Asana Drives Ahead With Its Vision For The Future Of Work

Summary

- Asana shows strong financial performance in revenue, customer acquisition, and net retention rate, although it is underperforming competitors like monday.com.

- Asana has a strong focus on enterprise and landed large deals that are cross-functional uses of its platform.

- Asana is positioned to benefit from the emerging generative AI revolution.

Hispanolistic/E+ via Getty Images

Investment Thesis

Asana (NYSE:ASAN) delivered robust financial results in Q1 2024, showcasing strength across multiple key metrics. The company's focus on the large enterprise sector yielded positive outcomes, evident in their successful collaborations with some of the world's leading companies. However, it appears that the market may not fully appreciate the potential growth opportunities in the work management market and the significant product innovations by Asana. Considering these factors, I believe this is a buy rating.

The sales to large enterprises continue to perform

The company experienced substantial revenue growth, with revenues reaching $152.4 million, reflecting a notable 26% increase compared to the previous year. One notable achievement for Asana was its significant progress in improving profitability, as evidenced by a decrease in GAAP operating loss from $96 million to $65.2 million. The company also exhibited improved cash flows, with negative cash flows from operating activities amounting to $14.6 million, a considerable improvement compared to the previous year's figure of $41.1 million. Furthermore, Asana's dedication to maintaining a positive work environment was acknowledged again, as it earned a place on Inc. Magazine's prestigious list of Best Workplaces for the sixth consecutive year.

During the last call, Asana reaffirmed its strategic emphasis on serving enterprise customers. The company reported a significant growth in the number of customers spending $5,000 or more annually in Q1, reaching a total of 19,864, representing a substantial 19% year-over-year increase. Revenues generated from these customers also grew 32% YOY. Similarly, the number of customers spending $100,000 or more annually in Q1 expanded to 510, marking a notable 31% year-over-year growth. Asana's dollar-based net retention rate surpassed 110% in Q1. Moreover, the dollar-based net retention rate for customers with an annualized spend of $100,000 or more exceeded 130%.

While Asana management is glad about its performance, it didn’t do better than competitor Monday.com (MNDY) which increased revenue by 50%. It also grew 75% of customers larger than 50k ARR, and its net dollar retention rate for customers (10 users+) is 125%. Smartsheet (SMAR) grew revenue for 31% which is also faster than Asana.

Asana has shown examples of working with the largest companies in the world

The CEO of Asana seems to place greater importance on achieving significant milestones in terms of the product's capabilities for top-tier corporate clients, rather than solely focusing on sales figures. With each passing quarter, Asana proudly highlights its largest deployment, boasting over 200,000 paid seats—the largest deployment offered by any provider in the market. This impressive achievement demonstrates the robustness of Asana's platform in meeting the needs of enterprise customers.

The management of Asana highlighted their collaborations with CIOs and CEOs to implement their platform across the entire organization, going beyond just marketing or HR departments. Notably, renowned companies such as Forbes, Maersk, New Balance, Navan, and others have embraced Asana for cross-functional purposes and are in the process of expanding its usage to all employees. As Asana continues to attract top-tier organizations, positive word-of-mouth marketing will spread further, facilitating the acquisition of new customers and solidifying Asana's position in the market.

Asana's intention of pushing the best way of working and collaboration

As part of its ongoing development, Asana has introduced Asana Intelligence, an initiative focused on automating work processes, minimizing team friction, and enhancing business outcomes through generative AI. While Asana has usual AI tools such as writing assistants, data generation capabilities, and document summarization features, it also offers recommendation and analytical functions to assist managers in identifying the most optimal next tasks and overcoming obstacles in achieving their goals, which are crucial components of effective work management in any organization. As of now, I think these functions are very unique.

Moreover, Asana actively shares insights and research on work through its Work Innovation Lab, demonstrating their commitment to understanding and improving the dynamics of work. Recently, they released the fourth-annual Anatomy of Work Global Index, providing an in-depth analysis of how work has evolved in a time of rapid volatility. This proactive approach indicates that Asana is striving to establish itself as a leader in reshaping and optimizing the way work is managed. Compared to other providers, Asana's approach appears to be more opinionated, akin to Apple's iPhone in the realm of smartphones.

