ZIM's Odyssey: Navigating Turbulent Waters

Summary

- ZIM Integrated Shipping Services experienced a sharp decline in operational and financial performance in Q1 2023, with net losses, decreased revenues, and lower freight rates.

- The shipping market faces oversupply challenges in 2023–2024. ZIM's financial performance will continue to be impacted based on market risks and uncertain demand dynamics.

- ZIM is facing a challenging operating environment with declining freight rates. However, the company implemented adaptation strategies, including fleet renewal and cost optimization.

- ZIM faces risks, including high short interest, a negative EPS growth rate, concerns about dividend sustainability, and a deteriorating cash position.

- Looking for more investing ideas like this one? Get them exclusively at Yiazou Capital Research. Learn More »

ronib1979/iStock via Getty Images

Investment Thesis

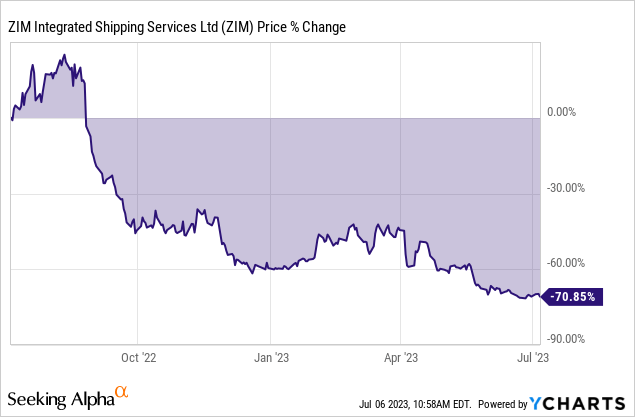

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) experienced a rapid deterioration in operational and financial performance in Q1 2023. Despite paying massive dividends, the stock has delivered a negative price return of 70% over the past 12 months.

The article evaluates what may and may not work for ZIM in its efforts to drive long-term growth. Notably, the shipping market faces oversupply challenges in the coming years, impacting ZIM's performance. On the other hand, ZIM has implemented strategies such as fleet renewal and cost optimization to adapt to changing market conditions. Nevertheless, its bullish catalysts are neutralized by the prevailing bearish factors, leading to a neutral rating for ZIM.

Rapid Deterioration

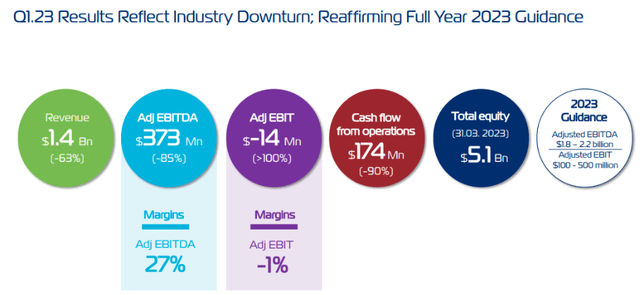

ZIM faced a rapid deterioration in its operational and financial performance in Q1 2023. Key operational indicators showed a decline in the carried volume of 10% year-over-year (YoY), with a significant deterioration in freight rates, down by 64% YoY. The volume deterioration was observed across all geographic trade zones except for the Cross-Suez route.

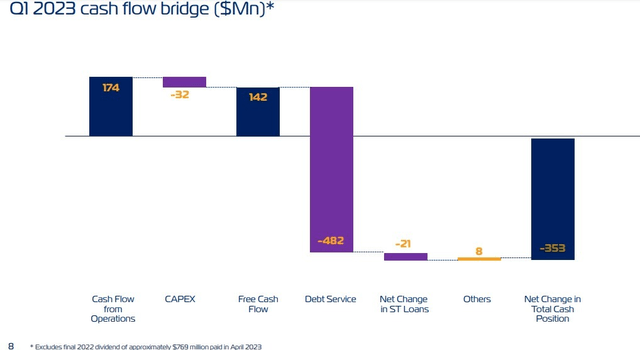

ZIM recorded a net loss of $58 million in Q1 2023, marking a significant decline of over 100% YoY and quarter-over-quarter (QoQ). Revenues also saw a substantial decline, down by 63% YoY and 37% QoQ. The free cash flow deteriorated massively compared to the previous year but was still positive at $142 million, insufficient to offset the significant QoQ cash outflow ($353 million). The cash conversion rate of 38% decreased by 21% YoY, indicating challenges in the company's liquidity.

Despite the challenging performance in Q1, ZIM has reaffirmed its full-year guidance for 2023. However, the guidance indicates that average freight rates will remain significantly lower than in previous periods. In addition, one potential positive factor for ZIM is the slight decrease in bunker rates, which could help mitigate some cost pressures. However, it is crucial to note that these rates are only expected to be slightly lower, and the overall impact on profitability may be limited.

