Enterprise Products Partners: A Significantly Undervalued 7.4% Yield With Tailwinds

Summary

- Enterprise Products Partners LP, a Master Limited Partnership, offers a robust yield of 7.4% and a strong track record of distribution growth, making it a safe high-yield investment option.

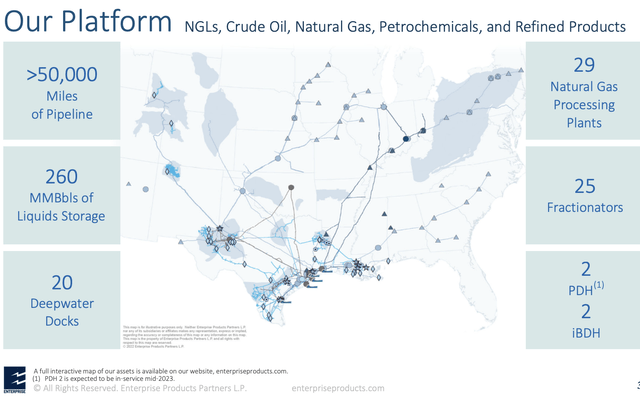

- The company plays a vital role in North American energy infrastructure with an extensive network of pipelines, processing plants, and storage facilities, and is set for long-term success due to its investments in expansions.

- Trading at an attractive valuation and projected to accelerate free cash flow, EPD presents an excellent opportunity for investors seeking a reliable high-yield play in the energy sector.

AlexSecret/iStock via Getty Images

Introduction

Investments with very high yields make me nervous. I've said this in many articles, as I believe there are too many sucker yields on the market. In this case, a sucker yield is an investment with a high yield with a lot of hidden risks. Often, high yields are high for a reason, as investors are pricing in potential weakness down the road or just not interested in owning it - despite its yield.

In this article, I'll discuss a 7.4%-yielding stock with a terrific dividend track record. That company is Enterprise Products Partners LP (NYSE:EPD), a Master Limited Partnership that has become the backbone of the North American energy infrastructure.

The company has a well-covered yield, a fantastic balance sheet, healthy growth, and the ability to generate satisfying long-term total returns.

I truly think it's one of the best high-yield plays on the market.

So, let's dive into the details!

Not A C-Corp

I'm starting this article the same way I started my Energy Transfer LP article by explaining that the company behind the EPD ticker is not a traditional C-Corp. The company is a Master Limited Partnership, which are tax-advantaged entities that connect producers of oil and gas to their customers. This includes storing products, shipping byproducts, and everything else with regard to managing the flow of energy products.

Energy Education

According to PIMCO:

Their core midstream oil and gas pipelines typically employ "toll-road-like" fee-based business models to handle, process and transport oil, natural gas, natural gas liquids ("NGLs") and refined products from the point of production to distribution. The structure of the MLP business model combined with their critical asset base contributes to the industry's high barriers to entry, generally predictable revenues and limited direct commodity price exposure, offering a number of potential benefits for investors.

MLPs are structured as pass-through companies, which means they do not pay corporate taxes. These taxes are borne by unitholders (shares are called units). Hence, investors have to deal with K-1 forms, and a wide range of foreign investors may not be able to invest in EPD.

So, please keep that in mind and assess how this may impact your tax situation.

Also, please note that I still use both dividends and distributions, as I have noticed that it's just easier for some readers to understand. While it's not technically correct, it doesn't really change anything.

Top-Tier Energy Dividends (Distributions)

As the overview above shows, there are many ways to invest in the energy sector. One of them is by buying midstream companies. These companies are less dependent on commodity prices, as they make money on commodity flows.

While extremely subdued commodity prices pose supply risks, it can be said that midstream companies offer much more reliable income compared to oil and gas drillers. These drillers may have more upside if commodity prices skyrocket, yet not everyone is willing to buy volatile income - which makes sense.

EPD is one of the best players in its industry.

The company has a massive network of NGL, crude oil, and natural gas pipelines, petrochemical & refined product services, and related operations that connect producers to customers in the energy industry.

This includes more than 50,000 miles of pipelines, 29 natural gas processing plants, 260 million barrels of storage capacity, 20 deepwater docks, and so much more.

