poorly managed location will affect the appeal of others. Thus, a food chain cannot succeed if it doesn't provide its customers with a predictable product, meaning that the Big Mac they order in Barcelona will be essentially the same as the Big Mac they order in Manhattan.

In order to capitalize on those two foundational attributes, the chain must be managed with discipline, specifically in terms of capital allocation. If a food chain loses the balance between expanding and improving same-store efficiency, it could quickly become overleveraged and suffer from terrible cash cycles. When managed correctly, the chain should be able to open new locations at a fast pace while improving the performance of existing ones, a combination that should result in steady revenue growth and consistent margin expansion.

The Starbucks' Strategy

Our strategy for expanding our global retail business is to increase our category share in a disciplined manner, by selectively opening additional stores in new and existing markets, as well as increasing sales in existing stores, to support our long-term strategic objective to maintain Starbucks standing as one of the most recognized and respected brands in the world. Store growth in specific existing markets will vary due to many factors, including expected financial returns, the maturity of the market, economic conditions, consumer behavior and local business environment.

--- Starbucks 2022 Annual Report (10-K), Page 6

As we can see, Starbucks is clearly focused on the five pillars we discussed above. Let's assess them one by one.

Predictability Of Quality

One of the biggest risks with food chains is food safety and food quality. To perform well on those two points, the company needs a strong leadership structure, that creates accountability for every person in the chain.

Unlike Chipotle, which I found as industry-leading with regards to the accountability aspect, as it does a huge number of internal promotions, and provides employees with industry-best benefits and bonuses, I find Starbucks not as impressive.

Starbucks does provide employees with some benefits, like health insurance and tuition coverage, but it's not nearly as attractive for employees compared to Chipotle. The company doesn't even disclose internal promotion numbers, and it seems there are no significant low-level performance-based bonuses. As evidenced by the unionization threat that seems to never go away from the company, Starbucks' employees aren't as satisfied.

On the flip side, Starbucks' food and drink propositions are much easier to assemble and less prone to health issues. There are few fresh ingredients and the food sold is mostly packaged and pre-prepared. Aside from milk and egg products that might go bad, there aren't too many things that could go wrong. Moreover, Starbucks is a leader in innovative solutions that reduce the amount of human intervention required to serve its customers, which is another attribute that decreases the company's risk.

Overall, I believe Starbucks could benefit from better employee satisfaction and accountability, but I don't think this is a deal-breaker.

Recognizability & Brand Loyalty

I'm sure that every reader of this article can close their eyes and imagine the peculiar Starbucks logo, so the recognizability aspect is clear. Starbucks has the largest market share in out-of-home coffee, and it created one of the most impressive traffic drivers in the restaurant industry with its loyalty and card programs.

Today, there are 75M individuals who visit a Starbucks 1-2 times per week in the U.S., and the company fulfills more than 400M transactions on a weekly basis. As of Q2-FY23, 90-Day Active Starbucks Rewards Members amounted to 30.8M in the U.S., reflecting 16.7% growth YoY, and 34.5% growth compared to 2021. Those members account for 57% of the total spend in the company-operated U.S. stores.

Additionally, the company provides customers with the Starbucks Card offering. Customers can load cash in the card, and get attractive value using it in Starbucks' locations. In Q2-FY23, Starbucks cards were used in 46% of the transactions in the company's U.S.-operated stores, and almost $2.6B were loaded into them.

Not only that the Starbucks Rewards program enhances customer loyalty, but it is also extremely beneficial for the company's cash cycle, as customers load cash in advance, and spread its use over a long period of time. Starbucks is able to exploit that cash to finance its ongoing operations, as well as use it for other purposes like investments in store openings and store improvements.

Disciplined Capital Allocation

There are a few ways to assess whether or not a company is disciplined with its capital allocation. Looking at Starbucks, the two most important metrics for me are return on invested capital (ROIC) and Net Debt to EBITDA.

Created and calculated by the author using data from Starbucks financial reports (10-K)

As we can see, Starbucks' steady-state ROCE is historically above 25% and in 2023 it should approach the 30% threshold. In simple words, Starbucks has demonstrated its ability to steadily turn $1 into $1.25, excluding covid-impacted years. Looking at leverage, it's very manageable, as the company can essentially pay down its entire debt commitments with its cash and less than two years of EBITDA.

