U.S. Bancorp: The Fed Just Sent Another Strong Buy Signal

Summary

- All 23 major U.S. banks, including U.S. Bancorp, passed the Federal Reserve's latest round of stress tests, indicating they have sufficient capital to withstand a severe economic recession.

- Despite a market sell-off in the regional banking market in Q1, U.S. Bancorp's shares continue to trade at a depressed price-to-book ratio, making it an attractive investment opportunity.

- Stabilizing deposit flows after Q1, a stress test pass, potential for a dividend increase in Q3 and a low valuation are strong reasons to consider USB.

Sundry Photography

The Federal Reserve recently completed its stress test for U.S. banks and results were closely watched after the regional banking market slid into a period of uncertainty after a number of bank failures. Fortunately, all 23 banks whose capital positions were under scrutiny passed the Fed's stress test and investors in U.S. Bancorp (NYSE:USB), the fifth-largest bank in the U.S. based on assets, have one more reason to buy the regional bank at a very attractive valuation.

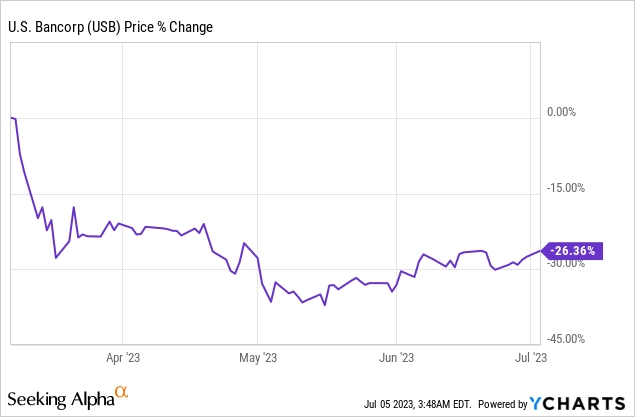

After recommending U.S. Bancorp in April -- a little bit too early, however: U.S. Bancorp: Lean Into The Fear -- I repeatedly added to the regional bank in the following months and USB is now my second-largest position in my portfolio after Western Alliance Bancorporation (WAL). The lack of a fundamental rebound, the passing of the Fed's stress test as well as stabilizing deposit flows in the regional banking market prove, in my opinion, that investors are still too fearful of U.S. Bancorp!

If you acted on my previous buy recommendation from April, you would have made a gain of 0.78%, so clearly the market has not been ready to correct some of the mispricing that I see with shares of Bancorp. As reasons to buy U.S. Bancorp, I have cited an overall robust deposit base, a strong liquidity position and better than expected Q2 earnings results.

The latest stress test results further support an investment in U.S. Bancorp

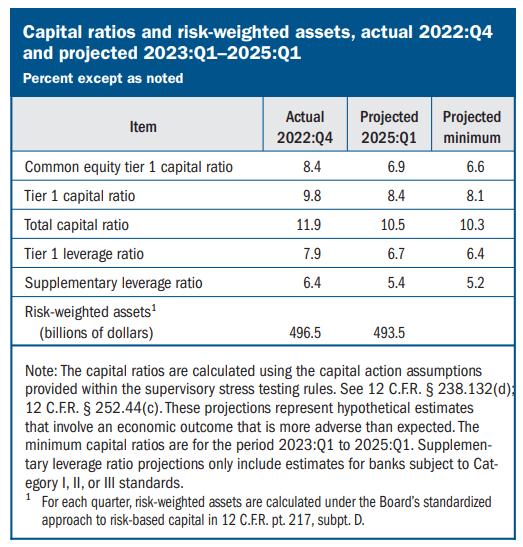

The Fed conducts annual stress tests in order to determine whether U.S. banks have sufficient capital positions in order to withstand an economic recession and are capable of absorbing an increase in loan defaults.

The 23 banks included in the stress test include the four top tier banks as well as the largest regional banks in the country, including U.S. Bancorp. According to the Fed's stress test, U.S. Bancorp would see its common equity tier 1 capital ratio, a key measure for banks, from 8.4% at the end of Q4'22 to 6.9% under the severely adverse scenario (Source) which is well above the regulatory minimum of 4.5%. In other words, even in a severe recession and a spike in loan losses, U.S. Bancorp has a strong enough capital position to survive. The stress test results favor U.S. Bancorp especially because the bank was prominently accused in April (Source) to have inadequate capital levels.

Source: Federal Reserve

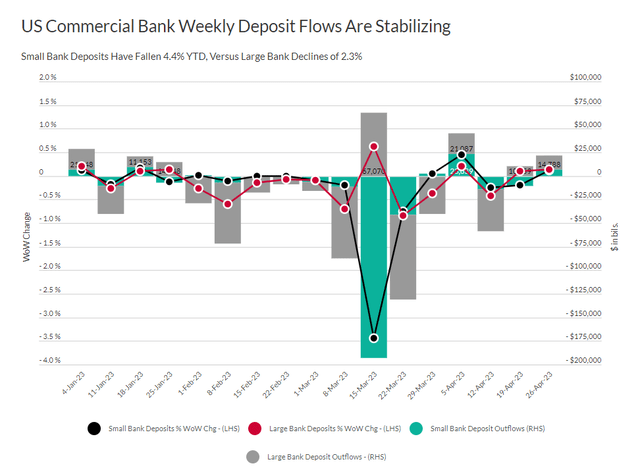

The stress test results further support an investment in U.S. Bancorp, in my opinion. Combined with rather limited deposit outflows in the first-quarter (the majority of which occurred not because of banking turmoil, but because customers engaged in cash-sorting efforts due to higher yields available in the market) and stabilizing deposit flows after the end of Q1'23, I believe investors have one more reason to consider buying U.S. Bancorp on the drop. The trend of stabilizing deposit flows likely continued in the second half of the second-quarter, potentially leading to surprise potential for the regional banking market in general.