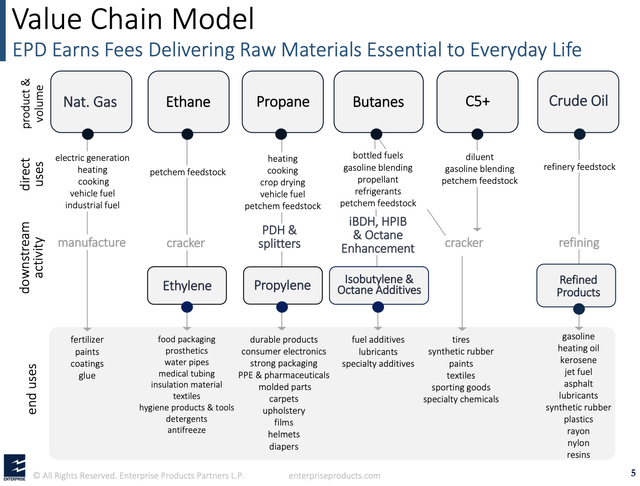

The overview below shows how the company connects producers to customers in various energy segments. Note that the company lists the end products that result from the commodities it transports through its network.

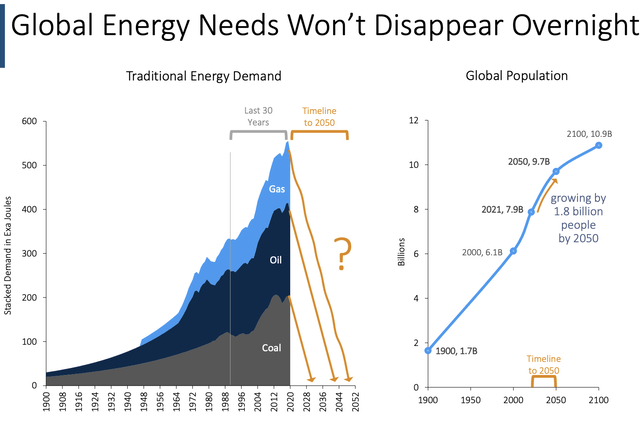

Based on that context, EPD has made one of the best PowerPoint slides I've ever seen (the one below). The company perfectly highlights that the energy transition isn't happening - at least not the way some stakeholder groups expect it to go.

We are now in a situation where we benefit from more than 120 years of investments in affordable energy, which lifted billions out of poverty. While renewable energy is slowly becoming an alternative, there is no way to decarbonize economies by 2050. That's total fantasy. Not only because we cannot easily replace affordable energy sources like coal, oil, and gas but also because the global population is expected to rise by almost two billion by 2050. These people need (affordable) energy.

As America is home to some of the biggest oil, gas, and coal reserves in the world, it is in a great spot to satisfy the expected surge (not decline) in demand. This benefits EPD tremendously.

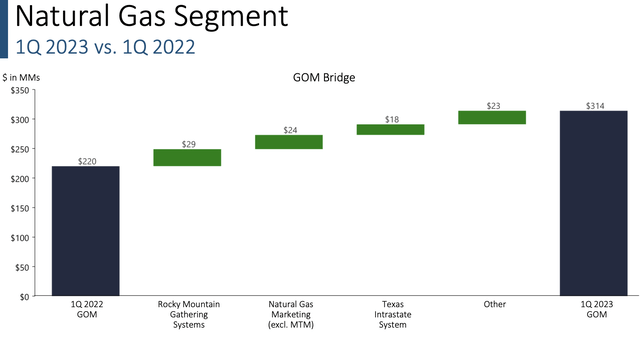

So far this year, EPD has witnessed strong increases in gross operating margins in its NGL and natural gas pipeline businesses, as well as its natural gas marketing and octane enhancement activities.

EPD saw record pipeline and fee-based natural gas processing volumes, record NGL and marine terminal volumes, and almost record total marine terminal volumes. In March alone, its marine terminals loaded over 70 million barrels of NGLs, crude oil, refined products, and petrochemicals for export.

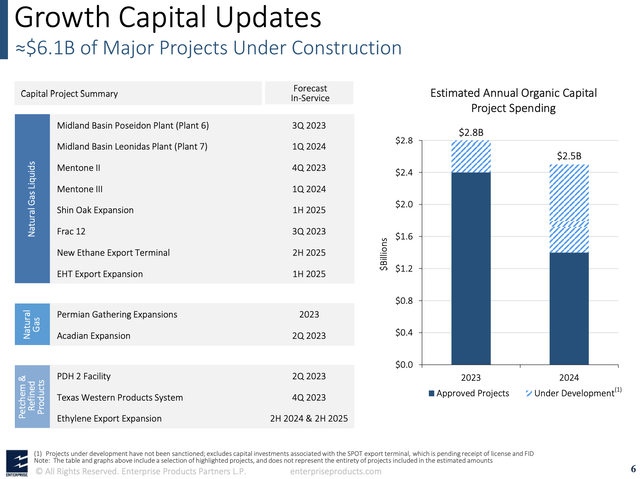

The company is also on track to put around $3.8 billion worth of major projects into service this year.

