Catalyst Pharmaceuticals: Expecting Higher FIRDAPSE Revenues In A Year

Summary

- The company reported record revenues of $85.4 million in 1Q 2023, a 98% YoY increase, and expects its 2Q, 3Q, and 4Q 2023 revenues to be higher than in 1Q.

- The company estimates about 10% of the patients that are taking 80 mg of FIRDAPSE per day may increase their doses to 100 mg after FDA’s approval.

- It can happen in 3Q 2023, increasing CPRX's quarterly and annual revenues by $3.5 million and $14 million, respectively.

- I calculate that each new FIRDAPSE customer, on average, can increase CPRX’s annual revenue by more than $0.28 million.

- More patients in the United States and Canada are expected to start taking FIRDAPSE. Also, by 2Q 2024, patients in Japan might start taking FIRDAPSE.

eyecrave productions/E+ via Getty Images

Year-to-date, Catalyst Pharmaceuticals (NASDAQ:CPRX) stock price is down 25%, despite the company’s strong 1Q 2023 results (however, not as strong as in 4Q 2022), and despite a promising full-year 2023 guidance. Catalyst Pharmaceuticals' financial results are linked to the sales of its two products: FIRDAPSE and FYCOMPA. The former is approved for the treatment of Lambert-Eaton myasthenic syndrome (LEMS) for adults and children ages six and up. The latter is a prescription medicine approved in people with epilepsy aged four and older alone or with other medicines to treat partial-onset seizures with or without secondarily generalized seizures and with other medicines to treat primary generalized tonic-clonic seizures for people with epilepsy aged 12 and older. It is worth noting that the company acquired U.S. commercial rights to FYCOMPA in January 2023.

FIRDAPSE is very competitive and the number of the patient who are taking FIRDAPSE is increasing. FDA’s approval for increasing the maximum 80 mg dose to 100 mg, which is expected to happen in 3Q 2023, can increase CPRX’s annual revenue by $14 million (based on its current customer base). Also, more patients in the United States and Canada are expected to use FIRDAPSE. Furthermore, in the second quarter of 2024, patients in Japan might start taking FIRDAPSE. Besides, FYCOMPA is a known drug, and Catalyst Pharmaceuticals' revenue from FYCOMPA is reliable. The company’s 2Q, 3Q, and 4Q 2023 revenues are expected to be higher than in 1Q 2023. Thus, after a 25% drop in the past six months (partly due to lower FIRDAPSE net product revenue in 1Q 2023 compared with 4Q 2022), CPRX is a strong buy.

Financial outlook, and cash & debt position

In its 1Q 2023 financial results, Catalyst Pharmaceuticals reported record revenues of $85.4 million, up 98% YoY. For the full year of 2023, Catalyst Pharmaceuticals affirmed total revenue guidance of between $375 million to $385 million. Thus, on average, the company’s quarterly revenues in 2Q, 3Q, and 4Q 2023 can be about 17% higher than in 1Q 2023. Also, the company forecasts a non-GAAP full-year 2023 net income of between $195 million and $205 million. Its net income in 1Q 2023 was $46.8 million. Thus, on average, CPRX’s quarterly net income in 2Q, 3Q, and 4Q 2023 can be 9% higher than in 1Q 2023.

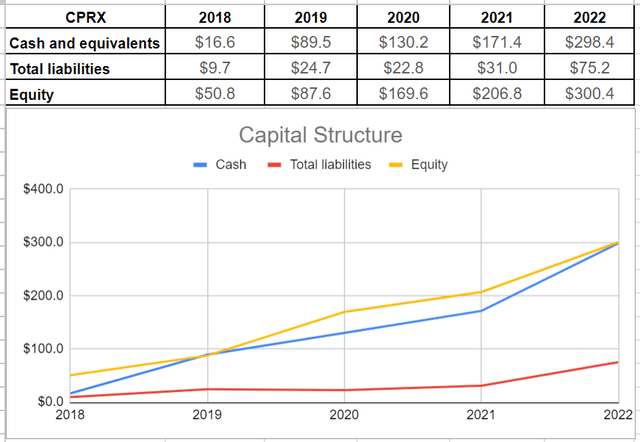

To be more accurate, I have analyzed CPRX’s capital structure during the last few years. We know that pharmaceutical companies are operating in a high-risk and high-reward environment. So, it is of great importance to realize if the company is capable of fulfilling its obligations to decrease its risks. Based on the company’s performance and outlook, it is not surprising to see their balance sheet is strong enough to bring benefits for shareholders. As indicated in Figure 1, the company has increased its cash balance continuously during the last years and ultimately reached $298.4 million at the end of 2022. Additionally, we can see that the management has offered strong business strategies to result in under-control liabilities. CPRX’s total liabilities surged to $75.2 million at the end of 2022 versus $31 million in 2021. It is worth noting that the company’s total liabilities are well beneath its cash balance and equity levels. Finally, their equity level improved considerably by 45% to over $300 million in 2022 versus $206.8 million at the end of 2021. As a result, CPRX’s balance sheet strength paves the way for more equity and debt financing in the future (see Figure 1).

