ETW: A Unique CEF For Income-Starved Investors

Summary

- Investors today are starved for income due to the rapidly rising cost of living.

- ETW invests in a portfolio of common stocks and then writes options against various indices in an attempt to earn income via the option premium.

- The fund is technically writing naked call options, which are much riskier than covered calls used by other option-income funds.

- The fund failed to cover its distribution last year and cut it as a result. It remains to be seen whether or not it can maintain the current 8.47% yield.

- The fund is trading at a reasonably attractive discount to its intrinsic value.

- Looking for a helping hand in the market? Members of Energy Profits in Dividends get exclusive ideas and guidance to navigate any climate. Learn More »

Marat Musabirov

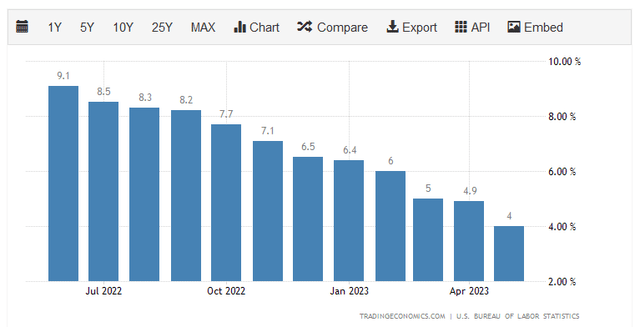

There can be very little doubt that one of the biggest problems facing the average American today is the incredibly high inflation and rapidly rising cost of living that has been consistently dominating the economy. This is evidenced by the consumer price index, which has increased by at least 4% year-over-year during each of the past twelve months:

As I pointed out in numerous previous articles (such as this one), the above chart is somewhat misleading because the fact that energy prices are lower than during the equivalent period of last year is making the inflation problem look less than it is. The core consumer price index, which excludes volatile food and energy prices, has not been showing nearly as much improvement when it comes to the cost of living. Regardless, an inflation rate of more than 2% year-over-year is generally considered to be unhealthy for the economy and we see this reflected in both the official numbers and the core consumer price index. The point is that people are desperate to obtain extra sources of income just to maintain their standard of living, which has led to a substantial number of people seeking out second jobs or entering the gig economy to boost their incomes. This could be one reason why the job numbers are staying stubbornly high despite all other measures of economic performance pointing to a weakening economy.

As investors, we are certainly not immune to the negative impacts of a rising cost of living. After all, we all have bills to pay and require food for sustenance. However, we do have other methods that we can employ in order to obtain the extra income that is needed to purchase these things in today's world. After all, we can put our money to work for us earning an income. One of the best ways to do this is to purchase shares of a closed-end fund aka CEF that specializes in the generation of income. These funds are unfortunately not very well-followed in the investment media and many financial advisors are not familiar with them. As such, it can be difficult to obtain the information that we would like to have to make an informed investment decision. That is a shame because many of these funds have advantages over exchange-traded and open-ended mutual funds. In particular, a closed-end fund is able to employ certain strategies that have the effect of boosting its yields well above that of nearly anything else in the market.

In this article, we will discuss the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund (NYSE:ETW), which currently boasts an impressive 8.47% dividend yield. That is a yield that seems certain to appeal to any income-focused investor. I have discussed this fund before, but many months have passed since that time so naturally a great many things have changed. This article will specifically focus on these changes as well as provide an update on the fund's financial performance. Therefore, let us investigate and see if this fund could be a good addition to your portfolio.

About The Fund

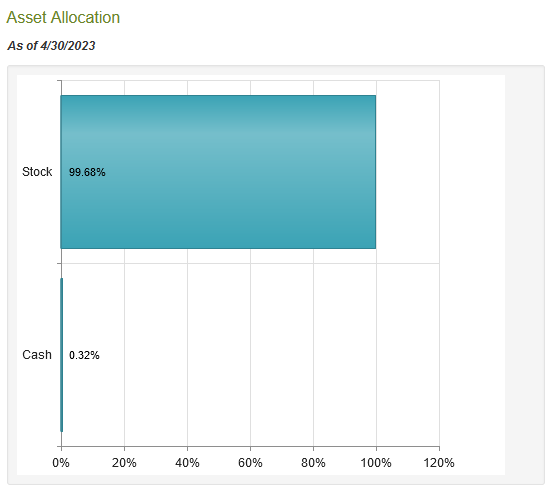

According to the fund's webpage, the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund has the objective of providing its investors with current income and current gains. This is somewhat unusual for a closed-end fund that has its assets entirely invested in common stocks. As we can see here, the fund currently has 99.68% of its assets invested in common stock:

