De-Training From Norfolk Southern

Summary

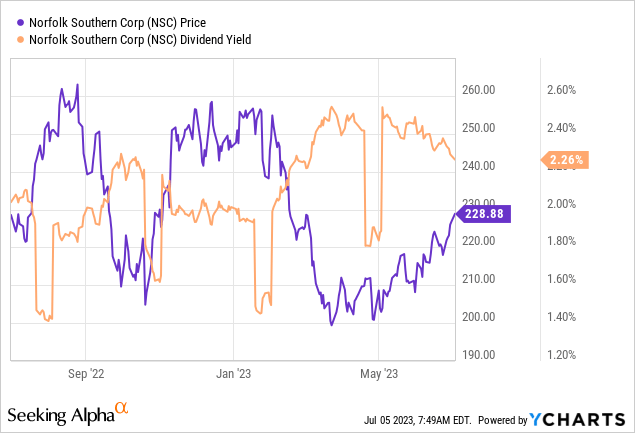

- Norfolk Southern shares have risen around 11.2% in the past three months, outperforming the S&P 500's 8% gain.

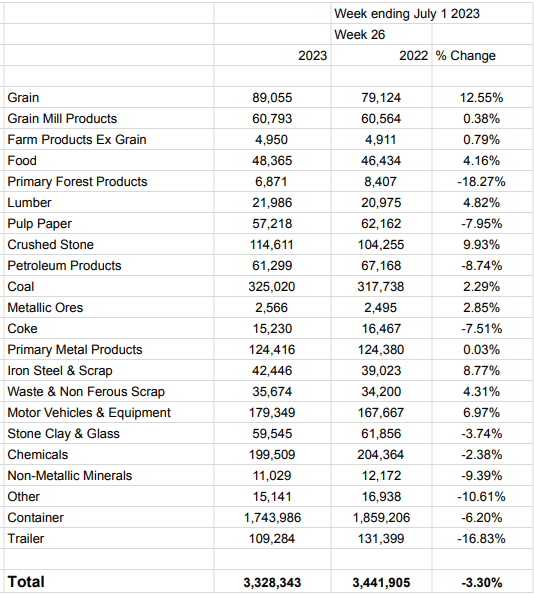

- The company's traffic has decreased by 3.3% this year, with forest products and intermodal traffic particularly affected.

- I plan to sell shares due to concerns over the company's valuation, slowing dividend growth, and increasing long-term debt.

Angelo Merendino

It's been just under three months since I wrote my bullish Norfolk Southern Corporation (NYSE:NSC) article, announcing to a rather disinterested world that I was going to be buying the shares, and in that time, the shares are up about 11.2% against a gain of 8% for the S&P 500. A more mature man than me would not take this opportunity to brag. I am not a mature man, so I'm going to revel in the fact that I bought based on the fact that the market punished the stock too much in the wake of the East Palestine disaster. While this is very gratifying, I'm now on the horns of a dilemma. Do I hold this stock or take my short-term profits and run? This question may also be relevant to a person who's considering buying today, or not. I'll make that determination by looking at the most recent financial results and comparing those to the valuation. Along the way, I also want to examine traffic trends, because I think these are meaningful when reviewing Class 1 railroads for reasons that should be blindingly obvious.

Welcome to the "thesis statement" that I put at the front of each of my articles. I do this so that people can review my thoughts while exposing themselves to as little of my bragging and awful jokes as possible. Anyway, I'm of the view that Norfolk Southern is in many ways an excellent business, with an unassailable "moat", but the valuation doesn't make sense at the moment, and for that reason, I'll be cashing in my chips this morning. I think there's growing reason to believe that the dividend growth we've come to expect will slow. This is troublesome in light of the fact that the yield is well below the risk-free rate. Taking on more risk to get less makes little sense to me. Additionally, while the shares aren't egregiously expensive by every measure, nor are they cheap at the moment. I'm of the view that the preservation of capital involves walking away sometimes. The shares may continue to rise from here, but I think it's worth remembering that what the market can giveth, the market can taketh awayeth.

Traffic Patterns

The company has hauled about 3.3% less traffic this year than last, and forest products and intermodal traffic in particular are negative standouts here. This is similar to what I found recently when reviewing Union Pacific. This is troubling, given that trailer traffic represented about 4% of the total cars hauled last year, and I remember being told in 2018 that intermodal growth was "where the growth is" in rails. I would suggest that traffic has slowed, and until the overall economy shows signs of greater robustness, we shouldn't expect much here. Since traffic ultimately drives revenue, revenue ultimately drives profit, and profit is the source of all investor returns, I'm not sanguine at the moment. That written, I'm willing to hang on to my shares if they're still trading at a reasonable valuation.

