Returning Investor Choice To The Stock Markets

Summary

- The SEC's National Market System (NMS) has failed to attract retail investors, who own 77% of the market capitalization, due to its complexity and lack of competition among exchanges for retail investors' orders.

- The NMS has become a chaotic collection of stock exchanges and high-frequency traders, with a few dominant broker-dealers replacing the exchanges in the execution of investor transactions.

- The article suggests that the problem can be resolved by a private sector firm that focuses on providing investors with a choice of exchanges, thereby restoring competition and fairness in the market.

Jasmina007

Introduction

There is no mechanism for creating investor choice of order execution today. This is the result of a mistaken plan - the SEC's National Market Structure - intended to bring competition and fairness to investors following the advent of electronic trading. But a single private sector exchange manager can repair the system by providing investors with a choice again.

According to SEC chair Gary Gensler, the SEC's objectives are to "strengthen competition and ensure individual investors are fairly treated." Investors can be forgiven for doubting both the strength of competition for their business and the fairness of their treatment. The focus of Wall Street is less on the reduction of investor costs and the improvement of investor service. Wall Street focuses more on arm-wrestling for each market faction's share of the investor booty.

Retail investors, for the most part, are blocked from the SEC-created National Market System (NMS) - a system created by rules the SEC set out for promoting competition and fairness in the transition to electronic markets. This NMS failure is not simply an unattractive minor facet of our market structure. Retail investors are the dominant source of equity capital. According to this Fed study, retail investors own 77% of the market capitalization in total via stocks (held directly), and mutual and pension funds. NMS' failure to attract retail investors is a major failure of the market structure.

Now there is no competition among exchanges for retail investors' orders. Nor do retail brokers seek competitive bids for customer orders from other broker-dealers. Instead, retail brokers usually send all their orders to a single broker-dealer, called a wholesaler. Moreover, wholesalers do not claim to fill retail orders at the best price. They collect a spread between the prices they provide retail customers and the better prices at which they lay off their risk in the NMS.

Another negative underlying marketplace reality is that stock exchanges arguably no longer compete at all - indeed, the old exchanges are adding new stock exchanges that increase the excess profits of the old ones by adding new arbitrage opportunities. Read here and here.

But this problem can be resolved by the private sector. All that we need is a firm that provides investors with a choice of exchanges.

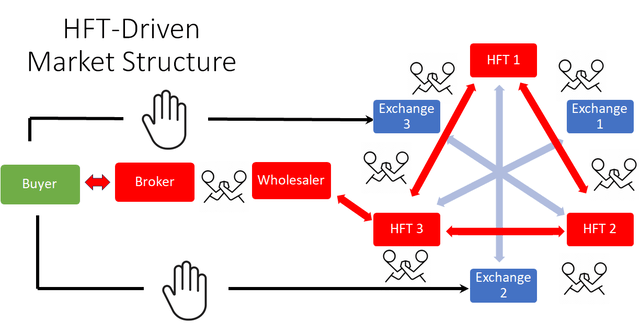

The NMS has become a chaotic collection of stock exchanges and high-frequency traders (HFTs)/wholesalers. Investors are left out of the negotiations that determine the profitability of a retail transaction to broker-dealers and exchanges. Retail brokers accept orders from investors and then turn them over to wholesale broker-dealers. A single wholesaler determines the profitability of each retail transaction. A few dominant broker-dealers have replaced the exchanges in the execution of investor transactions.

All because investors are denied a choice.

Effects on the current market participants

If investor choice is restored there would be no losers.

- An investor-friendly structure would not affect the exchanges serving HFTs.

- Retail brokers would offer more and better retail services, albeit at more competitive costs.

- Wholesalers would lose the sweet payment-for-order-flow situation, but broker-dealers always find a way to benefit from change.