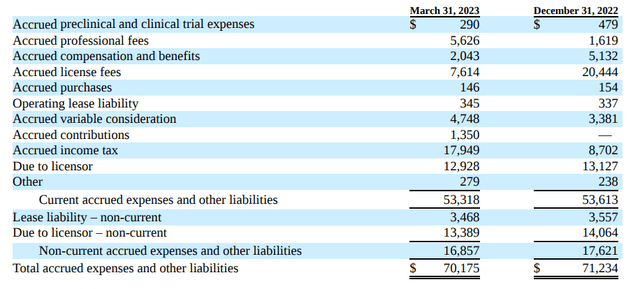

Furthermore, according to Figure 2, which shows the company’s accrued expenses and other liabilities, we can see that current accrued expenses and other liabilities accounted for 76% of CPRX’s total accrued expenses and other liabilities at the end of the first quarter of 2023 and also at the end of the fourth quarter of 2022. It shows that in 1Q 2023, the company’s short-term liabilities didn’t increase, and the management has been trying to control the level of its short-term debt, so a sudden deterioration from its current increasing trend of cash generation does not put the company at great liquidity risks.

Figure 1 - CPRX’s capital structure (in millions)

Author (based on CPRX's annual results)

Figure 2 - Accrued expenses and other liabilities

Author (based on CPRX's 1Q 2023 results)

The market outlook

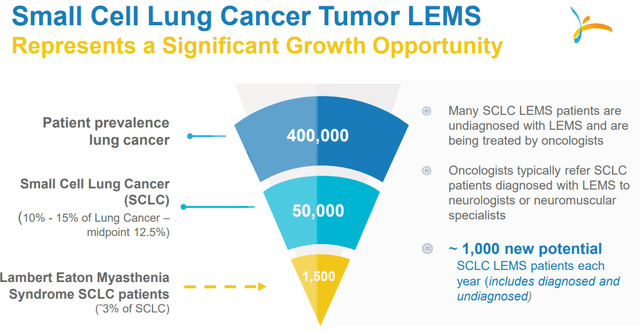

CPRX’s FIRDAPSE has a big competitor, RUZURGI, produced by Jacobus Pharmaceutical Company which has FDA’s approval to treat LEMS patients ages six through sixteen. It is worth mentioning again that CPRX’s FIRDAPSE has FDA approval to treat LEMS patients more than 6 years old. According to drugs.com, 120 tablets (10 mg) of FIRDAPSE are worth about $27000. FIRDAPSE’s label allows a maximum dosage of 80 mg daily in adults and children weighing 99 pounds or more. However, Catalyst Pharmaceuticals is trying to increase the indicated maximum dose for FIRDAPSE from 80 mg per day to 100 mg per day. Based on the feedback received from its recent meeting with FDA, Catalyst believes it now has the information necessary to complete the submission of its supplemental New Drug Application (sNDA) for marketing approval in the U.S. early in the third quarter of 2023. The company estimates that about 10% of patients currently on treatment may seek a higher daily dose. According to the Centers for Disease Control and Prevention (CDC), 3% of the patients suffering from Small Cell Lung Cancer (SCLC) are suffering from LEMS, and the prevalence rate of SCLC in the United States is 5 cases per million population. According to GI Research’s report published almost a year ago, the LEMS market is expected to grow at a CAGR of 6.7% from 2019 to 2027.

LEMS affects about 3000 people in the United States, and more than 800 LEMS-diagnosed patients are treated with FIRDAPSE. There are still about 800 LEMS patients diagnosed but not yet treated with FIRDAPSE. Also, there are about 1400 LEMS undiagnosed or misdiagnosed patients in the United States. Furthermore, many Small Cell Cancer Tumor LEMS patients are undiagnosed with LEMS and are being treated by oncologists. As a result, according to Figure 3, CPRX expects about 1000 new potential SCLC LEMS patients each year (including diagnosed and undiagnosed). Besides, targeting Japan and Canada’s market, CPRX is trying to expand its product sales. In Japan, currently, there is no approved therapy for LEMS, and there are about 1200 to 1300 people in Japan who are suffering from LEMS. CPRX anticipates starting selling FIRDAPSE in Japan in 2Q 2024 and expects to have a 10-year market exclusivity upon approval. In Canada, FIRDAPSE was approved in August 2020. In Canada, about 300 people are suffering from LEMS. As a result, I expect CPRX’s FIRDAPSE revenue to increase significantly in the following quarters. The research has been done, and now is the time for marketing. As there are not many competitors for FIRDAPSE, Catalyst Pharmaceuticals may be able to increase its FIRDAPSE sales in a significant way.

