Hexagon Composites ASA: Independence Day

Summary

- Norwegian Hexagon Composites (HC) is set to de-consolidate its stock-listed daughter company Hexagon Purus (HP), which is active in the Battery Electric Vehicle and Hydrogen business.

- HC will remain in the natural gas distribution and fuelling business, and the article discusses operational and commercial developments for both entities post-deconsolidation.

- HC's remaining businesses include Hexagon Agility, Hexagon Ragasco, and Hexagon Digital Wave, while HP covers all activities related to hydrogen and batteries.

gremlin

This article is not about a gigantic alien invasion and a former US Airforce pilot with current residence in the White House, but instead about Norwegian Hexagon Composites (OTCPK:HXGCF), hereafter just HC, and its also stock-listed (soon ex-)daughter company Hexagon Purus (OTCPK:HPURF), hereafter just Purus or HP – or rather how their relationship developed over the past couple of months ending with the upcoming de-consolidation of HP from HC’s financial statements.

Thus, at the very early innings of 3q23 we have a stand-alone Hexagon Purus entity that is active in the Battery Electric Vehicle and Hydrogen business, and HC excluding Purus (hereafter HCxP, and starting early July basically equivalent to HC) in the natural gas distribution and fuelling business.

This article is also about some operational and commercial developments for both remaining entities.

As a result, this article is structured as follows:

- Quick overview of the business of HC – readers familiar with the company or my previous coverage may skip this part. Readers interested in an in-depth discussion of all of HC’s activities may read my inaugural article published in October 2022.For the avoidance of doubt, this overview is reflecting HC’s group structure at the beginning of the year.

- Overview of how the group’s structure developed in 2023 leading to the substantially reduced share of HC in HP.

- Large commercial developments at HP before the transactions, thus impacting HC shareholders.

- Commercial developments at HCxP

- Valuation of HCxP and HP.

Here we go:

Introduction – Segments

In this article I will only briefly recall the offerings of Hexagon Composites Group and refer readers to the first article for more details.

In order to facilitate direct references to the key businesses, here is a quick introduction into the (IFRS reporting) segments of Hexagon Composites Group (or simply Hexagon or even just HC):

Hexagon Agility (2022 Revenue of NOK 3.5bn)

Offers type 4 cylinders for mobile pipelines operators of natural gas, where type 4 refers to the generation of cylinders used for gas transportation and storage. These cylinders are made of composite materials (e.g., by combining a carbon fiber reinforced plastic structure with an internal liner made of gas-tight, polyethylene plastic). Mobile pipeline cylinders are up to 40 feet long.

Agility also sells type 4 cylinders to truck makers that fit their vehicles with natural gas engines that require storage of gas as a fuel. Here, products of Agility’s customers range from HDV (heavy duty vehicles), including refuse trucks, over to transit buses.

Hexagon Ragasco (2022 Revenue of NOK 0.7bn)

Sells small cylinders used for both leisure activities (barbecue, camping) and basic needs (cooking in global regions with weak infrastructure) that rely on LPG (liquefied petroleum gas). Customers involve individuals as well as business customers in LPG distribution and forklift suppliers.

Ragasco is the only end consumer facing business of Hexagon.

Hexagon Digital Wave (2022 Revenue of NOK 0.1bn)

Digital Wave manufactures UE (Ultrasonic Examination) cylinder testing equipment and MAE (Modal Acoustic Emission) testing equipment. It also provides associated inspection services. Its customers include government entities, academic institutes, and private clients in the compressed gas and pressure vessel industries.

Digital Wave has the most significant share of service offering and is referred to by management as an asset-light business.

Hexagon Purus (2022 Revenue of NOK 0.96bn)

Hexagon Purus is a stock listed entity, of which Hexagon Composites Group 73.3% at YE2022. This segment covers all activities covering hydrogen and batteries. Similar to Agility, it offers mobile pipeline cylinders as well as on board storage solutions – the range of vehicles is quite wide, covering trucks, cars, marine vessels and trains.