- The wild card is a de novo firm that might shake things up,

Pre-electronic trading

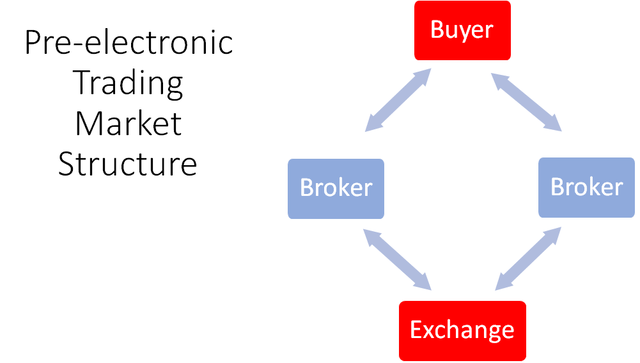

Over the two centuries of the evolution of securities trading from gatherings in coffee houses before the sudden shock of electronic trading, the costs of using the stock market have steadily fallen. There was a steady improvement in the quality of prices and the speed of order execution. This was due to the cooperation of investors, publicly held firms, broker-dealers, and the exchanges themselves. The market structure was simple and thus user-friendly for retail investors. The market formed a feedback loop like the graphic below that was relatively transparent to retail.

The exchanges are not always eager to innovate, primarily because exchange trading is a natural monopoly, and monopolies have no incentive to change what works. For most of the history of our securities-trading marketplaces, the New York Stock Exchange has taken a dominant position.

The disastrous status quo

Stock exchanges. With the advent of electronic trading, the SEC fashioned the rules of the NMS to encourage inter-exchange competition. In retrospect, the SEC's intended multi-exchange universe should have been reconsidered. Electronic trading - with the reduced cost and time of sending orders from one exchange to another, and the reduced cost of generating profitable trades by computers instead of humans - has strengthened the economic tendency for trades to centralize in a single market. By enabling multiple-location computer arbitrage, the NMS reduced competition for investor orders.

Wholesalers. From a retail investor's point of view, the NMS has been reduced to a single counterparty, the wholesaler that fills the investor's orders. Nobody, including the SEC, could have predicted that electronic trading would drive retail investors out of the NMS proper and into the hands of a single retail-broker-selected wholesaler.

The reason that retail brokers now avoid the NMS is that it has become an environment that humans cannot use. Only computers trade at a speed sufficient to take advantage of the multi-exchange system created by the SEC. Thus, computers and their masters have taken over exchange transactions. Investors are served outside the exchange system.

The SEC. How did the SEC mistakenly destroy retail investor exchange trading? The SEC introduced the NMS to smooth the securities market transition to electronic trading. The SEC intended the NMS to encourage interexchange competition and to assure that markets execute transactions at the best possible price. From my view, neither objective has been achieved.

Retail brokers. Investors' retail brokers now steer investors to the OTC market where wholesale broker-dealers buy the right to fill bundles of retail orders at values less than the best price. Our new market masters are a few computer-savvy broker-dealers - for example, Citadel and Virtu - that intermediate between investors and the NMS, described in the graphic below.

Fighting over the insider-outsider price spread

The exchanges and the HFTs arm-wrestle over their relative shares of the arbitrage profits from trading in the incredibly overpopulated NMS. The wholesalers also arm-wrestle with the retail brokers over a share of the spread between retail investor prices and insider prices. The retail investor is paying for the whole mess.

There is no competition at any stage of the investment chain for investor orders. Wholesalers are handed the retail orders. They fill retail orders at an outsider's price and reverse the retail orders at an inside price.

These wholesalers are macro-arbitrageurs, collecting the difference between NMS prices and retail investor prices, and splitting the income with retail brokers. The NMS has become a classic insider/outsider market. Insiders - the big broker-dealers/wholesalers - trade in the NMS. Outsiders - retail investors and buy-side institutions - get their orders filled at outsider prices by the wholesalers. The graphic below displays the structure of securities markets now.

Why are equity exchanges failing investors?

Despite two centuries of increased financial transaction centralization, resulting in major reductions in cost and order price transparency, unknowing human users have been abandoned by the exchanges.

The exchanges have become a sideshow where computers - designed to arbitrage multiple separate exchange prices - trade with each other. Few investor transactions are involved.

Yet the big exchange managers have become complacent. Their new activities include no plans to improve the disastrous conditions of our financial market structure, as market users and regulators might wish. The firms are instead using the capital generated by their exchanges to finance other new financial business lines.