As the price of one 10 mg tablet of FIRDAPSE is about $230, and CPRX’s FIRDAPSE revenue in 1Q 2023 was $57.5 million, I calculate that in 1Q 2023, patients in the United States and Canada have totally used about 2800 tablets per day. The company announced that in the United States, more than 800 LEMS-diagnosed patients are treated with FIRDAPSE. Assuming that in Canada, about 25% of LEMS-diagnosed patients are using FIRDAPSE, (as in the United States about 25% of LEMS-diagnosed patients are using FIRDAPSE), I calculate that in Canada, about 50 patients are using FIRDAPSE. Thus, on average, 850 patients in the United States and Canada took 33 mg of FIRDAPSE per day in 1Q 2023. As the company estimates about 10% of the patients that are taking 80 mg of FIRDAPSE per day may increase their doses to 100 mg after FDA’s approval, CPRX’s FIRDAPSE quarterly revenue can increase by $3.5 million ($14 million annually). Furthermore, I calculate that each new FIRDAPSE customer, on average, can increase CPRX’s FIRDAPSE annual revenue by more than $0.28 million.

Figure 3 - FIRDAPSE growth opportunity

CPRX’s portfolio expansion in the first quarter of 2023 provides a substantial revenue addition for the company. CPRX expects its 2023 FYCOMPA net product revenue to be $130 million (the company expects its 2023 FIRDAPSE net revenue to be $245 to $255 million). FYCOMPA, which is used for the treatment of partial-onset seizures with or without secondarily generalized seizures in patients more than 4 years and is an adjunctive therapy in the treatment of primary generalized tonic-clonic seizures in patients ages more than 12 years, received FDA’s approval in 2012, and has patent exclusivity until at least May 2025, with possible patent protection into 2026. FYCOMPA has a significant market opportunity as epilepsy is the fourth most common neurological disorder. About 3.5 patients in the United States have active epilepsy, increasing by about 150 thousand patients per year. FYCOMPA has a retention rate of more than 70% for adult patients, and a seizure freedom rate of about 72% when used adjunctively. FYCOMPA has been used for more than 10 years and has a well-established customer base. As a result, for now, Catalyst Pharmaceuticals' FYCOMPA revenue is reliable and may continue increasing in the following quarters.

Risks

The company’s current revenue growth is linked to the successful commercialization of its products. Until now, it seems that its products have been marketed well. However, some unexpected negative side effects can hurt the broad acceptance of the company’s products by physicians, patients, and the healthcare community. Also, for now, the company’s products are competitive in the market. But we are experiencing the invention of new drugs every day as the biotechnology and pharmaceutical industries are highly competitive. With more competitors for FIRDAPSE and FYCOMPA, CPRX’s revenue might decrease materially. Another important issue that can hurt the company’s revenue is connected to FIRDAPSE price. Some neuromuscular physicians and a number of LEMS patients are continuing to raise concerns with the pricing of CPRX’s FIRDAPSE. “A few of these patients continue to say negative things about us to the media, to other patients, to the FDA, and to politicians. We cannot assess the impact of these activities on our business,” the company explained in its 2022 annual report. As the target patient population for FIRDAPSE is small, the company needs to achieve significant market share and obtain relatively high per-patient prices for its products to achieve meaningful gross margins. In this condition, losing a few customers can hurt its gross margin in a significant way. Another important risk is related to the company’s other product: FYCOMPA. Because of the risks associated with taking FYCOMPA (some people taking the drug have undergone serious psychiatric and behavioral changes), potential patients may be reluctant to start treatment with FYCOMPA or may stop taking it in the future.

End note

Yes, the company’s FIRDAPSE net product revenues in 1Q 2023 were lower than in 4Q 2022. However, CPRX’s financial results in 2Q, 3Q, and 4Q 2023 are expected to be better than in the first quarter, and a year from now, the number of patients that take FIRDAPSE can be significantly higher. Also, the company’s FYCOMPA revenues are reliable. CPRX stock is a strong buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.