Wesdome: A Moderate Decline In 2022 Reserves

Summary

- Wesdome Mines saw a 15% YoY decline in gold reserves to ~1.0 million ounces in 2022 but did see continued exploration success last year and year-to-date.

- The company's reserve growth per share has improved since 2016, with Wesdome continuing to have some of the highest reserve grades industry-wide.

- Given Wesdome's position as a dual-asset Canadian miner with a strong track record of reserve growth per share & exploration success, I would view pullbacks below US$4.80 as buying opportunities.

Juan Jose Napuri

It's been a rollercoaster ride of a year for investors in the precious metals sector, and despite a solid Q1 report for Wesdome Gold Mines (OTCQX:WDOFF), the stock has found itself back near its Q1 2023 lows, dragged down by the abrupt change in sentiment from elevated optimism that we saw in late April. However, while 2022 was a year to forget, we've seen progress on multiple fronts in 2023, with continued exploration success at both mines and development tracking ahead of schedule at Kiena. That said, the one negative was a moderate decline in mineral reserves at both of its high-grade assets, with gold reserves down ~15% year-over-year to ~1.0 million ounces of gold. In this update, we'll look at whether this is an issue for the company and if the stock has now retreated into a low-risk buy zone:

All figures are in United States Dollars at an exchange rate of 0.77 to 1.0 CAD/USD for most instances.

Eagle River Operations (Company Presentation)

2022 Reserves

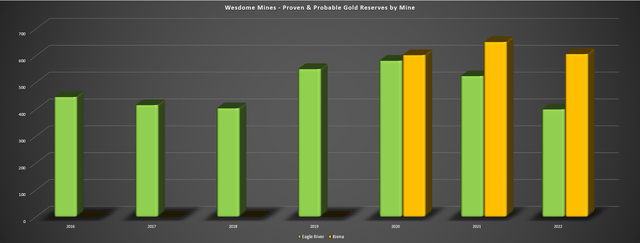

Wesdome released its FY2022 Resource/Reserve statement earlier this year, reporting year-end reserves of ~1.0 million ounces of gold at 12.9 grams per tonne of gold, a ~15% decline from the year-ago period. The moderate decline in reserves from ~1.17 million ounces at 12.6 grams per tonne of gold last year can be attributed to a sharp decline in tonnes (~2.42 million tonnes vs. ~2.89 million tonnes) offset by a slight improvement in grades, with the drop in reserves mostly tied to Eagle River vs. a marginal dip in gold reserves at Kiena. Wesdome noted that the slightly disappointing reserve update reflected higher cut-off grades, a lower exploration budget, and a more conservative mine plan with a "more stringent and robust approach to reconciliation, 3D modeling and resource classification". And it's important to note that while a step up in cut-off grades at both assets creates an additional hurdle to adding reserves, there's still a large spread between cut-off and reserve grades and it's consistent with what we've seen sector-wide because of rising costs.

Wesdome Mines - Gold Reserves by Mine (Company Filings, Author's Chart)

Digging into the reserve update a little closer, we can see that Eagle River reserves fell 124,000 ounces year-over-year to 400,000 ounces (762,000 tonnes at 16.3 grams per tonne of gold), with an increase in the cut-off grade at Eagle River to 6.52 grams per tonne of gold vs. 5.5 grams per tonne of gold in the prior year. We can attribute the increase to no change in the gold price assumption used to calculate reserves ($1,400/oz) but an increase in milling cost parameters to ~$69.10/tonne vs. ~$49.50/tonne previously, and higher surface/G&A costs of ~$72.80/tonne vs. ~$60.20/tonne. The result is that Eagle River's reserves support less than years of mine life (assuming an average processing rate of ~200,000 tonnes per annum), with FY2022 tonnes milled coming in at ~224,000 tonnes. That said, Eagle River has a solid history of reserve replacement, and ~1.05 million tonnes of material back its reserves up at similar grades (~13.9 grams per tonne of gold), suggesting the asset is likely to produce well into the 2030s even with moderate resource conversion.

