Xiao-I Releases Large Language Model 'Hua Zang' To Create China's Own ChatGPT

Summary

- Xiao-I Corporation, a leading AI enterprise in China, has launched its Large Language Model (LLM) called Hua Zang, developed by a team of 200 engineers.

- The LLM can be applied across various sectors and is controllable, customizable, and deliverable, with low computing, deployment, and training costs.

- AIXI has set ambitious 12-month goals, including developing a new business ecosystem, expanding language coverage, introducing international market applications, and disrupting traditional business models.

Xiao-I Releases Large Language Model "Hua Zang" To Create China's Own ChatGPT JohannesBluemel Photography/iStock via Getty Images

Business Overview

Xiao-I Corporation (NASDAQ:AIXI) is a leading cognitive artificial intelligence ("AI") enterprise in China, carrying the mission to build a Chinese version of ChatGPT. AIXI currently owns a cognitive intelligence platform serving customers across Financial services, Healthcare, Architecture, Manufacturing, and Public sector, etc. More details can be found in my previous article, Xiao-I: An AI Leader In China Saw 48% Revenue Growth In 2022.

Launch of Large Language Model "Hua Zang"

On Jun. 29, 2023, AIXI announced the launch of its advanced Large Language Model (LLM) called "Hua Zang (华藏)". According to the company, Hua Zang is a foundational model developed by a dedicated team of roughly 200 engineers. It uses proprietary algorithms, leverages data that has been independently collected, acquired, and aggregated by Xiao-I. This model can be broadly applied across various sections including financial services, government, healthcare, construction, energy, telecommunications, education, e-commerce, logistics, travel and tourism, media, manufacturing, automotive, pharmaceuticals, judiciary, retail, etc. The company highlighted three key features for its LLM:

- Controllable: The model ensures control in aspects of ideology, laws and regulations, algorithm capabilities, cultural values, and ethics, including data security and content output at the national and enterprise levels.

- Customizable: The model can be customized to specific customer needs, including model customization, content customization, component customization, and scenario customization.

- Deliverable: The model is characterized by its industry applications with low computing costs, low deployment costs, and low training costs."

Users now can request access to Hua Zang via this link.

During the event, the company made it clear about its 12-month milestones, which I think investors should feel excited about.

Three Months: Develop a brand-new business ecosystem.

Six Months: Completing language coverage and introducing international market applications.

12 Months: Disrupt traditional business models by providing open source platform within a global business ecosystem within 12 months.

How Would This Impact AIXI Stock Price?

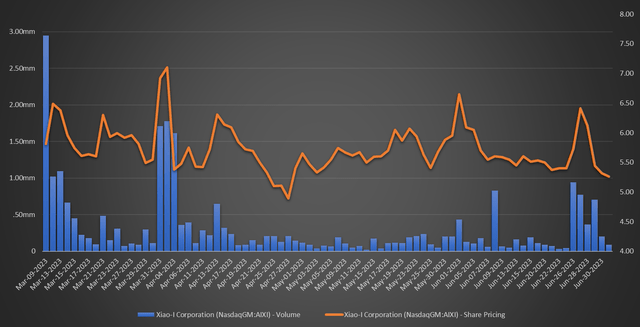

The company went public on March 9, 2023. The following chart shows its stock performance since then. It's currently traded slightly below its IPO price. Its average daily trading volume jumped to 941k, ~3x of its average daily trading volume of $320k, driven by the launch of LLM.

To understand how the launch of LLM will impact AIXI's stock price, I think we can look at the base scenario as well as the upside scenario.

Base Scenario: AIXI has two main revenue streams, 1) model-based cloud platform products, and 2) technology development services, and it serves a variety of enterprises/institutions across fields such as Telecommunication, Financial Services, Cloud, Infrastructure, Big-data, and Public Sector.

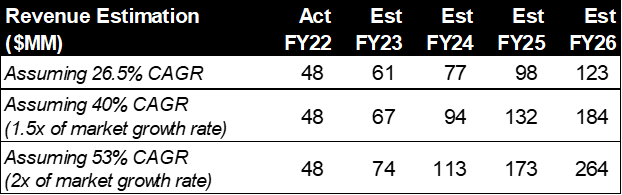

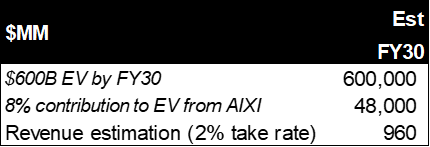

My assumptions for base case is that AIXI continues to maintain high growth rates along with a rapidly growing AI market in China. IDC predicts that "China's AI investment is expected to reach US$27 billion in 2026 (26.5% '21-'26 CAGR)'', representing 8.9% of worldwide investment, and ranking 2nd in the world. 60% of total spending in China's AI market will come from professional services, government, finance, and telecom." According to McKinsey, "By 2030, AI use cases can create $600 billion in economic value annually, inclusive of revenue generated by AI-enabled offerings, and cost savings through greater efficiency and productivity."

Applying some simple math, I think AIXI could grow its revenue in the range of $123MM to $264MM by FY26, and close to $1B by FY30. Admittedly we do not have any details to confirm or refute these data points. This was just an illustration of a company's potential growth trajectory in a secular market.

My estimation My estimation

Upside Scenario: Based on what the company shared in the LLM launch event, AIXI clearly wants to replicate the success of OpenAI. According to Reuters OpenAI is projecting its revenue of $200MM in 2023, and $1B in 2024. If AIXI were to become China's OpenAI and to expect explosive growth in a similar way, AIXI's financials will look way more exciting than the math I did in the Base Scenario section.

Stock Valuation

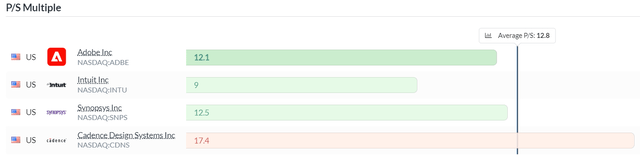

AIXI is currently traded at 8.7x P/LTM Sales. I would apply an average multiple for the following comps (AI services related stocks), which implies $7.8 per share and 47% upside from its current price.

Conclusion and Investment Risks

I think AIXI's LLM launch is a significant milestone leading to its bold 12-month business roadmap. Covering international markets and rolling out an open source platform are both big undertakings. That said, I consider this a viable plan because 1) AIXI has scaled R&D (4 R&D centers, R&D staff accounting for 62.5% of total number of employees, 50+ external experts, and 10+ partnerships with top universities); and 2) AIXI already has its very strong presence in various fields (see details in Xiao-I: An AI Leader In China Saw 48% Revenue Growth In 2022), so it is well-positioned to build a global business ecosystem.

In terms of investment risks, I thinking several things are worth mentioning as follow.

First, because ChatGPT has already set a high bar and familiarized over 100 million users with the AI technology, AIXI will have to deliver great products to get the market and its users excited.

Second, OpenAI's success is certainly fascinating, but we should also be aware of the cost implication. According to TheInformation, "OpenAI's losses roughly doubled to around $540 million last year as it developed ChatGPT and hired key employees from Google". As AIXI executes on its roadmap, managing costs of R&D and Infrastructure is as important as winning big deals.

Finally, similar to other US listed China stocks, their value may not be fully unlocked on the market as it will take time for investors to build confidence in these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.