United Microelectronics: My Top Undervalued Semiconductor Stock

Summary

- UMC is the most undervalued stock in the semiconductor market based on a P/E of 7.21.

- UMC's share price growth at the three-year mark is 188% and higher than any of the top five undervalued stocks based on P/E ratio.

- UMC's monthly sales data is the only mid-quarter metric. Investors need to overlook dismal YoY changes as MoM are positive and more reliable.

- UMC is a leader in the 20nm-28nm node range and doesn't compete against <10nm node foundries such as TSMC.

- This idea was discussed in more depth with members of my private investing community, Semiconductor Deep Dive. Learn More »

Annabelle Chih/Getty Images News

Price per share alone is not a sufficient metric to determine whether a semiconductor stock is undervalued or overvalued. In this analysis analyzed stocks with the lowest P/E ratio as a metric that may suggest the highest undervaluations. The five semiconductor stocks with the lowest P/E ratio are shown in Table 1.

Seeking Alpha

Otherwise, STMicroelectronics (STM) has been the share growth leader through the one-year period. I discussed the company in my March 1, 2023, Seeking Alpha article entitled “STMicroelectronics: Top Pick For Both Silicon And SiC Power Chips.”

ASE provides semiconductor assembly and testing services for more than 90% of electronics companies in the world. The packaging services include fan-out wafer-level packaging (FO-WLP), wafer-level chip-scale packaging (WL-CSP), flip chip, 2.5D and 3D packaging, system in package (SiP) and copper wire bonding, according to our report entitled High-Density Packaging (MCM, MCP, SIP, 3D-TSV): Market Analysis and Technology Trends.

In the remainder of this article I will do a deep-dive analysis on UMC, illustrating that it's indeed an undervalued and in fact underappreciated stock.

United Microelectronics

Revenue Growth

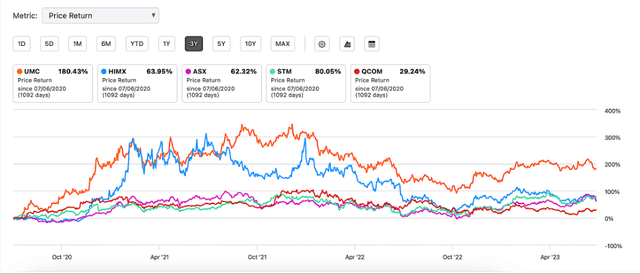

At the 3-year mark, United Microelectronics (NYSE:UMC) is the clear leader in share price change, growing 188% and more than twice the nearest company STM.

UMC (United Microelectronics Corporation) is a global semiconductor foundry headquartered in Taiwan that specializes in the manufacturing and production of ICs for a wide range of applications. As a foundry, UMC provides semiconductor manufacturing services to companies that design and develop their own IC designs but do not have their own fabrication facilities.

There are several major competitors that UMC faces in the foundry industry, most notably Taiwan Semiconductor Manufacturing Company (TSMC) (TSM), as shown in Table 2. Importantly, all (except HuaHong) have negative revenue performance between Q4 2022 and Q1 2023, with the average QoQ change of -20.5%.

The Information Network

A TSIA survey in Table 3 showed that Q1 2023 Taiwan IC revenue totaled NT$627.9 billion in manufacturing (US$21.1B) (18.4% decrease on-quarter and down 5.8% on-year, with Foundry NT$587.3B (US$19.7B), 18.8% decline on-quarter and down 1.6% on-year, and Memory and other manufacturing products NT$40.6B (US$1.4B), 12.7% drop on-quarter and down 41.8% on-year.

Thus, the Q1 2023 revenue of 22.4% drop by UMC (Table 2) is consistent the overall drop by Taiwan companies in Table 3.

TSIA

Process Technologies

UMC supports various process technologies, ranging from advanced nodes, such as 28nm, 22nm, 14nm, and 12nm, to mature nodes, including 0.35μm, 0.25μm, 0.18μm, 0.13μm, and 0.11μm. This allows UMC to serve a broad customer base with different design and production needs.

Table 4 shows revenue of UMC and competing foundries by process node. Importantly, UMC makes no chips at the 14nm node and below, unlike TSMC and Samsung (OTCPK:SSNLF). While this is a negative for UMC because smaller nodes command higher chip prices, which I presented in my June 15, 2023 Seeking Alpha article entitled “Taiwan Semiconductor's Weak 2023 Outlook Is Essentially A Near-Term Macro Phenomenon.”

