ZoomInfo: A Premium Price For Decelerating Growth Rates

Summary

- ZoomInfo Technologies Inc. provides sales and marketing solutions by offering detailed profiles of individuals and businesses, facilitating outreach to potential leads.

- Despite its alluring narrative, ZoomInfo's stock carries a premium valuation, while its growth rates appear to be decelerating.

- The company has acknowledged worse net retention activity in Q1 compared to the previous quarter, indicating potential challenges in customer retention.

- ZoomInfo's revenue growth rates have significantly moderated, raising questions about the justification for its premium multiple.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

maxsattana/iStock via Getty Images

Investment Thesis

ZoomInfo Technologies Inc. (NASDAQ:ZI) provides solutions to help organizations with their sales and marketing efforts.

ZoomInfo puts together all types of company and key personnel data, creating detailed profiles of individuals and businesses. They pride themselves on having up-to-date clean contact information on professionals and companies, allowing sales and marketing people to reach out to potential leads. Essentially, a convenient business-to-business platform.

The issue I have is that aside from an alluring narrative, ZoomInfo Technologies Inc. stock already carries a premium valuation, while its growth rates appear to be decelerating.

All in all, I'll stick to the sidelines.

Rapid Recap

ZoomInfo Technologies is a technology platform that empowers sellers and recruiters to reach the entities that make sales happen.

In my previous analysis, I said,

It appears that as of late, ZoomInfo's net retention figures have been moving lower.

Recall, a high retention rate means that you don't have a lot of churn.

And more importantly, you are able to upsell to your existing customer base. Put in other words, if you have a net retention rate of say 10%, that would mean that all else equal, you'd have 10% growth rates next year, without having to spend more to acquire another single customer. Clearly, you want a high retention rate. But you don't want it too high, where you are crushing your customer base with rising bills, and they end up exiting your platform.

That being said, even though ZoomInfo doesn't typically report its retention rates each quarter, ZoomInfo did acknowledge that in Q1 net retention activity was incrementally worse than what they had experienced in Q4.

With that in mind, let's discuss ZoomInfo's financials.

Revenue Growth Rates Moderate

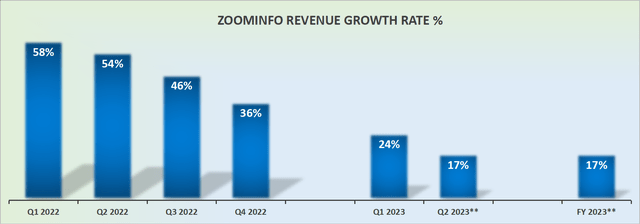

What you see above is a company whose revenue growth rates have fizzled out. Indeed, it's difficult to imagine that this time last year ZoomInfo was growing at more than 50% CAGR.

With this in mind, allow me to ask you this perhaps uncomfortable question.

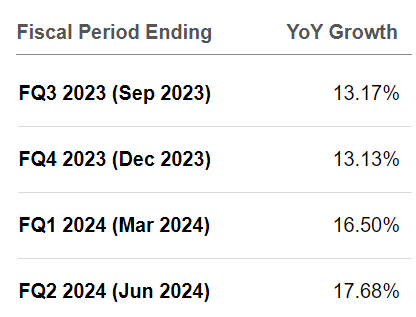

SA Premium

Do these revenue forecasts correspond with those of a rapidly growing company? And if not, can we make the case that ZoomInfo should carry a premium multiple? I don't believe that is a reasonable conclusion. But more on that soon. Before that, let's get to the next section, where we discuss ZoomInfo's profitability profile.

ZoomInfo's Cash Flows Are In High Demand

In the first instance, let's discuss ZoomInfo's balance sheet. ZoomInfo holds about $700 million of net debt. While in practical terms, ZoomInfo's balance sheet is a reasonably leveraged balance sheet, it's not prohibitively restrictive.

However, what this does mean, is that the ability for ZoomInfo to deploy significant capital toward share repurchases is encumbered, at least in the near term.

Even though ZoomInfo did repurchase $25 million worth of stock in Q1 2023, I can't imagine there will be significantly more buybacks coming. What makes me say so?

I believe that ZoomInfo will seek to reinvest aggressively back into its business, rather than repurchasing shares. Basically, ZoomInfo will seek to attempt to reignite its growth rates, rather than buy back its shares. But more importantly, I believe that ZoomInfo will probably seek to pay down $600 million of its term loan that becomes due in 2026.

My ultimate contention is this, ZoomInfo's cash balance is in high demand, and I don't envision ZoomInfo returning to repurchasing shares any time soon.

To sum up my thesis, what we see above is that in the past 3 months, the multiple that investors have been willing to pay for ZoomInfo has expanded by nearly 30% from a forward P/Sales of 6 to a P/Sales of 8 - and yet, I can't see much justification for this expansion.

The Bottom Line

ZoomInfo Technologies Inc. offers sales and marketing solutions by providing comprehensive business and personnel data.

However, despite its appealing narrative, the stock already carries a premium valuation, while its growth rates are slowing down. As a result, I remain cautious and prefer to stay on the sidelines. ZoomInfo's net retention rates have declined, and its revenue growth has moderated from the previous year's high levels.

Additionally, the company's balance sheet carries a considerable amount of net debt, limiting its ability to allocate capital for share buybacks. Given these factors and the expanding valuation multiple, I find it challenging to justify the current market sentiment towards ZoomInfo Technologies Inc. stock.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

Our Investment Group is focused on value investing as part of the Great Energy Transition. For example, did you know that AI uses thousands of megawatt hours for even small computing tasks? Join our Investment Group and invest in stocks that participate in this future growth trend.

I provide regular updates to our stock picks. Plus we hold a weekly webinar and a hand-holding service for new and experienced investors. Further, Deep Value Returns has an active, vibrant, and kind community. Join our lively community!

We are focused on the confluence of the Decarbonization of energy, Digitalization with AI, and Deglobalization.

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

DEEP VALUE RETURNS: The only Investment Group with real performance. I provide a hand-holding service. Plus regular stock updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.