Norfolk Southern Traffic Statistics (Norfolk Southern investor relations)

Financial Snapshot

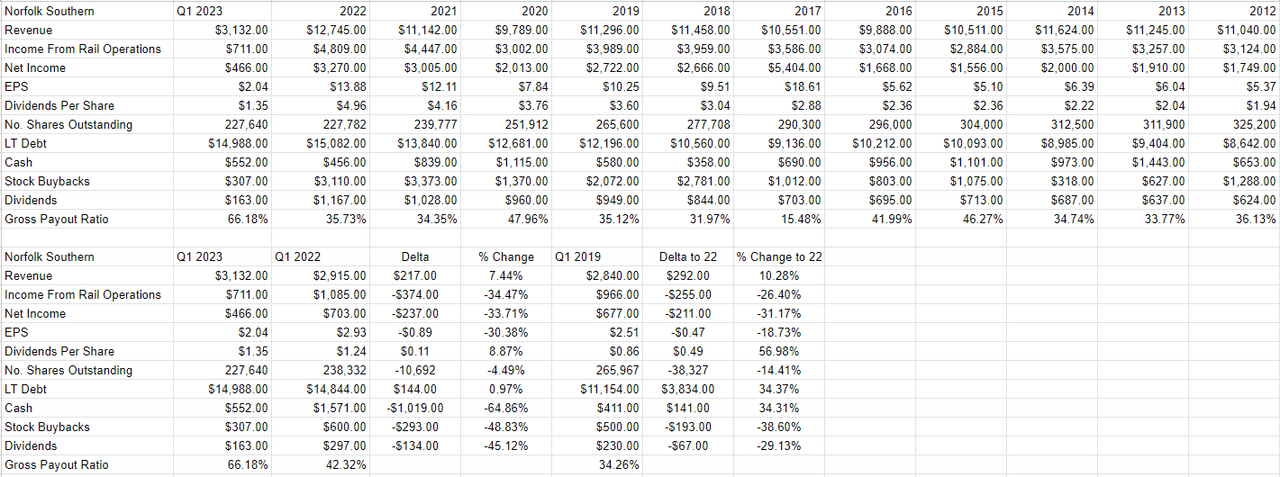

I'm not happy with the latest financial results, because revenue was up nicely from the same period a year ago, yet net income was crushed, down fully 33.7% from the year-ago period. Obviously, a portion of this relates to the $318 million drop caused by what the company has deemed in its financial statements as "The Eastern Ohio Incident." It's not just that standalone tragedy that impacted results, though. Materials expense was higher by about $41 million, or 24%. Purchased services were up by about 13.5%, or $59 million, and compensation and benefits were up $71 million, or 11.5%. So, input costs seem to be rising at a time when traffic is slowing. That's another disconcerting trend, in my view.

Additionally, long-term debt has grown, but not by as much as it has at some of this company's competitors. It now sits at about $15 billion, which is troublesome in my view. Like with Union Pacific, I think this company's dividend growth will need to slow relative to what it was over the past decade. Interest payments are required, and dividends are not, and the payout ratio currently sits at about 66%, up 56% from the year-ago period. In my view, continuing to grow dividends at their historical CAGR of 8.9% would be a heavy lift. Investors who expect that this growth will continue indefinitely will be disappointed, in my view. Put another way, a decade ago, the company carried about $9.4 billion of debt, and the dividend payout ratio was about 34%. As of the latest quarter, the company carries about $15 billion in debt, and the payout ratio is 66%. In my previous missive on this name, I expressed some confidence that the dividend could be grown from current levels. Although I don't fear a cut, I think extraordinary levels of dividend growth would be a heavy lift.

Norfolk Southern Financials (Norfolk Southern investor relations)

The Stock

If you're one of my regulars for some reason, you know that I consider the stock and the business to be different things. I've written my reasoning so often that I worry about boring my regular readers. I don't worry so much, though, that I won't indulge in the tendency to repeat myself, so here goes. The business generates money by hauling bulky cargo. The stock is a scrip of virtual paper that gets traded around in the public markets, and the up and down price movements often reflect more about the mood of the capricious crowd than it does anything to do with the stock. Additionally, when the crowd does react to what's going on at the firm, it often overreacts, and these overreactions are the source of potential profit, in my view.

I really, really hate to remind you of my recent success here, but I'm going to suffer this discomfort for you because this is a good example of what I mean. When the market reacted very negatively to the East Palestine disaster, I leaped at the chance to buy some stock, feeling confident that the price would rise when reason reasserted itself. In my experience, this is the only way to profitably trade stocks: spot the differences between the crowd's expectations about the future, and likely future, and place a trade accordingly. Additionally, I've found that buying stocks when the crowd is relatively skittish is a great strategy.