Price Actions

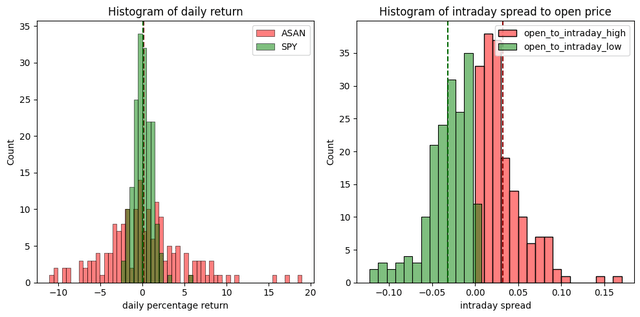

When it comes to price movements, The chart below shows the price action characteristics between 2022-10-17 to 2023-06-30. ASAN has wider daily return fluctuations than the market average, with a standard deviation about 4x of SP500. Most days have positive returns. The stock often traded in an intraday range with most time dropping or raising 3%. When shocking good/bad news comes, you could also see one day raise/fall 10%+. There are also a couple of times it makes explosive gains for around 15%.

Price actions (Author)

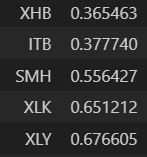

If we calculate the correlation ratio of ASAN prices to all major sector ETFs, ASAN is mostly correlated with sectors like Consumer Discretionary (XLY), Technology (XLK), Homebuilders (XHB), etc. However, no specific sectors have high correlation ratio numbers (the highest is only 0.67).

Correlation (Author)

Risks

Moving forward, Asana does face several notable risks that investors should consider. Firstly, intensified competition with Monday may impact ASAN's margins as both companies vie for market share. Secondly, ASAN's strategy of promoting its cross-functional work management approach could encounter obstacles if the platform's functionalities fail to deliver on their promises, potentially hindering user adoption and growth. Lastly, ASAN's reliance on the strong vision and leadership of CEO and founder Dustin Moskovitz poses a risk. Any negative developments surrounding Moskovitz could potentially impact the stock and investor sentiment. It is important for investors to carefully evaluate these risks when considering an investment in ASAN.

Evaluation

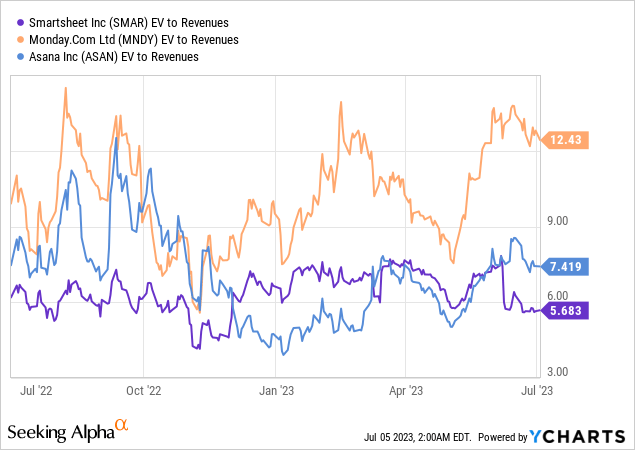

With an EV/Sales ratio of 7.4x, the stock appears reasonably priced in comparison to competitors like Monday and Smartsheet (chart below). The market seems to have set cautious expectations for ASAN. The company has provided revenue guidance of $640.0 million to $648.0 million, reflecting a year-over-year growth of 17% to 18%. Assuming a sustained growth rate of 17% over the next five years and 15% for the subsequent five years, ASAN's revenue could potentially reach approximately $2.4 billion in a decade. Based on the current EV of around $4.45 billion, this projection would result in an EV/revenue multiple of 1.85x in 10 years (assuming no share dilution). In my opinion, ASAN deserve a EV/revenue of 5x given its sales strategy and differentiated product strategy. Therefore, the stock fair value of EV should be 12B indicating a 2.7x return in 10 years.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ASAN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)