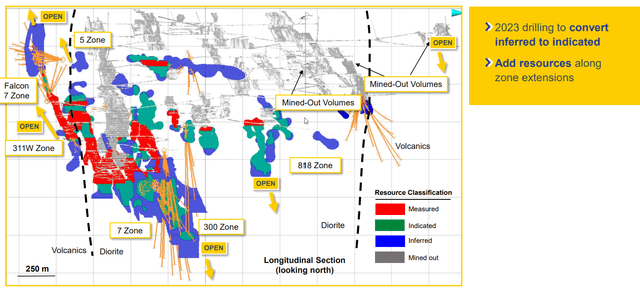

Eagle River Mine - Current Resources (Company Presentation)

It's also worth noting that there look to be opportunities to increase resources and reserves based on the company's drilling success last year at Eagle River, with most zones being open at depth, plus up-plunge extensions and parallel zones to Falcon 7. In addition, the company has intersected impressive grades in volcanic rocks, pointing to an opportunity to make additional discoveries in volcanic rocks outside the existing Eagle River Mine footprint, with the quartz diorite stock historically being the most favorable host rock observed to date. Hence, from both a near-mine and regional standpoint, I am optimistic about future resource and reserve growth at Eagle River even if gold reserves have fallen to their lowest levels since 2017 at this high-grade asset.

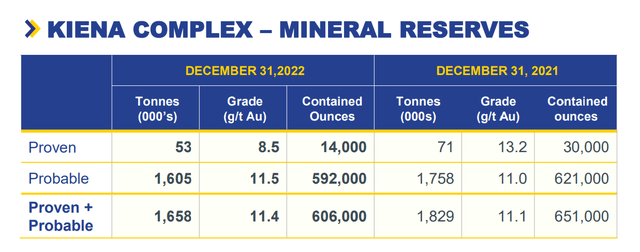

Kiena Mine - Mineral Reserves (Company Website)

Moving over to Kiena, the asset had a solid Q1 with ramp development slightly ahead of schedule (it plans to start mining at the 129 Level in early 2024 where there's significant more ounces per vertical meter), and we've seen positive exploration updates as well. The most significant was an update with multiple high-grade intercepts, including 6.4 meters of 75.6 grams per tonne of gold, 4.3 meters of 33.6 grams per tonne of gold, and 22.8 meters of 4.1 grams per tonne of gold from the A, Footwall 2, and Hanging Wall Basalt zones, respectively. These results have confirmed the continuity of Kiena's A Zone to ~2,000 meters below surface, and the emergence of the Hanging Wall Basalt Zone is a positive development given that rock quality is more competent on a relative basis, allowing for better development rates in the future.

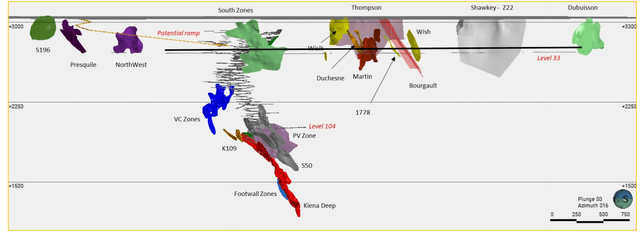

Kiena Mine Resources & Targets (Company Presentation)

So, while Kiena's reserves were down year-over-year by 45,000 ounces (606,000 ounces vs. 651,000 ounces), there's certainly a case to be made that the new discoveries over the past two years could catapult Kiena's reserves above the 800,000 ounce mark by year-end 2024 even after factoring in depletion from mining, pointing to 30% plus reserve growth from current levels. Plus, this doesn't even contemplate the possibility of adding ounces at the nearby Presqu'ile Zone, which if developed, could provide a second point of access to the mine, improve ventilation, and allow the company to take advantage of additional processing capacity to potentially boost Kiena Complex production. So, while Kiena's reserves may seem low with less than a six-year mine life assuming annual mine production of ~300,000 tonnes per annum, I am quite optimistic when it comes to resource and reserve growth here as well.

Was there any negative news?

Since the 2020 Preliminary Economic Assessment completed at Kiena, we've seen costs creep up quite a bit, with mining cost parameters increasing over 20% to ~$101.20/tonne and processing costs also up sharply, contributing to a total cost of ~$171.00/tonne vs. ~$125.00/tonne previously. Plus, some companies in Quebec continue to call out labor inflation as a challenge, with Hecla (HL) noting that labor and inflation are more pronounced at its Casa Berardi Mine. That said, while this has lifted the cut-off grade to ~3.9 grams per tonne of gold, there is still a significant spread between the cut-off grade, Kiena's reserve grade (11.4 grams per tonne of gold), and the grade of new discoveries. To summarize, while some deposits will have a very difficult time adding new reserves or converting resources they might have expected to after two years of severe inflationary pressures, Wesdome is more shielded from this issue with industry-leading grades at its two mines.

