Alliance Resource Partners: Coal Is Not Dead

Summary

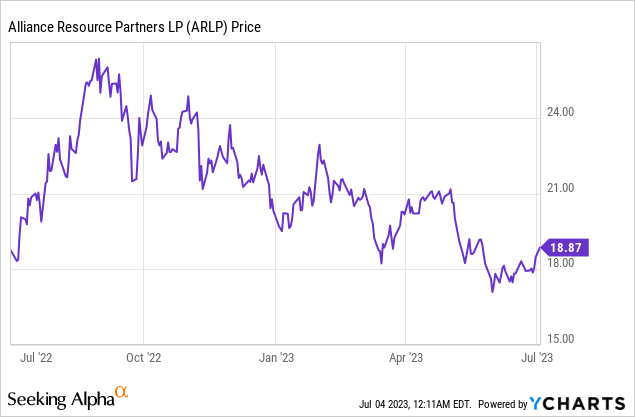

- Alliance Resource Partners is now down nearly 30% from its 52-week high last September, as easing inflation and a potential economic slowdown weighs on market sentiment.

- Despite the negative public perception of coal and the rapidly growing adoption of renewable energy, global coal consumption has actually increased by 66.7% in the past two decades.

- Global coal demand should hold up much better than expected, as the capacity of renewable energy remains uncertain, while electricity usage in China and India continues to increase.

Ingrid_Hendriksen

Investment Thesis

After a stellar run from 2020 to 2022, Alliance Resource Partners (NASDAQ:ARLP) has pulled back nearly 30% since last September, as easing inflation and a potential economic slowdown are weighing on sentiment. The market is also concerned about the outlook of coal amid the growing adoption of renewable energy.

However, the current pessimism seems exaggerated and the demand for coal will likely hold up much better than the market's expectations. The capacity of US renewable energy remains questionable and coal consumption in Asia is expected to trend upwards amid ongoing economic expansion.

The Outlook Of Coal

Alliance Resource Partners is one of the largest coal companies in the US, currently with 7 underground mining complexes across the country generating 36 million to 38 million tons of coal annually. The company has also been expanding into oil & gas minerals (which generate royalties) to diversify its business, but the majority of its revenue still comes from coal operations.

The public reception of coal has been deteriorating in the past few years due to the rising emphasis on sustainability, and many suggest that coal will be "dead" soon. However, coal still plays a crucial part in energy generation and its global demand should hold up much better than most expected.

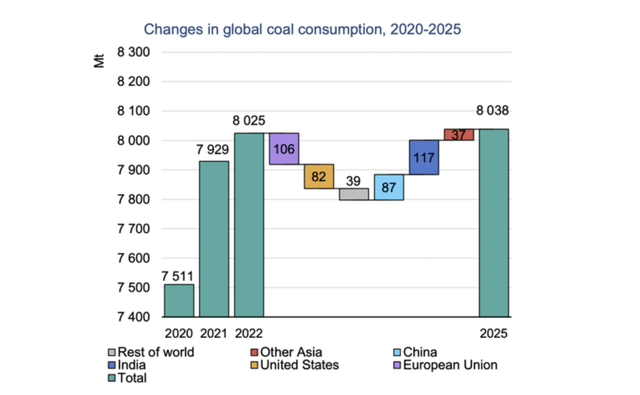

Despite the ongoing discussions around its negative externalities, global coal consumption has been rising consistently in the past two decades, up 66.7% from just 4,800 million tons in 2000 to roughly 8,000 million tons in 2022, according to the IEA (International Energy Agency). Due to the unprecedented energy crisis in Europe amid the Russia and Ukraine war, coal consumption actually reached an all-time high last year, up 1.2% from 2021.

Global coal consumption will likely moderate slightly moving forward, but I do not see consumption plummeting in the near term. Most of the expected decline is attributed to Europe, as the region continues its shift to renewable energy. Consumption in the US will likely see a drop as well, but the magnitude largely depends on the pace of the energy transition, which continues to be uncertain.

The country's adoption of renewable energy has been growing rapidly in the past few years, but whether it has sufficient capacity to handle the rising electricity usage remains highly questionable. For instance, renewable energy and nuclear together only accounted for around 40% of electricity generation in 2022, while coal still accounted for nearly 20%, according to the EIA (Energy Information Administration). If the transition to renewable energy stumbles, coal consumption in the US will likely reaccelerate meaningfully.

