After Q2, It May Be Time To Lock-In Telia's 8% Dividend Yield

Summary

- Telia, a Nordic-focused mobile network operator, has been struggling with poor performance and declining shares, leading to questions about the sustainability of its 8.3% dividend yield.

- The company has been divesting assets and made large impairments of goodwill in 2020 and 2022, but is suffering from high electricity costs and a struggling TV & Media business, which represented nearly 10% of total revenues in 2022.

- Despite these challenges, Telia maintains a dividend policy of paying at least SEK 2 per share, though this is not covered by the earnings.

- Telia is soon reporting Q2 earnings, which will give important clues if the dividend is secured by the operational improvements and capital management.

omersukrugoksu/iStock via Getty Images

Telia (OTCPK:TLSNF) is a mobile network operator owned largely by the state of Sweden (41%). After a long journey of operating businesses in faraway jurisdictions, Telia is today a purely Nordic focused operator. The business has been performing poorly for many years and after a prolonged decline of the shares, the dividend yield stands today at around 8.3%. Telia has been a good dividend payer in the past and as the expected returns mostly relies on the dividend. Since it is difficult to see the path to better business performance, the stock isn't a bargain, Telia deserves a hold as the high dividend is likely secured.

The stock has performed poorly against the peers

Telia is the largest mobile network operator (MNO) in the Nordic region, primarily in Sweden, Finland and Norway. It also operates in Lithuania and Estonia and is about to exit Denmark. Telia holds a market leading position in Sweden and Estonia and is the second largest in Finland, Norway and Lithuania.

Sweden is clearly the largest market for Telia. Its share of revenue is more than twice the size of Finland and Norway. Lithuania and Estonia combined are approximately half the size of Finland or Norway. The TV & Media business represented nearly 10% of the total revenues in 2022.

Telia's stock price has lagged significantly its closest peers in the Nordic region. There are multiple reasons, which we explore next. Furthermore, the Swedish krona has lost its value significantly against euro and dollar.

Share price development of Telia and its Nordic peers. (Koyfin)

In the first quarter of 2023, Telia reported an EPS of SEK 0.15 below the expected SEK 0.26. However, the company maintained its guidance for 2023. Telia expects its service revenue to grow by low single digit and adjusted EBITDA to remain flat or grow by low single digit. Since the results were rather poor in Q1, there's a significant risk of a negative profit warning if the business doesn't turn to a better direction. In the Q1 earnings call, the management communicated about improving business for the rest of the year.

TV & Media business is hurting the profitability

Telia has been struggling with plenty of issues. In 2018, it acquired Bonnier Broadcasting, a broadcasting company focused mostly on problematic linear television services. At the time of purchase, the EV/EBIT valuation was 15.3x, which afterwards appears to be poor capital allocation.

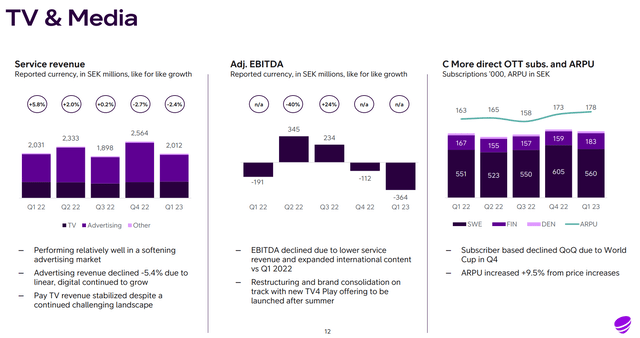

In the first quarter the TV & Media operations produced a negative SEK 364 million adjusted EBITDA compared to negative SEK 191 million the year before. According to Telia, the decline was due to lower service revenue and expanded international content. The TV business will likely remain a burden to the company's earnings as businesses cut their marketing spending.

Development of TV & Media business. (Telia Q1 presentation)

Asset sales have run their course

Like many other MNOs Telia has been divesting plenty of its assets. The latest divestment took place in April when Telia sold its Danish operations. According to several analysts, the realized price was excellent (9x EV/EBITDA). Telia is going to pay down the debt with the proceeds lowering the indebtedness 0.2-points measured by net debt to EBITDA. Currently, Telia's indebtedness stands 2.5x. The closing of the deal is expected to take place in 2024.

In 2021, Telia sold minority stakes of its different tower portfolios to Brookfield and other investors. The same year it finalized the sale of the international telecommunications infrastructure business and also realized a high multiple in the deal. After these divestments what's left of Telia is its core Nordic mobile network and media businesses, and there aren't many assets to be sold to fund a dividend or capital expenditures of the core business.

In 2020 and 2022, Telia made larger impairments of goodwill. Last year the impairment was made due to the rising interest rates and higher cost of capital and totaled 19.1 billion crowns, approximately $1.9 billion. The impairment resulted in a large negative net income for the year. Goodwill and intangibles still represent 34.5% of the total assets, which is lower than two of its main competitors Tele2 (65.3%) and Elisa (43.3%). Telenor has clearly the most solid balance sheet out of the peers (15%). If the interest rates keep on rising, there's a slight risk of further impairments down the road.

