Enterprise Products Partners: Top Pick In Energy As Distribution Growth Accelerates

Summary

- Enterprise Products Partners L.P. has gone nowhere for over a decade.

- Units yield 7.4% and distribution growth is set to accelerate to the 4% to 5% range.

- I am most optimistic for the prospects of multiple expansions, given management's commitment to lower leverage and the company's recent credit rating upgrade.

- I reiterate my strong buy rating on Enterprise Products Partners, as one is handsomely rewarded for waiting for the upside.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

pandemin

Enterprise Products Partners L.P. (NYSE:EPD) has been a poor stock to own over the past decade, but that underperformance has led to both an attractive valuation as well as arguably increased motivation for management to unlock unitholder value. While management seems to go back and forth on commitments to reduce capital expenditures, the company is still generating enough free cash flow to conduct modest unit repurchases as well as pay down debt.

I am particularly encouraged by EPD management’s decision to lower their long-term leverage target, which has in turn led to the company earning a credit ratings upgrade. The 7.4% distribution yield is highly attractive given that I am seeing increasing reasons to believe in multiple expansion, especially if management commits to bringing down leverage even further. I reiterate my strong buy rating and highlight the notable attractiveness of the stock after a broader market rally.

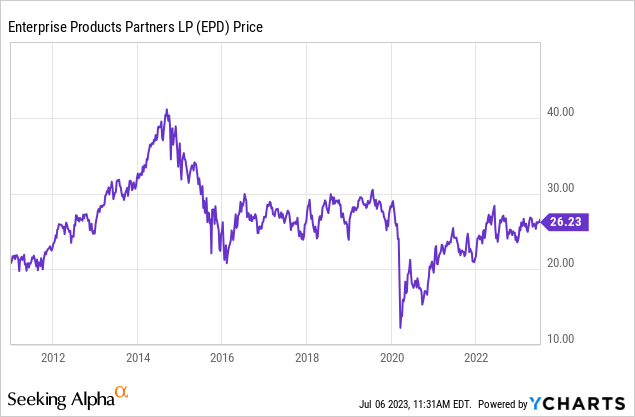

EPD Stock Price

While EPD trades sharply higher than pandemic lows, the stock has been nothing but a disappointment over the past decade as unitholders have had only the distribution to fall back on. EPD had traded at very rich valuations at the beginning of the decade yet now trades as a legitimate value stock. EPD is trading at the same stock price as 2012.

I last covered EPD in January, where I rated the stock a “strong buy” given the potential for larger returns of cash to unitholders. The stock is up single-digits since then, underperforming the broader index, and management has increased its CapEx guidance for the year. Nonetheless, there is real reason to increase the bullishness here as rare catalysts are forming for the stock.

EPD Stock Key Metrics

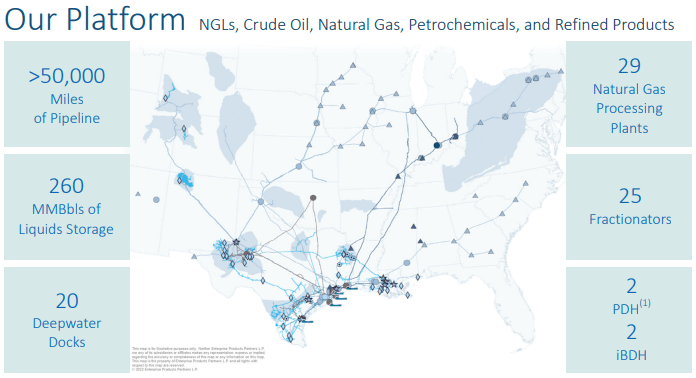

EPD is a midstream giant, meaning that its role in the energy ecosystem is to transport energy products (notably NGLs, crude oil, and natural gas) through its pipeline network. There was once a time in which the midstream pipeline business model was considered to be similar to an energy toll road, a term popularized by Richard Kinder of Kinder Morgan (KMI).