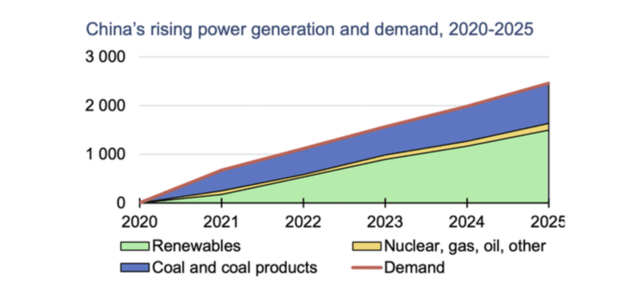

On the other hand, the demand in Asia will likely remain strong, particularly in China and India. Unlike the West, China still relies heavily on coal as its primary energy generation source. According to Statista, coal accounted for around 61% of its energy consumption in 2022. The country has also been investing heavily in renewable energy such as wind and solar, but their capacity is currently too low to meet the substantial energy demand.

While the country's reopening has been softer than expected, it is still expected to grow real GDP by 5.4% in 2023 and 5.1% in 2024, which should provide solid support for coal consumption. As shown in the chart below, the demand for coal and renewable energy will likely increase together moving forward.

I believe the biggest growth driver for coal should come from India's booming economy. The country is currently the second-largest coal consumer in the world, only behind China. India is expected to lead the world in real GDP growth at 6% in 2023 and 7% in 2024, according to the OECD (Organisation for Economic Co-operation and Development).

The country has also been attracting foreign investments from manufacturing companies such as Foxconn, Apple's (AAPL) largest supplier, which should further boost its economic activity. The ongoing economic expansion is poised to significantly drive up electricity usage, which subsequently boosts the demand for coal. For instance, 75% of the country's electricity was generated by coal-firing plants in 2022, according to India's Ministry of Coal.

The strong demand for coal from India, China, and other Asia countries will likely offset the declining consumption from Europe and the US. As shown in the chart below, the IEA expects global consumption of coal to be roughly flat from now till 2025, which should provide a solid support for coal prices.

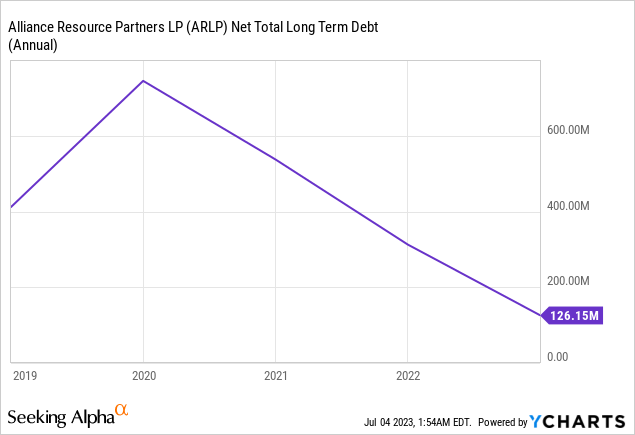

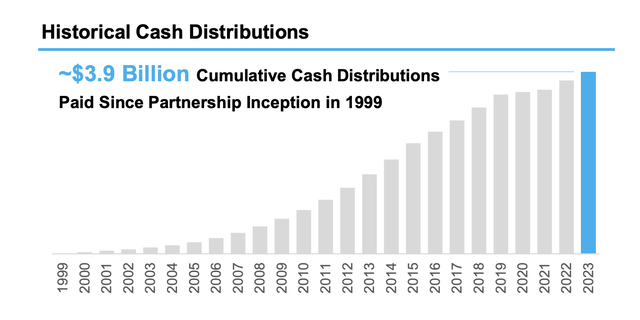

Strong Balance Sheet

Alliance Resource Partners is also a well-managed company with a strong balance sheet. Thanks to the substantial amount of cash generated in the past three years, the company's net long-term debt has declined from over $700 million to just roughly $126 million in the latest quarter, as shown in the first chart below. The current net leverage ratio of 0.19x gives management ample financial flexibility for share repurchase, dividends, or to further scale its investments in oil & gas. As shown in the second chart below, the company has cumulatively returned $3.9 billion to shareholders since 1999 and should continue to do so.

Alliance Resource Partners

Investors Takeaway

I believe the market is way too pessimistic on the outlook of coal. Global coal consumption just hit an all-time high last year and will likely stay at current levels in the next few years. Europe will be a drag on future consumption but the uncertainties around the capacity of US renewable energy and the rising electricity usage of China and India will likely offset that weakness.

Besides, 93% of sales for FY23 and 63% of sales for FY24 are already locked in, which provides further downside protection in the near term. Considering the company's EV/EBITDA ratio of just 2.5x, I believe the current price presents an attractive risk-to-reward ratio. Not to mention the company also pays a fat dividend yield while investors wait for the upside to materialize. Therefore I rate Alliance Resource Partners as a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.