The Trade Desk: Remarkable Surge That I Didn't Anticipate

Summary

- I turned cautious on The Trade Desk stock too early this year and should have let its recovery prove its worth.

- The company's ability to deliver and guide above 20% growth in the first half was remarkable, demonstrating its market leadership, even as its peers pulled back.

- TTD is expensive, but its valuation remains well below its 2020 highs. Also, it's expected to continue gaining leverage as it gains share against its industry.

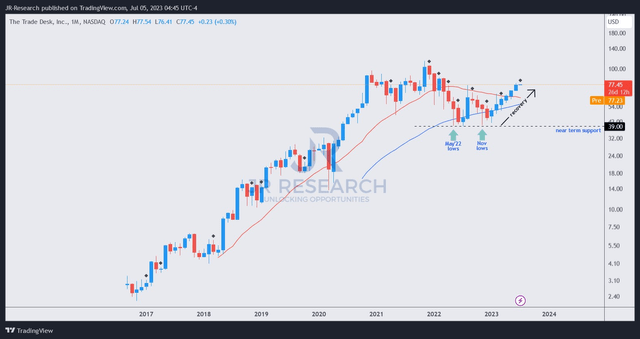

- TTD has recovered its long-term uptrend, indicating that buyers remain confident of its strategy and platform leadership.

- Investors should consider buying its next pullback, seeing an opportunity to participate in a profitable, high-growth player that has executed consistently well.

- Ultimate Growth Investing members get exclusive access to our real-world portfolio. See all our investments here »

style-photography

I must admit that I have been astounded by the stunning performance of The Trade Desk, Inc. (NASDAQ:TTD) stock over the past six months since my previous update. TTD has outperformed its communication sector (XLC) peers and the S&P 500 (SPX) (SPY) significantly since forming its bottom in early January 2023.

As such, TTD has not looked back after its stunning collapse to form its long-term lows from May to July 2022. Moreover, CEO Jeff Green and his team have continued to prove doubters wrong, with another remarkable Q1 earnings release in May. While the ad and media industry players have stuttered with macroeconomic uncertainties, The Trade Desk's leadership in the programmatic ad space has coped remarkably well.

Keen investors should have gleaned helpful commentary from management in May, highlighting its diversified revenue exposure across several verticals. The company stressed that "travel spend nearly tripled in Q1" while performing well in other areas such as "food and drink, automotive, and home and garden." Therefore, it helped to mitigate weaknesses in the shopping and business verticals, which underperformed.

As such, The Trade Desk's ability to post revenue growth of 21.4% in Q1 and guided for about 20% growth in Q2 was impressive. It demonstrated the company's clear leadership in the CTV programmatic space and its ability to capitalize on the nascent retail media space. The company also highlighted that it "presents an incremental market opportunity," suggesting another potentially lucrative growth area.

Moreover, with the US economy coping relatively well so far, dip buyers early this year likely assessed that The Trade Desk could manage better than its peers, allowing it to gain more share. New CFO Laura Schenkein accentuated that the company's "disciplined" approach has paid off, allowing The Trade Desk to continue investing while its "peers are pulling back." As such, the company intends to leverage its momentum to "stay the course and grab [more] share."

I am certain that my downgrade on TTD to Hold in January was way too early, as I underestimated the competitiveness of the company's platform. I was too careful about whether The Trade Desk could survive potentially weaker macroeconomic conditions in 2023 while trading at a much higher valuation than its peers.

Notwithstanding, that doesn't necessarily mean that investors who missed its January lows should jump on board now, as its valuation has surged further and seems even more pricey.

At a forward EBITDA multiple of 47x, it's way ahead of its media peers with a median EBITDA multiple of just 6.3x. In addition, Seeking Alpha Quant rated TTD with the worst possible valuation grade of "F," suggesting that investors should exercise caution.

TTD price chart (monthly) (TradingView)

Despite that, I did not observe a sell signal on TTD suggesting long-term investors consider taking profits/cutting exposure at the current levels. While the remarkable recovery from its January lows has weakened recently, TTD's momentum could continue, as it valuation remains well below its overvalued zones in late 2020.

In addition, the company is expected to continue gaining operating leverage through 2025. As such, based on its FY25 EBITDA multiple of 29.5x, the market might not have fully reflected its potential growth, discounting execution risks from macroeconomic uncertainties.

As such, I view TTD's recovery favorably and believe that investors can consider capitalizing on its next pullback, as it has resumed its uptrend bias decisively.

Rating: Hold (on the watch for a revision).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore (NUS). NUS is also ranked among the top ten universities globally. I currently hold the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

I own it and it will be for my grandson.

Why did I buy @around 24 in mid 2019?

Great product and innovative guys!

Good looking numbers!

Jeff Green. Checking him out I saw:

Calm, no bullshitter and honest!!!!!

What more do you need?

Descent beginning I November 2021 was partly due to the general malaise starting at that time.