Levi Strauss & Co.: An Earnings Surprise Is Likely

Summary

- Despite increasing revenue, iconic apparel company Levi Strauss & Co has experienced a decrease in profitability, with analysts predicting a further decline. However, shares are still considered cheap enough to warrant an upside.

- LEVI stock is expected to announce a decrease in revenue of 8.9% for Q2 2023, compared to the same period in 2022. Net profits are also expected to decline from $49.7 million to $12 million.

- Despite the negative outlook, I still rate Levi Strauss & Co a solid 'buy' candidate due to its cheap shares and the possibility of reporting better-than-expected results.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Justin Sullivan/Getty Images News

For the most part, 2023 has proven to be a really great year for the investment community. But there have been some companies that have been hit rather hard. Whether this is because of a decline in revenue, a drop in profitability, or a mixture of the two, some companies have just been downright pained in recent months. One really great example of this can be seen by looking at Levi Strauss & Co (NYSE:LEVI), one of the most iconic apparel companies on the planet today. Even though revenue continues to increase, bottom line results have been hit hard. On top of this, analysts believe that pain on the top line is just around the corner. While I do think that the picture for the business may not be as appealing as I thought it was previously, I would argue that shares are still cheap enough, even after factoring in anticipated pain, to warrant upside from here.

A look at expectations

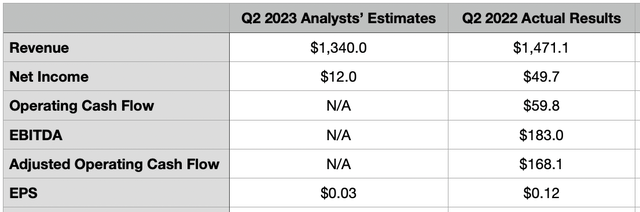

After the market closes on July 6th, the management team at Levi Strauss & Co is expected to announce financial results covering the second quarter of the company's 2023 fiscal year. Analysts do have some rather negative expectations for the company for when it reports. For starters, it's believed that revenue will come in at around $1.34 billion. Although this is a nice chunk of money to you and I, it would represent a decrease of 8.9% compared to the $1.47 billion the company generated the same time last year.

If this comes to fruition, it would be rather surprising. I say this because, frankly, it flies in the face of what the company has achieved recently and it stands in juxtaposition to what management is expecting for this year as a whole. What do I mean by this? Well, for starters, if you look at data covering the first quarter of 2023 compared to the same time last year, you will see that revenue increased from $1.59 billion to $1.69 billion. This 6.1% increase would have been an 8.8% increase had it not been for foreign currency fluctuations. And according to management, the growth year over year was driven by a combination of higher unit sales and higher average selling prices per unit. So there's no sign of weakness on this front at all. As for the 2023 fiscal year in its entirety, management expects revenue to come in at between $6.3 billion and $6.4 billion. That would be an increase of between 1.5% and 3% compared to what the company saw in 2022.

While I have a hard time believing that top line results will conform with analysts' expectations, I have no problem believing that the bottom line for the company will suffer some. The current expectation is for the company to generate earnings per share of only $0.03. This would represent a significant decline from the $0.12 per share that the company generated the same time last year. In absolute dollar terms, this would translate to a decline in net profits from $49.7 million to only $12 million.

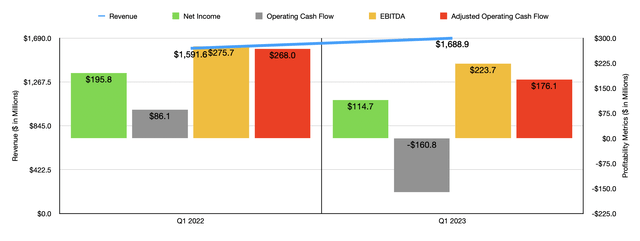

This kind of pain does have a recent precedent to it. During the first quarter of 2023, net income came in at $114.7 million. That represented a decline compared to the $195.8 million the company generated one year earlier. This drop came about in spite of the increase in sales and was driven largely by a decline in the company's gross profit margin from 59.3% to 55.8%. Management stated that foreign currency fluctuations negatively impacted the company's gross profit by about $26 million. Had it not been for this, combined with higher product costs and lower full price sales, the picture for the firm would have been far better. Selling, general, and administrative costs, also rose from 44.6% of sales to 46.5%. Again, foreign currency fluctuations played a significant role here. But management also had higher costs associated with an increase in the volume of goods shipped, higher advertising expenses, and more.

