Fox: Strong Performance Despite Evolving Media Landscape

Summary

- Fox Corporation has shown consistent revenue growth with a strong balance sheet and high return on equity, positioning it as a leading player in the media industry.

- The company reported impressive results in its 2023 Q3 earnings call, surpassing market expectations in earnings per share and revenue, driven by key events like Super Bowl LVII and a strong programming lineup.

- Despite challenges from evolving consumer habits and increased competition, Fox Corporation is positioned for future growth.

- A discounted cash flow analysis suggests it may be overvalued, recommending a hold rating for the company.

Spencer Platt/Getty Images News

Intro

Fox Corporation (NASDAQ:FOX) (NASDAQ:FOXA) is a U.S. news, sports, and entertainment company that operates through three segments: Cable Network Programming, Television, and Other. The Cable Network Programming segment produces news, business news, and sports content distributed in the U.S. It includes channels like FOX News, FOX Business, and Big Ten Network. The Television segment acquires, produces, and distributes programming, including The FOX Network and Tubi. The company also owns 29 broadcast television stations and operates the FOX Studios Lot in Los Angeles.

This article aims to thoroughly assess FOX's financial performance and potential for growth. We will analyze the company's revenue and profitability trends, its ability to generate free cash flow, and the overall financial stability reflected in its balance sheet. Additionally, we will employ a discounted cash flow analysis to estimate the intrinsic value of FOX, providing valuable insights for investors considering FOX as a potential investment opportunity in the current market.

Performance

FOX Corporation has established itself as a prominent player in the media industry, delivering consistent revenue growth, profitability, and competitive returns. Analyzing key financial metrics, such as revenue, free cash flow, return on equity (ROE), and total returns, provides insights into the company's performance and its ability to navigate the evolving media landscape.

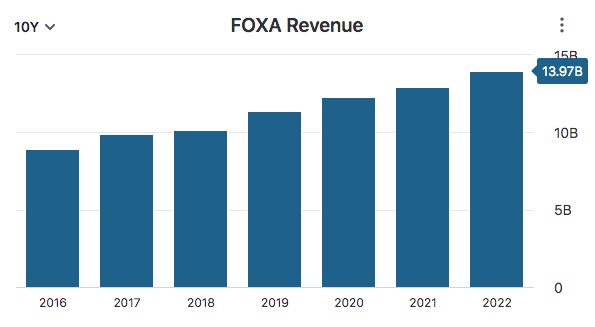

Over the past seven years, FOX has displayed steady revenue growth, expanding its top line by approximately 57%. This growth showcases the company's ability to capture market share and deliver engaging content to its audience. It is noteworthy that FOX has achieved consistent revenue growth for each year analyzed, demonstrating its resilience and adaptability in a dynamic industry.

Data by Stock Analysis

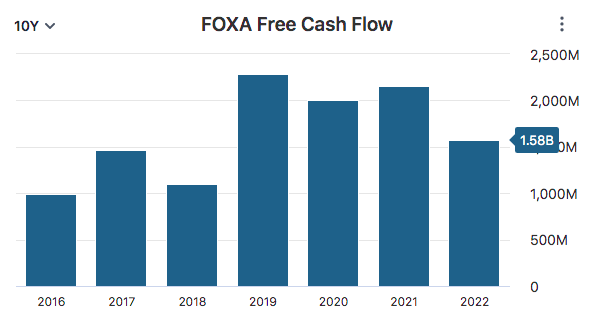

Additionally, FOX has generated robust free cash flow, which has totaled $12.5 billion over the analyzed period. While free cash flow has varied from year to year, FOX's ability to consistently generate positive free cash flow reflects its capacity to fund operations, invest in new content, pursue strategic initiatives, and reward shareholders through dividends and share buybacks.

Data by Stock Analysis

A high growth rate is crucial for several reasons. Firstly, it indicates the company's ability to outpace inflation and generate increasing revenue, highlighting its competitive edge in capturing market demand. Secondly, high growth rates attract investor interest, as they anticipate future value appreciation and potential capital gains. Lastly, sustained growth enables companies to reinvest in research and development, expand their market reach, and drive innovation to stay ahead of competitors.