2023 Q1 Presentation

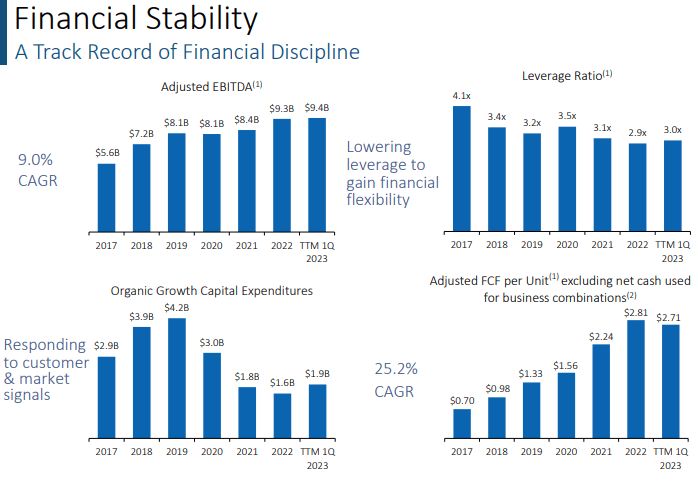

Unlike many midstream companies which seem to be in a constant cycle of poor execution and dividend cuts, EPD has been able to generate consistent cash flow growth - all while also driving leverage lower. Given the capital intensity as well as difficulty in execution of this industry, I cannot emphasize enough how impressive this feat is - it is not an overstatement to say that EPD is “in a league of its own.”

2023 Q1 Presentation

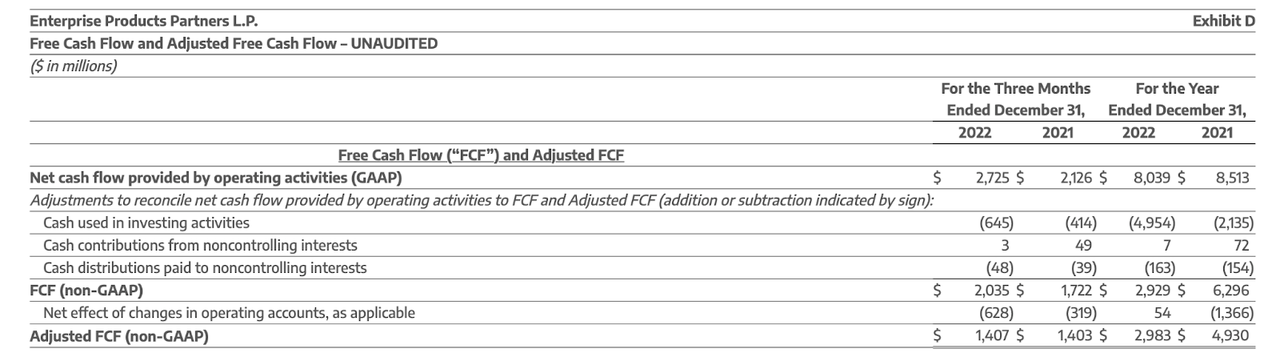

Regarding the note for free cash flow, “net cash used for business combinations” refers to external acquisitions, which in my opinion is a reasonable add-back. Free cash flow is otherwise defined rather typically as cash from operations minus cash used in investing activities.

There is great debate about whether to value midstream companies on the basis of “distributable cash flow” ("DCF"), which only accounts for maintenance CapEx, or free cash flow, which further accounts for growth CapEx. I am of the view that free cash flow is a more reliable metric, given the rampant history of poor execution in the sector.

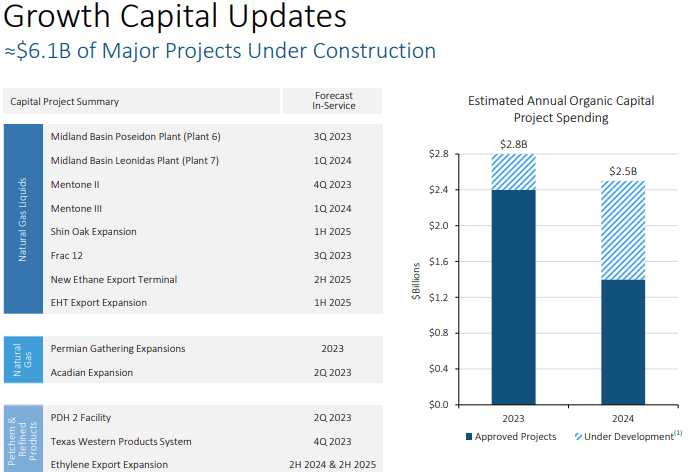

In my prior report, I noted that management was guiding for around $2 billion of growth CapEx in 2023, representing a step-down from the $3 billion to $4 billion budget of prior years. Yet on the recent earnings conference call, management guided for between $2.4 billion to $2.8 billion in growth CapEx in 2023, with 2024 expected to see growth CapEx of between $2 billion and $2.5 billion. While management stated that they “have a hard time seeing us get to the upper end of this range,” I note that they made an identical comment regarding the prior guidance.

