3 Ways You're Probably Mismanaging Your Portfolio In July 2023

Summary

- Real estate is currently undervalued due to fear of a recession and interest rate hikes.

- The demand for oil and natural gas is expected to continue to rise, so why wouldn't we grab undervalued companies?

- It's time to sell tech at highs, and rotate sectors to those that will do well in the next trading cycle.

sankai

1. You're probably not buying real estate.

Let's look at the facts here. Interest rates are sky-high, housing prices are through the roof, and investors have been selling down the real estate market left and right. Clearly they must be right, right?

Folks, let me remind you of something Warren Buffett said.

Be fearful when others are greedy, and greedy when others are fearful.

That quote is so important that it's literally in the introduction to my book. Buying low and selling high is investing 101, yet I see so many people ignoring it and allowing emotions to take control even though they understand the concept; if I had a penny for every time, I'd have enough to buy a small private island.

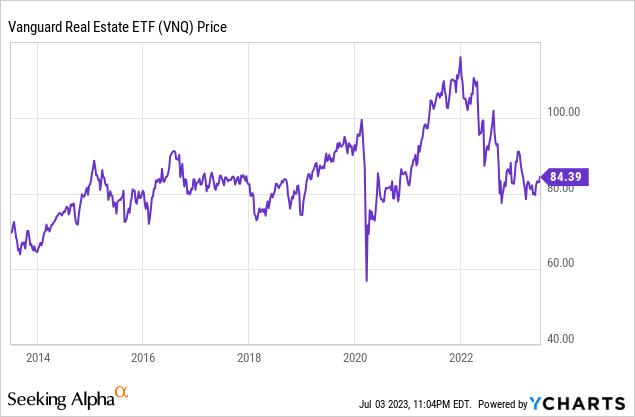

Real estate is down big time right now. Let's have a look at a chart of VNQ's pricing:

You can look at that chart above and see our current prices are the same as they were in 2015. Folks, is the real estate market worth more now than in 2015? Yes, yes it is. I realize it's an oversimplification, but follow me here.

People have been reacting to their fear of a recession and interest rate hikes by irrationally selling excellent holdings. Right now, real estate is very cheap, and REITs are one of the income investor's bread and butter meals. Did you sell off your REITs?

As we move into 2024 and beyond, chances are good that one of two things will happen:

A. Rates will stay the same.

B. Rates will fall.

In case A, companies adapt to the "new normal," fear of a recession wanes, and those that sold down real estate will begin to buy it again at a normal pace.

In case B, companies begin to borrow again and re-establish older patterns, fear of recession wanes, and those that sold down real estate begin to buy it back at an accelerated pace.

Either case can happen if there is a recession, or not. If there is, then it will simply take longer. In either case, real estate begins to get bought back up in the future.

We're investors. Buy low, sell high. And right now real estate is low, so go buy it.

2. You're probably not buying any energy.

I have seen a big increase in the number of articles here proclaiming loudly that "the energy trade is over!" Friends, the post-COVID, post-Russia/Ukraine energy trade has been over for at least a year. That's not what we need to be looking at anymore. We need to look at the fundamentals here.

Oil pricing, as I sit here right now, is at $71.19 on WTI futures. Henry Hub is showing $2.75. WTI is nearly bottomed out in price. It's unlikely we sink much lower, even in a recession, as the United States Administration has committed to refilling the SPR in the mid-60s. Furthermore, the effects of the Saudi cuts haven't really been felt, and OPEC+ holds a lot of power to cut further if they'd like. Oil isn't going much lower than mid-60s. For more of my thoughts on oil pricing in a recession, see this article.

The natural gas futures are also very interesting. Right now, we see a significant contango with Dec 2024 futures for Henry Hub showing $4.18. This is very likely. There is currently a ton of natural gas infrastructure being built around the globe, and the industry widely expects only large increases in demand.

Over time, the demand for oil has only risen, and that's not going to change any time soon. Natural gas as well. If you want to say that's wrong, then you'd might as well say the sun will rise in the West tomorrow. You'd be just as accurate. Yes, green energy is a thing, but it will not be able to usurp demand for fossil fuels. And much of Europe is dismantling the only other source of clean power - nuclear: making dependence on oil and natural gas even more likely.

There are some high-flying energy stocks that I wouldn't be buying into at the moment. Ones like Exxon Mobil (XOM) and Valero Energy (VLO). Great companies, very highly valued at the moment. That's not my style. I like to research and write about undervalued energy companies that pay great dividends. There are plenty out there. You should be putting some of these in your portfolio, because as demand and pricing rises, they will do well. And in the meantime, you'll collect those sweet dividends.

3. You're probably holding too much of the high-flying tech stocks.

What did I say in the first section? Buy low, sell high. Be fearful when others are greedy. Folks, the high-flying names in the tech sector are where others are greedy at the moment.

Certain names have driven a lot of the growth in the S&P 500 this year. Nvidia (NVDA, Meta (META), Amazon (AMZN), Alphabet (GOOGL), etc., have all been outsized contributors to this growth. They're once again darlings of the markets, or are they? Are they just the rage at the moment?

If you know about the "emotional rollercoaster" in investing, then you know that retail traders and investors begin to pile into the rollercoaster just as it reaches the top. When the names are all over the news. When everyone and their mom is talking about it. Friends, even my mom mentioned META.

This is where the savvy investor sells. We are approaching the short to midterm apogee for these stocks, and the time of maximum financial risk. If you've been in here since the crash and S&P 500 futures hitting 3500 (you were buying that whole time, right?) then toss the stocks and sell them to someone who's just now getting back in. Let them take the risk.

I've gotten rid of most of mine in personal and managed accounts. I keep selling covered calls on my last remaining shares of AMZN trying to get it called away, but that's all I've got left. After making thousands of dollars per 100 lot, it's time to move on. Lots of great value stocks and dividend payers out there at the moment.

Conclusion

Markets have been extraordinarily difficult to navigate the last few years. All of you should be deep in the green now though, if you've done things right. If you haven't, don't worry, there are many great writers on SA who can help you learn. The markets are unforgiving, but they also teach lessons we don't tend to forget.

It's time to start rotating holdings from the "rate hike cycle ending" trade, and into what I'm calling the "new normal" trade. Rate hikes are close to ending, and markets trade 6-12 months in the future. That means we need to position ourselves for what's happening after they do end.

Consider what this means going forward. Tech has been bought heavily this year and is now at its peak from Dec 21 (XLK). Now is not the time to buy tech. Now is the time to sell it. If you haven't been buying tech since the bottom, you missed out. It's done and over.

Start moving into sectors that will do well when rates drop, and/or when the fear of recession wanes. That's the new normal trade.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)

Though, I'm not buying more here.

GOOG between $115-$119 is a solid buy point. AMZN remains a long-term winner; though a pull pack wouldn't shock me. I get you are a trader, so you have a vastly different approach.

BTW, I have stopped buying tech, but I am not selling any of my GOOGL, or AMZN...or AVGO :)