Also during the first quarter of 2023, cash flow data for the company came in worse than it did the year prior. Operating cash flow declined from $86.1 million to negative $160.8 million. On an adjusted basis, it fell from $268 million to $176.1 million. Meanwhile, EBITDA for the company dropped from $275.7 million to $223.7 million. Management did not provide any guidance when it came to these profitability metrics. And analysts have not provided any estimates either. But for context, in the second quarter of last year, operating cash flow was $59.8 million. On an adjusted basis, it was $168.1 million. And finally, EBITDA totaled $183 million.

For 2023 in its entirety, management believes that earnings per share will be between $1.30 and $1.40 on an adjusted basis. This would imply adjusted net profits, at the midpoint, of $540.5 million. That would translate to a small decline compared to the $569.1 million in profits generated in 2022. If we assume that other profitability metrics will decrease at the same rate, we would expect adjusted operating cash flow of $739.3 million and EBITDA of $823.9 million.

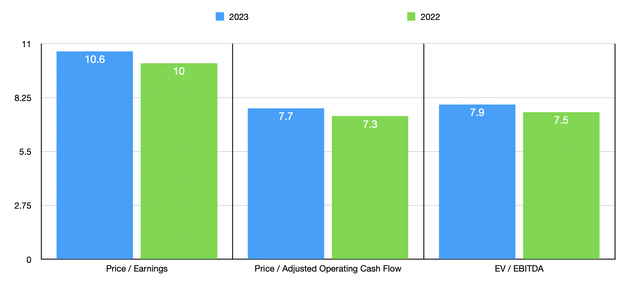

Taking these figures, we can easily value the company. On a forward basis, as you can see in the chart above, shares are trading at a price to earnings multiple of 10.6. This is up from the 10 reading that we get using data from 2022. The price to adjusted operating cash flow multiple should rise from 7.3 to 7.7, while the EV to EBITDA multiple should increase from 7.5 to 7.9. In the table below, I compared the company to five similar firms. Using forward estimates, on a price to earnings basis, Levi Strauss & Co ended up being the most expensive of the group. But when it comes to the price to operating cash flow approach and the EV to EBITDA approach, two of the companies ended up being cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Levi Strauss & Co | 10.6 | 7.7 | 7.9 |

| G-III Apparel (GIII) | 7.4 | 10.6 | 5.4 |

| Capri Holdings Limited (CPRI) | 5.7 | 4.3 | 7.1 |

| Gildan Activewear (GIL) | 10.4 | 8.0 | 9.1 |

| Delta Apparel (DLA) | N/A | N/A | 29.4 |

| Kontoor Brands (KTB) | 9.6 | 7.4 | 8.1 |

Another thing that investors should be paying careful attention to would be share buybacks. As of the end of the most recent quarter, the company had $680 million remaining under its current share repurchase authorization plan. In the first quarter of this year, management allocated only $8.1 million toward buybacks. That's down from the $71.5 million that the company allocated the same quarter one year earlier. And for 2022 in its entirety, management repurchased 8.7 million shares for a combined $172.9 million. I would expect additional share buybacks to have occurred during the second quarter of the year. But just like what we saw for 2023 so far, I would expect the value of repurchases to be lower than they were last year.

Takeaway

All things considered, I understand why the market may not be too keen on Levi Strauss & Co right now. Since I last wrote about the company in late March of this year, the stock has declined by 9.8% at a time when the S&P 500 has shot up 13.2%. The worsening of the bottom line, combined with analysts' negative expectations, have surely done a number on investor sentiment. Having said that, I would be very surprised if the company does not report results above forecasts when it comes to revenue for the second quarter of the year. To not do so would mean that management would likely have to revise lower their expectations for 2023. While this is definitely a possibility, I think it is not terribly likely. And when you consider this possibility, combined with how cheap shares are on an absolute basis, I would argue that the company still makes for a solid 'buy' candidate at this time.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)