TORM: The Tailwinds Trump The Headwinds But Not Yet A Buy

Summary

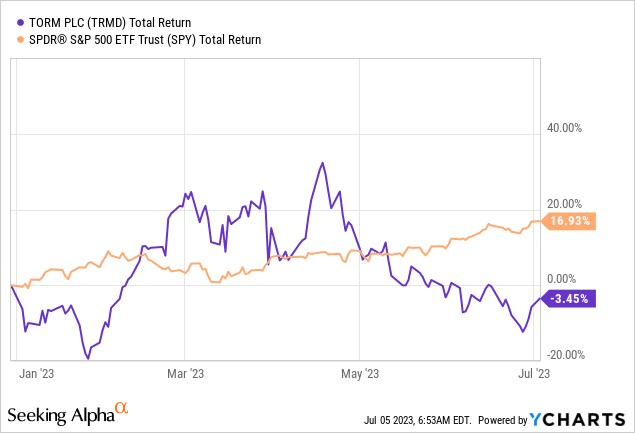

- Danish tanker operator TORM plc has seen a choppy performance in 2023, with its stock down by -3% YTD, compared to a 300% return in 2022.

- Despite short-term headwinds, underlying conditions for the industry look promising, with longer ton-miles and lower fleet growth, which could support freight rates.

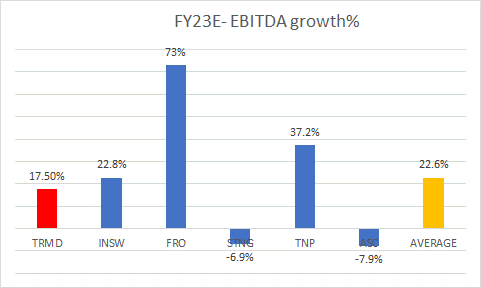

- TORM's financial outlook remains positive, with double-digit expected EBITDA growth this year despite a high base effect, although its performance is considered sub-par compared to a few of its competitors.

- We close with some thoughts on the technicals.

Lilkin/iStock via Getty Images

Not A Great 2022 So Far

TORM plc (NASDAQ:TRMD), a Danish-based pure-play tanker operator is currently considered to be one of the prominent global carriers of refined oil products. The company specializes in the large vessel segment of the product tanker market from Medium Range (MR) to Long Range 2 (LR2) tankers and currently operates close to 80 vessels.

Compared to a stellar 2022, where TORM's stock ended up delivering returns of close to 300%, this year’s performance has been quite choppy, with the stock currently down by 3% on a YTD basis (even as the broader markets have delivered returns of +17%).

YCharts

There are quite a few catalysts behind the subdued performance of tankers this year; firstly there's the specter of slowing demand across the world, with many regions at risk of falling into a recession, ongoing production cuts by Saudi Arabia and Russia have tightened the noose even further, and the erstwhile wildcard of China potentially increasing its fuel export quotas hasn’t come to pass; on the contrary, Chinese authorities continue to cut it.

Yet Underlying Conditions For The Industry Continue To Look Promising

Whilst these short-term headwinds could cause some volatility in tanker charter rates (TORM is particularly susceptible as it is heavily exposed to spot fees), we believe the sub-plot of the ongoing reorientation of ton-miles could help shore things up.

As long as sanctions against Russia persist, one will continue to see a recalibration of trade flows, with shipping lanes becoming more complex resulting in longer ton-miles.

