Patrick Industries: Still Appealing Even After Significant Weakening

Summary

- Patrick Industries, a producer and distributor of components and building products, has seen its share price perform well despite financial performance lagging behind last year's figures.

- The company's Q1 2023 revenue was 32.9% lower than the previous year, largely due to a reduction in production by its RV OEM customers and a decline in the housing market.

- Despite the company's financial struggles, PATK stock is still considered cheap and has potential for additional upside, leading to a soft 'buy' rating.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

StefaNikolic/E+ via Getty Images

One company that has done surprisingly well recently is Patrick Industries (NASDAQ:PATK). For those not familiar with the enterprise, it focuses on producing and distributing components and building products and materials. Much of its work is centered around servicing OEMs that produce recreational vehicles, manufactured housing, industrial items, and more. More specifically, the company sells laminated materials that are used for furniture, walls, countertops, and more, as well as a variety of other similar offerings. Recently, shares of the company have actually done quite well relative to the broader market. But investors are likely concerned because financial performance has severely lagged what the company saw the same time last year. Fortunately, even if this pain persists, shares the company look cheap enough to warrant optimism in my opinion. No, the company is not the best prospect on the market. But for those interested in it, I can understand why a purchase might be considered.

Strength in spite of weakness

Normally when you see financial performance of a business weakened materially, you would expect the share price of the company in question to plummet in response. But the beautiful thing about value investing is that, when you buy a company that's cheap enough, further downside becomes very difficult for the market to digest. Such has been the case, in my opinion, when it comes to Patrick Industries. Since I last wrote a bullish article about the company in February of this year, shares have increased by 10.3% at a time when the S&P 500 has risen 9.9%. This is not exactly a win because I don't consider the outperformance to be material. But when you look at the fundamental data reported by management, it's clear the picture could have been worse.

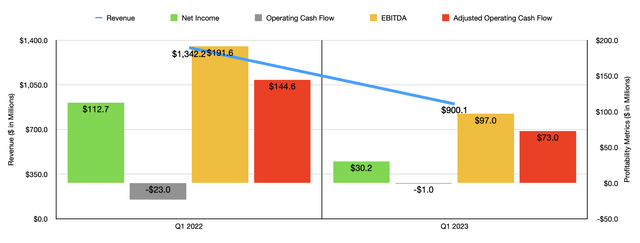

To see what I mean, we need only look at financial performance covering the most recent quarter. This is the first quarter of the company's 2023 fiscal year. During that time, revenue came in at $900.1 million. That's 32.9% lower than the $1.34 billion the company reported one year earlier. The company actually performed surprisingly well when it came to its marine operations and it also benefited from acquisitions that were completed in 2022. However, revenue associated with its RV business plunged $454 million. This was driven by a continued reduction of production by its RV OEM customers.

For those who follow the RV market, this is not exactly surprising. High interest rates aimed at combating inflationary pressures, combined with a couple of years of robust demand for RVs that essentially frontloaded demand from future years, Is responsible for the current pain that we are seeing. It's also worth noting that the company suffered $40 million decline in its manufactured housing sales. Truthfully, I would expect this to worsen because, as I have detailed in other articles, the housing market in general is in the early stages of a great deal of pain.

Naturally, a decline in revenue would bring with it a decline in profitability. Net income plummeted from $112.7 million to only $30.2 million. Other profitability metrics mostly followed suit. It is true that operating cash flow went from negative $23 million to negative $1 million. However, if we adjust for changes in working capital, we would see that number be cut almost in half from $144.6 million to $73 million. Meanwhile, EBITDA for the company plunged from $191.6 million to $97 million.

As I detailed in one recent article, the housing market is certain to experience some pain over the next several quarters. Deliveries of homes remain elevated, backlog is shrinking rapidly. Using the most recent data available as of the publication of the aforementioned article, backlog across nine major home builders declined between 22.6% and 63.4% year over year. Eight of the nine companies also saw orders drop year over year, with the most significant drop totaling 50.1%. Cancellation rates are also skyrocketing, with numbers ranging between 13.9% and 22% compared to the prior expected range a year earlier of between 5% and 17%. Given the concentration of revenue for the company, the RV markets pain is even more important. The current forecast for the number of wholesale shipments this year is 297,100 units at the midpoint. That would imply a drop of 39.8% compared to the 493,300 units that were shipped in 2022. We should see a partial recovery in 2024, with total shipments climbing up to the mid 300,000 range. But it could be many years before we get back to the kind of numbers experienced in 2022.

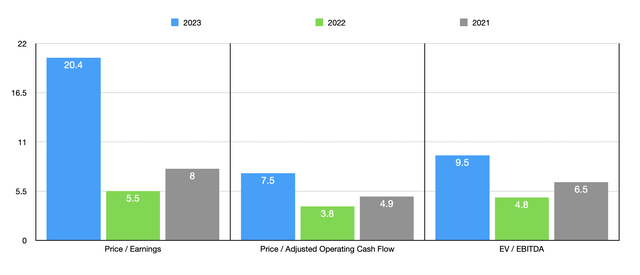

For the current fiscal year, management has not provided any guidance. But if we annualize the results experienced so far, we would expect net income of $87.9 million. Adjusted operating cash flow would be $238.5 million, while EBITDA would come in at $325.6 million. Taking these numbers, we can easily value the company. In the chart above, you can see how shares are priced on a forward basis. You can also see how they are priced using data from 2021 and 2022. Although the company does look pricey on a price to earnings basis, the cash flow results still make it look affordable. As part of my analysis, I also compared the company to five similar firms. These can be seen in the table below. Using the forward estimates for each of them, I calculated that only one of the five companies ended up being cheaper than Patrick Industries when it comes to the price to earnings approach. And when it comes to the other two valuation metrics, only two of the five ended up being cheaper.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Patrick Industries | 20.4 | 7.5 | 9.5 |

| LCI Industries (LCII) | 21.7 | 5.9 | 12.0 |

| Modine Manufacturing (MOD) | 15.4 | 16.7 | 8.5 |

| American Axle & Manufacturing Holdings (AXL) | 22.2 | 2.1 | 4.6 |

| Gentherm (THRM) | 28.1 | 46.7 | 10.8 |

| XPEL Inc. (XPEL) | 39.1 | 136.0 | 27.6 |

Takeaway

Considering how much pain Patrick Industries has seen from a fundamental perspective, it's a bit surprising that shares have outperformed the broader market. The stock definitely looks more expensive now than it did previously. And I expect the weakness that we have seen to continue for the foreseeable future. But this doesn't necessarily mean that the stock is a bad prospect. Given how cheap it still is, both on an absolute basis and relative to similar firms, I would say that some additional upside is still warranted. Because of that, I have decided to rate it a soft 'buy' at this time.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.