The Dividend Of Four Corners Property Trust Remains Attractive

Summary

- Four Corners Property Trust is offering a nearly 8-year high dividend yield of 5.4%, with a wide margin of safety.

- The REIT has a strong business model, with a 99.9% rent collection and occupancy rate, and 92% of its debt at fixed interest rates, protecting it from interest rate surges.

- Despite a slowdown in acquiring new properties due to high interest rates, the company is expected to grow its FFO per unit by 5% next year and 4% in 2025.

naphtalina/iStock via Getty Images

Almost nine months ago, I recommended purchasing Four Corners Property Trust (NYSE:FCPT) for its 7-year high dividend yield of 5.6% back then and its resilient business model. The dividend of the stock was considered risky by some investors due to a high AFFO payout ratio (82%). Since my article, the REIT has raised its dividend by 2% and has offered a total return of 10.5%. It is now offering a still-attractive dividend yield of 5.4% but its AFFO payout ratio remains high, at 82%. In this article, I will analyze why the stock remains attractive for income-oriented investors.

Business overview

Four Corners Property Trust is a REIT that was spun-off from Darden Restaurants (DRI) eight years ago. It initially had only the properties of the restaurant chain but it has added some properties that do not belong to the restaurant category in recent years. The REIT currently has 1,030 properties across 47 states.

Most REITs are under pressure due to exceptionally high cost inflation, which has significantly increased their operating costs. In addition, the Fed has been raising interest rates at an unprecedented rate since early 2022 in order to cool the economy and restore inflation to healthy levels, around 2.0%-2.5%. As a result, interest rates have soared to multi-year highs and thus they have greatly increased the interest expense of most REITs.

Fortunately for the shareholders of Four Corners Property Trust, this REIT has some key characteristics, which greatly differentiate this REIT from the vast majority of its peers. First of all, Four Corners Property Trust has 92% of its debt at fixed interest rates.

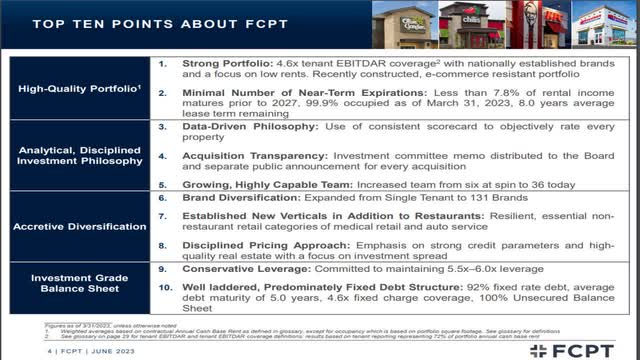

FCPT Overview (Investor Presentation)

Source: Investor Presentation

As a result, the trust is protected from the surge of interest rates to a great extent. To be sure, its net interest expense increased only 12%, from $32.6 million in 2021 to $36.4 million in 2022, and hence it had a limited effect on the results of the REIT in 2022. Indeed, Four Corners Property Trust managed to grow its funds from operations [FFO] per unit 3% last year, from an all-time high of $1.56 in 2021 to a new all-time high of $1.60.

It is also impressive that Four Corners Property Trust has a rent collection rate of 99.9% and an occupancy rate of 99.9%. The vast majority of REITs has occupancy rates lower than 97%. Therefore, the consistent occupancy rates of Four Corners Property Trust around 99.9% are outstanding and confirm the strength of the business model of this high-quality REIT.

It is also worth noting that Four Corners Property Trust has expanded its tenant base from initially one tenant, Darden Restaurants, to 136 tenants. The company has proved highly disciplined in the addition of new tenants, some of which do not belong to the restaurant business. Most of these tenants belong to the medical retail and auto service categories and hence they are essentially immune to the threat of e-commerce, which has taken its toll on the performance of other REITs, such as retail property REITs.

Four Corners Property Trust is currently experiencing deceleration in its business, primarily due to the surge of interest rates, which make it hard to identify attractive new properties to invest in. In fact, this is the exact goal of the Fed. It has raised interest rates to multi-year highs in order to drastically reduce the total amount of investments in the economy and thus cool the economy. The higher the interest rates the fewer the properties that offer yields that are much higher than the prevailing interest rates.

Indeed, in its latest conference call, Four Corners Property Trust mentioned this challenge and stated that its pace of acquiring new properties slowed down significantly in the first quarter of the year. However, management stated that it has a promising pipeline of new properties and thus it expects acquisitions to gain steam in the second and third quarter of this year.

In the first quarter, the REIT grew its cash rental revenues and its EBITDA by 12% and 9%, respectively, over the prior year’s quarter thanks to material rent hikes and acquisitions. However, its adjusted FFO per unit remained flat, at $0.41, primarily due to increased interest expense. Analysts expect similar performance in the upcoming quarters and thus they expect the REIT to grow its FFO per unit by only 1.3% this year, from $1.60 to $1.62.

However, cap rates in the real estate market have improved lately thanks to less intense competition and stricter lending standards. Given also an expected recovery in the pace of acquisition of new properties, Four Corners Property Trust is expected by analysts to grow its FFO per unit by 5% next year and by another 4% in 2025. Overall, the REIT seems to be on a reliable growth trajectory.

Dividend – Debt

As mentioned in the introduction, Four Corners Property Trust is currently offering a nearly 8-year high dividend yield of 5.4%, with an AFFO payout ratio of 82%. A high yield combined with a high payout ratio usually signals that the dividend is at the risk of being cut. However, this is not the case for this REIT.

First of all, Four Corners Property Trust has grown its FFO per unit for 6 consecutive years and is on track to extend its streak this year. In addition, thanks to its high-quality business model, which involves doing business with financially strong tenants, the REIT is resilient to economic downturns. To be sure, in 2020, which was marked by the severe recession caused by the coronavirus crisis, Four Corners Property Trust continued growing its FFO and its dividend.

Moreover, Four Corners Property Trust has a strong balance sheet, as it has an interest coverage ratio of 3.3. Due to the multi-year high interest rates prevailing right now, the interest coverage ratio of Four Corners Property Trust is among the highest in the REIT sector.

Furthermore, Four Corners Property Trust has net debt of $965 million, which is only 44% of the market cap of the REIT. The major credit rating firms have appreciated the solid balance sheet of Four Corners Property Trust and thus they have offered investment grade ratings to the REIT. Fitch has offered a BBB credit rating while Moody’s has offered a Baa3 credit rating to the trust. Overall, Four Corners Property Trust is in a solid financial position, which provides a wide margin of safety for the dividend.

Final thoughts

Since my previous article, almost nine months ago, the stock of Four Corners Property Trust has gained 6.3% and has offered a total return of 10.5% but it remains attractive. The REIT is still offering a nearly 8-year high dividend yield of 5.4%, with a wide margin of safety. On the other hand, investors should be aware that this REIT is growing its FFO per unit consistently, year after year, but at a slow pace. Therefore, the stock is suitable primarily for income-oriented investors.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.