Purus itself does not report any segments, however Purus management regularly provides financial information about what they refer to as the “Wystrach business”, named after the 2021 acquired specialist provider of mobile pipeline and storage solutions for hydrogen.

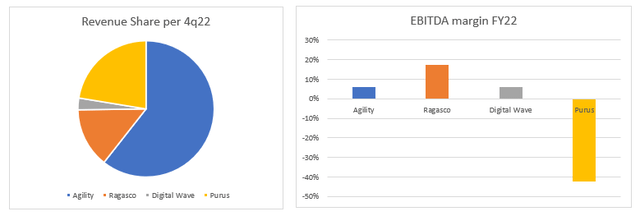

Contribution to Group Financials

The four segments are of significantly different size, grow at significantly different rates and operate at significantly different profitability levels. For its basic capital market communication, HC uses revenue (and revenue growth) as well as unadjusted EBITDA margins. The following graphs show the contribution of each segment (and on a fully consolidated basis for Purus):

Hexagon Segments by Size (Author)

Ownership and Purus Situation

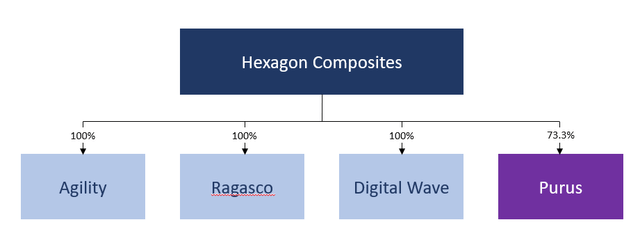

At the start of 2023, Hexagon Group had the following shares in its businesses:

Ownership of key business (Author)

At the time, the group also held – and still holds – 40% stakes in two entities developing solutions to store gases in liquid form, but both of them are currently in product development stage only. I thus will not address these entities (Cryoshelter) any further. But for the avoidance of doubt: natural gas storage is HCxP’s business and hydrogen storage is HP’s business.

In the past, HC management had stated may times that they will reduce the group’s share in Hexagon Purus to below 50% over time, but they did not give any roadmap.

However, things became much more specific during the first six months of 2023:

Convertible Bond Private Placement and Equity Private Placement

On March 1, 2023 Hexagon Purus announced a set of joint capital measures the successful completion of which it announced on March 2, 2023:

- HP privately issued some 18.5 million new shares at NOK 27 each for gross proceeds of about NOK 18 million (NOK referring to the Norwegian Krone)

- Further, Purus completed a Convertible Bond Private Placement, raising gross proceeds of approximately NOK 800 million.

- Of that NOK 800 million, NOK 500 million were bought by Mitsui & Co., Ltd. (OTCPK:MITSY). Per the latter announcement, the transaction with Mitsui is accompanied by a “Memorandum of Understanding for additional investments of up to NOK 1,500 million in the coming years, making Mitsui a long-term strategic partner and over time a significant minority shareholder in Hexagon Purus.”

Before discussing the immediate and mid-term effect of these issuances, here is a quick summary of the key features of the Convertible Bond:

- 5-year senior unsecured

- 6% fixed interest rate payable semi-annually in kind (i.e. through issuance of additional bonds)

- The conversion price per common share in the Company for the Convertible Bonds has been set to NOK 33.75

So, assuming full conversion in 5 years’ time we get:

- NOK 800 million of notional issued in March 2023

- NOK 240 million of additional to be issued as interest (5*6% on 800 million)

- At a strike price of NOK 33.75 this yields some 30.8 million additional shares

Overall, assuming full conversion, the Equity Offering and the Convertible Debt Offering in aggregate will add some 49.3 million shares to the YE22 Purus share count of 258 million, i.e. add some 19.1% in share count or create dilution of existing shareholders of about 16.0%.

And speaking of existing shareholders: Hexagon Composites did not participate in Equity Offering. As a result, HC’s stake in HP’s equity fell to 68.4% after the Equity Offering – i.e. on an undiluted basis. I did not find information clearly stating if HC did participate in the Debt Offering, and I will come back to this below.