CEF Connect

The reason that this objective is a bit unusual considering this is that common stocks are not a very good asset for anyone seeking income. With the exception of only a handful of companies, the dividend yields of nearly all common stocks are nothing particularly impressive. After all, the S&P 500 Index (SP500) only yields 1.47% at the current price. Even the traditionally high-yielding utility sector has a lower yield than most money market funds today. Thus, it makes little sense for an equity fund to have current income as an objective.

The twist to this fund is that the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund employs an options strategy to generate income from its portfolio of common stocks. The fund's fact sheet describes this in detail:

The fund invests in a diversified portfolio of common stocks and writes call options on one or more U.S. and foreign indices on a substantial portion of the value of its common stock portfolio to seek to generate current earnings from the option premium.

This is a twist to the covered call option writing strategy that I discussed earlier this week. With the covered call writing strategy, the fund writes options against stocks that it already owns. Thus, the worst-case scenario is that it has to sell something that it already owns at a price that is less than the market price. This is a fairly safe strategy because the fund does not need to go out and purchase the stocks that it will have to deliver in the event of an option exercise, which could cost it potentially unlimited amounts of money. This fund though is not actually using the covered call writing strategy. This is because it is writing options against a broad market index, but it does not actually own the index. Thus, if the option is called against it, the fund's losses could be unlimited depending on the price of the index in question. Management's hope here appears to be that the fund's portfolio will deliver comparable performance to the relevant indices, offsetting any potential losses from the naked call. Alternatively, the fund could purchase the option back before its maturity date, but even this results in the fund taking losses. Overall, this is a riskier strategy than the covered call strategy that is used by funds like the BlackRock Enhanced Global Dividend Trust (BOE) or the Eaton Vance Enhanced Equity Income Fund (EOI).

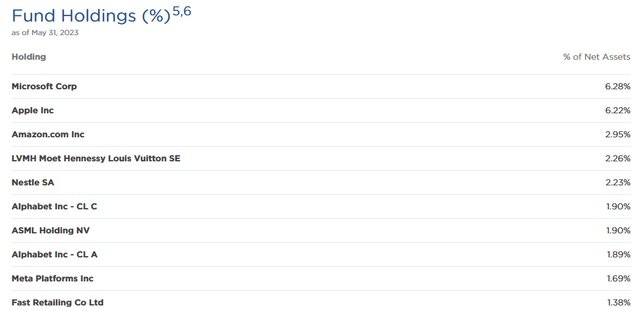

One of the interesting things about Eaton Vance's closed-end funds is that they have a rather unusual portfolio considering that the fund claims to be focusing on providing its shareholders with a high level of current income. This is the case with this fund as well. Here are the largest positions in the fund:

The surprising thing here is that several of these companies do not pay dividends. Even the ones that do pay dividends have such low yields that they may as well not pay a dividend. Here are the current dividend yields of each of these stocks:

| Company | Dividend Yield |

| Microsoft (MSFT) | 0.80% |

| Apple (AAPL) | 0.50% |

| Amazon.com (AMZN) | N/A |

| LVMH Moet Hennessy Louis Vuitton (OTCPK:LVMHF) | 1.64% |

| Nestle (OTCPK:NSRGF) | 2.75% |

| Alphabet (GOOG) | N/A |

| ASML Holding (ASML) | 1.01% |

| Alphabet (GOOGL) | N/A |

| Meta Platforms (META) | N/A |

| Fast Retailing Co. (OTCPK:FRCOF) | 0.70% |

As of the time of writing, a money market fund pays around 5%, so all of these companies are yielding substantially less than a relatively safe cash position. The S&P 500 Index (SPY) yields 1.47% as of the time of writing, so only two of the ten largest companies manage to beat it in yield. That is strange for an income-focused fund and clearly indicates that the fund's dividend income will be much less than it otherwise could be. With that said, the fund's fact sheet does state that the options strategy will be the source of most of its income. The options strategy is not going to be as safe as dividend income though due to the losses that an index call writer will take as an index goes up in price.