FOX maintains a strong balance sheet, indicated by a debt-to-equity ratio (D/E) of 0.71 and a current ratio of 1.75. A D/E ratio below 1 suggests a conservative capital structure, reducing financial risk and increasing the company's ability to meet its financial obligations. Additionally, a healthy current ratio ensures FOX has sufficient short-term assets to cover its short-term liabilities. A strong balance sheet instills confidence among investors, creditors, and stakeholders, enabling FOX to withstand economic downturns, pursue growth opportunities, and fund strategic initiatives.

FOX has delivered solid profitability over the years, as demonstrated by its return on equity (ROE). FOX has achieved an average ROE above 14% in the last four years. Maintaining a high ROE is important as it signifies efficient utilization of shareholder equity and reflects the company's ability to generate substantial returns relative to its invested capital. A high ROE indicates effective management, strong operational performance, and competitive advantage, positioning FOX as a financially viable and successful business.

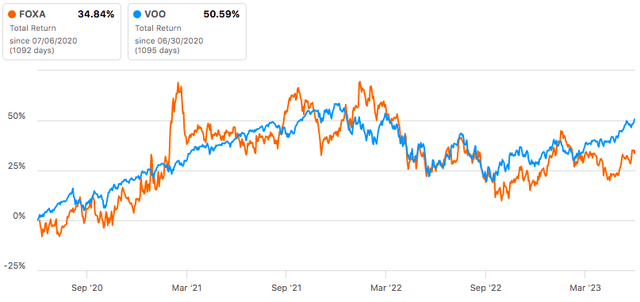

Over the past three years, FOX delivered a total return of 34%. Although this falls short of the S&P 500's total return of 50%, it is essential to consider the unique challenges and opportunities within the media industry. FOX's ability to generate positive returns during a time of significant disruption with the rise of direct to consumer streaming platforms, highlights its resilience and market positioning.

FOX's sustained revenue growth, solid financial position, and profitability underscore its position as a leading player in the media industry. The company's ability to adapt to changing market dynamics, invest in content creation, and maintain a strong balance sheet positions it for future success. While FOX's total returns may not have outperformed the broader market, the company's ability to navigate the industry's challenges reflects its resilience and potential for long-term value creation.

Outlook

FOX's 2023 Q3 earnings call revealed impressive results, exceeding market expectations. The company reported an earnings per share (EPS) of $0.94, surpassing the consensus estimate by $0.08. This highlights FOX's strong financial performance and effective management of its operations. Additionally, the company achieved revenue of $4.08 billion, reflecting a notable year-over-year growth of 18.21%. The revenue exceeded market projections by $44.14 million, further solidifying FOX's ability to generate substantial top-line growth.

These robust earnings call results demonstrate the company's continued success and reaffirm its position as a leader in the industry. One of the leading drivers of this success was Super Bowl LVII, featuring the Kansas City and Philadelphia matchup, became the most-watched program in U.S. television history, attracting 115 million viewers across FOX platforms. This achievement highlighted the exceptional performance of FOX Sports and demonstrated the company's continued strength in delivering captivating sports content.

Looking ahead, FOX's anticipated EPS Growth is 20.51% with estimated earnings per share (EPS) for the fiscal year ending in June 2023 standing at $3.36. These bullish estimates are driven by the company's strong programming lineup. As the fourth quarter winds down it has included many sporting events that make up a strong lineup of programming and advertising demand for FOX Sports, including the return of NASCAR, the second season of the USFL, the start of Major League Baseball's 2023 season, the finals of the UEFA Nations League, and the first-time broadcast of the Belmont Stakes. Additionally, the launch of the second season of Next Level Chef, a lifestyle franchise from the Studio Ramsay partnership, is expected to draw significant viewership.

Additionally, FOX is still dominating in news. FOX News Channel continues to maintain its position as the most-watched cable network in both total day and prime time, surpassing CNN and MSNBC combined. FOX Business Network also led as the most-watched business cable network, surpassing CNBC in total viewers during the business day and market hours for the fourth consecutive quarter.

However, The rapidly evolving landscape of consumer viewing habits, technology, and business models has presented challenges for FOX. Increased competition from new entrants and emerging technologies, coupled with the rise of new distribution platforms, have disrupted traditional revenue streams. Consumer preferences have shifted towards subscription-based and ad-supported streaming services, leading to a greater availability of content with reduced or no advertising. The transition to digital consumption has also resulted in the use of time-shifting and advertising-skipping technologies, impacting the attractiveness of programming to advertisers.

