A Check On The Economic Screws; 'I Told You So' Edition

Summary

- Now that the threat of the debt-ceiling is gone, we check on the screws holding the economy together.

- Our checks over the last year+ showed that the screws were tight enough and that a recession was unlikely.

- In the latest check, we conclude that the economic screws are tight enough to prevent a recession in the next 12-months.

- This idea was discussed in more depth with members of my private investing community, Away From The Herd. Learn More »

DNY59/E+ via Getty Images

In our February 2023 article (here), that last checked on the economic screws, we stated..."The only serious threat to the economy (and the stock market) in the next 6 months is the politics around the insane 'debt-ceiling'." Now that the threat of economic suicide (debt ceiling) is gone, we report on the current state of the economic screws that hold the economy together,

The Screws Holding the Economy Together

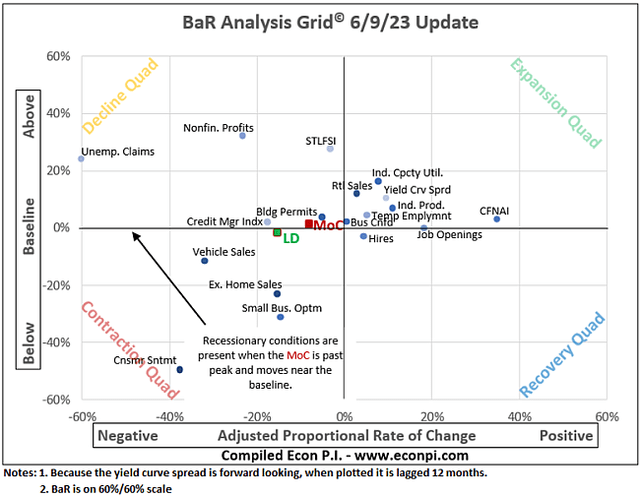

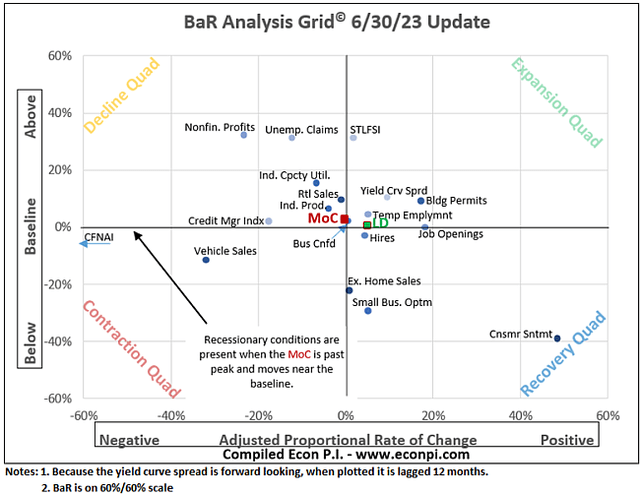

The first chart below is the BaR grid (from econpi.com) for June 9, 2023, and the second chart is the most recent chart dated June 16, 2023.

econpi.com

econpi.com

Notice that both the LD (leading indicators) and MoC (mean of coordinates) have moved back into the expansion quadrant. This means that the average of economic measures are, once again, starting to show economic growth. This screw is no longer loose, and progressively getting tighter.

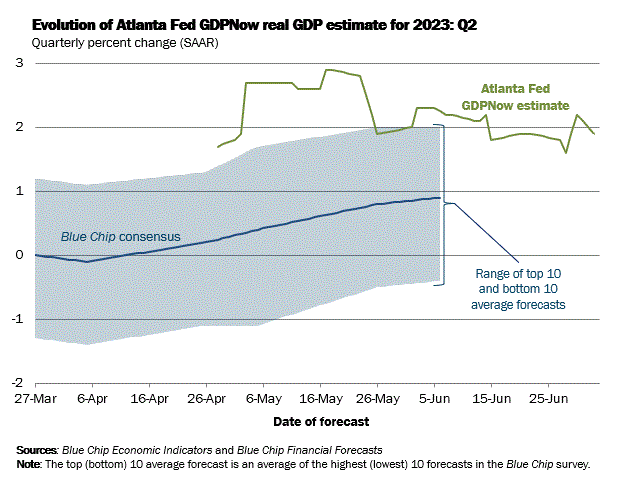

The GDPNow estimate of Q2 2023 is averaging 2%. This screw is 'tight enough' (chart below).

