Gravity: Attractive Upside And Minimal Near-Term Risks

Summary

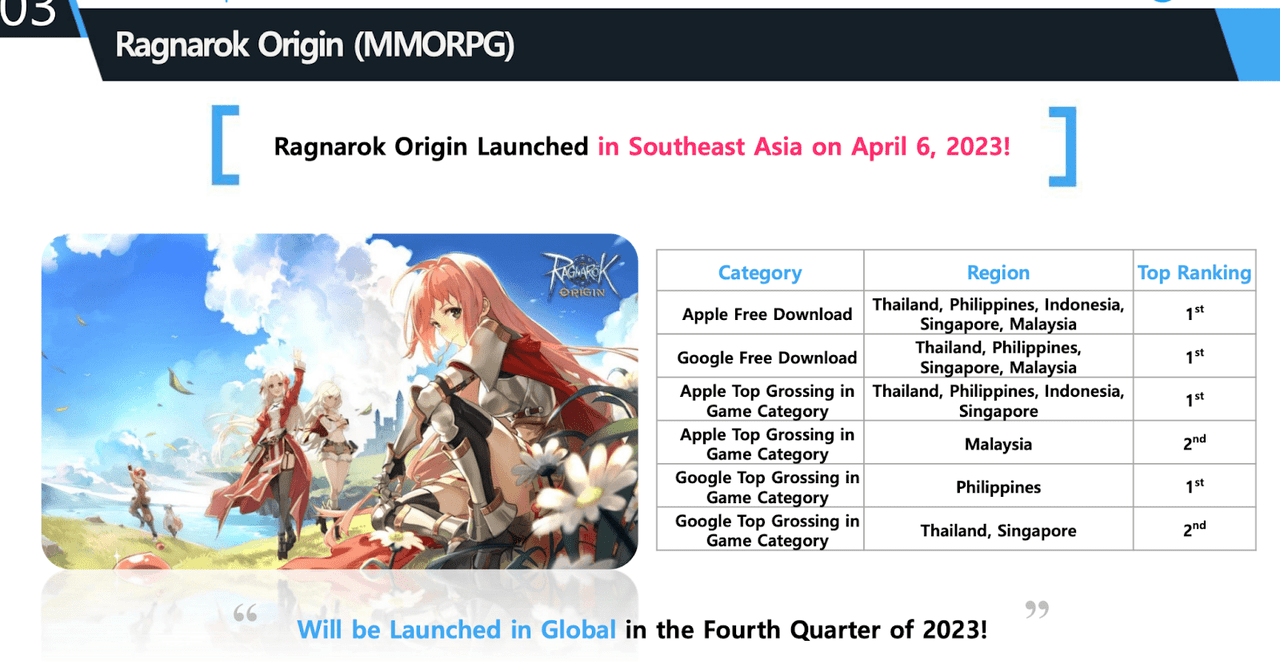

- I expect GRVY to see continuing growth due to the Ragnarok Origin launches in Southeast Asia in April and Global market, including the US, in Q4.

- GRVY has continued to display strong fundamentals as of Q1. Near-term risk remains minimal.

- At $70 per share today, GRVY stock is undervalued in my opinion. I rate GRVY a buy.

Edwin Tan

Gravity (NASDAQ:GRVY) is a South Korean developer and publisher of online and mobile games. Its core product, Ragnarok Online, is a popular Massively Multiplayer Online Role-Playing Game / MMORPG in many markets - primarily in Asia - and is currently available in 91 markets.

I first covered GRVY in June 2020, when I assigned the stock a buy rating given the projected upside potential from the release of a new update for one of its flagship Ragnarok games at the time. Though the journey has been volatile since then, the stock is up ~24% from my initial coverage price. YTD, it has also been up by ~67% as it seems to have benefited from some tailwinds.

I maintain my buy rating for the stock. Trading at $70 per share today, I believe that the stock is undervalued. Even under a relatively conservative bull case assumption, the stock still offers a ~14% upside in FY 2023 based on my target price model.

Catalyst

As a game developer, GRVY’s success has been attributed to Ragnarok, one of the most famous MMORPG franchises in Asia with a global user base. Ragnarok’s value as an asset is reflected in GRVY’s steady double-digit growth, operating margin, and strong balance sheet over the years.

