Buy The REIT - Sell The Real Estate

Summary

- While the market is bearish on REITs, those who buy actual real estate don't share the sentiment.

- While REITs normally trade in-line with the value of their properties, a gap has opened up.

- We discuss how to take advantage of this gap.

- Looking for a portfolio of ideas like this one? Members of Portfolio Income Solutions get exclusive access to our subscriber-only portfolios. Learn More »

THEPALMER

Cognitive dissonance has hit the real estate market as people simultaneously love real estate and hate REITs. Physical real estate properties are presently selling for all-time highs while the REITs that own them are selling at fear mongering, recession level multiples. We discussed the cheapness of share prices more thoroughly here, but today I want to discuss the expensiveness of the physical real estate.

When these two facts are put together it creates a rather odd opportunity in which one can buy a REIT at 70 cents on the dollar and then sell its assets at full price.

Allow me to begin by taking a look at a variety of actual real estate transactions.

Real world transactions

The office market has been written off as dead, but big money has come in and paid quite a price tag in the recent SL Green (SLG) Office sale.

"New York City's largest office landlord, said on Monday it sold a 49.9% stake in 245 Park Avenue to a U.S. affiliate of Mori Trust Co. Ltd. at a gross asset valuation of $2.0B."

I highly doubt Mori Trust spent a billion dollars without doing extensive homework. This particular deal came in at about flat to SLG's cost basis, but that is far better than what the market is pricing in.

Office is of course the most fundamentally troubled REIT sector and as we move on to other sectors I think it is clear that real estate values are up substantially.

Gladstone Land (LAND) announced a $6.4 million gain on sale

"It has completed the sale of an unfarmed parcel in Florida for $9.6 million. This provided a 343% return on investment and resulted in a capital gain of approximately $6.4 million."

As this particular land was unfarmed it had no revenues associated with it making the sale clearly accretive to shareholder value. The 343% return on investment was made possible by the HBU style of the sale as this land was well located for development. As such it is not indicative of general farmland throughout the country.

However, a series of sales from Farmland Partners (FPI) demonstrates that farmland has broadly appreciated to all-time highs even when it is sold to remain as farmland.

On April 4th,

"Farmland Partners Inc. announced that it sold 862 acres of farmland in White County, Arkansas, for $3.7 million - an approximate gain of 24% over net book value."

On May 15th,

announced that it sold 2,426 acres of farmland in Nebraska and South Carolina to the tenants who rented the properties. The transactions totaled $16.2 million and represented a total gain on sale of more than $3.1 million, or approximately 24% over net book value."

On June 9th,

announced that it has sold 1,370 acres of farmland stretching across four farms in Arkansas, Georgia, Illinois, and South Carolina. The transactions totaled $8.9 million and resulted in a cumulative gain on sale of $3.7 million - approximately 73% over net book value."

On June 29th, FPI announced

"farmland transactions include sale of ~$19.9M worth of seven farms, which helped the company achieve a gain of more than 26%."

Keep in mind that in GAAP accounting, farmland does not depreciate. So a 26% gain on sale literally means they sold it for 26% more than they bought it for.

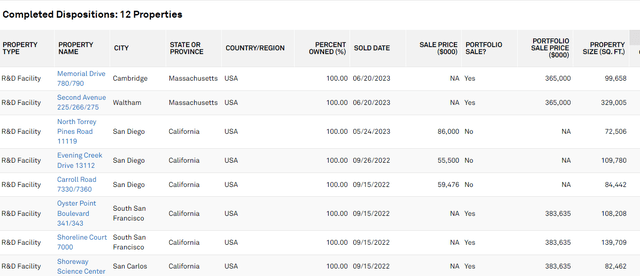

Life Science Real Estate Gains

Alexandria (ARE) has been an active seller to internally fund its development pipeline. Even as ARE stock is surrounding by doom and gloom, the company's AFFO/share continues to rise at a good clip, rental rates are increasing and their disposition activity shows a clear demand for life science real estate.

S&P Global Market Intelligence

That is $1.015 Billion of sales at an average sale price of $989 per square foot and a cap rate in the high 4s. Why might one buy at a cap rate in the 4s when parts of the Treasury curve are north of 5%?

Because the buyers anticipate long term growth.

Multifamily real estate

Apartments have raised rents substantially over the past few years which has taken property values to close to all-time highs.

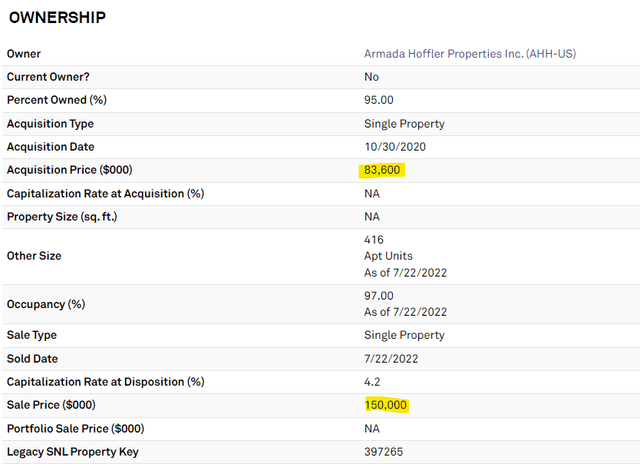

Armada Hoffler (AHH) sold Annapolis Junction for $150 million. Records show a cost basis of $83.6 million highlighted below.