We don’t know if conversion will happen, the Purus closing price per share on July 3, 2023, was NOK 20.30, i.e. 40% below the conversion price. But 5 years is a long time, and further below I will discuss some positive recent business developments. Plus, according to Purus’ announcement, the Convertible Debt Offering was “multiple times oversubscribed”, so institutional investors (the “smart money”) seemed to be very confident about Purus’ prospects.

Hexagon Composite to pay Dividend-in-kind with Purus Shares

On June 7, 2023 HC announced a dividend-in-kind to its shareholders made up of HP shares. I will discuss the details of the offering in a minute, but here is the key purpose of this transaction, in the words of the announcement:

As a result of the share distribution and subject to final EGM approval, Hexagon Composites’ ownership will decrease significantly, and the Company will undertake a non-controlling ownership in Hexagon Purus.

To be very clear, “non-controlling” in this context yields to the deconsolidation of HP from HC’s financial statements. More specifically, going forward, for example HC’s financial statements will no longer include the Revenue (and expense / debt / …) numbers from HP.

Thus, some “caution” is required going forward with HC’s financial statements: First, in terms of ongoing comparables with a different consolidation perimeter – but HC management in the past had presented HCxP numbers for all relevant metrics already – and second with respect to the merely accounting one-off effect upon deconsolidation, most likely to occur in 3q23:

A deconsolidation will also entail a one-off accounting gain for Hexagon Composites, better reflecting the market value of Hexagon Purus.

In any case, as per HC management statement in the announcement, they do not plan any further reduction in HC’s equity stake any time soon:

Following the proposed distribution of shares, Hexagon Composites does not intend to reduce its ownership exposure in Hexagon Purus any further for the foreseeable future. We will remain a strategic partner with Hexagon Purus while allowing the other Hexagon Group companies to fully leverage their growth potential.

Here, “foreseeable future” may implicitly refer to the 5-year period before the conversion, if any, of the Convertible Debt. If HC had indeed not participated in this offering, then (all else equal) conversion would reduce HC’s share. Note that Purus management has stated several times in the past that they expect Purus to be operating cash flow positive by the end of 2025 (with allowance for working capital needs), which would reduce the need for future equity raises substantially. However, investment capital need may remain elevated given the growth perspectives for Purus – and as mentioned above, Mitsui has signed a memorandum to invest up further NOK 1,500 million. Finally, and to put Mitsui’s stake in perspective:

- As per HP’s homepage on July 4, 2023, Mitsui held an equity stake of 1.88%, i.e. some 5.2 million shares.

- Mitsui’s share of NOK 500 million of notional of the Convertible Debenture, plus dividends in kind, would convert into some additional 19.3 million shares in 5 years’ time.

- This compares to the about 120 million shares owned by HC even after the special dividend has been distributed to HC shareholders:

On June 29, HC published a summary of the resolution made by the respective extraordinary shareholder meetings:

- HC will distribute 69,199,364 of its HP shares to HC shareholders (as of July 5, 2023).

- This is exactly 25% of the undiluted share count of HP.

- It reduces HC’s current undiluted equity share of HP to some 43.4%

- (In a separate statement, HC clarified that it – together with its majority stakeholder, private Flakk Group – will ensure to not again hold a majority of Board of Directors members.)

In other words, despite the significant recent reduction in its equity stake, HC will remain the largest shareholder for the time being.

Please note that I cannot comment on the tax treatment of the special dividends – in particular, since each country’s tax regime is essentially like a different planet.

The Ragasco Question

There is one thing I wanted to mention at least:

During the 1q23 earnings call of HC, one analyst asked if HC management had any interest in selling the Ragasco business. The rationale was that Ragasco is a bit of an outsider within remaining HC, in that it is end consumer facing. And now that HC got rid of the one big “alien” in its consolidation perimeter, it may make sense to further focus the offering.