Geographic Expansion (Store Openings)

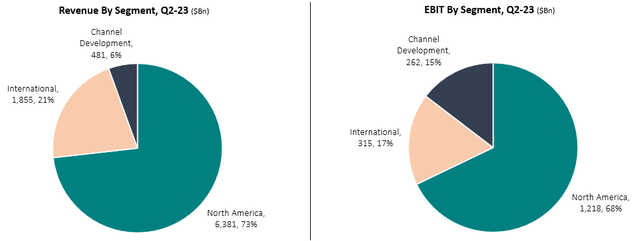

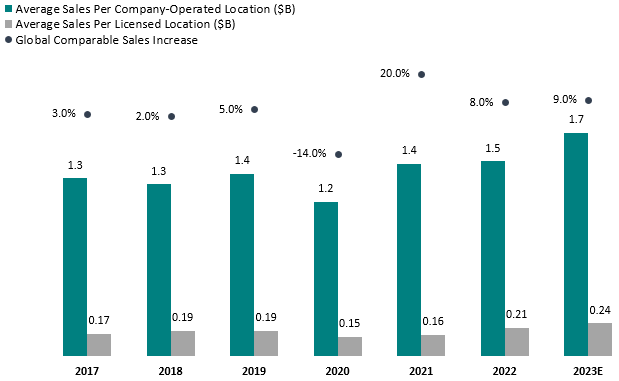

Created and calculated by the author using data from Starbucks financial reports (10-K)

If I had to pick one reason restaurants are so simple to understand, it's their simple growth trajectory. Even a 5-year-old can understand that a company with 38,211 locations will probably make more money than a company with 15,011. At the end of 2022, the company licensed and operated 35,711 locations, and management is targeting 7% global store growth for the mid-term, with China being the major growth driver, at 13%.

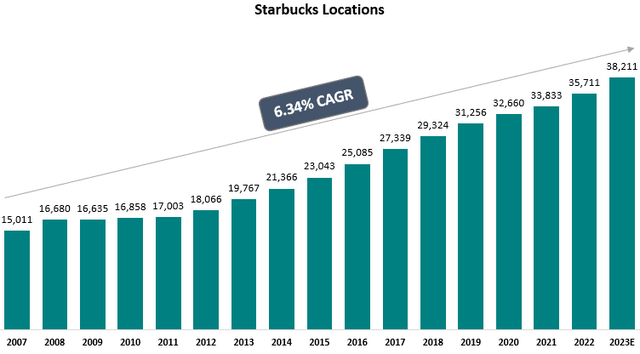

Created and calculated by the author using data from Starbucks financial reports (10-K)

Putting macro-affected years aside, we can sense that generally, a 7% growth rate is very achievable for Starbucks. Naturally, as the company's baseline expands, it's going to be harder to stick to the 7% range, but management is confident in its ability to supervise and maintain that rate for the foreseeable future.

Same-Store Sales

Created and calculated by the author using data from Starbucks financial reports (10-K)

Lastly, looking at same-store sales, Starbucks' numbers are mixed. Before the pandemic, the company's same-store sales growth was in the low single digits, which is pretty low for a food service company. Post-pandemic, we're seeing impressive numbers, but it's hard to tell how much of it is attributed to a post-pandemic recovery and how much of it is core efficiency and price improvements. As we'll discuss, management is targeting and guiding same-store sales in the 7%-9% globally, which, if achieved, will be great for the stock.

Growth Prospects

So Starbucks has clearly delivered great results with its strategy in the past. However, we all know that what matters is the future. In order to continue to generate market-beating returns for its shareholders, Starbucks will have to continue to provide same-store sales growth, along with significant store openings, and equally important, continued margin expansion.

Thankfully, Starbucks Investor Day in 2022 has provided us with a detailed growth plan for FY23-FY25, which makes our life easier. For the mid-term, Management is guiding for 10%-12% annual revenue growth and 15%-20% EPS growth.

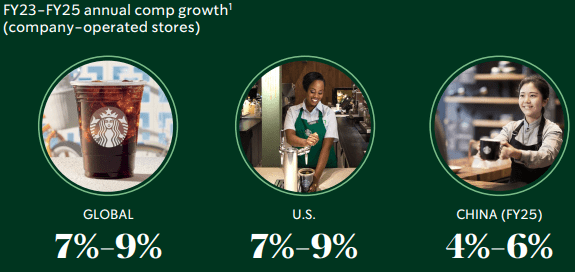

Comparable Sales Growth

Starbucks 2022 Investor Day, CFO Presentation

Management is expecting the majority of revenue growth will be generated from comparable sales growth, with 7%-9% same-store sales growth globally in the mid-term.

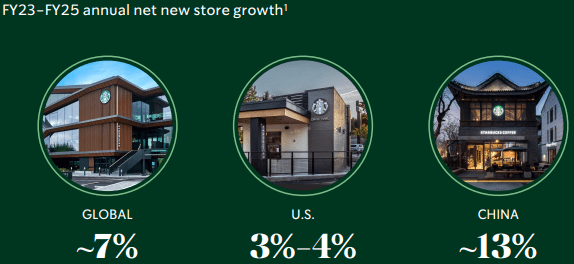

Store Openings

Starbucks 2022 Investor Day, CFO Presentation

Starbucks' expansion plans are quite ambitious. The company plans to grow stores at a 7% pace globally. Management is targeting 18,000 stores In the U.S., and 9,000 stores in China by the end of FY25, reflecting 518 and 2,757 net openings, respectively, in the next year and a half.