There have been surprisingly few changes to the fund's largest positions since the last time that we reviewed the fund. Indeed, the only changes of note are that Tesla (TSLA), Roche Holding (OTCPK:RHHVF), and Linde (LIN) were removed and replaced with ASML Holding, Meta Platforms, and Fast Retailing. We can also see that the weightings of several of the fund's holdings changed significantly, but that could be the simple result of one company outperforming another in the market. The fact that there have been relatively few changes in more than half a year may lead one to expect that the fund has a fairly low turnover. That is certainly true as the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund had a 12.00% annual turnover last year, which is remarkably low for an equity closed-end fund.

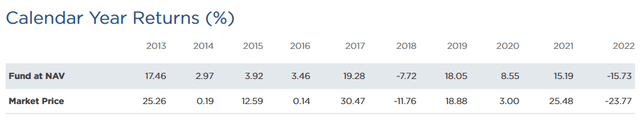

The reason that this is important is that it costs money to trade stocks or other assets and these costs are billed directly to the fund's shareholders. That creates a drag on the overall performance and makes management's job more difficult. After all, the fund's managers have to earn a sufficiently high return to cover these added expenses and have enough left over to provide the shareholders with an acceptable return. There are very few funds that can accomplish this on a consistent basis, and we frequently see actively-managed funds underperforming comparable index funds as a result. This one has historically not performed too badly:

The big thing that we notice here is that the fund outperformed the S&P 500 Index in 2022, as it declined by less than the 18.11% decline of the index. However, it did substantially worse than the index in 2018, 2019, 2020, and 2021. This is to be expected from an option-income fund since the call option writing strategy caps the fund's upside potential in exchange for current income. In a broad-based market decline though, the fund should outperform because the option premiums offset some of the losses and the options are unlikely to be exercised. This is something that could be appealing for some investors because it results in less volatility overall.

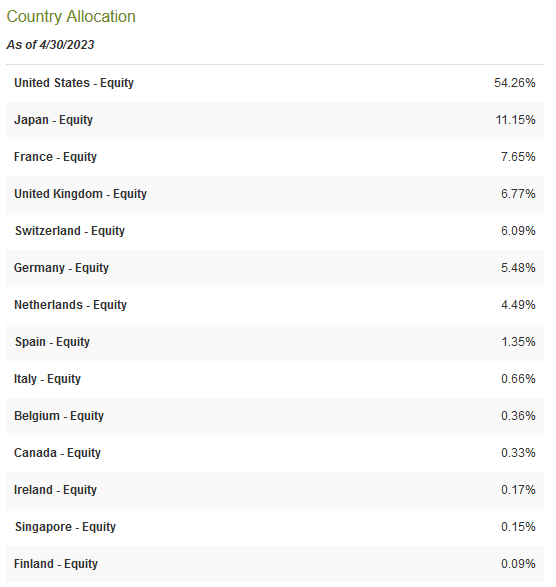

One thing that we note by looking at the list of the largest positions in the fund is that it includes a number of non-American companies. This is something that extends to the rest of the portfolio. As we can see here, only 54.26% of the portfolio is invested in securities issued by American companies:

CEF Connect

The United States only accounts for a bit less than a quarter of the global gross domestic product, so the fund is over-allocated to the United States relative to the nation's actual representation in the global economy. However, most global funds have a weighting of 60% to 70% towards that country so this fund is still more globally diverse than most. This is something that is quite nice to see because of the protection that it provides us against regime risk. Regime risk is the risk that some government or other authority will take an action that has an adverse impact on a company in which we are invested. The only realistic way to protect ourselves against this risk is to ensure that only a relatively small proportion of our assets are invested in any individual nation. This fund is doing that to a certain degree, and it could help American investors reduce their exposure to their own country, which is something that most Americans desperately need.