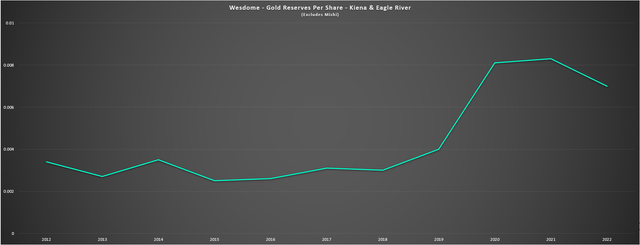

Reserves Per Share

Reserve growth is important, but far more important is reserve growth per share. This is because reserve growth that comes at the expense of significant share dilution means that investors are getting exposure to fewer ounces of gold per share held and the result is one is actually seeing their exposure to precious metals diluted by owning any precious metals producer that cannot maintain reserves per share. Therefore, an investor in any producer with this criterion is not getting their desired leverage to the silver and or gold price if reserves and or production per share are declining. Obviously, this isn't ideal, since it makes little sense to own producer that carries higher volatility and risk vs. a commodity (the metal itself) if it is not offering the leverage that one should get for taking on this added risk. Some examples of companies that have consistently failed to deliver reserve growth per share are Coeur Mining (CDE), Americas Gold and Silver (USAS), and McEwen Mining (MUX), and I continue to see these names as un-investable.

Wesdome - Gold Reserves Per Share (Kiena & Eagle River) (Company Filings, Author's Chart)

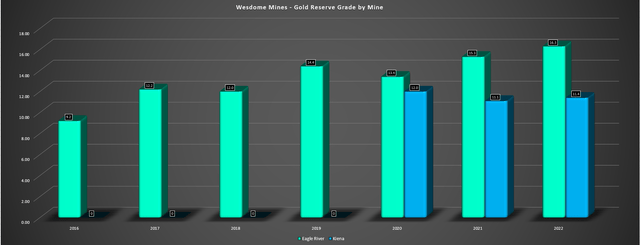

Just as importantly for Wesdome, the company has seen a material improvement in reserve grades since 2016, with its reserve grade up from 9.2 grams per tonne of gold (Eagle River) to 16.3 grams per tonne of gold and 11.4 grams per tonne of gold at Eagle River and Kiena, respectively. This figure has significantly bucked the trend of the industry in the period, with average underground mined grades declining over 10% since 2016 and ~20% since 2012. So, this is a key differentiator for Wesdome and the quality of its reserve growth per share ranks quite high, with this not being a case of a producer adding lower-quality or lower-grade reserves to maintain its per share metrics, which is what we've seen from some names like First Majestic (AG) that lobbed up a Hail Mary with Jerritt Canyon that missed its mark and Evolution Mining (OTCPK:CAHPF) that has still yet to see Red Lake pay off, even if the asset came with solid grades and a large reserve base.

Wesdome - Gold Reserve Grade by Mine (Company Filings, Author's Chart)

One negative development for reserve growth per share is that Wesdome should see above average share dilution this year, with ~147.5 million shares as of its most recent MD&A and the company likely to end the year with 150+ million shares outstanding due to continued sales under its At-The-Market Equity program [ATM]. However, while Wesdome may not add meaningful reserves this year, I would expect minimal share dilution in 2024 and healthy reserve growth at Kiena in the year-end 2024 report as new zones are pulled into reserves, with long-term upside from Presqu'ile (internal study expected at year-end) which could take advantage of excess mill capacity, with a planned exploration ramp once permits are received. So, although reserves per share declined in 2022 and we could see further declines in 2023 (~5% share dilution year-over-year), this trend should reverse back up in 2024.

Summary

Wesdome has done a solid job of growing reserves per share over the past decade, and with the potential to build on reserves at Kiena and Eagle River over the next few years by bringing new zones into the proven/probable categories, the recent share dilution from ATM sales should be offset. Hence, the long-term trend in reserve growth per share is likely to remain in place. However, the updated low-risk buy zone for the stock comes in at US$4.80 and while Wesdome has become more reasonably valued at ~8.7x EV to FY2025 free cash flow estimates, we've seen several names become even more attractively valued, with some producers treading at less than 4.2x EV to FY2025 free cash flow estimates, and even names like Sandstorm Gold Royalties (SAND) trading at just ~12x EV to FY2025 estimates with much higher margins.

In summary, while I continue to see Wesdome as a top-12 producer sector-wide, I see more attractive bets elsewhere from a relative valuation standpoint.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SAND either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.