Additionally, changes in consumer behavior have adversely affected Multichannel Video Programming Distributors (MVPDs) delivering FOX's networks, as consumers increasingly explore alternative options. These industry-wide shifts may lead to declines in viewership, affiliate fees, and advertising revenues. To remain competitive, FOX is focused on expanding its digital distribution offerings and direct engagement with consumers through platforms like TUBI, FOX Nation, and FOX Weather.

Tubi, FOX's streaming platform, remains a standout for the company and should drive growth for FOX for years to come. During Q3, Tubi experienced stellar growth with a 31% increase in revenue and a 38% year-on-year increase in total view time. The platform's momentum continued to accelerate, and it reached a milestone by being included in Nielsen's The Gauge, becoming the most-watched ad-supported streaming service in the United States.

In a challenging industry landscape, FOX's solid financial performance can be credited to its emphasis on differentiation, effective cost management, and the creation of long-term value for shareholders. It is our opinion that these strategic priorities have positioned the company for future growth, enabling it to navigate successfully in a competitive market. During FOX's Q3 earnings call, Lachlan Murdoch, the Co-Chairman of the Board, shared the following insights and remarks regarding the future of FOX.

We are confident in the strength of the FOX brands and the strength of our balance sheet. And while we are not completely immune to the headwinds facing the broader industry and the general economy, we are well positioned given our areas of differentiation. Nonetheless, you can expect us to be even more focused on our cost base as we look to reinforce our strategy for future growth.

Valuation

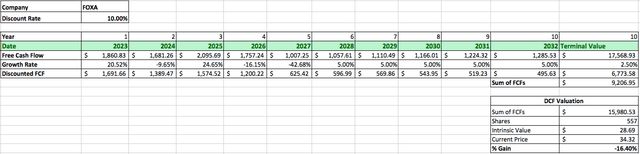

We will utilize the discounted cash flow (DCF) analysis, which is our preferred method for evaluating the value of companies, to assess the true worth of FOX. This analysis involves determining the present value of the projected future cash flows of the company in order to derive its intrinsic value.

To initiate the analysis, we will begin with FOX's free cash flow of $1.54 billion from the previous year. Considering the average analyst earnings growth rate of 20.52% for 2023, we will incorporate growth rates of -9.65%, 24.65%, -16.15%, and -42.68% for the subsequent four years based on the average analyst earnings estimates. Predicting FOX's future free cash flows beyond the next five years presents challenges due to uncertainty and limited visibility. However, taking into account the company's strong historical performance, it seems reasonable to assume a more conservative growth rate of 5% for the following five years.

To calculate the terminal value, we will apply a conservative perpetual growth rate of 2.5%. Using a discount rate of 10%, which accounts for the long-term return rate of the S&P 500 with dividends reinvested, we determine that FOX's intrinsic value amounts to $28.69. This indicates that FOX may currently be overvalued, potentially offering investors a loss of 16.40% compared to the company's current market price.

Takeaway

FOX Corporation has exhibited consistent revenue growth, profitability, and competitive returns, positioning itself as a prominent player in the media industry. The company has demonstrated steady revenue growth, generating positive free cash flow and maintaining a strong balance sheet. FOX's return on equity (ROE) has remained high, indicating efficient utilization of shareholder equity. While its total returns may have fallen short of the broader market, FOX has displayed resilience amidst industry disruptions.

During the 2023 Q3 earnings call, FOX reported impressive results, surpassing market expectations in terms of earnings per share (EPS) and revenue. The company's success can be attributed to key drivers such as the highly-watched Super Bowl LVII and strong programming lineup. Additionally, FOX's streaming platform, Tubi, experienced significant growth and became the most-watched ad-supported streaming service in the United States.

Despite challenges posed by evolving consumer habits and increased competition, FOX's focus on differentiation, cost management, and long-term shareholder value creation has positioned it for future growth. However, considering the current market price and the results of a discounted cash flow (DCF) analysis, FOX may be deemed overvalued, suggesting a potential gain of -16.40% for investors. Based on these factors, a hold rating is recommended for FOX, taking into account Tubi's strong growth and the current price of the company's shares.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.