Electricity prices have come down

Lately, Telia has been suffering from the high electricity costs. According to Statista the wholesale electricity price per megawatt hour spiked in December 2022 at 235 euros. In March, the price was down to 69 euros. Here in Finland, the second largest market for Telia, we have had even negative electricity prices after turning on the new nuclear power plant, which turned out to be the one of the most expensive buildings on earth.

In Q1 the electricity costs were SEK 130 million higher than the year before. Telia has a cost savings program of SEK 2 billion in place, but according to the company, they struggle to reach the pursued savings in the inflationary environment.

Dividend is in danger but likely maintained

Telia has a dividend policy of paying at least a dividend of SEK 2 per share. For the previous fiscal year, Telia is paying exactly that, a dividend of 2 SEK per share split into four installments. However, Telia is making the last payment in February 2024. The schedule will help Telia a bit to maintain its payments. This year, the dividend payment is 4.7% less than last year.

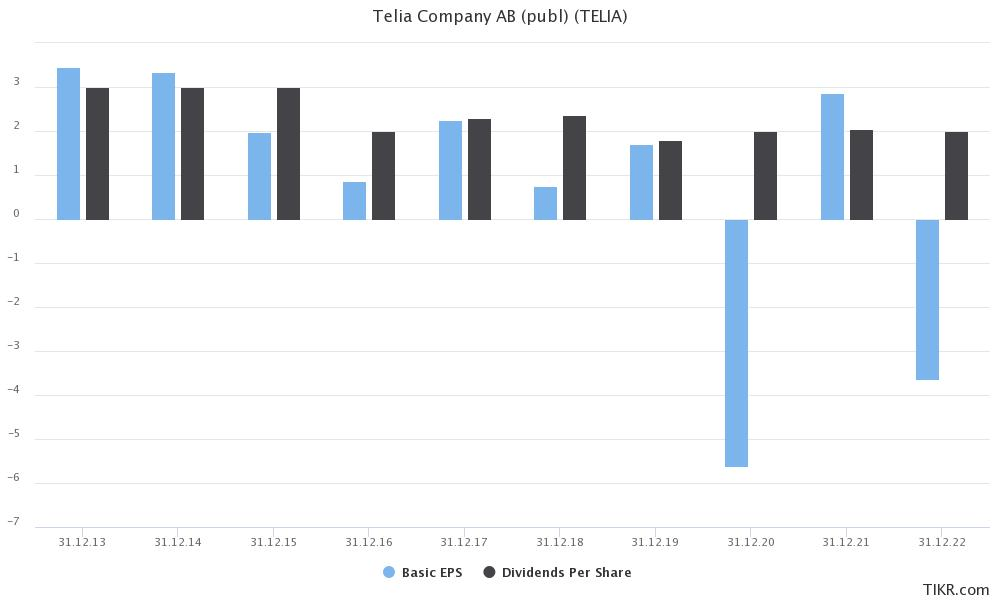

Due to the high impairments of goodwill, Telia's earnings per share doesn't cover the dividend. In the past 10 years, earnings per share has been higher than the dividend only five times. The average EPS has been only SEK 0.83. From a cash flow perspective, the situation looks slightly better, but not rosy. The average cash flow per share has been SEK 2.82 per share for the past ten years. However, the situation has been getting worse in the recent past.

EPS and DPS over the years. (Tikr)