GDPNow

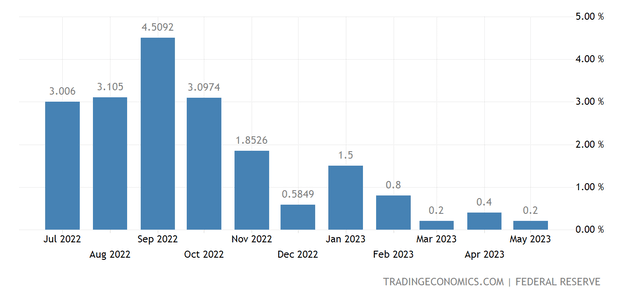

Industrial Production of the United States increased 0.2% y-o-y in May of 2023, matching the smallest increase since the pandemic recovery started in 2021. Although the rate of increase is low, industrial production does continue to increase. This screw remains tight enough, but just barely (chart below).

tradingeconomics.com

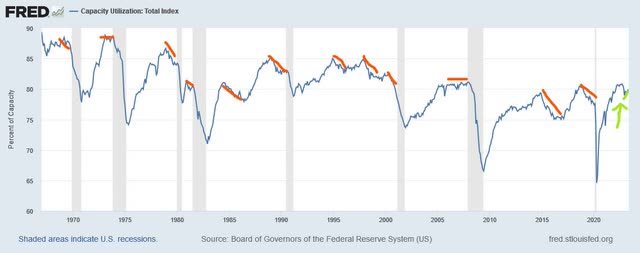

Capacity utilization either stalls or drops ahead of recessions. However, it is a necessary condition, but not sufficient for a recession; no recessions resulted following the drop in capacity utilization of 1985, 1995, and 2015. Capacity utilization has been increasing (green marking below) making this screw tight enough.

FRED

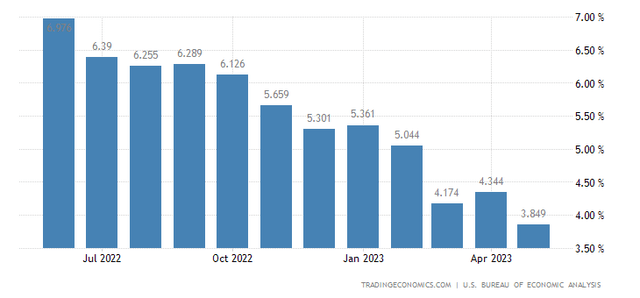

PCE (personal consumption expense), which is the Fed's preferred gauge of inflation, has been trending lower all year. This screw is tight enough (chart below).

tradingeconomics.com

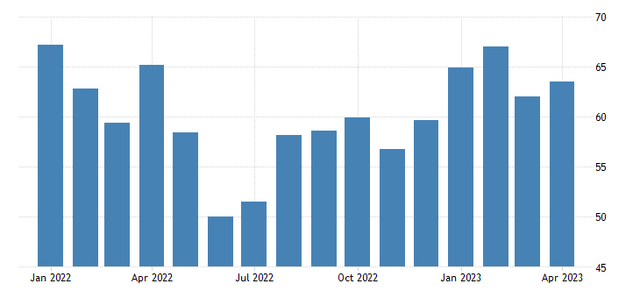

The University of Michigan consumer sentiment for the US has been trending higher for more than a year. This screw is tightening.

tradingeconomics.com

The Aruoba-Diebold-Scotti business conditions index is designed to track real business conditions at high frequency. The average value of the ADS index is zero. Bigger positive values indicate progressively better-than-average conditions, and bigger negative values indicate progressively worse than average conditions. The index shows that business conditions have improved and are above average which makes it a tight economic screw (chart below).