Normally, I would not give much attention to this, but as a matter of fact, it was only at HC’s year-end Earnings Call that some analyst asked when Purus would be deconsolidated. And as we know today, it did not take that long for it to happen after the question was asked.

Further, Ragasco is HC’s highest margin business (not at least because it is the only one that could fully pass on increased input costs to customers), and HC has big plans with the Agility business and probably also Digital Wave, thus fresh cash could be welcome. For example, in late 2022, HC sold-and-leased-back a North American facility. So why not sell an entire business?

To be very clear: This is all speculation triggered by one analyst question and management responded in no way that would indicate specific plans. But then, this would of course be the exact sort of plan to be hidden in the drawer for as long as possible.

Closing Remarks

First a rather technical note, quoting from the final announcement on the offerings:

In addition, the Offering will broaden the Company’s institutional investor base, while also serving as a platform for the contemplated up-listing to the main list of the Oslo Stock Exchange, which is currently expected to take place by the end of March 2023.

Purus’ up-listing became effective on March 30, 2023.

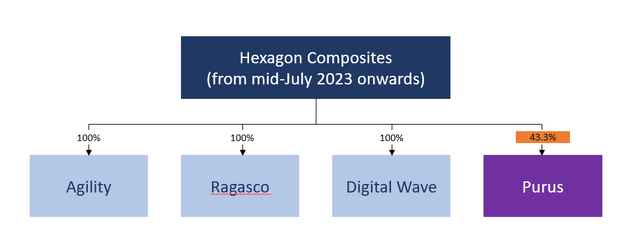

With all of that, we need to re-draw the participation graph as of mid-July 2023:

Ownership of Business (Author)

While the final say on deconsolidation is with HC’s auditor, it seems that after 5 years, Hexagon Purus is now a stand-alone entity also from an accounting perspective of its (current) major shareholder. Arguably, it would be pre-mature to call Purus an independent company – considering its ongoing significant capital needs.

But maybe it is sensible to look at it the other way around: In the end it is Hexagon Composites and its management who are now “free” to discuss the number of their established “natural gas business” without the distortion from the fast growing and cash-burning battery and hydrogen business.

We will now turn to the prospects of these different endeavours:

Business Developments

As will become very clear very soon, the majority of key operational news since my last update on HC was related to Purus as well:

Purus – Hino Agreement

On March 15, 2023, Purus announced that it had signed a “landmark” deal with Hino Motors, Ltd. (OTCPK:HINOY), a subsidiary of the Toyota Motor Corporation (TM).

I will discuss key elements of the deal in the order of appearance in the announcement (which includes a link to a one page pdf-summary of the transaction, which replaces the transaction governed by the 2022 Binding Letter of Intent between Purus and Hino):

Hexagon Purus (…) has signed a distribution agreement with Hino Motors Sales U.S.A., Inc. (“Hino”) where Hexagon Purus will produce complete battery electric heavy duty trucks for the U.S. market, distributed exclusively through select qualifying dealers in Hino’s network.

This is a rich passage to start with:

- The agreement is a distribution agreement where Hino is the distributor.

- It is targeting the heavy-truck market in the US.

- It will be Hexagon Purus who are producing the trucks to be distributed (but we will come back to this).

- It is about battery electric trucks, not hydrogen trucks, for the avoidance of any doubt.

Before we interpret too much of this, let’s look at the next snippet from the announcement:

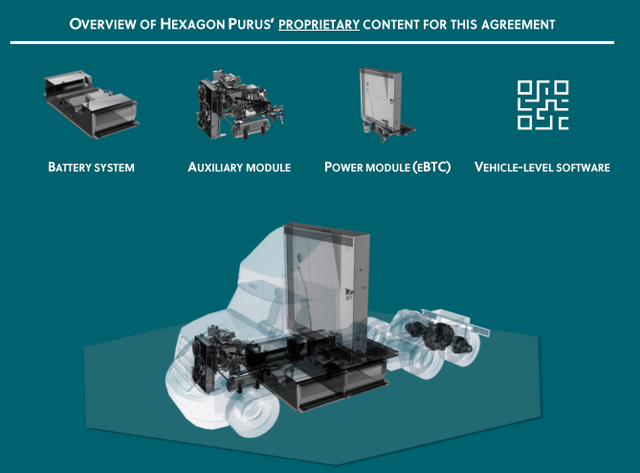

The vehicles will be based on Hino’s XL 4x2 truck chassis and upfitted with Hexagon Purus’ proprietary zero-emission technology, including battery systems, auxiliary modules, power modules and the vehicle-level software.