Starbucks 2022 Investor Day, COO Presentation

And new store economics are very impressive, as the company expects a full return on investment in less than two years from opening.

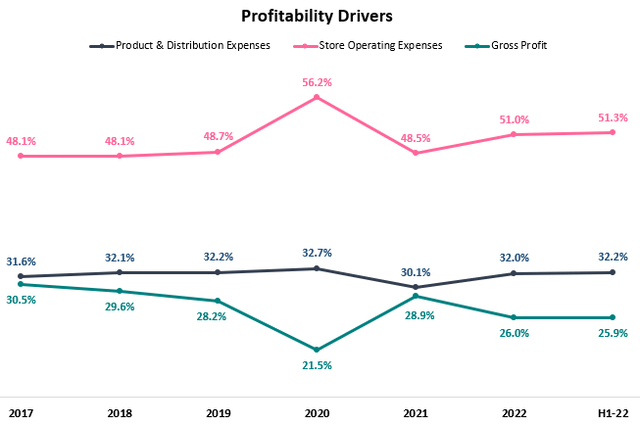

Margin Expansion

Created and calculated by the author using data from Starbucks financial reports; Product & Distribution Expenses are shown as % of total sales; Store Operating Expenses are shown as % of company-operated stores sales.

Looking at Starbucks' margins, it's clear there's significant room for expansion. The company is still very far from historical levels as Production & Distribution Expenses and Store Operating Expenses as a percentage of sales are at a 7-year high. Consequentially, the company's gross margin is very low, at 25.9%, compared to 30.5% in 2017. If Starbucks is able to achieve 2017 margins, that's a 3.6 percentage point expansion by itself. As the company's investments in R&D and store openings continue to materialize, I see no reason why the company shouldn't progress toward 2017 levels.

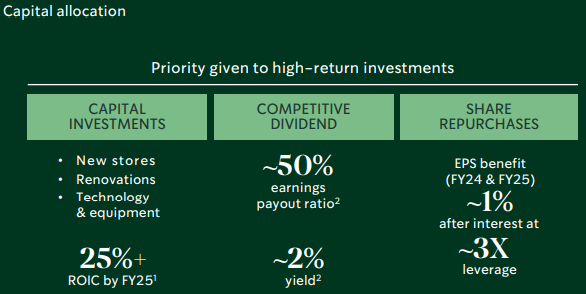

Capital Allocation

Starbucks 2022 Investor Day, CFO Presentation

Looking at capital allocation, management expects to stay above the 25% ROIC threshold, with steady leverage. With a commitment to a 50% payout ratio and a 15%-20% EPS growth target, dividend investors can expect dividend growth of around 8%-12% annually.

Relative Valuation Comparison

Overall, Starbucks checks most of my qualitative boxes. So let's switch gears to valuation.

Looking at food services companies, the first metric that deters investors is their P/E ratio. Historically, the restaurant sector has been viewed as highly competitive, and food services were viewed as narrow-moat businesses. However, in 2023, it seems that restaurants, especially quick-service restaurants, are demonstrating impressive resiliency in a tough economic environment.

The way I see it, food services are one of the hot industries to invest in, which already is a red flag for me. In my opinion, the strong results are a combination of pent-up demand due to the pandemic, decreasing cost inputs after a huge inflation surge in 2022, and faster-than-normal store openings as delayed growth plans were pushed forward.

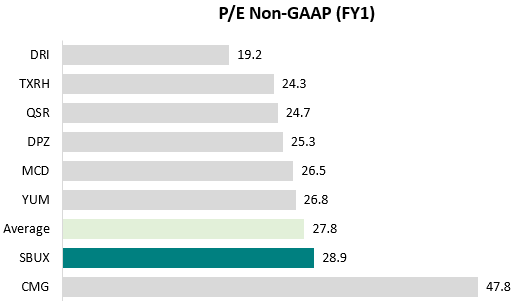

Created by the author using data from Seeking Alpha; Data as of July 5th, 2023

As we can see, the average P/E multiple in our group is much higher than the S&P 500. And Starbucks specifically, is trading at a premium compared to its peers.

Created by the author using data from Seeking Alpha; Data as of July 5th, 2023

Looking at a longer time horizon, we see a slightly more attractive picture. According to analysts' estimates, our peer group as a whole is expected to grow its EPS by 30% in the next two years, reflecting an average P/E multiple of 21.0 in 2025. With that growth prospects in mind, the current premium of the restaurant industry seems more reasonable.

