SMH: Investing In The Semiconductor Ecosystem

Summary

- The semiconductor industry is expected to continue growing due to increasing global demand for chips.

- The industry is heavily influenced by geopolitical tensions, particularly between the US and China.

- The future growth of the industry is expected to be driven by R&D expenses and capital expenditure, with revenues projected to reach $2.1 trillion by 2032.

PonyWang

Introduction

No other industry has a greater impact on our everyday life than the semiconductor one. We can find integrated circuits - chips from now on - in almost every object we use.

Chips are so important that the major world economies passed laws to support the semiconductor industry in 2022 to overcome the chip shortage that sprung as an aftermath of the covid pandemic.

Chips are at the centre of geopolitical tensions among superpowers like the US and China, as they are vital components to establish military dominance, and thanks to the semiconductor industry, so far, Taiwanese people have been able to prevent the invasion of their Chinese neighbours.

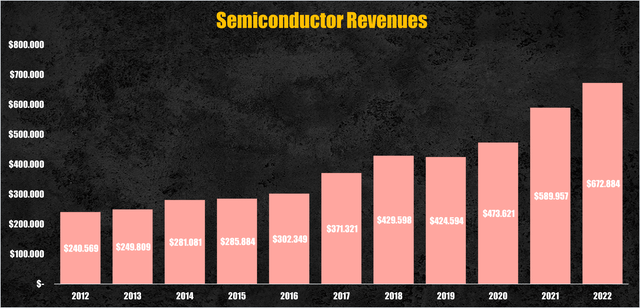

Revenues generated by semiconductors almost tripled in the last decade from $240 billion in 2012 to $672 billion in 2022 and given the investments made, which almost reached $100 billion last year, the industry is expected to keep growing.

Semiconductor revenues (Personal Data)

The VanEck Semiconductor ETF (NASDAQ:SMH) - a broad ETF that offers good exposure to the whole semiconductor ecosystem - can represent a good alternative to get exposure to the growing semiconductor industry.

Semiconductor Ecosystem

Put simply, the semiconductor industry revolves around the concept of ecosystem, with every company linked to the others by supply and demand.

IP vendors

At the very bottom of the ecosystem, we have the Intellectual Property (IP) vendors. These companies design the building blocks needed to develop the most advanced chips. IP vendors licence their patents to chip designers who incorporate them in their designs.

IP vendors play a crucial role in helping chip designers to save money and time in the development of already existing standard chip components.

The leading IP vendor is Arm Holdings, a private British company owned by the Japanese SoftBank, whose IPs are used by the world's largest chip designers.

EDA Software Developers

Among IP vendors, we have companies like Synopsys (SNPS) and Cadence (CDNS), which rather than just licensing chip patents, also develop Electronic Design Automation (EDA) software.

This software are used by chip designers to design their chips on top of the licenced patent acquired by IP vendors.

Fabless

IP patents and software tools are purchased by Fabless companies. Fabless is a title derived from the words "fabrication plant" and the word "less", and as the name suggests, these companies only design and sell the chips while outsourcing the manufacturing processes.

The Fabless segment is dominated by US companies like Nvidia (NVDA) - the market leader in the GPU and AI chip segments - and AMD (AMD) - the runner-up in the CPU segment which poses a serious threat to Intel's decades-long market dominance.

However, not only traditional Fabless compete in this segment. Big techs like Apple, Amazon, Microsoft, Google, and Meta - which sit on piles of cash and thousands of top-tier engineers - have started to internally design their chips, rather than acquiring them from third parties, to better suit their hardware, data centres, and recently, AI needs.

IDMs

Other than Fabless companies, in the chip designer's family we have the Integrated Device Manufacturers, or IDMs for short. These companies internally integrate all the phases from the design to the manufacture of their chips.

While in the past the IDM model was the gold standard, nowadays more and more companies are disinvesting their foundry businesses, turning into Fabless, due to the high costs to run the Fabs and the constant investments needed to keep up with the technological advancements.

While IDMs like Intel (INTC), Micron Technology (MU), and Samsung (OTCPK:SSNLF) still manufacture most of their chips in-house, in recent times also these companies have relied on external foundries to manufacture their most advanced chips.

Foundries

To satisfy the demand for Fabless and IDMs, pure-play foundries were born. Also called Fabs, these companies don't design or sell any chip but rather destinate their resources to build fabrication plants and offer their production capabilities to chip designers.