Notably, in the second quarter, the company will commission PDH 2 and the expansion of the Acadian gas pipeline system. In the second half of the year, they will complete their 19th NGL fractionator, two natural gas processing plants in the Permian, and the first phase of the Texas Western Products Pipeline.

Demand is so high that EPD is essentially running full across all its assets, with the exception of the Rockies.

The company is also significantly expanding its ethane, ethylene, propylene, and LPG systems. They are upgrading export capacity and adding geographic diversity to their ethane export assets with positions at Morgan's Point and Beaumont.

Additionally, EPD is expanding LPG and propylene capacity at its Houston Ship Channel facility by 50%. Ethane exports are experiencing substantial growth in demand by several petrochemical companies in Asia, Europe, and the Americas.

At this point, it is important to mention that EPD has the financial ability to invest in its business, distribute its dividends/distributions, and maintain a healthy balance sheet. The company has done this for decades, and it's one of the few players that did NOT cut its distributions during the energy crash of 2015/2016.

- Enterprise Products Partners expects its growth capital expenditures for 2023 to range between $2.4 billion and $2.8 billion. This projection incorporates potential expenditures related to projects that are currently under development but not yet sanctioned.

- At the end of the first quarter, Enterprise Products Partners' total debt principal outstanding stood at around $28.9 billion, with a weighted-average life of roughly 20 years. The weighted-average cost of its debt is 4.6%, and nearly 97% of the debt is fixed-rate. The company's consolidated liquidity at the end of 1Q23 was roughly $4 billion, including $3.9 billion of availability under credit facilities and $76 million of unrestricted cash. The company has an A- credit rating, which is truly unique in the industry.

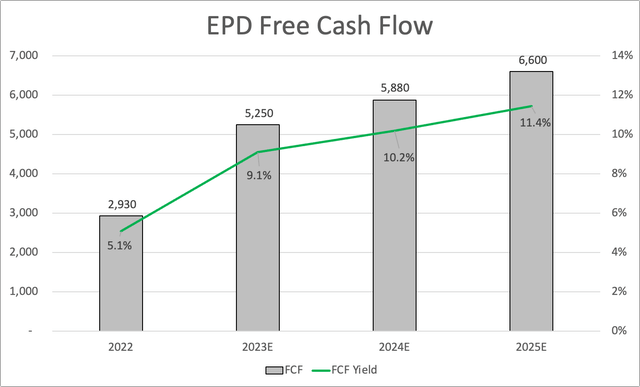

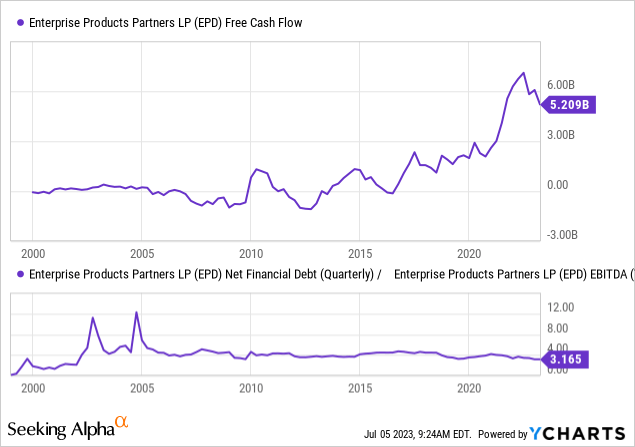

Related to both CapEx and its balance sheet, the company hasn't exposed its investors to a rising net leverage ratio since the early 2000s. Since 2016, the company is consistently free cash flow positive. Despite major new projects, the company generated $5.2 billion in LTM free cash flow.

The A- credit rating is the result of the company's success in sticking to its 2.75-3.25x EBITDA leverage target.

The same goes for dividend/distributions coverage.

In the first quarter, the company reported an adjusted EBITDA of $2.3 billion and generated $1.9 billion of distributable cash flow with 1.8x coverage.