Besides Chipotle, Starbucks is the only company that's trading above the peer average. Unsurprisingly, those are the two companies that are expected to grow at the fastest pace.

Overall, I view large quick-service franchises (like most of the companies we have on our list) as companies that do have a significant moat, in the form of large scale and high brand value. Thus, I find the higher multiples reasonable, and with Starbucks' growth trajectory, I find its premium compared to the peers' average reasonable as well.

Valuation

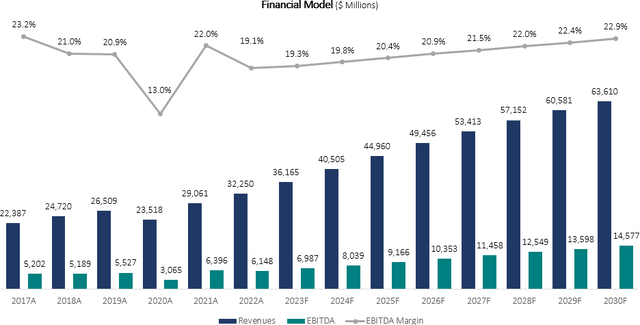

I used a discounted cash flow methodology to evaluate Starbucks' fair value. I assume the company will grow revenues at a CAGR of 8.4% between 2023-2030, based on its expansion plan and comparable sales targets.

I project EBITDA margins to increase incrementally up to 22.9% in 2030, due to improvements in gross margin, and more significantly, due to economies of scale which will result in a decrease of G&A and R&D as % of sales, as well as a decrease of pre-opening and restructuring costs as % of sales.

Created and calculated by the author based on Starbucks financial reports and the author's projections

Taking a WACC of 8.3%, and adding Starbucks' net debt position, I estimate the company's fair value at $125.2B or $108.9 per share.

Risks

Let's begin with the most prominent risk when it comes to Starbucks, which is the China exposure. In 2022, China was responsible for $3B in sales for the company, which is 9.3% of total revenue. We know that the International segment is not as profitable as North America, so we can assume that China generated an even lower percentage of the total operating income. So, the China exposure, as of today, isn't that significant. However, China is one of the biggest (if not the biggest) growth drivers for the mid-term. Starbucks expects its operating income in China to 4x between 2022-2025 and plans to open more than 2,700 stores in the country.

The risk of exposure to China comes in two verticals. First, as Covid taught us, the government is capable of shutting down business activity for a long period of time. Without getting into politics, I think we can all agree the chance of that happening again is larger than zero, and we already saw Starbucks' stock declining on headlines of a new outbreak in China. Secondly, as geopolitical tensions heat up between the U.S. and China, there's the possibility that the activity of American companies in China will be limited. Again, I think the chance of that happening is larger than zero.

Although I find both risks very unlikely, I think we have to acknowledge there will be occasional downtrends just because of a bad China headline. Adding all of that up, I believe Starbucks is a riskier investment than a company like Chipotle in that regard, which is one of the reasons I used a higher WACC.

Another risk I'd like to address is the resignation of Starbucks' legendary CEO, Howard Shultz. On three separate terms, Howard Shultz has led Starbucks to new records. After leading the company for a total of more than 20 years, I think it's reasonable to worry about the company's ability to succeed without him as its leader. The new CEO, Laxman Narasimhan, came from outside the company in 2023 and has never worked in the food service industry. He might be very capable, but we have no experience in the field to rely on.

Lastly, I want to discuss unionization. As we all know, companies that operate a large number of stores by themselves are more prone to unionization than those that rely solely on a franchise model. With more than 10,000 operated stores in the U.S., Starbucks is a fertile ground for unionization. And why is it a risk? I encourage you to take a look at the list of 'Wants' made by the Starbucks unions. In essence, by unionizing, workers can demand better wages, which means, for us investors, lower margins. Moreover, unionization is a sensitive topic and could lead to legal risk, as well as hurt the brand's image. All in all, it would be much nicer if there was no such risk weighing on the company. Currently, a little over 3% of Starbucks company-operated stores in the U.S. have unionized, and it seems the company is focusing on improving employee satisfaction to disincentivize additional unionization.

Overall, I find Starbucks' risks to be way more significant than what I saw with Chipotle. Thus, I think investors need to consider how much margin of safety they require to amend for those.

Conclusion

Starbucks has one of the most compelling and simplest growth stories in the market. All the company needs to do is continue and expand the number of its locations, and replicate its exceptional proven formula for success. Fundamentally, the company's business is very well run. While I do find the current valuation attractive, I believe there are serious risks weighing on the company, namely exposure to China, a new inexperienced CEO, and unionization. Despite that, I rate the stock a Buy and plan to monitor the company closely, to see if any of the risks are materializing.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)

If you'd like to receive a notification when I publish my next article please hit the follow button.

I would love to hear your thoughts / suggestions / questions regarding my analysis.