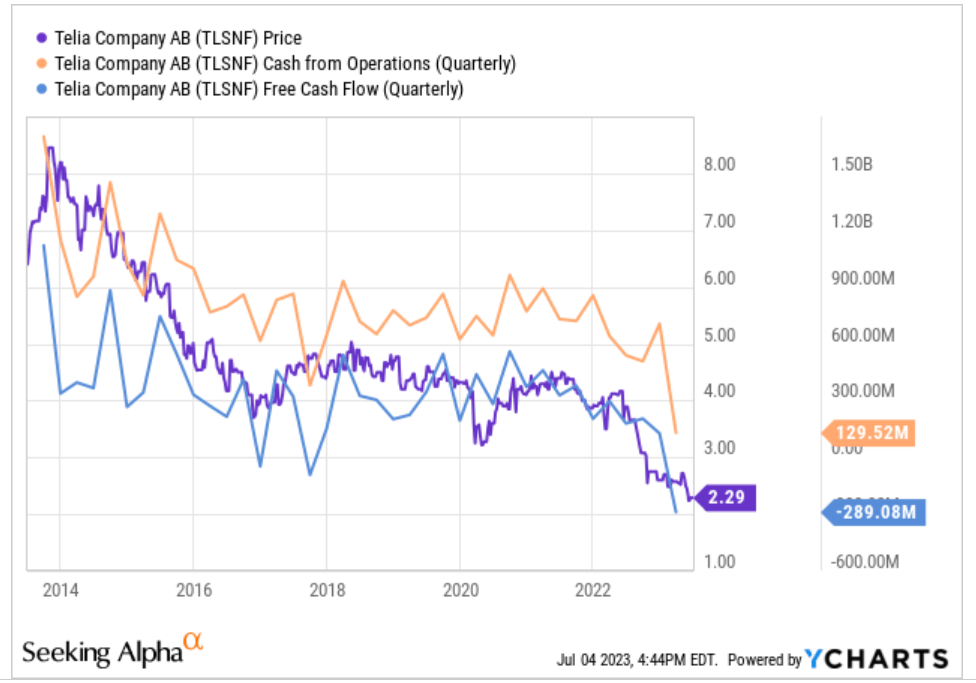

In the Q1, the free cash flow turned negative. Although the company blamed temporary reasons, vendor financing program, one issue to pay attention to is the somewhat declining trend in the quarterly free cash flow. If the cash flow turns to better direction in the coming quarters, investors can be more confident with their dividend income.

Telia's OCF, FCF and the share price. (Ycharts)

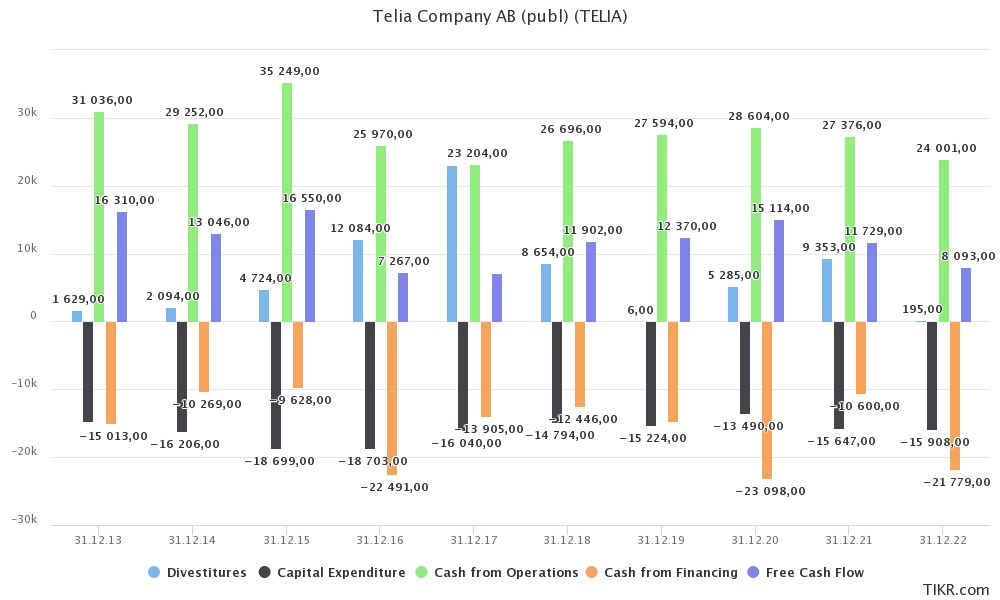

As divestments have run their course, Telia needs to fund the dividend payment of approximately SEK 8 billion in another way. In its outlook, the company expects capital expenditures to be between SEK 13-14 billion against a typical level of 16 billion. The guidance excludes payments for spectrum and licenses. It can also halt its share repurchases, which were SEK 5.5 billion last year.

Here, by the back of the envelope calculation, halting share repurchases and reduction of capital expenditures would be enough to cover the dividend. Furthermore, the company needs to reach its operational free cash flow guidance of SEK 7-9 billion. This is probably achieved if headwinds of TV & Media are overcome by reduction in electricity costs and other operational improvements.

Overview of Telia's cash flow profile. (Tikr)

Potential dividend cut would probably unleash a selling pressure on the stock. It's important to note that for an existing investor spending dollars or euros, the dividend is smaller than last year due to the weaker Swedish krona.

Not much room for multiple expansion

Telia's stock price has fallen to a level seen last time in 2003. Still, the stock doesn't appear cheap by multiple analysis. The forward-looking EV/EBIT-multiple is ticking high at around 17.5x. The forward-looking EV/EBITDA stands at 6.5x, below the five-year mean of 8.2x.

Forward-looking P/E-multiple hovers around 15x with a five-year mean of 18.3x. P/S-multiple has compressed down to 1x, which is historically low and below the five-year mean of 1.7x. P/B doesn't look like a meaningful measure due to the impairments and high amount of goodwill present on the balance sheet.

There could be some room for returning to the mean if the business performance improves, but without a clear path to better both the safety margin and upside look limited. The average target price of 19 analysts is SEK 29 against the share price of SEK 24 at the time of writing. If the business performance improves from Q1, we could easily see the stock returning to its previous trading range of around SEK 26-28.

Conclusion

Telia will publish its Q2 result on 20th of July. If Telia is able to turn the negative cash flow development around, the timing could be opportunistic to tap into the high dividend yield. The development of the cost saving program, the profitability or the lack of thereof of TV & Media segment and capital expenditures are some of the key components to watch. Due to the fairly high valuation and lack of foreseeable catalysts, the returns rely on the wobbly dividend.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TLSNF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.