Exxon Mobil: Vanishing Profits

Summary

- Exxon Mobil Corporation guided to a drastic profit hit for Q2 2023, placing the EPS target far below analyst estimates.

- Even with structural cost savings implemented, the energy giant has normalized profits in the $4 range, far below analyst targets above $9.

- The stock remains far too expensive above $100, with profits vanishing back to substantially lower pre-Russian invasion levels.

- Looking for higher risk/reward options trading ideas? I offer this and much more at my exclusive investing ideas service, Out Fox The Street. Learn More »

Dragon Claws/iStock via Getty Images

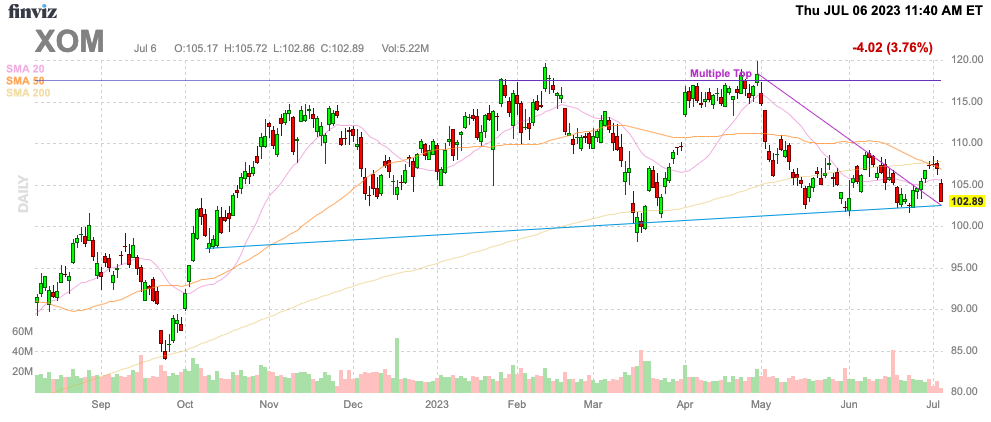

As predicted and somewhat easily deduced by declining energy prices after the surge from the Russian invasion of Ukraine, Exxon Mobil Corporation (NYSE:XOM) was destined to slash profits targets for the year ahead. After the big price surge in early 2022, the market incorrectly predicted energy prices would remain higher for a long time. My investment thesis remains Bearish on the stock, which is still trading at nearly $103 despite the collapsing profits.

Source: Finviz

Slumping XOM Profits

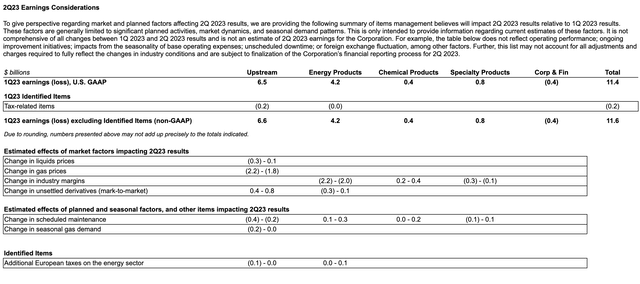

Exxon Mobil reported a huge hit to the estimated EPS for Q2. The energy giant is now forecasting a Q2 2023 profit of ~$7.5 billion following a Q1 where income was $11.4 billion with an $11.6 billion non-GAAP profit.

During the just-ended quarter, Exxon Mobil saw natural gas prices crush quarterly income by ~$2.0 billion, with a similar hit to margins in refining products. The combination amounts to a $4.0 billion dip in profits during the sequential quarter, with other categories mostly offsetting each other.

Source: Exxon Mobil Exhibit 99.1

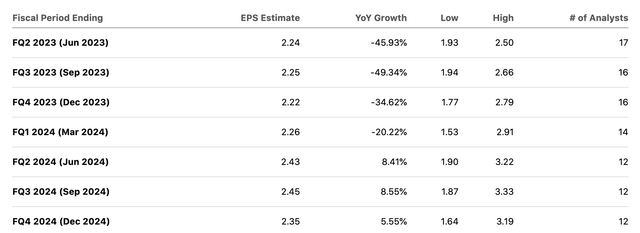

Exxon Mobil has ~4.1 billion shares outstanding, leading to a Q2'23 EPS estimate of $1.83 now versus current analyst estimates up at $2.24 per share. Even more amazing is that analysts had generally forecast a trough quarterly earnings around $0.40 above the actual updated Q2'23 internal EPS target.

Source: Seeking Alpha

WTI oil (CL1:COM) spent a large part of Q2 trading around $80/bbl. Oil prices definitely have some potential downside in Q3, with the quarter starting at only $70/bbl. The company still had some $4 billion in quarterly profits from Upstream operations at risk here considering WTI has a history of trading far below $70/bbl at the lows in the past.

Heading Lower

Despite collapsing profits, Exxon Mobil still trades above $100. The stock didn't trade much above this level pre-Covid, and Exxon Mobil still trades close to the peak even though profits have already collapsed about 60% from the peak in Q3'22, when the energy giant earned $4.45 per share.

Investors don't appear to realize that Exxon Mobil struggled to earn quarterly profits topping $1 per share back in 2019. The company has implemented some cost controls, but the energy giant also instituted a large wage hike for employees back in late 2022.

The general problem with energy companies is that cost cuts usually lead to lower breakeven energy prices. A company like Exxon Mobil can keep pumping oil and natural gas at even lower prices versus conserving valuable assets for higher prices.

Investors need to prepare for the scenario where the company returns to producing a $4 to $5 EPS in a normalized energy price environment. Heck, Exxon Mobil only produced a 2019 EPS of $2.25.

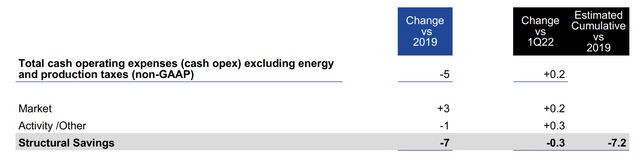

The company promotes a structurally improved cost structure where cash costs are down substantially from 2019. The calculation is complicated, but Exxon Mobil predicts annual structural savings in the $7 billion range, leading to annual EPS boost in the $1.75 range.

Source: Exxon Mobil Q1'23 press release

As highlighted above, the structural cost savings from 2019 only boost EPS back to the $4+ annual range. Either way, the debate is over whether Exxon Mobil can hold onto structural costs savings and produce normalized profits in the $4 to $5 range with a stock trading above $100, not maintain analyst EPS estimates still holding onto a $9+ EPS scenario that clearly isn't realistic here.

Exxon Mobil is only down ~4% in early trading, suggesting the market still hasn't caught on to the likelihood of lower profits going forward. Analysts need to drastically cut EPS targets for the years ahead, and the constant cuts should push the stock lower and lower.

Takeaway

The key investor takeaway is that the market still hasn't caught onto the downside risk at Exxon Mobil Corporation. The business has structurally lower costs heading into the is downturn, but one has to wonder how discipline the industry has this time around with lower costs allowing for lower breakeven energy prices.

Investors should continue selling Exxon Mobil stock until analysts substantially lower EPS targets for the years ahead and adjust price targets that had the stock jumping back above $120.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (28)

Thank you for your input

You choose not to own shares

We choose to own shares

If everything we buy from houses, cars, staying at hotels, travel, car rentals and food are all up 25-40%, why should energy get cheap?

My utility bills continue to increase.

I’m not betting on any meaningful move on oil heading lower any time soon.