This development undoubtedly came as a disappointment for many investors (including yours truly) who may have been hoping for EPD to become less capital intensive and to return more of its cash to unitholders. When an analysts pointed out the discrepancy on the earnings call, management cited seeing “a lot of good opportunities both on the upstream side and the downstream side.”

2023 Q1 Presentation

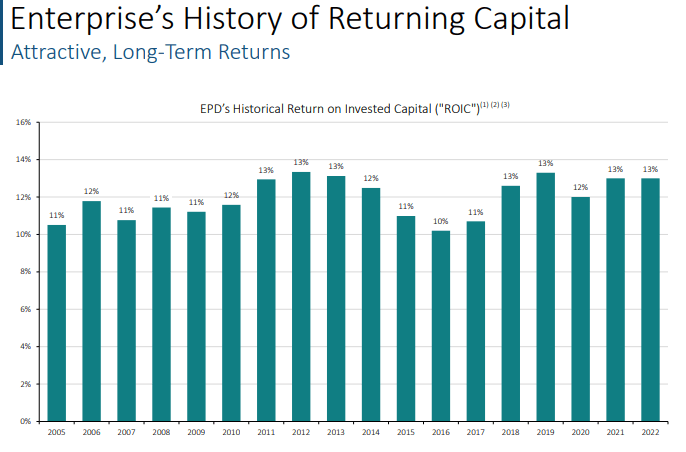

I note that this nonetheless is not an immediate cause for concern given that EPD has shown a tremendous track record of strong execution on growth projects, as evidenced by their roughly 13% historical return on invested capital. Many of the other midstream companies I cover have not seen the same success and perennially trade at low valuations due to that - Energy Transfer (ET) is a notable example.

2023 Q1 Presentation

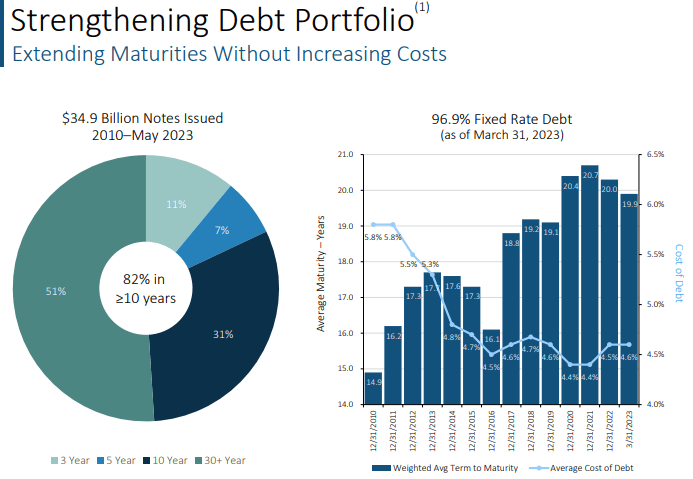

EPD also stands out for efficiently managing its balance sheet, with a well-staggered maturity schedule.

2023 Q1 Presentation

That said, EPD is not immune to the pressures from rising interest rates, as evidenced by its $1.75 billion debt issuance earlier this year, which came at a blended 5.2% interest rate, slated to pay down debt maturing at a 3.35% interest rate.