S&P Global Market Intelligence

The sale price represents a 4.2% exit cap rate.

Industrial

So far it has been REITs selling, but in this instance, it is a REIT buying. Prologis (PLD) recently bought $3.1B of industrial real estate at a 4% cap rate.

"Prologis to acquire nearly 14 million square feet of industrial properties from opportunistic real estate funds affiliated with Blackstone for $3.1 billion, funded by cash. The acquisition price represents an approximately 4% cap rate in the first year and a 5.75% cap rate when adjusting to today's market rents."

In all of these examples there is a recurring theme I am wanting to drive home. In every case it is a very well capitalized buyer who is under no obligation to transact.

- Forced sales happen frequently and can result in adverse pricing.

- Forced buys don't really happen.

In each case, it is a sophisticated buyer coming in and after extensive underwriting they determine the properties will generate ample return even at these all-time high prices.

There is nobody on the planet that knows more about industrial real estate than Prologis, so if they are willing to buy today at a 4 cap, it makes me feel great about owning STAG Industrial (STAG) at a 6.5% FFO yield and owning Plymouth Industrial (PLYM) at an 8.1% FFO yield.

The gap between REIT pricing and real estate pricing

As of 6/28/23, the median REIT trades at 77% of net asset value (NAV). Some are trading at half of NAV. The market justifies this discount by saying property prices have come down since the most recent NAV estimates, but that just isn't the case. Every week I see new transactions coming in at all-time high prices. I would estimate the new average is closer to 75% of today's NAV.

With the rise in interest rates, cap rates are rising. The market has misinterpreted this to mean that NAV's are falling.

Recall that NAV is net operating income divided by cap rate. So yes, the denominator is higher now, but so is the numerator. Rental rates are up across 18 of the 20 real estate sectors (office and malls are flattish in rent with occupancy down making NOI down). The rest are up in NOI.

The higher NOI balances out the higher cap rates and in the stronger sectors more than balances out the cap rate delta.

So what has happened is REITs have sold off while real estate continues to appreciate in value. The result is an enormous gap between stock prices and the value of the underlying assets.

How to take advantage of the dissonance between REIT pricing and real estate pricing

Leveraged buyouts (LBOs) will resurface in popularity. Private equity or other well capitalized entities are likely to start coming in, buying the discounted REITs and selling their properties to net the delta between NAV and market price.

As individual investors, the LBO business model is not feasible to execute. There are, however, some other ways to do it.

1) Buying REITs that LBO themselves.

Farmland Partners is actively selling assets and using the proceeds to buy back its stock. Last I calculated, it has bought back close to 1/3 of outstanding shares by selling assets at a premium to NAV and buying shares back at discounts to NAV ranging from 55% to 25%.

SL Green is another company LBOing itself. I still view office as too risky to want to do it personally, but for those who feel they can understand the trajectory and have the stomach for risk it could be quite opportunistic.

2) Buying REITs that are positioned to be subject to M&A

Top of our list for REITs positioned to get bought out are Plymouth Industrial, Global Medical REIT (GMRE), Broadstone Net Lease (BNL) and one of the cheap grocery anchored shopping center REITs, Brixmor (BRX), or Kite Realty (KRG).

3) Patience

Eventually, market prices move to intrinsic value. The patient investor can buy high quality discounted assets and wait until prices reflect asset values. Whether it takes months or years is unknown, but I am happy to collect dividends while I wait.

Opportunistic Market Sale: 20% off for a limited time!

Right now there are abnormally great investment opportunities. With the market crash, some fundamentally strong stocks have gotten outrageously cheap and I want to show you how to take advantage and slingshot out of the dip.

To encourage readers to get in at this time of enhanced opportunity we are offering a limited time 20% discount to Portfolio Income Solutions. Our portfolio is freshly updated and chock full of babies that were thrown out with the market bathwater.

Grab your free trial today while these stocks are still cheap!

This article was written by

2nd Market Capital Advisory specializes in the analysis and trading of real estate securities. Through a selective process and consideration of market dynamics, we aim to construct portfolios for rising streams of dividend income and capital appreciation.

Our Portfolio Income Solutions Marketplace service provides stock picks, extensive analysis and data sheets to help enhance the returns of do-it-yourself investors.

Investment Advisory Services

We now offer a variety of ways to invest with us. Our focus is on maximizing client returns while staying within risk their risk parameters. To learn more about our advisory services you may schedule a 15 minute intro meeting here: https://calendly.com/2mc/intro

Dane Bowler, along with fellow SA contributors Simon Bowler and Ross Bowler, is an investment advisory representative of 2nd Market Capital Advisory Corporation (2MCAC). As a state registered investment advisor, 2MCAC is a fiduciary to our advisory clients.

Full Disclosure. All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of the specific person. Please see our SA Disclosure Statement for our Full Disclaimer.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AHH, ARE, BNL, FPI, PLYM, STAG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person. Readers should verify all claims and do their own due diligence before investing in any securities, including those mentioned in the article. NEVER make an investment decision based solely on the information provided in our articles. It should not be assumed that any of the securities transactions or holdings discussed were profitable or will prove to be profitable. Past Performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions. Commentary may contain forward looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article. S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P 2nd Market Capital Advisory Corporation (2MCAC) is a Wisconsin registered investment advisor. Dane Bowler is an investment advisor representative of 2nd Market Capital Advisory Corporation.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)