Fabs competition is based on the level of node miniaturization. The node represents the level of miniaturization and performance achieved in the manufacturing process.

Following Intel co-founder Gordon Moore's law of miniaturization, stating that the size of the transistors shrinks every two years to allow the number of transistors on a chip to double, the nodes must shrink too.

However, is easier said than done due to the billions of dollars needed to develop and set up advanced nodes, with only a handful of companies having the technical capabilities to manufacture the most advanced chips. The Taiwanese TSMC (TSM) is the market leader in the foundry segment with a 57% market share.

Given the high barrier to entry of the foundry business, the number of players is limited, and many IDMs like Intel and Samsung offer their foundry capabilities to Fabless companies. The Korean Samsung Foundries is the only player able to compete with TSMC's 5 and 3 nanometers nodes. Intel has long been on the same level as TSMC and Samsung, but due to bad reinvestment strategies implemented in the past, has lost its competitiveness, and now is playing catch-up with the other two.

Equipment Manufacturers

Node's miniaturization wouldn't be possible without dedicated machines able to operate at the scale of a nanometer.

Among the many equipment manufacturers, which sell machinery and tools to foundries, ASML Holding (ASML), is the only provider of extreme ultraviolet lithography (EUV) machines, which are needed to manufacture 7, 5, and 3 nanometers chips.

Given the difficulty, time, and money required to develop a EUV machine, the Dutch company was the only one that tried to develop one. Its efforts paid off and today ASML has a 100% market share in the EUV lithography business, meaning that every foundry that wants to manufacture chips of 7 or fewer nanometers has to purchase ASML's machines at a price tag ranging from $130 to $300 million.

Industry Performance

Looking at the performance of the semiconductor sector, using a sample containing the 68 major semiconductor companies by market capitalization, over the past decade the industry had a median return of 19% and a median volatility of 41%.

Semiconductor performance (Personal Data)

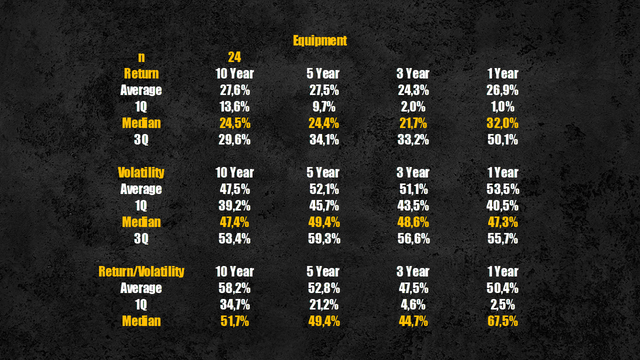

Excluding the IP segment being biased by the presence of software companies which operate in other segments other than the semiconductor one, the segment that registered the highest return was the Equipment Manufacturers segment, with a return of 24%, however, it also had the highest volatility equal to 47%.

Equipment segment performance (Personal Data)

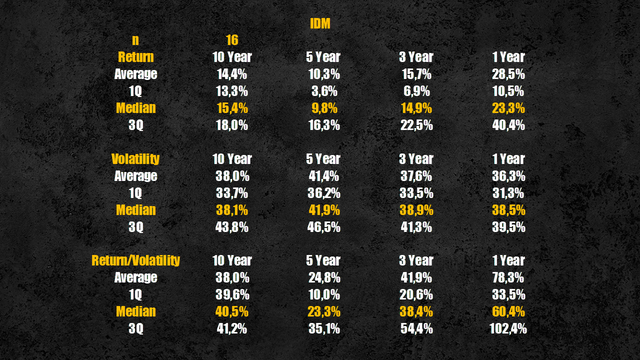

The worst-performing segment was the IDMs segment, whit a median return of only 15% and volatility of 38%.