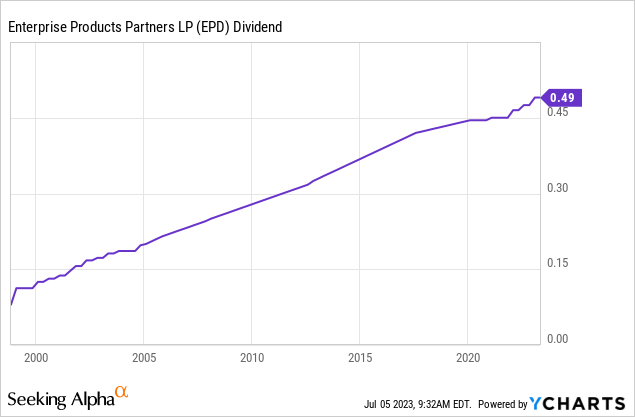

Not only is its 1Q23 dividend/distribution covered, but the company has hiked its dividend for 24 consecutive years with an average annual dividend growth rate of 7%.

In the first quarter, the company hiked its dividend by 5.4%.

Outperformance & Valuation

The company's conservative management has paid off handsomely. Not only is the company able to expand its business and reward investors without sacrificing financial health, but it is also enjoying consistent outperformance.

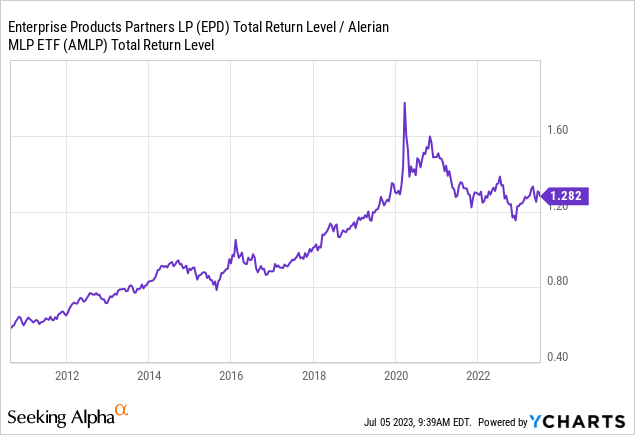

Since the inception of the Alerian MLP ETF (AMLP), EPD has consistently outperformed this ETF.

However, since 2020, it has been unable to outperform, which is the result of increasing industry health. Investors prioritized less healthy companies with better valuations that were expected to become healthier thanks to improved industry fundamentals.

While the company won't likely be able to outperform its peers the way it did before 2020, I think it remains one of the best plays in the industry, mainly because of its safe dividends and conservative management.

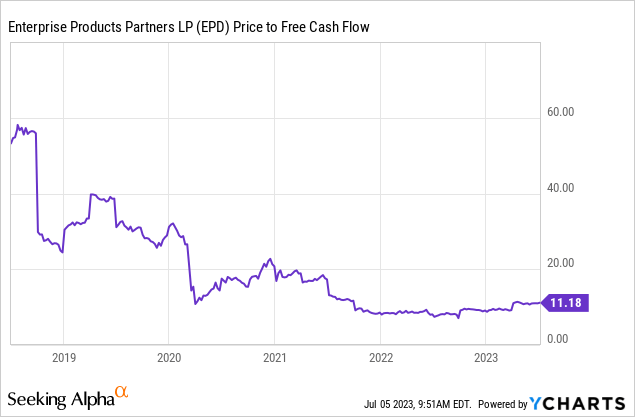

With regard to the company's expansion and strong flows, free cash flow is expected to accelerate by double digits on a multi-year basis.

Next year, free cash flow is expected to reach $5.9 billion, which implies a 10% free cash flow yield. This further improves financial stability and coverage of distributions. It also indicates an attractive valuation.

The company is trading at roughly 10x next year's free cash flow. I believe this is a highly favorable valuation.

The stock is currently trading at $26.50. The consensus price target is $32.30, which is 22% above the current price.

I agree with that and believe that EPD shouldn't trade anywhere below that target.

However, due to economic headwinds, I do not believe in a rapid recovery. That's not a bad thing as it gives investors time to accumulate shares/units at attractive price levels - especially considering its juicy yield. I think that's a good deal.

Takeaway

Investing in high-yield stocks can be risky, but Enterprise Products Partners stands out as a safe and attractive option.

With a robust yield of 7.4% and a strong track record of distribution growth, EPD offers a secure source of income. As a leading Master Limited Partnership, EPD plays a vital role in North American energy infrastructure, boasting an extensive network of pipelines, processing plants, and storage facilities.

The company's investments in expansions and its ability to meet growing energy demand position it for long-term success. EPD's conservative management, demonstrated by its financial stability and consistent outperformance, further enhances its appeal.

Trading at an attractive valuation and projected to accelerate free cash flow, EPD presents an excellent opportunity for investors seeking a reliable high-yield play in the energy sector.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (26)