Rates Spark: ISM Is A Dancer

Summary

- It's very much glass half full for inflation risks, and the latest Fed minutes voice concern that has been echoed by the ECB (and BoE).

- This plus supply pressure and rising deficits is placing ongoing upward pressure on market rates.

- Despite survey evidence pointing down, we think pressure remains for even higher market rates.

TERADAT SANTIVIVUT

By Padhraic Garvey, CFA; Benjamin Schroeder; Antoine Bouvet

Fed minutes sounds suitably hawkish – in tune with the market mood of late

Fed minutes are sustaining the hawkish tilt that has been dominating policy discussion of late. The Fed paused in June, but some participants would have preferred a hike. There was acknowledgement of ongoing firm GDP growth and high inflation, with core inflation in particular showing no tendency to show any material fall this year so far. The balance is one of a hawkish Fed, with some seeing the possibility of avoiding a material downturn. Staff still see a mild recession ahead.

The Fed also noted that credit remains available to highly rated borrowers, but that lending conditions had tightened further for bank-dependent borrowers. Apart from obviously higher borrowing costs, the Fed also notes a tightening in lending standards in the commercial real estate space. There was also a tightening in credit conditions for lower rated borrowers in the residential mortgage market. But overall vulnerabilities to funding risks are deemed moderate by the Fed.

There was more in support of the risk of another hike beyond the July one

On liquidity conditions the Fed noted the build in US Treasury balances post the debt ceiling suspension through more bill issuance, and for that to coincide with a tightening in conditions. The Fed expected the rise in the Treasury cash account to be offset by falls in reverse repo balances, and that bank reserves would also fall. Still, the Fed sees bank reserves remaining ample through to the end of 2023. The latter is an interesting insight, as it suggests the Fed is not concerned as of yet that liquidity conditions are at a point where they could prove troubling for the system.

This appears to pave a safe route for further funds rate hikes. A 25 basis point hike is now 85% discounted for July, and there was nothing in the minutes to negate that discount. In fact there was more there in support of the risk for another hike beyond the July one. At this juncture the Fed does not see enough out there to send any sense that it is done with hikes.

Our latest view on US market rates is contained here, rationalising the persistent drift towards a 4% handle for the 10yr Treasury yield.

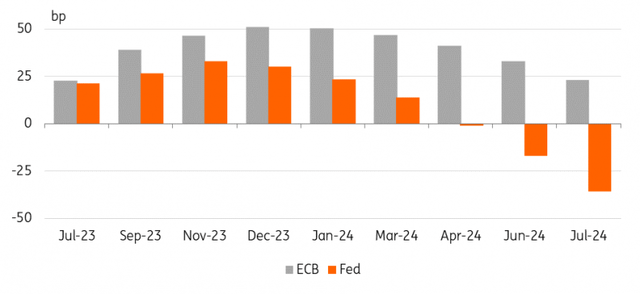

Money market pricing of Fed and ECB key rate changes

Refinitiv, ING

The ECB is holding its hawkish line

The Bundesbank’s Joachim Nagel, one of the more prominent hawks of the European Central Bank, has been on the wires over the past few days pushing the known narrative that rates need to rise further and that the fight against inflation was more akin to a long distance run than a sprint.

The transmission of monetary policy seems to be working with the latest ECB bank interest statistics showing a strong pass-through. On the inflation front there are also some more encouraging disinflationary signs. The PPI dipped into negative territory yesterday coming in lower than expected and pointing to lessening pipeline pressure. The ECB’s own consumer survey also saw a further drop in inflation expectations. At the same time the macro backdrop is getting gloomier, with the final PMIs having been revised lower just this week.

Some will caution that the ECB models are not as reliable nowadays as before, so there has to be an increasing focus on current inflation dynamics. While falling price expectations of consumers are positive, they are usually closely correlated to what happens with current inflation. Some more dovish ECB members, such as Italy's Visco, have spoken out against the hawks' calls to err on the side of doing too much on rates.

For now the market is still buying into the story that more hikes are needed

For now the market is still buying into the story that more hikes are needed and is now fully discounting two more rate hikes from the ECB by the end of the year. But there are also question marks, and these will only get larger with more disappointing data, as to how tenable that hawkish ECB position is. Markets are discounting the first rate cut by summer 2024, though not yet fully discounting three cuts from the peak in total by the end of 2024.

The longer outlook is showing growing cracks. It's not just that the curve remains deeply inverted. It's also real rates for instance that have not really recovered from their 40bp slump in late May to late June. Hitting a low around zero, the 5y5y real ESTR OIS is still below 10bp. The flipside though is a 5y5y inflation forward still at 2.55%, and still on an unbroken, general upward trend since mid-2020. This is something the ECB will be watching more closely.

Today’s events and market views

US data remains the main focus. At the start of the week the ISM manufacturing again painted a gloomy picture, but the ISM for the services sector out today represents the larger share of the economy. Here the consensus is to see a rebound from the dip to the 50 level, and we think this should help a great deal in getting 10Y UST yields to 4%.

Ahead of tomorrow's official US jobs report the ISM's employment sub component will also get more scrutiny – it had dipped below 50 last month, contrasting with the later strong payrolls number. Of course, the ADP estimate will also have some (limited) bearing on expectations tomorrow, while the initial jobless claims and JOLTs job openings data should allow a more contemporaneous sense of the current labour market situation in the US. So far it has been surprisingly resilient.

The main data event in the eurozone are the retail sales numbers following Germany's factory orders this morning. The Bundesbank's Nagel has his fourth scheduled appearance this week.

Sovereign bond supply will come from France and Spain today. Being geared to the longer end of curves supply may have helped the curve bounce off the extreme lows in past sessions.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

This article was written by