IDMs segment performance (Personal Data)

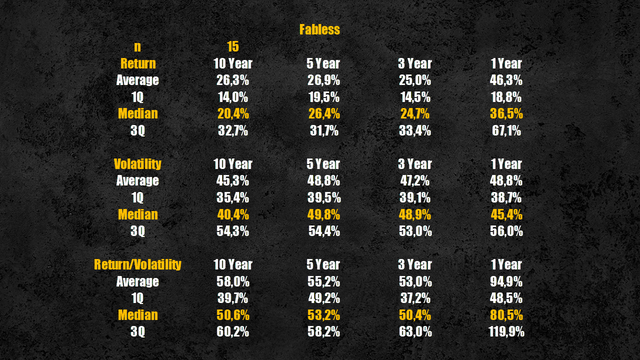

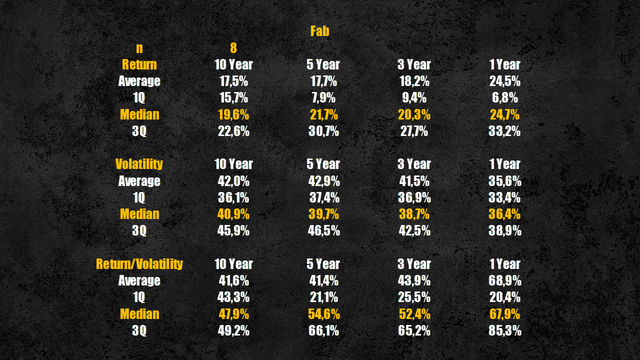

Both the Fabless and Fabs segments had similar returns, respectively 20% and 19%, and similar volatility of around 40%.

Fabless segment performance (Personal Data) Fabs segment performance (Personal Data)

Reducing the considered period to the past five, three and one years, the Equipment segments slide to the second position, behind the Fabless segment which, thanks to investors' favourite stocks like AMD and Nvidia, took the lead in the semiconductor industry.

IDMs instead, reaffirms the infamous title of the worst-performing segment, partially dragged down by Intel's lack of competitiveness against its foundry and designers' rivals.

Industry Fundamentals

Stock performance aside, semiconductors are notably a cyclical industry, which requires heavy and consistent investments in R&D and capital expenditures to keep innovating.

Semiconductor companies cannot achieve a significant moat with just brand loyalty - Intel had a market share of over 80% in 2016, but it has shrunk to 60% in 2022, as it failed to deliver CPUs on par with AMD's one. A persistent moat is obtained only by maintaining technological leadership in designing and manufacturing processes like ASML with its EUV lithography, Nvidia in the GPU segment, and TSMC with its advanced nodes.

Technological leadership require clever capital allocation strategies to carefully destinate resources to support future growth.

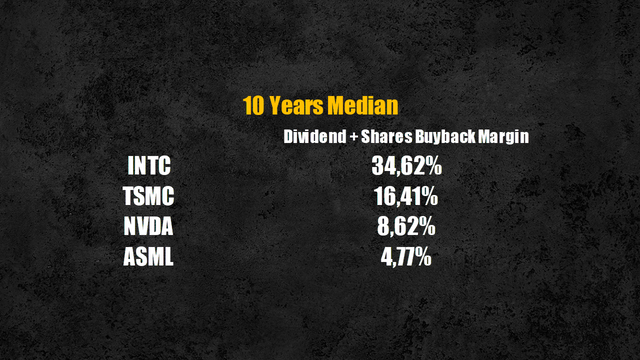

Intel for example, clearly adopted a failing strategy, choosing to reward its investors instead of reinvesting into the business, allocating a median of 34% of its revenues to stock repurchases and dividends. TSMC, Nvidia, and ASML - which are all companies with significant moats - destinated respectively, 16%, 8% and 5% of their revenues to shareholders reward initiatives, preferring to reinvest more into next-generation technologies.

Shareholders rewards initiatives (Personal Data)

Easy to say that the common thread of the semiconductor ecosystem relies upon its reinvestment needs.

Future Growth

Future growth can be determined by looking at how much and how well a company, or in this case an entire industry, has reinvested into its growth drivers.

The main growth drivers for the semiconductor industry are represented by R&D expenses - needed to develop new chips, nodes, and equipment - and by capital expenditure - needed to build the fabrication plant and research centres.

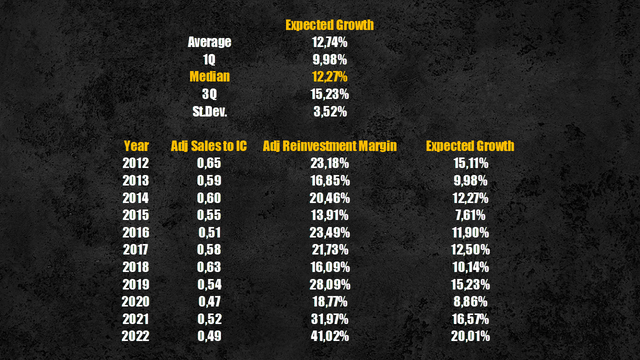

The reinvestment margin shows what percentage of revenues has been reinvested for future growth, while the sales-to-invested capital ratio tells how much revenues are generated by each dollar reinvested. By multiplying both ratios, we obtain the expected growth rate based on how much and how efficiently a company, or industry in this case, has reinvested.