Again, there is a lot to digest:

- The chassis for the trucks will come from Hino.

- Purus will “add” a wide-scope set of technology related to powering the truck. This goes beyond just the batteries but involves software and other steering elements.

See the following overview from the transaction-summary mentioned:

Hino truck contribution from Purus (Hexagon Composites)

Finally, we have:

The agreement foresees the delivery of up to 10,000 trucks by 2030. (…) The potential total value over the course of this agreement could reach approximately USD 2.0 billion (approximately NOK 20 billion). Hino will also be responsible for after-sales service during the lifetime of this exclusive distribution agreement. Serial production of these electric heavy-duty trucks will commence during the last part of 2024.

To summarize:

- Serial production – by Purus, i.e. based on the Hino provided chassis – will start in late 2024, thus Purus will most likely start to recognise Revenue in 2025 (when actually sales start).

- In addition, the one-page summary clarifies that the agreement will run from 2024-2030.

- Purus aggregate revenue is estimated to up to NOK 20 bn – if evenly spread across 2025-2030 this would amount to some NOK 3.3 bn per year. It seems reasonable though to assume a gradual production ramp-up and thus a somewhat “backloaded” annual revenue pattern.

- After-sales service is Hino’s duty again.

The most important things to notice is the effect that this agreement may have on Purus’ growth ambition, as expressed by management’s 2025 revenue guidance of NOK 4-5 bn (see for example slide 25 in the 1q23 earnings call presentation):

First, a substantial part of this revenue may come from the Hino deal – which is battery electric vehicle business. Thus, investors interested in the hydrogen business may want to check twice if Purus is the right choice for them. I will come back to this.

Second, a substantial part of the revenue will stem from third party inputs, with the corresponding high share of COGS (cost of goods sold).

One final comment on the role of Toyota Motors: TM has been sceptical about battery electric cars, see for example this statement by the group’s outgoing CEO:

Toyota is concerned that switching to pure electric vehicles is not practical in the near future. Outgoing CEO Akio Toyoda held the opinion that EVs are simply “overhyped” and that having too many of them could potentially be problematic.

With their Hino business, TM is here essentially entering the business in a key (and highly subsidised) market.

Purus – Samsung Agreement

As much as you can’t fight an enemy’s starship without your own starship at hand, you can’t up-fit battery electric cars without batteries at hand.

Purus faced the consequence of this relationship the hard way, when they lost a huge contract similar to that with Hino in 2021 because they were not able to demonstrate sufficient battery supply. As a result, their deemed partner pulled back (all per management comments during Purus’ 1q23 Earnings Call).

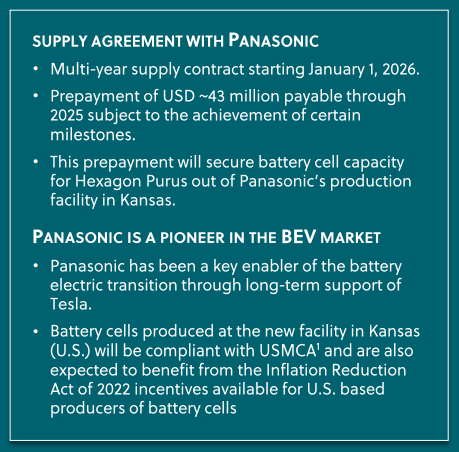

Consequently, in March 2023 Purus also entered into long-term supply agreement for battery cells with Panasonic. The terms are best summarised in the 1q23 earnings call slides:

Summary Panasonic Agreement (Hexagon Purus)

To put the Equity and Convertible Debt offering into perspective: The pre-payments to Panasonic alone create a cash burden of about NOK 430 million until the end of 2025.