Navigating Oversupply Challenges

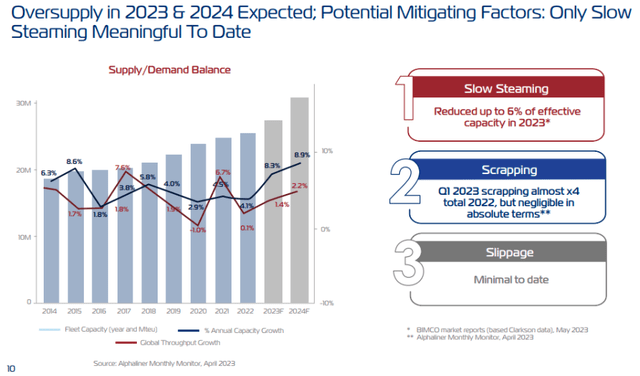

ZIM is operating in the shipping market, which is expected to face oversupply challenges in 2023 and 2024. Forecasted global throughput growth for these years is 1.4% and 2.2%, respectively, while the projected annual capacity growth is much higher at 8.3% for 2023 and 8.9% for 2024. As a result, this indicates a potential risk of oversupply, which could negatively impact freight rates and profitability.

However, there are mitigating factors that may help alleviate the oversupply risk. One such factor is slow steaming, which has been effective in reducing adequate supply by up to 6% so far in the current year. The practice helps manage capacity and maintain a better supply-demand balance.

Another potential mitigating factor is the implementation of scrubbing technology, which could lead to the retirement of older vessels that do not meet the stricter IMO 2023 regulations. Although scrubbing has increased in the first quarter of 2023, it remains to be seen if more vessels will be sent to the scrap yard as compliance costs rise.

On the demand side, the global demand pattern for 2023 follows similar trends to pre-COVID years, with positive development observed towards the end of the first quarter. Assuming 1.4% YoY growth, the volume is expected to improve in the second half of 2023 after a weak start, with support due to the end of the destocking cycle.

Adapting To Challenges: ZIM's Q1 2023 Performance & Strategic Measures

ZIM experienced a challenging operating environment in Q1 2023, characterized by downward pressure on freight rates. The company reported an adjusted EBITDA of $373 million and an adjusted EBIT loss of $14 million, reflecting the impact of declining revenues. Cash flow from operations was $174 million, contributing to the company's total solid cash position of $4.3 billion at quarter-end.

Although ZIM observed some price gains in March and April 2023, freight rates have continued to slide, and the company anticipates ongoing rate pressure in the near future. This expected pressure on rates will also impact the company's second-quarter results. Despite these challenges, ZIM maintains its positive outlook for 2023 and reaffirms its full-year guidance provided in March.

ZIM has taken proactive measures to adapt to the changing operational environment. By implementing a vessel chartering strategy and improving its cost structure, the company aims to operate more effectively in this challenging market and create sustainable long-term value. The company's robust balance sheet and ample liquidity give it the strength to navigate the downturn.

Additionally, the fleet renewal program is a key element of ZIM's environmental, social, and governance (ESG) strategy. The use of liquefied natural gas (LNG) in its vessels contributes to carbon intensity reduction and offers financial benefits due to the lower price of LNG compared to low-sulfur fuel oil (LSFO). ZIM has already started receiving newbuild vessels, including LNG-powered ones, and expects further deliveries throughout the year and early 2024.

Also, ZIM continues to adapt its commercial strategy to changing customer demand and identify attractive opportunities in the market. Expanding car carriers, retail services and focusing on temperature-controlled cargo may contribute to profitable growth. Additionally, the company seeks investment opportunities in innovative technologies within the shipping and supply chain ecosystem, aiming to support early-stage companies and assist them in their growth trajectory.

ZIM acknowledges the challenges posed by ongoing rate pressure but remains focused on optimizing its fleet, maintaining cost competitiveness, and supporting profitability. The company acknowledged the softer rates and rate pressure in the market, which have impacted its financial results. It has strategically shifted its capacity allocation, exiting certain trade lanes with significant rate erosion and redeploying capacity to more profitable trades, such as the Asia-Australia route and the West Coast of South America-East Coast of North America service.

Regarding time charter activity, despite the cost-prohibitive environment for liners, the chartering market remains active, with limited capacity available. ZIM has taken decisive actions in the past, focusing on the fleet renewal program to accommodate the delivery of new, fuel-efficient vessels. The company plans to deliver most of the capacity up for renewal, making room for the more efficient tonnage that will enhance its cost-effectiveness in each trade.

Moreover, the progress of the contract rate season is still ongoing, with negotiations taking longer than expected. ZIM aims to secure contracts for 50% of its expected volume, with the remaining 50% exposed to the spot market. The average rates secured for contracts are significantly lower than the previous year's rates, aligning with current spot levels.

In terms of volume trends, ZIM experienced a decline in intra-Asian volumes. While some seasonality is related to the Chinese New Year, the weakness in volume can also be attributed to factors beyond seasonality. Regarding costs, ZIM has successfully reduced its OpEx (excluding bunker costs) to $868 million in Q1 2023 from $997 million compared to the previous year.

ZIM continues to focus on cost optimization and improving operational efficiency. While some cost categories have increased, such as port costs, ZIM aims to bring down costs further and expects continued improvement in its ex-bunker costs. With the introduction of larger and more cost-efficient vessels, the fleet renewal program is expected to contribute to cost reduction.