For UMC, 24% of its revenues were generated from chips made at the 16/28nm node, which we see as strong competition by TSMC, Samsung (SSNLF), and GlobalFoundries (GFS).

The Information Network

Investor Takeaway

Competitive Analysis with TSMC

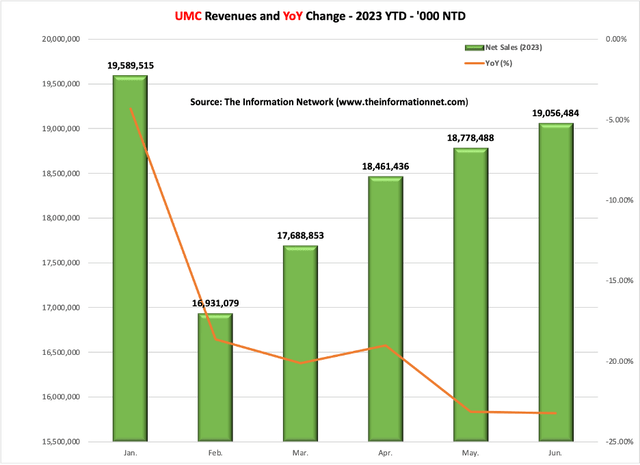

UMC reported on July 6, 2023, that June sales down 23.24% Y/Y to ~NT$19.06B. In May sales dropped ~23.14%. Overall, six month sales from Jan to June have declined 18.4%.

This drop in sales is:

- Consistent with data I presented in Tables 2 and 3 above

- Consistent with data from the Semiconductor Industry Association reporting that worldwide chip sales down 21.6% YoY and projects annual downturn of 10.3% in 2023

In Chart 1, I show UMC’s monthly revenues for 2023. Importantly, it shows that monthly revenues (green bars) are increasing while YoY revenues are decreasing (orange line).

Readers must recognize that two years ago, in my June 25, 2021, Seeking Alpha article entitled “Applied Materials: Tracking A Likely Semiconductor Equipment Meltdown In 2023,” I forecast a meltdown in semiconductor equipment in 2023 along with an oversupply of semiconductors. We're now seeing this drop, and therefore it's no surprise that revenues are down YoY from a strong 2022 with global semiconductor revenues of $574 billion.

The Information Network

Chart 1

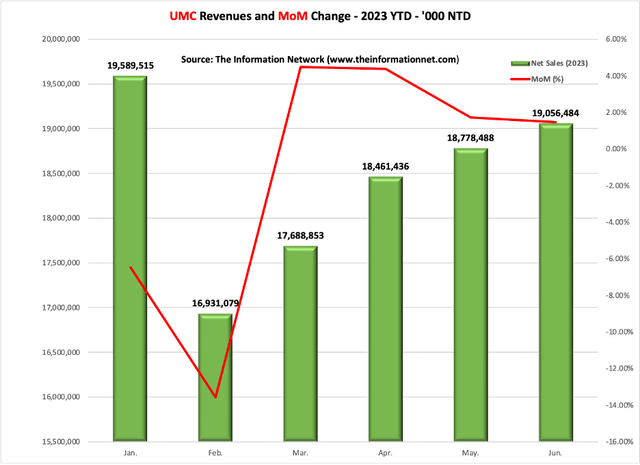

In Chart 2, I show MoM sales revenue growth (red line) for UMC for 2023. These figures indicate that revenue growth for UMC is showing resilience in meeting customer demand.

The Information Network

Chart 2

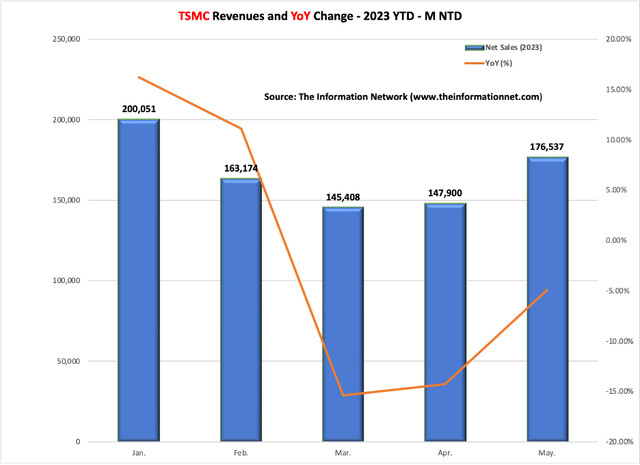

To further evaluate the performance of UMC, I show similar data for TSMC, which I presented in Table 2 above in which TSMC’s Q1 2023 revenue growth was -16.1% QoQ, and in the ballpark with UMC’s -22.4% change.