Distribution Analysis

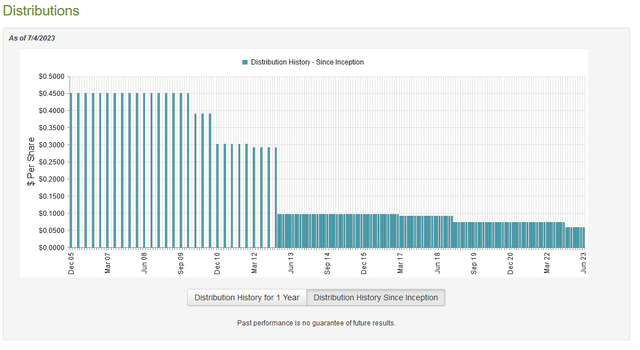

As mentioned earlier in this article, the primary objective of the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund is to provide its investors with a high level of current income and current gains. The fund seeks to achieve this objective by maintaining a portfolio of common stocks and writing index options with the objective of using the option premiums as a source of income. Option premiums are certainly capable of generating a fairly high effective yield from a portfolio when the strategy is executed properly. The fund then aims to pay out all of its investment income and capital gains to the investors via distributions. As such, we can probably assume that this fund will have a very high yield. This is certainly the case, as it currently pays out a monthly distribution of $0.0582 per share ($0.6984 per share annually), which gives the fund an 8.47% yield at the current price. Unfortunately, the fund has not been particularly consistent with its distribution over time as its payout has steadily declined over time:

This is certainly disappointing, especially the most recent cut that occurred late last year. This cut actually resulted in the income of the fund's investors going down at a time when they needed it most to maintain their lifestyles in the face of the quickly escalating cost of living. With that said, it is not particularly surprising that the fund was forced to cut as it has substantial exposure to the American mega-cap technology stocks, which were among the hardest-hit stocks in the market decline last year.

However, anyone purchasing the fund today does not need to worry about the fund's past. This is because an investor today will receive the current distribution at the current stock price and will not suffer any negative impacts from the fund's performance prior to their purchase. The most important thing for anyone today is how well the fund can sustain its current distribution and current yield.

Unfortunately, we do not have an especially recent document that we can consult for the purposes of our analysis. As of the time of writing, the fund's most recent financial report corresponds to the full-year period that ended on December 31, 2022. As such, it will not have any information regarding the fund's performance so far this year. However, the full-year 2022 period was a very challenging one for most segments of the market due to the Federal Reserve and other central banks reversing their previous loose monetary policies and tightening up in an effort to combat inflation. This report is also newer than what we had the last time that we discussed this fund, so that is a bonus. During the full-year period, the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund received $21,042,725 in dividends from the assets in its portfolio. When combined with some income from other sources, it reported a total investment income of $22,267,254 during the full-year period. The fund paid its expenses out of this amount, which left it with $11,158,054 available for shareholders. That was, unsurprisingly, not nearly enough to cover the $92,294,753 that it actually paid out to its investors during the period. At first glance, this could be concerning as the fund's net investment income is nowhere enough to cover the amount that it is paying out.

However, the fund does have other methods through which it can acquire the money that is needed to cover the money that is paid out to the shareholders. For example, it is using an option-writing strategy to get money. The money that it makes from this strategy is considered either a return of capital or a capital gain depending on the situation, so it is not included in the fund's net investment income. In addition, the fund might have capital gains from the common stocks in its portfolio. This was certainly the case during the full-year period, as the fund reported net realized gains of $67,437,584 but these were offset by $264,146,134 net unrealized losses.

Overall, the fund's assets went down by $270,361,065 during the full-year period after accounting for all inflows and outflows. This certainly explains the distribution cut! However, the net realized gains plus the net investment income was $78,595,638, which at least covers a good portion of the distributions that were paid out. The fund did still fail to cover its distributions over the period, though. Hopefully, the cut will solve this problem but we will have to wait until the fund's next financial report is released (probably around the end of next month) before we can be certain of this.

Valuation

It is always critical that we do not overpay for any asset in our portfolio. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a closed-end fund like the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund, the usual way to value it is by looking at the fund's net asset value. The net asset value of a fund is the total current market value of all the fund's assets minus any outstanding debt. This is the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of the fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are obtaining the fund's assets for less than they are actually worth. That is, fortunately, the case with this fund today. As of July 3, 2023 (the most recent date for which data is available as of the time of writing), the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund has a net asset value of $9.01 per share but the shares currently trade for $8.19 each. This gives the fund's shares a 9.10% discount to the net asset value at the current price. This is a larger discount than the 8.12% that the shares have averaged over the past month, so the price certainly appears reasonable today.

Conclusion

In conclusion, the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund offers income-starved investors an interesting way to obtain more income without purchasing a traditional levered fixed-income fund. This could be an advantage as this fund should have somewhat different performance characteristics than most bond funds and be less volatile than pure equity funds. However, it is important to keep in mind that it is not a covered call fund and its options are technically naked calls so it will have greater risks than some of its peers. Overall though, the fund might be worth owning if it can indeed sustain the current distribution.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)