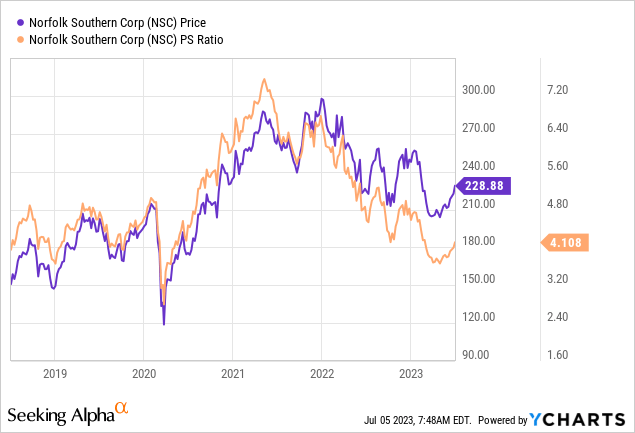

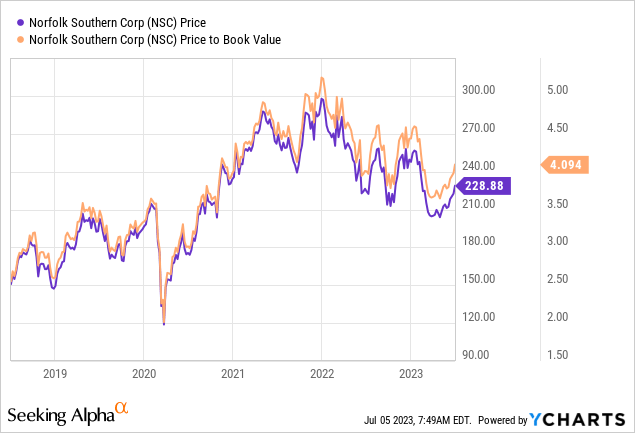

Another word for "relatively skittish" is "cheap", which is why I really like buying cheap shares. I measure cheapness in a few ways, ranging from the simple to the more complex. On the simple side, I like to look at the ratio of market price to some measure of economic value like earnings, free cash flow, and the like. I want to see a stock trading at a discount to both the overall market and its own history. When I last reviewed Norfolk Southern, the stock was trading at a price-to-sales ratio of 3.7, a price-to-book ratio of 3.6, and was sporting a dividend yield of 2.5%. Fast-forward to the present, and we see that the dividend yield is down slightly and shares are now about 11% more expensive per the following.

Because context matters, I think it's important to point out that the current dividend is about 225 basis points lower than the risk-free rate at the moment. I think it's also important to remind readers that I think dividend growth is going to slow here.

I previously suggested stock investing is about spotting the discrepancies between expectations and subsequent reality. I think it makes sense to buy when the crowd gets too pessimistic, and sell when the crowd gets too optimistic. The downside of this is that there's always going to be some Seeking Alpha commenter who assumes the current state is the permanent state and will spend some of their finite time on this planet telling a stranger on the internet (me in this case) that they're wrong. C'est la vie.

Anyway, I want to try to quantify expectations as much as possible, and to do that, I turn to the works of Stephen Penman and/or Mauboussin and Rappaport. The former wrote a great book called "Accounting for Value" and the latter pair recently updated their classic called "Expectations Investing." These both consider the stock price itself to be a great source of information, and the former in particular helps investors with some of the arithmetic necessary to work out what the market is currently "thinking" about the future of a given business. This involves a bit of high school algebra, where the "g" (growth) variable is isolated in a standard finance formula. When I last reviewed this metric, the market was assuming a growth rate of about 4.5%. At the moment, the market seems to be expecting a growth rate of about 5.6% from Norfolk Southern. I consider this to be excessively optimistic.

Given all of the above, I'm going to take my chips off the table today. The shares may continue to rise from here, but I think the risk will rise right along with it, and I'm too old to go on that roller coaster again. For that reason, I'll sell the stock, and be content with the risk-free returns I can get from bonds at the moment.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NSC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Although I'm currently long, I'm about to sell.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (8)

Good job.

And your sense of humor makes me laugh.

I’d have done the same thing.

Take the money and run.

There’s a lot of stocks that make more sense now.

I guarantee it’ll be there when you get back to it.

Right now I like OPRA.

8-)

I'll have a look at OPRA, so thanks for mentioning it.

Take care

PD

Yeah if you're accumulating, and are dripping the shares you'll likely be fine over the longer term. I'm just too old, and too much of a coward to not take the money when it's presented to me.

Take care.

PD

You've just won the "Buffett liked rails decades ago, so they're a bargain at any price today" prize for being the first to mention the Oracle of Omaha.

I like faith in the transcendent. I like faith in family, and friendships. I like faith in community.

Faith in stocks? Fuhgeddaboudit.

I think if you really explore Buffett's thoughts, you might come to understand that he'd never overpay for a stock. People who buy today overpay for this stock in my opinion.

If there's a factual error, or error in reasoning, please point it out. Ill informed appeals to authority because "I think stranger on the internet is wrong" is beneath you.

Thanks again for the comment. Congratulations on being the first, and take care.

PD