Chart 3 shows 2023 monthly revenue for TSMC (blue bar) and YoY change (orange line) through May 2023. As with UMC, YoY revenue growth is strongly negative, although the May revenues ticked up.

The Information Network

Chart 3

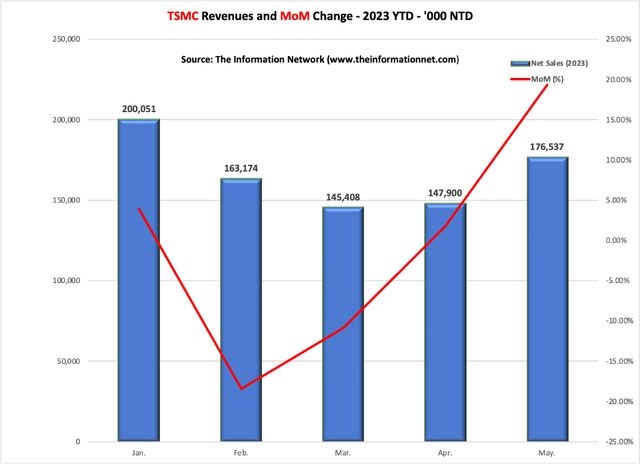

Chart 4 shows MoM sales revenue growth (red line) for TSMC for 2023. These figures indicate that revenue growth for TSMC is showing better growth. In May 2023, TSMC grew 19% following a lackluster 2% growth in April. This compares to USMC, who’s MoM revenues grew 2% in May following 4% in April.

While both UMC and TSMC are foundries in Taiwan, TSMC has focused on expensive, small node chips while UMC’s sweet spot is in the mid-node segment of the industry between 16-65nm.

According to our report entitled Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts, prices of wafers range between:

- $9,000 for 7nm and $18,000 for 3nm wafers.

- $5,000 for 65nm and $8,000 for 16nm wafers.

The Information Network

Chart 4

Financial Metrics

In this analysis, I used PE ratio as a metric that may suggest the highest undervaluations, choosing the lowest PE ratios among semiconductor stocks.

Of these five companies, based on PE ratio and share price performance I analyzed UMC, as my Top Undervalued semiconductor stock.

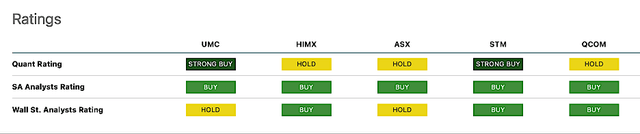

Chart 5 compares ratings of these five companies, with STM the highest performing. I noted the stock performance of STM in this article as well as already analyzing the company in my March 1, 2023, Seeking Alpha article entitled “STMicroelectronics: Top Pick For Both Silicon And SiC Power Chips,” and I reiterate my position on STM. Hence, this article addresses UMC, which has a Strong Buy Quant Rating.

Seeking Alpha

Chart 5

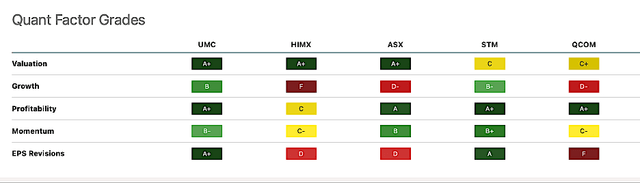

Chart 6 shows the Quant Factor Grades for the five companies, with A+ grades for UMC for Valuation and Profitability - the highest performing company in these Factor Grades.

Seeking Alpha

Chart 6

Until we see a broad-based recovery in the macro environment, we won’t see a broad-based recovery in the stock market.

Chart 7 shows the performance of the five stocks for a three-year period. UMC is clearly the top performing stock.

