Asana: Clear Tailwinds And Strong Execution

Summary

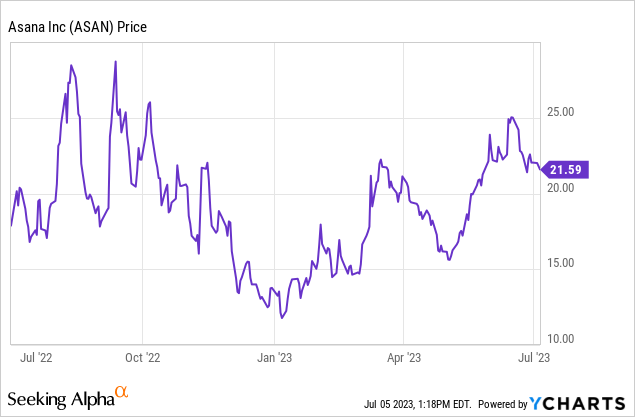

- Shares of Asana are up more than 60% this year, with the company's recent beat-and-raise boosting investor confidence.

- Asana's long-term demand is expected to be bolstered by the ongoing shift to remote and distributed teams, with its products designed to simplify tasks and automate workflows.

- Despite the year-to-date rally, the stock still trades at a valuation that has room to ride higher.

- My year-end price target is $26, representing 8x EV/FY24 revenue.

gilaxia

With markets now cruising at post-recession highs, investors are wondering: will the enthusiasm continue bubbling forward, or are we due for a pullback? Without postulating on the direction of the overall market, my strategy this year has been consistent: pick individual stocks with company-specific tailwinds and appealing valuations that can perform well whether the market is up or down.

This year, shares of Asana (NYSE:ASAN) are already up more than 60%. The company has been following a classic "underpromise, overdeliver" strategy, and with results coming in much better than expected, investors' confidence in this stock has returned. In my view, more upside is coming ahead.

I remain bullish on Asana. The company is certainly no stranger to macro headwinds, though management notes that pockets of its business have stabilized.

And looking at the big picture: amid this recession, many companies are taking the opportunity to rationalize and rethink headcount. A common thread around this reorganization is how to simplify tasks, automate workflows, and potentially do more work with distributed and remote teams. All of these are key secular tailwinds for Asana's workflow products to thrive.

As a reminder to investors who are newer to this stock, here are my key long-term bullish drivers for Asana:

- Asana's long-term demand will be bolstered by the ongoing shift to remote and distributed teams. More and more companies are embracing a distributed working model, if not a fully remote one. With fewer in-person touchpoints, software tools become critical to keeping teams together and in sync.

- Massive global TAM. Asana believes it has a $51 billion TAM by 2025 and is applicable to the global base of ~1.25 billion information workers. By that metric, Asana's current user base represents only <5% of the global eligible workforce.

- Land and expand. Asana adopts the classic software go-to-market playbook, which is to prove its concept and value with smaller teams at first, but eventually expand to entire organizations and companies. Dollar-based net retention rates are clocking in above 140% for companies spending more than $100,000 annually on Asana, a leading indicator that Asana's traction among larger enterprises is growing.

- Huge gross margin profile. Asana's pro forma gross margins are in the ~90% range, making it one of the highest-margin software companies in the market. While the company isn't profitable today, that gross margin profile gives Asana plenty of leeway to scale profitably when it's larger, as nearly every dollar of incremental revenue flows through to the bottom line.

And despite the year-to-date rally which has continued post-Asana earnings release in early June, the stock still trades at a valuation that I think has room to ride higher. At current share prices near $21, Asana trades at a market cap of $4.68 billion. After we net off the $523.5 million of cash and $46.1 million of debt on Asana's most recent balance sheet, the company's resulting enterprise value is $4.20 billion.

Meanwhile, Asana has updated its full-year revenue outlook to $640-$648 million, representing 17-18% y/y growth ($2 million higher on the low end than its prior outlook, and conservative given the beat to Q1).

Asana outlook (Asana Q1 earnings release)

This puts the stock's valuation at 6.5x EV/FY24 revenue. Considering 90%+ gross margins, substantially improving operating margins, secular tailwinds to keep growth in the ~20% range, as well as a founder-led culture with CEO Moskovitz being a frequent insider purchaser of shares, I think there is still plenty of room for upside.

My year-end price target for Asana is $26, representing a 8x EV/FY24 revenue multiple and ~20% upside from current levels. Stay long here and keep riding the recent momentum higher.

