Sportsman's Warehouse: A Rocky But Opportunistic Future

Summary

- Sportsman's Warehouse's stock price has fallen as earnings dropped from Covid-highs, despite plans to expand operations through new stores and ecommerce sales.

- The company's financials have fluctuated significantly in recent years, with current low revenue levels attributed to poor weather and a weak macroeconomic sentiment.

- Despite a seemingly cheap valuation, the company's stock is considered high-risk due to its leveraged balance sheet, capital-intensive store openings, and fluctuating financials.

Editor's note: Seeking Alpha is proud to welcome Caffital Research as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Kevin C. Cox/Getty Images News

A quick take on Sportsman's Warehouse

Sportsman's Warehouse (NASDAQ:SPWH) has seen a turbulent stock price as its earnings have varied massively in a Covid-related environment. With the earnings expected to stabilize in the next couple of years, the company will show its true earnings potential. After analyzing the company's financials, I believe the current stock price of $5.7 represents a fair value of the share, as the price represents SPWH's normalized earnings well - this is why I'm on hold for the stock.

The company

Sportsman's Warehouse is a retail chain specializing in outdoor equipment. The chain has locations across United States catering for example to hunters, campers, hikers, and fitness enthusiasts. Sportsman's Warehouse offers a wide selection of products, including firearms, fishing gear, camping gear, apparel, and related accessories.

The company plans to expand its operations through opening new stores, as well as expanding ecommerce sales. This is told in SPWH's Q4 presentation:

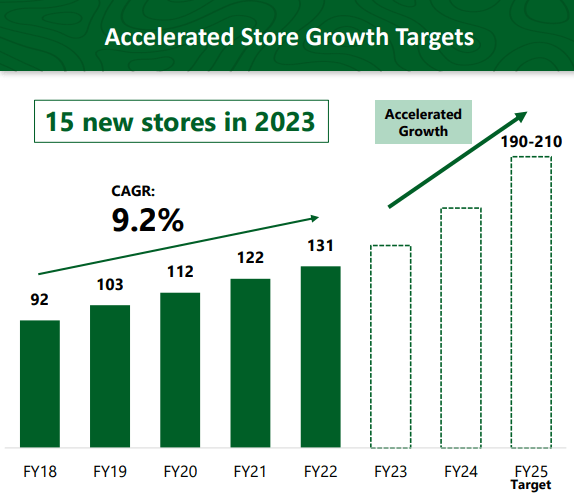

The store chain's planned store openings (SPWH Q1 Investor Presentation)

SPWH plans to open 15 new stores in 2023 across the United States, with the growth in stores accelerating in the future.

In my opinion, the company's growth plans have backfired on the investors. The company has burned loads of cash that it has generated during Covid-highs, that it could have instead returned to investors in form of dividends. I believe the company should instead focus on maintaining and streamlining current stores; with a good cost discipline, I can imagine the company to be a great cash cow for investors.

Demonstrating this point, the company's return on its capital has plummeted greatly - the company's trailing ROIC stands at 4.7%, compared to its widely higher historical numbers (for example, 17.4% in FY2019). Even with a significant rise in sales, the total return on SPWH's capital would lag. In 2021 and 2022 combined, the company spent $117 million in CapEx, with investments guided to follow into 2023 with a $54 million guidance according to the company's Q4 presentation. Although the industry has had difficult times, I do not believe the investments will begin to show fruit within a couple of years, as the investments seem to be made carelessly during a stretched consumer sentiment.

The company's main competition is Bass Pro Shops, a company that planned to buy out SPWH but ultimately backed down. Other competitors include Dick's Sporting Goods (DKS), Cabela and The Sportsman's Guide. As the industry is quite stable, I do not think these companies pose a huge threat as they share a similar business model - the main competitive risk is the brand associated with each company.

The stock

Sportsman's Warehouse's stock has gone through a wild ride, as its earnings have been highly turbulent:

SPWH's performance over past three years (TradingView)

The stock reached highs of around $18, as Great Outdoors, the owner of Bass Pro Shops, had plans of buying out the company in late 2020. The deal was called off later though, and the stock has started plummeting with its earnings.

Financials

Financials for the company have fluctuated a lot in the recent years, as the consumer sentiment has gone from a Covid-boosted revenue level into current, low level. Current low revenue levels "are a cause of bad weather and a weak macroeconomic sentiment", in the CEO's, Joseph Schneider's words.

Before factoring in significant growth, an investor must approximate the company's normalized earnings levels. In FY20, operating result was an astonishing $134 million; in FY21, it was $100 million. Currently trailing operating profit sits at $37 million, or 2.7% of revenues respectively. An analyst can take many approaches to estimate earnings, but today I will be estimating on Q2 guidance, adjusting for seasonality and other notable effects.

After Q1, Sportsman's Warehouse had 136 stores open nationwide. With these stores open, the company's board of directors expects revenues to be in the range of $310-340 million, with the middle point being $325 million. I believe it's fair to assume that weakened weather and macroeconomic outlook weakened this revenue by $10 million, so around 3% of total revenue. Normalized revenue for 136 stores comes at $335 million for Q2. Years 2015 through to 2019, prior to Covid fluctuations, SPWH has made an average of 23.9% of its revenues in Q2. Extrapolating the company's revenues from this, normalized revenue comes in at $1,403 million. The company has had stable gross margins of 33% across its history, so gross profit normalized should come in at $463 million.