Seeking Alpha

Chart 7

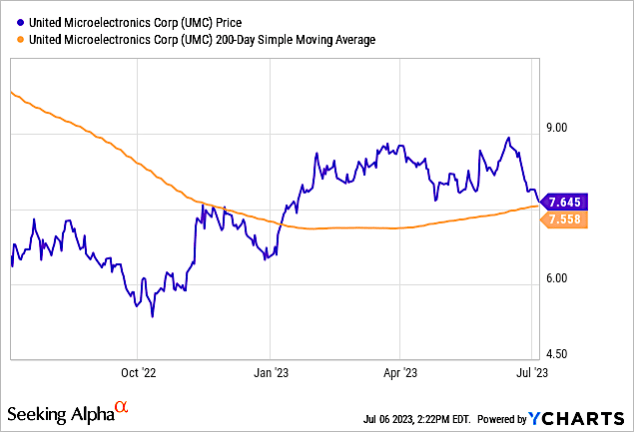

UMC is in a short-term oversold condition, but the stock is above its 200-day moving average which is pointed up indicating that the intermediate term trend is bullish, as shown in Chart 8.

YCharts

Chart 8

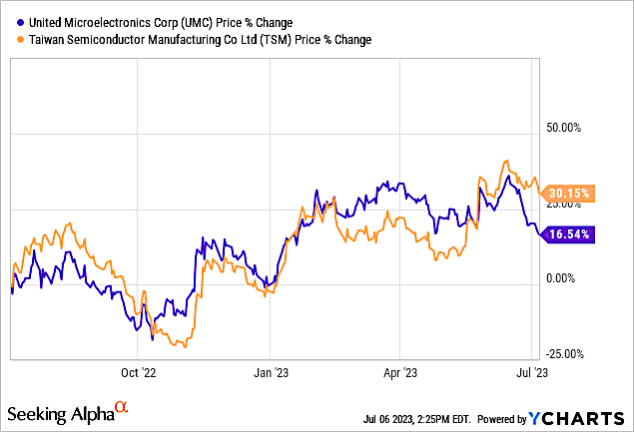

Chart 9 compares one-year share performance of UMC with TSMC. Performance between the two companies was comparable until mid-June 2023, when selling pressure accelerated for UMC. With only monthly sales as a financial metric, investors were reacting to the YoY drop in monthly sales. This is a mistake. Coupled with the business model of UMC and Quant Factors shown above, UMC is clearly in an oversold situation.

YCharts

Chart 9

As I showed above in Table 1, UMC’s Price-To-Earnings ratio (7.2x) is below the Taiwan market (18.8x) and half that of TSMC’s 15.3x.

For investors looking at alternatives to stocks with valuations in the stratosphere Nvidia (NVDA) or AMD (AMD), or the FAANG stocks generating nearly all the stock market growth in 2023, UMC is a refreshing change. While P/E ratio is just one of a few metrics to evaluate undervaluations, it serves its mission of pointing to high long-term growth and high Quant Factor Grades.

This free article presents my analysis of this semiconductor equipment sector. A more detailed analysis is available on my Marketplace newsletter site Semiconductor Deep Dive. You can learn more about it here.

This article was written by

Dr. Robert N. Castellano, is president of The Information Network www.theinformationnet.com. Most of the data, as well as tables and charts I use in my articles, come from my market research reports. If you need additional information about any article, please go to my website.

I will soon be initiating an investor newsletter. Information to register will be online on my website.

I received a Ph.D. degree in chemistry from Oxford University (England) under Dr. John Goodenough, inventor of the lithium ion battery and 2019 Nobel Prize winner in Chemistry. I've had ten years experience in the field of wafer fabrication at AT&T Bell Laboratories and Stanford University.

I have been Editor-in-Chief of the peer-reviewed Journal of Active and Passive Electronic Devices since 2000. I authored the book "Technology Trends in VLSI Manufacturing" (Gordon and Breach), "Solar Panel Processing" (Old City Publishing), "Alternative Energy Technology" (Old City Publishing). Also in the solar area, I am CEO of SolarPA, which uses a proprietary nanomaterial to coat solar cells, increasing the efficiency by up to 10%. I recently published a fictional novel Blessed, available on Amazon and other sites.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.