U.S. Bancorp's valuation and yield in comparison other regional banks

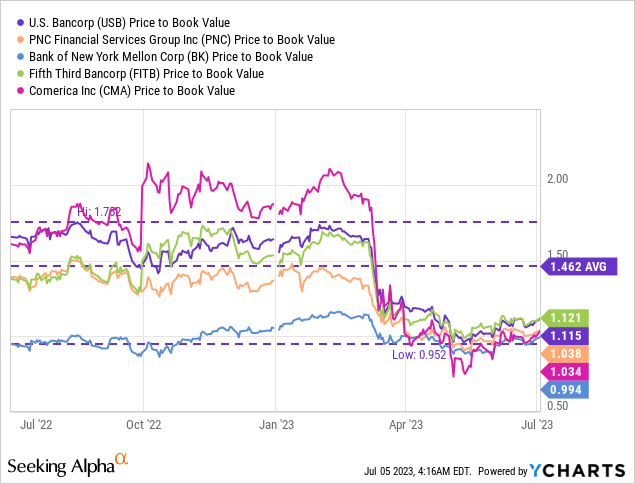

U.S. Bancorp has not yet recovered from the market sell-off in the regional banking market in the first-quarter and the bank's shares continue to trade at a depressed price-to-book ratio, in my opinion.

U.S. Bancorp's valuation is depressed because its current P/B ratio is 24% below its 1-year average P/B ratio. Most regional banks have seen large valuation declines in the wake of the Silicon Valley Bank failure, including Comerica (CMA), PNC Financial (PNC) and Fifth Third Bank (FITB). That U.S. Bancorp's valuation has not yet rebounded is the main reason for me why I have continually added to my position in the regional bank since April.

If U.S. Bancorp achieves its average P/B ratio of 1.46X again, then USB could be valued at around $44-45, which is where I see the bank's fair value, implying 33% revaluation potential. Just before the crisis, U.S. Bancorp traded at about $46 and I would expect the bank's shares price to eventually return to this price range.

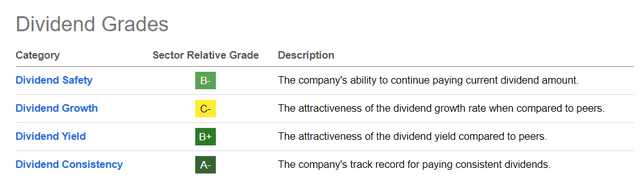

Dividend yield, payout ratio and potential for dividend increase in Q3'23

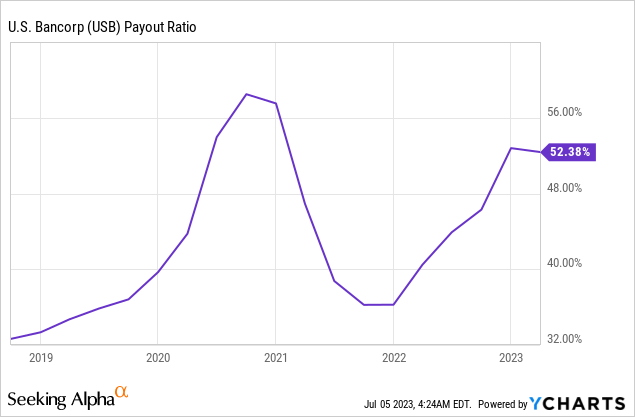

What I find especially attractive about an investment in U.S. Bancorp is that the bank's shares pay a 5.7% dividend yield that is supported by a relatively low payout ratio. According to Seeking Alpha, U.S. Bancorp only pays out slightly more than 50% of its earnings which should be more than sufficient to allow the bank to pay its dividend.

U.S. Bancorp has a Seeking Alpha dividend safety grade of B-, strongly indicating that the bank's dividend is not only relatively safe, but that it can grow going forward. Given U.S. Bancorp's history of dividend growth (12 straight years), I expect the bank to raise its dividend $0.02 per-share to $0.50 per-share in the third-quarter... which would reflect a 4% dividend raise and bring the forward dividend yield to 6%.

Risks with U.S. Bancorp

The biggest risk for U.S. Bancorp is a potential reboot of the regional banking crisis which I consider to be a low-probability event. The stress test results have also made clear that U.S. Bancorp should have adequate capital in case of a severe economic recession which should be comforting to investors to know, especially because U.S. Bancorp has seen a steep decline in its market cap during the regional banking crisis in the first-quarter.

Closing thoughts

U.S. Bancorp passed the Fed's stress test as did the other 22 (regional) banks that were included in the Fed's annual stress test. Considering that U.S. Bancorp is well-capitalized, deposit flows started to normalize after the end of the first-quarter and USB continues to trade below its historical price-to-book ratio, I believe that the bank remains an attractive rebound investment in the regional banking market. As deposit flows continue to stabilize and depositors/savers/investors regain confidence in the safety of their deposits and in the banks that hold them, we could see a strong upside revaluation in regional banks in the next twelve months... from which USB would also stand to profit, in my opinion. I therefore continue to see a favorable risk profile for U.S. Bancorp after the stress test and would expect USB to revalue back to its pre-crisis valuation level within the next year!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of USB, WAL, CMA, PNC, FITB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)