In the last 12 months, the company's selling, general & administrative expenses have been around $407 million. Adjusting this for the rising number of stores, where there were approximately 4% less stores open in the last 12 months compared to present moment, the adjusted number for current stores would be $424 million. If we expect additional operational efficiencies, which the company is trying to find, we can deduct $5 million from this number, with SG&A coming in at $419 million.

From these expectations, we can gather that normalized operating result should be at around $463 million - $419 million = $44 million. I expect interest payments annually to be at around $8 million. With a 24% tax rate, the company would have a net income of $26.6 million, or an EPS of $0.71 with 37.69 million shares currently outstanding.

Excluding lease agreements from debts, which are operative in nature, the company has interest-bearing debts totaling $150 million, and basically no cash. The company's balance sheet is extensively leveraged, which could be highly risky for investors.

Valuation

Sportsman's Warehouse's stock price at the time of writing sits at $5.7. This corresponds to a normalized P/E of 8.1 with my estimates, with possible growth. This number alone seems dirt cheap to me, but there are several factors to factor in. Given estimates can fluctuate a lot into both directions, investors are looking at a very high-risk stock. Opening stores is also very capital intensive, as the company's CapEx sits at $74 million for last twelve months. These investments with a leveraged balance sheet can be dangerous for the company.

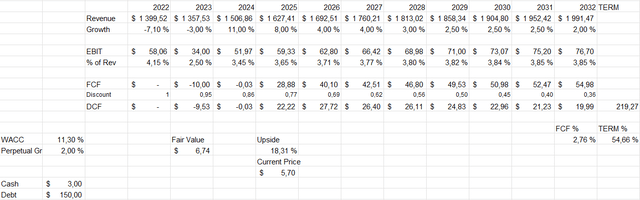

With these inputs, I constructed a Discounted Cash Flow model to give a fair estimate of the stock's intrinsic value. Given revenue growth numbers are based on a moderate store growth, with the operating climate normalizing in 2024 - as macroeconomic situation betters and as the company opens a planned amount of 15 stores in 2023 - this represents a 11% growth in revenues. Sequentially, in 2025, I'm expecting revenues to climb 8 percent, as the chain continues to open stores. After that, sales are expected to grow a bit faster than the economy, as customers find recently opened stores and as ecommerce sales grow modestly. Eventually, the growth slows into a two percent perpetual growth rate nominally, on pace with my expectations of the economy's nominal growth long term.

Free cash flow is expected to be worsened for a couple of years due to extensive investments related to store openings - this is why especially in the years 2023 and 2024 I'm expecting free cash flow to drop into negative territory. After 2024, investments should continue at a lower rate, as store openings slow down.

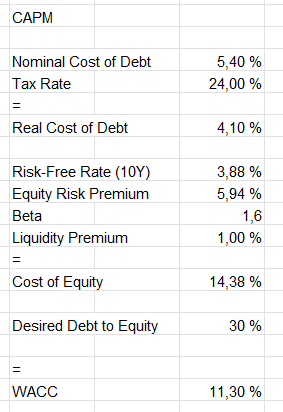

Finally, I'm factoring in a 11.3% weighted average cost of capital, as the company is highly exposed to risks, both operatively and in terms of financing. This figure is calculated through Capital Asset Pricing Model:

CAPM Model (Author's calculation)

The model's 5.4% interest is my approximate of the interest of SPWH's current debt. On the Cost of Equity side, I'm inputting US10Y bonds as the risk-free rate, with the yield standing at 3.88% at the time of writing. The model expects an ERP of 5.94%, which is Professor Aswath Damodaran's latest approximate of the United States' premium. With an increasingly risky balance sheet and earnings, I'm inputting a Beta of 1.6 for the company - way above the company's historical average. This is due to the company's highly increased risk profile for equity investors. Finally, because of the size of the company and its liquidity, I'm adding a percentage point of liquidity premium. With a desired Debt/Equity ratio of 30%, we get a WACC of 11.3%. After factoring given factors in, the DCF model shows as follows:

DCF Model (Author's calculation)

With given assumptions, the fair value for SPWH would be $6.74, or around 18% above the stock's current level. This model does not constitute a too high rating for the investment opportunity, in my opinion, as the model fluctuates highly on given figures. This valuation, though, does give investors some margin of safety.

Risks

The company is posed with many risks. As mentioned before, SPWH holds $150 million in debt. This should worry investors, as the company's cash reserves are alarmingly low, and as capital expenditures are forecasted to stay high for the next couple of years.

An investor must also be cautious about the store chain's new store openings. The invested capital hasn't yet materialized into growing earnings, and extensive capital expenditures are expected to continue into at least the year 2025. If these investments - made during a heightened cycle for the industry - fail, investors could face deep troubles with earnings.

With rising interest rates, consumers could be facing a prolonged period of shortened buying power. This could pose a very high risk for SPWH, as the company needs cash flows for its outstanding debts. This debt is in short-term borrowings, which can seem concerning. The company claims in its Q4 presentation, though, that it has a total borrowing capacity of $350 million, that could mitigate the risk partly as the company wouldn't require payments in the very short term.

With these risks in mind, in my opinion, investors should be cautious about buying with current expected rate of return for the stock.

Closing remarks

Although the company seems like a screaming buy from historical figures, I believe investors should be very cautious about the stock. The company's management team has burned excessive amounts of capital on new stores that haven't materialized into growing earnings.

This writeup may include some errors of thought, which could result in earnings that are way different from the ones I expect. In a scenario where the company proves earnings above those that I expect, I would change to a higher rating. Without sufficient evidence of such turnaround, I'm keeping a 'hold' rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.