To exclude short-term noise, I calculated the expected growth rate over the past 10 years and took the median value, equal to 12.27%.

Semiconductors expected growth rate (Personal Data)

Revenues Projection

Despite the growth rate obtained being everything but a fixed value - given the impact that macroeconomic and geopolitical factors can have on the semiconductor industry - I used it as the expected revenues CAGR for the next 10 years, resulting in revenues expected to triple from $672 billion in 2022 to $2.1 trillion by 2032.

Semiconductors revenues projection (Personal Data)

While it might seem an optimistic projection, or too conservative for Nvidia's fanboys, in the long run, the demand for semiconductors will only increase.

Chips, advanced or not, will be needed to support growing sectors which are currently developing next-generation technologies like electric vehicles, renewable energy, robotics, IoT, data centres, and the latest arrived AI.

Supporting the thesis, throughout 2022, major economies like the US, Europe, and Japan, have issued so-called "Chips Acts" - worth nearly $100 billion - aimed to solve major supply chain-related issues and the over-dependence from Taiwanese Fabs given the threat of a possible Chinese invasion.

Industry Risks

While we can be optimistic about the industry's future, semiconductors also bring several risks. At a broad level, geopolitical tensions represent the major threat to the industry. Many are the restrictions imposed by Western governments, especially the US, to ban the export of critical chip technologies to China trying to limit their access to the most advanced chips which might be used for military purposes threatening the world balance of powers.

With TSMC owning more than 50% of the foundry industry, many worry about what would happen if China tried to invade Taiwan. Western tech giants like Apple, which manufactures all its chips in TSMC's plants, would see their chips supply completely cut off, and no longer after that, the whole economy would probably collapse.

Zooming into the semiconductor ecosystem, each segment has its problems.

Fabless companies are witnessing increasing competition from big tech companies internally developing their chips. Apple already develops all its chips in-house, while Google and Amazon, among others, are said to develop their chips, partially departing from Qualcomm and Nvidia respectively.

IDMs instead, face double competition from pure-play foundries and chip designers. While Fabs can focus all their resources on mastering nodes' miniaturization - while Fabless are solely concerned about mastering the design of new chips - IDMs have to master both at the same time with limited resources. As it happened to Intel, given the extreme levels reached so far, is hard for IDMs to keep advancing at the same rate as their competitors.

Semiconductors companies in general have to maintain a good level of inventory efficiency. Ratios like the inventory turnover and the average days of outstanding inventory must be used to compare companies and check if they are able to carefully time the demand and supply of chips. Intel, which has struggled in recent times, has the lowest inventory turnover ratio, equal to 3.99, and the highest number of days of outstanding inventory, equal to 91 if compared to its competitors in the Fabs and Fabless segment.

Inventory efficiency ratios (Personal Data)

SMH ETF

The VanEck Semiconductor ETF - tracking the top 25 semiconductor companies listed on US exchanges - offers good exposure to all segments of the semiconductor ecosystem, diversifying among Fabless, Fabs, IDMs and Equipment manufacturers.

SMH ETF top 10 holdings (VanEck)

Geographically speaking, given the index composition, 79% of its holdings are US companies, 11% are Taiwanese, while the remaining 9% is invested in the Netherlands ones.

SMH ETF top 10 countries (VanEck)

Considering the geopolitical risks involving Taiwan, the SMH ETF offers limited exposure to the island.

The benchmark index is the MVIS US Listed Semiconductor 25, and since the ETF inception in May 2000, it has a total return of 269% against the 211% of the S&P 500.

Conclusion

Despite some short-term turbulences due to macroeconomic and geopolitical factors, the unstoppable growth momentum that began since the outbreak of the Covid pandemic isn't stopping any time soon.

Due to our increasing dependence on chips in our everyday lives, and the growing adoption of chips in many next-generation technologies, the semiconductor industry will keep playing a critical role going into the future representing a good investment opportunity.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.