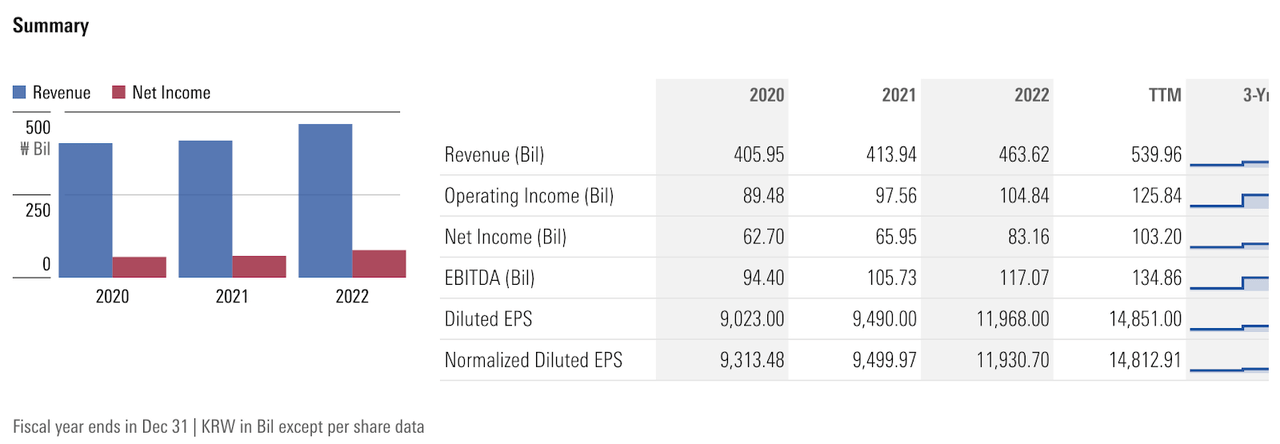

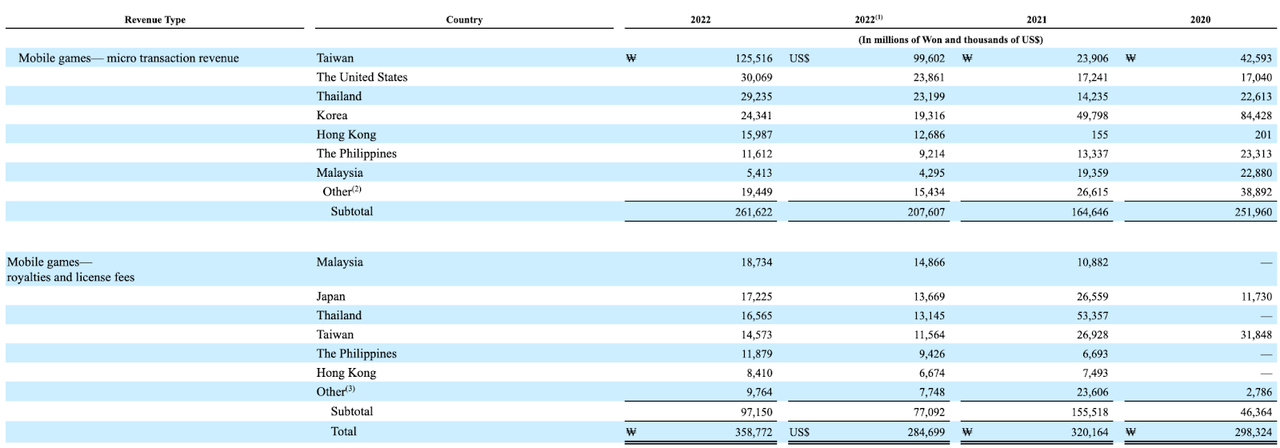

GRVY generates over 77% of its revenue from the mobile games business, primarily through fees from microtransactions. In FY 2022, revenue grew by ~12% to ~$368 million (463.62 billion KRW) while the operating margin remained steady above 22%. Net profit has been positive and expanding in the last few years.