Why? Because the SEC's new regs, which incentivized the exchanges' focus on high-speed traders, discouraged exchange attention to retail investors. The exchanges jumped on the opportunity created by the broker-dealer's high-speed arbitrage of exchange prices by adding as many clone-like exchanges as possible to expand high-speed opportunities for computer-based arbitrage.

Thus, the SEC regs resulted in a confusing welter of multiple exchanges, too many exchanges from retail investors' point of view. The SEC's belated response, an embarrassing decision to stop the big exchange managers' creation of ever more exchange clones finally put a limit on the big firms' profligacy. No more new exchange clones will exist solely to increase interexchange arbitrage and generate the resulting exchange fees.

Why are these dominant exchange firms ignoring their loss of investor orders? Because exchange measures to improve retail trader access work against the interest of broker-dealer arbitrageurs and thus against the interest of the exchanges.

Simplicity attracts retail investors. Complexity attracts computerized arbitrageurs. The exchanges have chosen computers capable of thousands of trades every second over human retail investors that plod along at human speed.

The multiple exchanges in the NMS marketplace do not compete. The evidence of this is that three firms own most of the 15+ exchanges. Firms do not create multiple subsidiaries with one function to compete with themselves. The exchange managing firms add these superfluous exchanges because revenues from arbitrage rise proportionally to the number of exchanges since the SEC has regulated per-transaction fees. Each new exchange earns about the government-protected margin while increasing arbitrage transactions at all the old exchanges.

To limit the disastrous effects of the NMS, the SEC limits the number of exchanges and the revenues they charge for trade execution. In other words, the securities exchanges have become a government-protected oligopoly.

Exchange profitability is certain. The upside of this development from the dominant exchange firms' point of view is that exchange profitability is certain. The downside is that profit margins are slim. The exchange managers cannot chase this low-profit low-risk business because the SEC has closed the door on new clone exchanges. But these dominant firms have no incentive to divest the now-very-safe government-subsidized and protected exchanges.

The big firms' exchange transaction platforms have become cash cows used by the exchange management firms to finance the switch from transaction fees to other trading infrastructures such as data-for-sale, software, and compliance. The firms show no interest in off-loading their multiple exchange franchises, but they use the capital exchanges generate to acquire other services provided to investors. Examples include ICE investing in the mortgage industry, and Nasdaq in bank compliance support.

How financial futures escaped the NMS

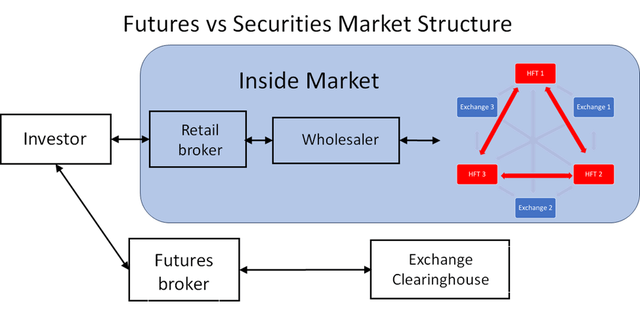

Futures or securities? The remaining investor choice. The graphic below adds the futures markets to the securities markets to provide a clearer picture of current investor choices. The central fact of futures markets that kept them outside the NMS is that they are not the same financial instruments as those traded in the NMS and that their prices differ from those of NMS securities.

Other aspects of futures trading prevent the separation of markets into inside and outside components.

The most important difference between securities and futures trading is investor market access.

The NMS eliminated investor choice within its borders. To foster competition and encourage fairness to investors, competing markets must find a way to obey the SEC's rules while preserving investor choice. Futures markets have shown that this is possible.

Conclusion

The securities market no longer provides investors with the power to limit their costs and improve their service through competition. NMS rules promulgated to produce retail investor fairness and competition between firms that make the financial structure work for investors have failed to achieve the SEC's goals.

The primary reason for the failure of the financial market structure is that investors have been denied the choice of pricing sources. This may be fixed by an aggressive private sector firm.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.