ZIM's Investor Presentation

Regarding contract rates, the company indicated that it has already rebased its rates to market levels, eliminating any QoQ profit headwinds in Q2. It is fully exposed to the spot market and does not anticipate further rate reductions from contracts. Regarding contract negotiations, ZIM does not intend to lock in rates resulting in loss-making cargo. Some customers have been pushing for rate reductions, which has extended the negotiation process. The company is focusing on securing financially viable rates for its operations.

Further, the car carrier business has been a profitable area for ZIM. It has expanded this activity significantly, growing from a single vessel operator to operating 14 car carriers, with plans to increase to 16 vessels. The company demonstrated that the car carrier business contributes to its overall revenue growth, offsetting the decline in detention and demurrage. The company acknowledged that Q1 was in line with its expectations, as it anticipated a difficult start to the year due to the absence of tailwinds from contract rates, resulting in total exposure to the spot market. Similarly, ZIM expects Q2 to be similarly challenging.

Regarding net debt, ZIM had paid dividends and distributed cash to shareholders, resulting in decreased cash reserves and increased net debt. As it continues to take delivery of newbuild vessels with longer-term charter agreements, its lease liability and overall financial indebtedness are expected to grow. Finally, as per the management, the level of leverage ratios (net debt to EBITDA) that the industry historically had was above 2, and it anticipated eventually returning to similar levels.

Specific Downsides

The significant decline in ZIM's share price indicates market sentiment, but assessing the underlying factors influencing the stock is important. One concerning aspect is the high short interest rate of 22.08%. This suggests that a significant number of investors are betting against ZIM's bullish momentum, potentially indicating negative sentiment or skepticism about its prospects.

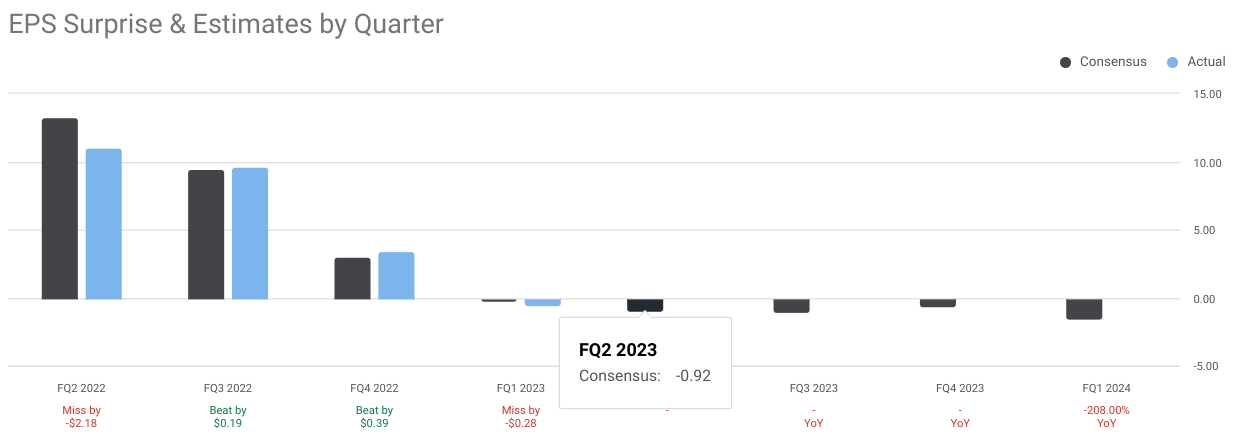

Another critical data point is the EPS forward long-term growth rate, estimated at -17.96%, which indicates a pessimistic outlook for the company's earnings growth over the next 3–5 years. However, the dividend payout ratio of 59.57% raises concerns about the sustainability of dividend payments.

With ZIM expected to continue making losses based on earnings estimates, the company will likely struggle to maintain its dividend payments in the long term. As a result, ZIM could disappoint income-focused investors who rely on consistent dividend income. In other words, an exceptional trailing twelve-month dividend yield of 132.01% seems unsustainable.

EPS Estimates (Seeking Alpha)

Takeaway

In conclusion, ZIM has experienced net losses, decreased revenues, and lower freight rates. The company operates in the shipping market and faces oversupply challenges, which may continue to impact its financial performance.

Despite the challenges, ZIM has implemented adaptation strategies and focused on optimizing its fleet, maintaining cost competitiveness, and supporting growth potential. ZIM's inclination towards sustainability provides a foundation for navigating market dynamics and may create value in the coming years, but the road ahead is bumpy for the short term.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.

This article was written by

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate the due diligence process through in-depth analysis of businesses.

I previously worked for Deloitte and KPMG in external & internal auditing and consulting.

I am a Chartered Certified Accountant and a Fellow Member of ACCA Global, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.

My primary strategy focuses on high-quality, free cash flow generative stocks with an above-average growth rate and a strong business moat.

I manage my own highly concentrated portfolio, and I occasionally engage in short-term trades to profit from asset mispricings when Mr. Market does not feel very well.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ZIM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.