Phili Fed

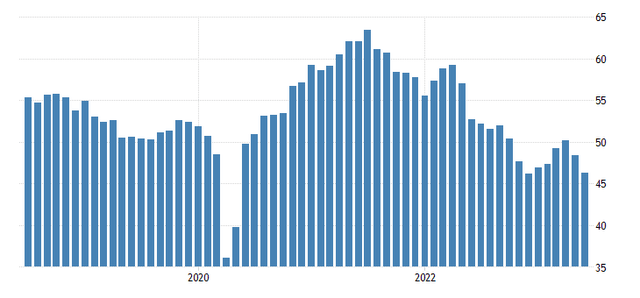

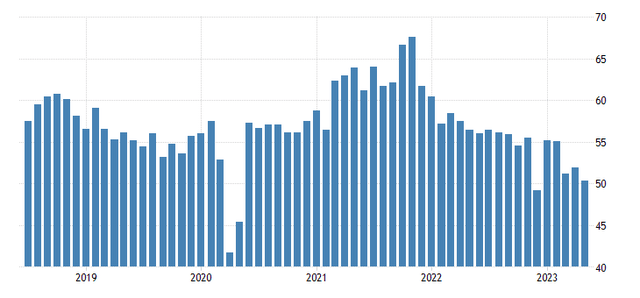

Manufacturing PMI for the US has decreased the past 3-months and has been in a protracted fall from mid-2021 levels and is below pre-COVID levels. This screw is loose.

tradingeconomics.com

Non-manufacturing PMI has been trending lower since 2021, but is still above 50 which means it is still growing. This screw is tight enough, but is loosening.

tradingeconomics.com

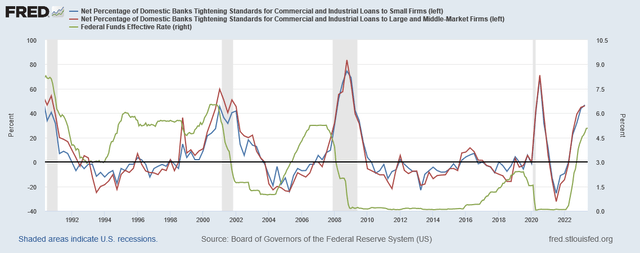

Banks tightening lending-standards always precedes recessions, but tightening lending-standards does not always lead to recessions; e.g. 1994-1999 and 2014-2016. The tightening of lending-standards seems to be leveling off, but what is clear is that lending standards are raised when the FFR is raised, and recessions happen only if rates get too high for the economy to cope. At the moment, it is unknown if the Fed will go too far, which means this screw is loose.

FRED

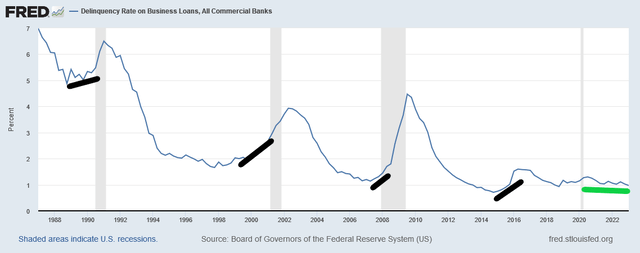

However, recessions occur when both lending-standards and delinquency-rates are rising. At the moment, delinquency-rates are at low levels and not rising (green highlight below). This screw is tight.

FRED, ANG Traders

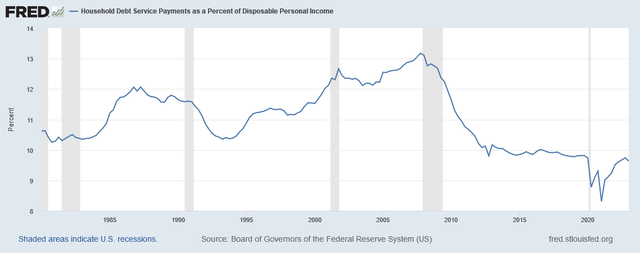

Household debt service as a percent of disposable income Is just above historic lows and going lower. This is a tight screw.

FRED

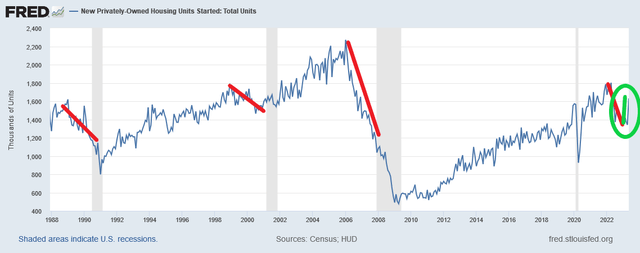

Recessions are always preceded by at least one-year of falling housing starts. Housing starts had been falling for 12-months, but spiked 22% higher in May. This screw is loose. but starting to tighten rapidly.