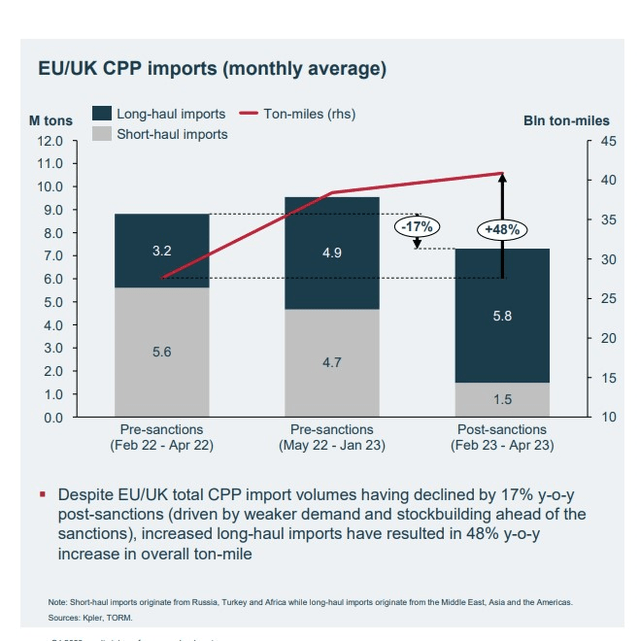

TORM Q1 Presentation

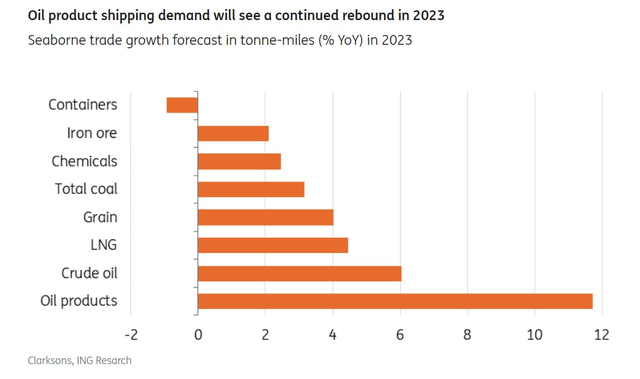

Indeed a few months back, TORM management noted that even though there’s been a decline in the volume of imports to the EU/UK, there’s also been close to a 50% bump-up in the level of ton-miles traveled since the pre-sanction era. To counter the loss of Russian supplies, western nations are shifting their dependence towards other geographies, making other trade routes more prominent (resulting in more ton-miles). Case in point, petroproducts from India, which have gone through the roof. In fact ING believes that increased demand for refined oil products from terrains such as India should help oil product shipping demand grow at double-digit levels this year.

ING

It’s also not as if Russia is standing still; Russian oil which previously used to be largely transported via shorter hauls across Europe is now being re-directed to Asian regions that are much further off.

Thus, even if recessionary conditions leave an adverse mark on overall demand, these longer seaborn-ton miles should still ensure that charter rates don’t fall off a cliff.

Then contours from the supply side are also likely to play a key role. Tanker order book levels are currently at 27-year lows, and it also appears as though there isn’t a great deal of alacrity amongst operators to engage in new-builds. In fact TORM’s CEO has categorically stated that he isn’t a fan of the new-build strategy. Given that the average lifespan of these tankers typically extends beyond two decades, operators would understandably be wary about making deep financial commitments to new builds, particularly as fossil fuel adoption will likely dim post-2030). A subdued outlook for tanker fleet growth (expected to be less than 1% through 2024), should keep the utilization of existing fleets at high levels, thus providing further support for freight rates.

TORM's Short-term Financial Outlook And Valuation Backdrop

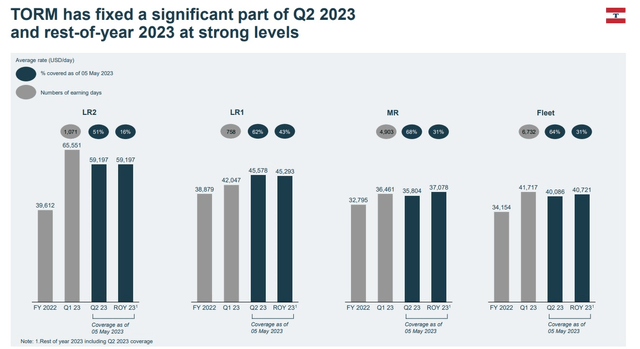

Given that TORM’s realized TCE (time charter equivalent) rates in FY22 had grown at a whopping annual rate of 149% ($34,154/day), it’d have only been reasonable to expect a solid flow through to the EBITDA level as well.

Well on the EBITDA front, TORM ended up delivering $730m of EBITDA in FY22 alone; to put that performance into context, you could add TORM’s EBITDA performance in the preceding four years, and that 4-year aggregate EBITDA figure would still come up short of what was seen in FY22.