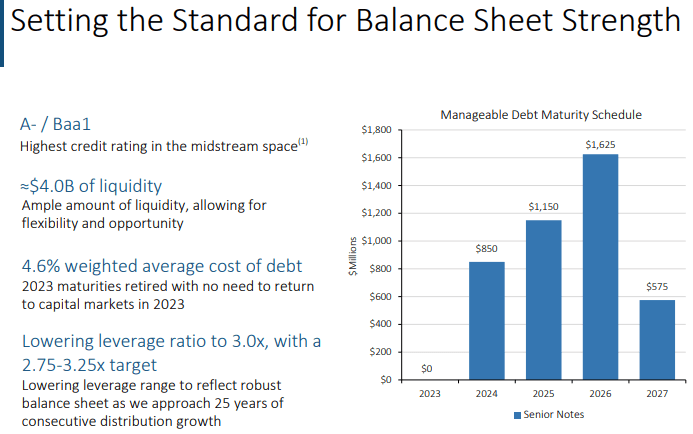

Yet the most bullish of recent developments may be management’s decision to reduce their target leverage ratio from 3.25x-3.5x down to 2.75x-3.25x, prompting a ratings upgrade to A- from Standard & Poor’s. This makes them the only A- rated midstream company and may help the stock earn a higher multiple.

2023 Q1 Presentation

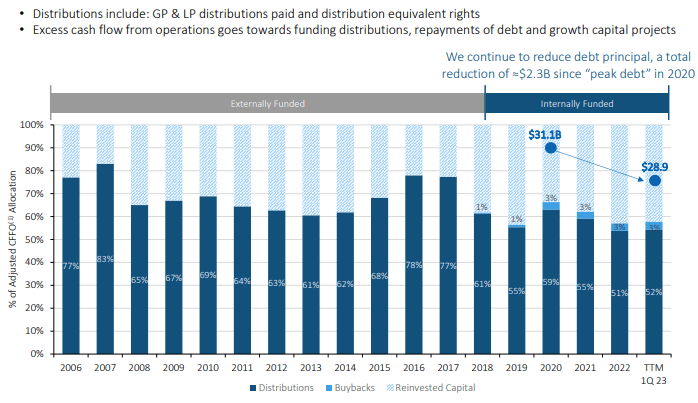

EPD is one of the few midstream companies which are able to fully-fund growth projects with internally generated capital, with cash flow left over to unit buybacks and debt paydown.

2023 Q1 Presentation

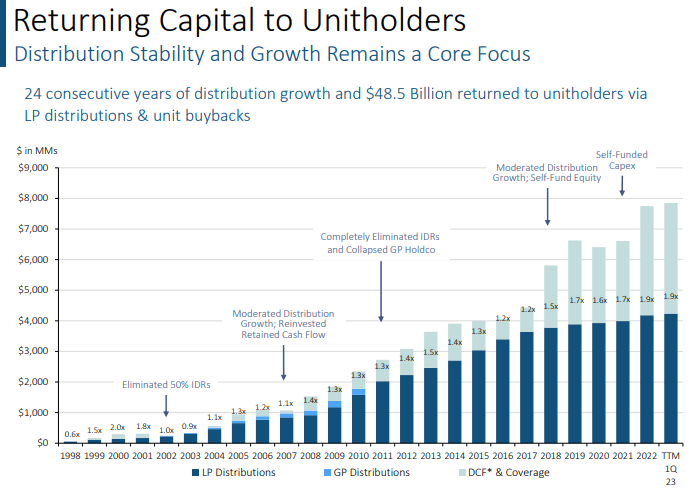

Analysts asked management about the pace of distribution growth moving forward. Management hinted that growth might accelerate back to historical norms of 4% to 6%, noting that the small increases over the past 5 years have been due to their transition to an internal funding model. If management executes against those promises, then I could see the market warming up to the attractive combination of high yield and moderate growth.

Is EPD Stock A Buy, Sell, or Hold?

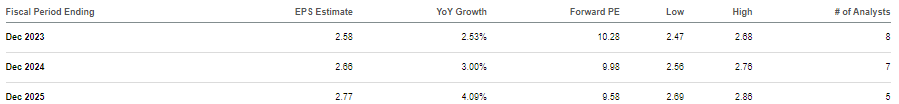

As of recent prices, EPD was trading at reasonable valuations of around 10x forward earnings. As discussed above, GAAP earnings are an imperfect metric due to depreciation & amortization not perfectly matching the outlay for CapEx, but the two tend to come out pretty close most years.