Q1 download

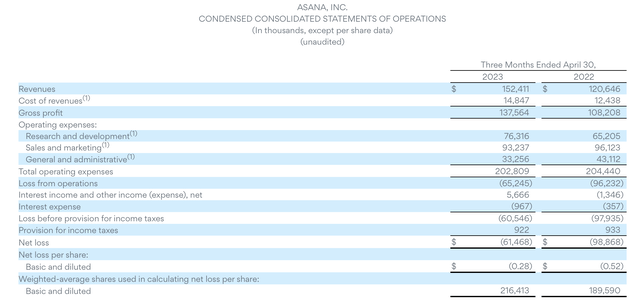

Let's now go through Asana's latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Asana Q1 results (Asana Q1 earnings release)

Asana's revenue grew 26% y/y to $152.4 million in the quarter, beating Wall Street's expectations of $150.6 million (+25% y/y) as well as the company's initial guidance growth range of 24-25% y/y. The company continues to focus on high-value enterprise customers, and the count of customers generating >$100k in ARR grew 31% y/y to 510.

Anne Raimondi, the company's COO, noted on the Q1 earnings call that while Asana certainly wasn't immune to macro-driven slowdowns, the company saw stabilization of trends in certain areas:

Turning to our business, the macro headwinds continue to impact our expansions and created longer sales cycles in Q1. We expect to see similarities throughout fiscal year 2024. The good news is that pockets of the market have stabilized. For example, top-of-funnel demand and our free-to-paid conversion rate remained steady in the first quarter. Engagement with our product remains high and we continue to focus on out bounding to build and strengthen our enterprise capabilities. We're making good progress with more work to do [...]

We're also seeing some seven-figure opportunities emerge as various industries accelerate their efforts in digital transformation, which may now be further accelerated with AI. Forbes, the Global Media branding and technology company that reaches over 140 million people worldwide each month across all of its platforms is digitizing legacy operations across their marketing, video, social and HR teams with Asana."

The company is also having more conversations with customers around AI, with the company integrating more AI-driven recommendations into the Asana Work Graph (one of Asana's core products that maps out the cross-functional stakeholders involved in delivering a project). Smart recommendations can now be made to individual users to prompt them to join certain projects.

Asana also reported a 110% net revenue retention rate, indicating healthy upsell trends amid the installed base (particularly among larger customers, where Asana reported a net revenue retention rate of over 130% for customers with >$100k in ARR). Management also noted that churn rates remained low; with strong upsell trends among larger customers offsetting slightly weaker upgrade rates in smaller ones.

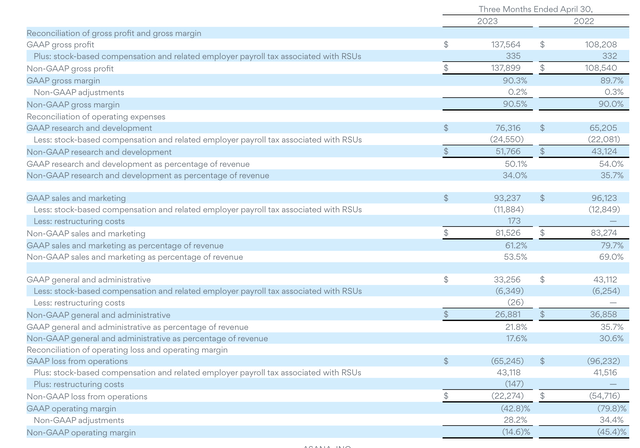

From a margin perspective, Asana's best-in-class pro forma gross margins rose 50bps y/y/ to 90.5%:

Asana margins (Asana Q1 earnings release)

And with the company chasing efficiencies on headcount - particularly in sales and marketing, where pro forma costs actually fell -2% y/y to $81.5 million and reduced fifteen points as a percentage of revenue - Asana's pro forma operating margins gained 31 points to -14.6%, blunting a common investor criticism that Asana is a "growth at all costs" company. I think we have to look at more mature companies like Box (BOX) as an example of Asana's pathway - at greater scale, high gross margins start to kick in as opex growth slows down, leading to substantial room for profitability.

Key takeaways

Asana is a rapidly growing software company that has secular tailwinds as companies look to streamline and reorganize their workforces. With among the highest gross margins in the software sector, we're starting to see the benefits kick into operating margin expansion. Stay long here, especially as the company shows strong execution in a tough macro environment and leans into its AI foundations to deliver new features.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ASAN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.