Nevertheless, this is a necessary condition to get the Hino deal, which is key for Purus’ attempts in the battery electric market.

Hexagon excluding Purus

There has been no news of comparable relevance with regard to Purus’ (former) mothership, HCxP. Over the last couple of months, most news was in relation to the Agility business, which renewed deals in the US, and entered into new agreements in Mexico and Jordan.

So overall, continuous positive news-flow from a top-line perspective for Agility. And in May 2023, Agility announced the launch of its extended aftermarket offering, Hexagon Agility FleetCare, responding to:

Having put over 70,000 vehicles on the road, Hexagon Agility sees the need for a step-change in after-sales service support in the industry.

In my previous article I discussed the bottom-line issues currently faced by Agility. These are expected to ease over the second half of 2023, as input costs stabilise and the price increases by HC become effective. Thus, EBITDA margins should continue to increase. Over time, this should make HCxP an even better deal than it seems to be right now:

Valuations

At market closing on Euronext on July 3, 2023, HC had a market cap of NOK 5.858 bn and HP had a market cap of NOK 5.619 – note that this is pre-special dividend, i.e. based on a 68.4% stake of HC in Purus as discussed above.

Hexagon Composites excluding Purus

Adjusting HC for its Purus stake yields a valuation of HCxP of NOK 1.74 bn (and in theory, this value should not be affected by the special dividend).

As a reminder: HCxP generated revenue of about NOK 4.3 bn in 2023 with an EBITDA margin of about x% (absolute value). In my previous article on HC, I discussed the cash needs in detail. Taking 2022 actual numbers shows free cash flow of 133 for HCxP.

Overall, I am still convinced that HCxP is very reasonably valued in the light of the prospects the business has – see for example the discussion in the previous article about the 15l Cummins (CMI) engine.

Hexagon Purus

I have been hesitant to buy Purus (but nonetheless opened a tiny position which will see some inflow soon from the special dividend).

Purus is often seen as a hydrogen play, and there is certainly something to this – see for example the discussion of the Wystrach business for hydrogen distribution also in the previous article. However, the Hino deal shows that a lot of the short-to-medium-term growth will come from battery electric trucks. This is a place that is already crowded, so I am not convinced about the long-term prospects and margins for Purus. (Plus, a lot of the Hino-deal revenue will come from Hino.) That said, electrification is obviously the megatrend in transportation, so if Purus will successful here, a lot of money will be earned.

Today, Purus is trading at about 5x TTM-Revenue. There will no doubt be a lot of growth in Purus’ markets, but Purus is no 90% gross margin software business but a machine manufacturer (despite the proprietary software used in the Hino trucks). So, it needs a lot of profitable growth to fit into its valuation.

There are clearly abundant opportunities, for example: We had negative prices of 500 EUR per MWh of electricity in Germany on Sunday, July 2, 2023. It was windy and sunny day, so there was a lot of renewable energy production not met by demand. The next step in transforming the energy system will be to extend options for storage and or transformation. And here, hydrogen will play a key role and distribution solutions like those offered by Purus / Wystrach will be key (as will be the transition to battery electric vehicles, as they will contribute to load-flexibility).

Overall

In the end, each investor’s preference between HC and Purus will depend on the expectation of how energy and transportation / mobility markets will develop. I am a long-only investor – more flexible investors may consider a combined trade of going long HC and short HP to “net” the HCxP exposure. I can’t advise on such trade, but continue to believe that in theory this is a very good deal.

To summarise, I believe HC is more reasonably valued, especially the HCxP share. Thus, I believe HC is a Buy at current levels.

Purus, on the other hand, is a Hold right now, until I get more visibility on the margins of the business and how the business mix develops, especially the hydrogen part.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HXGCF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.