Seeking Alpha

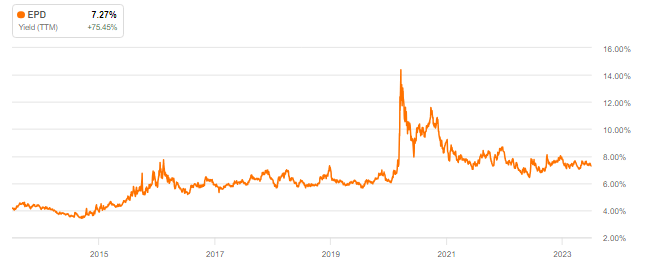

EPD is trading at among its highest yield - the only time it traded higher was during the pandemic crash when the yield briefly soared over 10%.

Seeking Alpha

The high distribution yield is surprising given that EPD has a 24-year history of increasing distributions and has steadily increased distribution coverage in recent years.

2023 Q1 Presentation

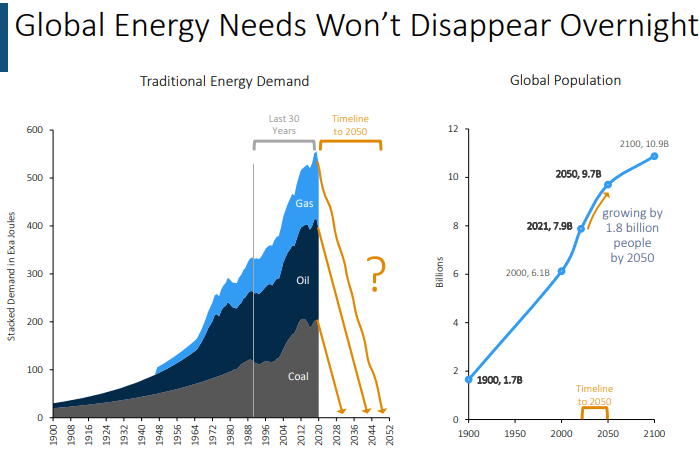

From a mathematical perspective, the 7.4% distribution yield plus around 4% of distribution growth should comfortably lead to 11% to 12% annual returns moving forward. Yet clearly the more “juicy” returns must come from multiple expansion potential, which might be a funny thing to say for an energy stock. But EPD management makes a good point that all the developments in recent years regarding oil prices and the energy transition have shown that “energy security” is an indispensable quality.

2023 Q1 Presentation

As an investor in cannabis stocks, I have seen too intimately how difficult it is for politicians to agree on forward change. What’s more, EPD has lower exposure to crude oil (and thus greater exposure to natural gas) relative to other midstream companies, giving it slightly lower tail-end risk.

2023 Q1 Presentation

Between Enterprise Products Partners L.P.'s history of strong execution, accelerating distribution growth, and evolving energy story, I can see a real case for multiple expansion here. I am doubtful that EPD can trade back to the 4% yields it did during the energy heyday prior to 2016, but a 6% yield looks reasonable, if not still too conservative. Assuming that this multiple expansion takes place over the next decade (also conservative), that implies another 2% of annual return potential, bringing the potential forward annual returns to the 14% level.

What are the key risks? An investment in EPD may require considerable patience. If one is not satisfied by distributions (even large ones), then EPD may make for a boring investment. It is possible that the hoped-for multiple expansion occurs very slowly, or not at all, in spite of strong distribution growth and an improving balance sheet. I find that unlikely given that dividend growth stocks tend to re-rate higher at some point or another, but EPD is not included in the S&P 500 index and might lag due to that. I should note that EPD issues a K-1 tax form which may pose a hassle to some investors, though I note that in the past their K-1 form has been among the easiest to import into tax software.

It is possible that I have underestimated the rate of the energy transition - in particular adoption of electric vehicles has been stunning with many EVs now costing as much or less than gas counterparts. At the very least, volatility in the energy sector may hold down valuation multiples due to poor sentiment, but the last several “boom” years in the sector have likely greatly boosted the credit profiles of EPD’s counterparties.

A final risk to consider (which may admittedly be stretching it) is that there is limited disclosure related to EPD’s customers - their annual report only lists “Vitol Holdings” as their largest 10% customer. This may raise some hairs given the history of fraud in the energy sector, but it probably not a considerable risk given EPD’s long track record. I reiterate my strong buy rating, especially considering the rising valuations of the broader market.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EPD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (8)

Why do you think now is finally when it breaks out?