The reason we bring that up is because we’d like investors to get a sense of the heightened EBITDA base effect that would be in play this year. Yet still, despite the high base effect, TORM looks set to deliver positive EBITDA growth this year as well, with an expected growth figure of 18%.

Whilst that figure could see mild alterations in the months ahead, we don’t believe there will be any major swings as H1 will almost certainly have closed at TCE rates well over $40k per day. As things stand, a decent portion of the rest of the year's tonnage appears to have been locked in at $40k plus rates.

TORM Q1 Presentation

Prima facie, annual EBITDA growth within the high-teens threshold, after such a strong base year would have been considered to be a commendable proposition. However, when you juxtapose that EBITDA runway against some of the other competitors in this space, TORM’s likely performance comes across as sub-par (peer set average growth-23%).

YCharts

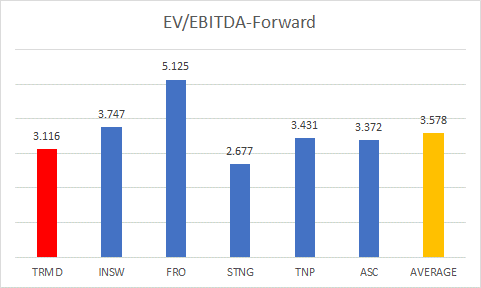

Considering the likely forward EBITDA performance, it seems acceptable that TORM is not priced exorbitantly and rather trades at a 13% discount to the peer set average multiple of 3.58x.

YCharts

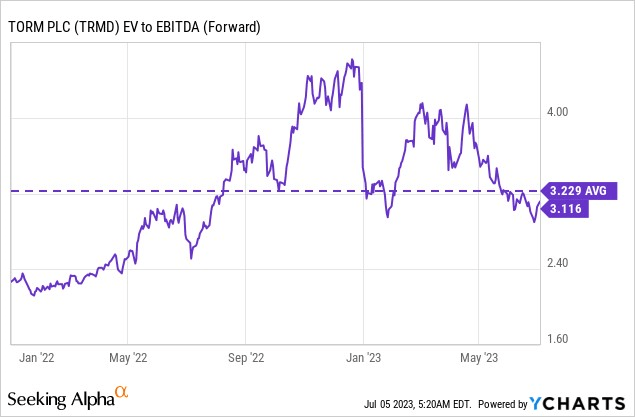

Also note that TORM is now roughly in line with its long-term average EV/EBITDA average.

YCharts

Closing Thoughts - Technical Considerations

On the technical front, we are currently quite conflicted about TORM’s prospects.

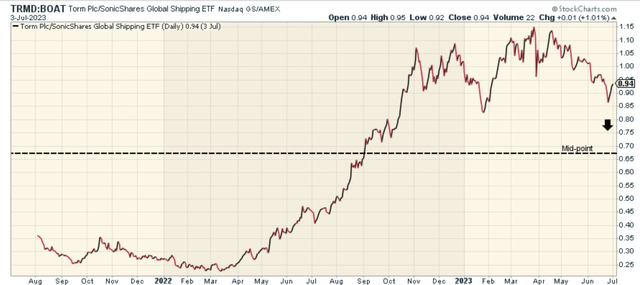

Firstly, it’s worth asking if TORM could benefit from some rotation interest within the shipping segment. Well, the image below suggests that is unlikely; despite a pullback in TRMD’s relative strength ratio versus a portfolio of global shipping stocks, it is still around ~40% higher than the mid-point of its range.

StockCharts

Meanwhile, on TORM's own weekly imprints we can see that after a long uptrend of more than a year, the stock broke down in May. Selling pressure can be validated by the fact that 8 out of the last 11 weekly candles have all closed in the red, even as we see a series of lower lows and lower highs.

Investing

If you have a short-term view, one could perhaps argue that the selling has been overdone as the stock recently bounced off the lower Bollinger band, forming a green-bodied candle in the process (highlighting the growing presence of bargain hunters).

However, we still think it would make better sense to go long only after one sees some base formation. Fortunately, the stock is now not too far away from the $18-$21 band, a terrain that had previously served as a congestion zone in August-October 2022 (area highlighted in yellow). Maybe one could see some base formation near those levels.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)