FRED, ANG Traders

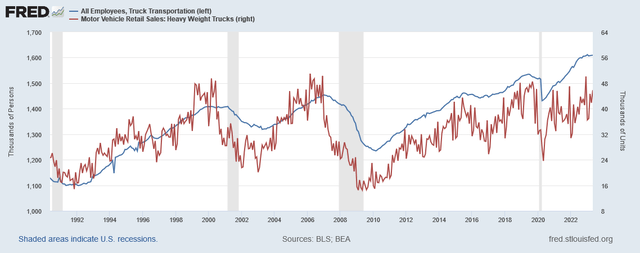

Truck transport employment stops growing or declines and heavy truck sales collapse for more than a year ahead of recessions. Truck transport employment is at all-time highs and truck sales, while below ATH, are above the long-term average. This continues to be a tight economic screw.

FRED

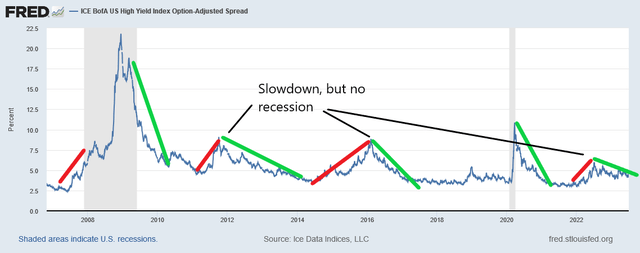

The BofA High Yield Spread Index rises as economic conditions worsen (red indications), but not every rise results in a recession. Currently, the High Yield Spread Index is signaling an economic recovery (green highlight below). This is a tight screw.

FRED, ANG Traders

The Most Important Screw

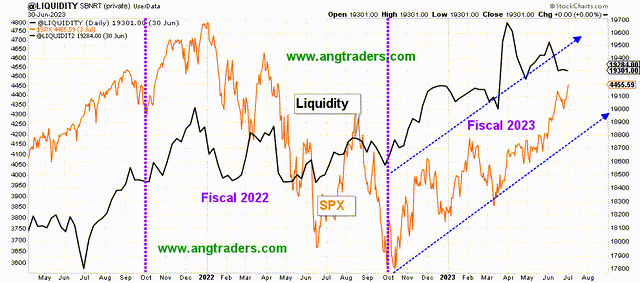

The fiscal response to COVID produced a post-WWII record government budget-deficit (private-sector surplus) which prevented a depression. The net-transfer (spending minus taxation) to the private-sector was +$2,908B in fiscal 2021. But in April and June of 2022, taxes drained ~$400B and ~$125B, respectively, from the private sector, and a return to pre-COVID spending levels produced a net-transfer of only +$1,166B; a nearly-2/3 reduction in private-sector surpluses which caused economic and stock market weakness in Fiscal 2022 (Treasury fiscal year-end is September 30).

So far, in fiscal 2023 (which started October 1, 2022), the net-transfer has been +$1,200B, compared to a mere +$714B at the same time last year. That means that the net-transfer rate is running 68% higher than last fiscal year! It is virtually impossible to shrink the economy with that level of private-sector surplus. The positive effect of this increase in the private-sector surplus can be seen in our liquidity model and in the stock market (chart below).

ANG Traders, stockcharts.com

In conclusion, the balance of "economic screws" are tight, and now that the threat of economic suicide (the debt-ceiling) is over-with, and the fund-flows from the Treasure are running 68% higher than last year, it is highly unlikely we see a recession in the next 6-12 months.

Take advantage of our 14-day free trial and stay on the right side of the market and Away From the Herd.

" I am SO VERY thankful for the discovery of this site, and the wisdom and knowledge I have gained ..."

" I have not seen this type of analysis anywhere else. "

"It is probably the only report of its type on the planet when you think about it."

Take advantage of our 14-day free trial and stay on the right side of the market and Away From the Herd.

This article was written by

During my 44-years of investing, I have come to understand that the only constants in the stock market are fear and funds (money), and that Modern Monetary Theory (MMT) provides the best description of how money moves through the economy.

In partnership with David Huston, and in association with Alan Longbon we search for and analyze repetitive sentiment and fund-flow-based patterns in the stock market's price history, and offer a Marketplace service, Away From the Herd (https://seekingalpha.com/account/research/custom_subscribe?slug=ang-traders), that reports our findings and allows subscribers to replicate the trades we are involved in for our own accounts. My four decades of experience in the market have taught me to not trade "for the sake of trading". Identifying, and staying with the primary trend is key to wealth accumulation. We use a variety of investment instruments such as stocks, ETFs, and options to take advantage of opportunities as they arise.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)