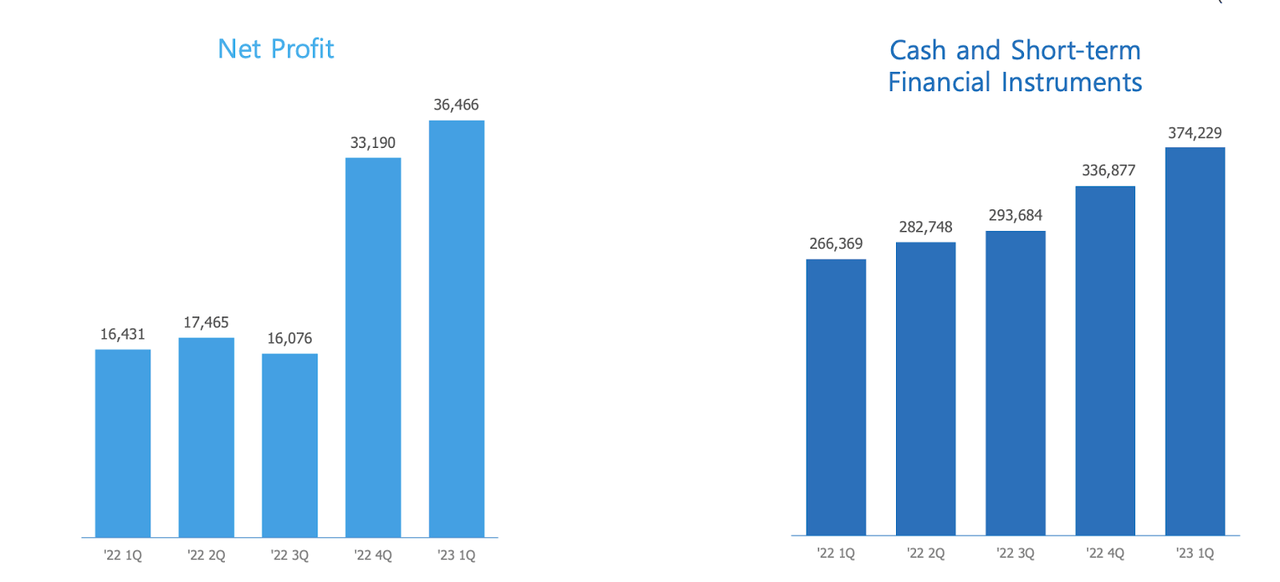

Furthermore, GRVY has no debt and has been relying on cash generated from its operations to sustain its business. Cash balance stood at ~$286 million (~374 billion KRW) as of Q1, expanding by over 40% YoY.

Given the established brand reputation, GRVY's additional launches and updates of either of its three flagship games - Ragnarok Origins / RO, Ragnarok M: Eternal Love / RMEL, and Ragnarok X: Next Generation / RXNG - are always anticipated and expected to drive high engagement from its users. As such, I consider these periodic launches and updates key catalysts for GRVY.

Most recently, GRVY saw an ~86% YoY revenue growth in Q1, driven by the revenues from the RXNG launch in Korea and from the RO launch in Taiwan, Hong Kong, and Macau. Historically, these geographic markets have also contributed a lot to GRVY’s growth.

In Q2 and beyond, I expect GRVY to see continuing growth from the RO launch in Southeast Asia / SEA as well as the global launch of RO in Q4, which will cover the USA. Since SEA’s RO launch happened in April, just a month after GRVY wrapped up its Q1 earnings report, I would expect a strong Q2 as revenues from SEA - primarily from Thailand, and the Philippines - start to flow into the business by then.

As it stands, Thailand, USA, and the Philippines count as other key markets that have contributed greatly to GRVY’s mobile games revenue growth. Overall, I believe that GRVY will also benefit from nurturing the USA, Hong Kong, and Taiwan markets further, given the attractive growth there over the recent years. In addition, users in those developed markets tend to have higher disposable income than most users in emerging markets like SEA, effectively presenting higher ARPU potential.

Risk

I believe that near-term risk remains minimal as momentum from the new launches is likely to continue into FY 2023. While there may probably be an argument about concentration risk due to GRVY’s high dependencies on the Ragnarok brand to generate its revenues, GRVY has continued to prove that it has the expertise in developing and publishing high-quality games across various genres.

Its track record of delivering successful titles, such as RO and RXNG, has garnered a loyal and dedicated fan base, further mitigating the risk associated with its dependence on a single brand.

Valuation / Pricing

My target price for GRVY is driven by the following assumptions for the bull vs bear scenarios of the FY 2023 target price model:

Bull scenario (80% probability) assumptions - GRVY to finish FY 2023 with an EPS of ~$13 (~16,963 KRW), reflecting a 50% YoY growth.

Bear scenario (20% probability) assumptions - GRVY to finish FY 2023 with an EPS of $10, reflecting a 10% YoY growth.

I assign GRVY a P/E of ~6.2x across both scenarios, which is where it is currently trading. My assumption for the bull scenario is also a little conservative, considering that annualizing the Q1’s EPS of 5,248 KRW (~$4) would yield a higher FY 2023 EPS of ~$16. Last year in FY 2022, GRVY also ended up with a higher end-year EPS (11,930 KRW) than if we were to project an end-year EPS based on its annualized Q1 EPS (9,460 KRW).

author's own analysis

Consolidating all the information above into my model, I arrived at an FY 2023 weighted target price of ~$80 per share. With GRVY trading around $70 per share recently, the stock presents ~14% upside.

I maintain my buy rating for the stock. Given the outsized growth across revenue and earnings in Q1 as well as the upcoming catalysts, it seems likely that EPS will expand quite meaningfully in FY 2023, as it did in FY 2022. However, the bull scenario for my FY 2023 target price model is even still relatively conservative compared to how things turned out in FY 2022.

Conclusion

GRVY's success has primarily been driven by its popular MMORPG franchise, Ragnarok. This has been resulting in steady growth, strong financial performance, and a solid balance sheet for the company. Looking ahead, I anticipate further growth from the launch of RO in SEA and the global launch in the US, which are expected to contribute to GRVY's expansion.

Considering the minimal near-term risks and the projected growth opportunities, I maintain my buy rating. I have arrived at a weighted target price of approximately $80 per share for FY 2023. With the stock currently trading around $70 per share, this suggests a potential upside of ~14%.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.