Capital Increase Opens Up Short-Term Arbitrage Opportunity

Summary

- Carbios, a green chemistry company, announced a capital increase that could raise up to €136 million.

- The article presents a potential short-term trading opportunity due to the capital increase in the amount of €1.37 per share (given market data as of June 30, 2023).

- There is no free lunch, hence, risks are involved.

Daniel Balakov

Carbios' Capital Increase

This analysis aims to highlight a short-term trading opportunity arising from the capital increase which Carbios (OTCPK:COOSF) announced on June 22, 2023. In the event of 100% fulfillment, the net proceeds would amount to around €118 million (an increase to around €136 million is possible if the Extension Clause is fully exercised).

As a refresher, Carbios is a cutting-edge green chemistry company specializing in the development of enzymatic solutions for the recycling and biodegradation of plastic waste. As a very young company, Carbios plans to use the biggest chunk of the proceeds to finance the construction of its first plant; the remaining funds will be allocated to R&D.

Let's jump right into the technical details of the capital increase (Carbios press release):

- Subscription price: €25.32 per new share

- Subscription exchange rate: 3 new shares for 7 existing shares

- Trading period for pre-emptive subscription rights (PSR): June 23 through July 5, 2023 inclusive

- Subscription period: June 27 through July 7, 2023 inclusive

- Result of the capital increase: July 11, 2023

- Delivery and admission of new shares on Euronext Growth Paris: July 13, 2023

Refresher on Subscription Rights

It is important to understand that subscription rights basically represent a re-allocation of assets, but no change in the combined amount of those assets. Value is reallocated from existing shares to the PSR. Keep in mind that once the PSR have been booked, existing shareholders have the opportunity to sell them on the stock exchange at the market price (not the initially calculated theoretical price). In this way, they are, in theory, not worse off.

With Carbios, the closing share price before the announcement of the capital increase was €40.10 (as of June 20, 2023). Given the closing price, the subscription price (€25.32), and the subscription exchange rate (7:3), the theoretical value of the PSR is €4.43. Thus, the ex-rights share is valued at €35.67, i.e., the closing price minus the theoretical value of the PSR.

As you can see, an investor's wealth is solely reallocated even though at first sight, the stock price decreases, at least theoretically, from €40.10 to €35.67 as the PSR is booked into the investor's account. However, the actually observed stock price is likely to deviate from the theoretical price due to a bunch of reasons. One of these might be market participants' perception of the capital increase on a company's fundamental perspectives, resulting in upward (downward) pressure for the share price.

Trade Idea

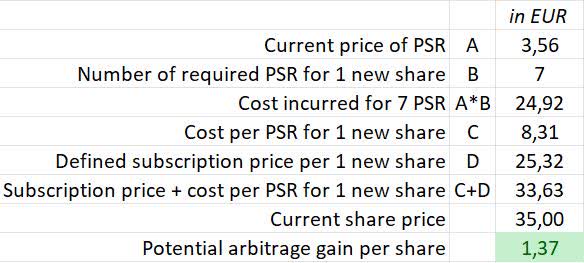

The table below illustrates the relevant calculation on a per-share basis. Please note the data is in Euro, neither transaction costs nor taxes are included. Current prices for both PSR and Carbios stock are as of June 30, 2023.

Potential arbitrage on a per-share basis (own calculation)

At the current PSR price (€3.56), given that seven units are required to obtain three newly issued shares, the PSR price attributable to a single new share amounts to €8.31. Hence, taking this amount and adding the subscription price (€25.32) the virtual price for a new share is €33.63. This is below the current market price (€35.00), i.e., your gain amounts to €1.37 per share.

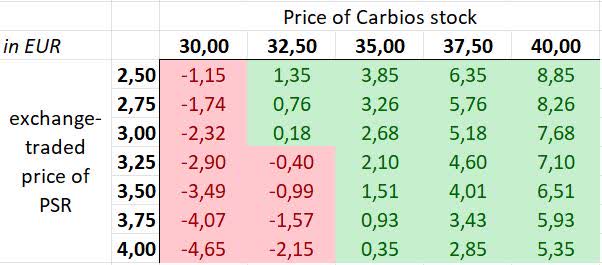

Admittedly, the idea is highly dependent on the final market price post-delivery of the new shares, which is scheduled for July 13, 2023. Below, we illustrate the sensitivity of the per-share arbitrage gain (loss) contingent to both the PSR price and the stock price.

Sensitivity of arbitrage gain/loss on a per-share basis (own calculation)

Given the tight holding period spanning from the purchase of the PSR, followed by the delivery of new shares (July 13, 2023), and finally the sale of the Carbios share on/around the settlement date, the potential return for investors is significant on an annualized basis.

Risks

We all know that there is no free lunch. Yet, Carbios is a small-cap company with no material analyst coverage and therefore a below-average profile. Against this backdrop, markets might be less efficient compared to blue chip companies, which could explain part of this arbitrage opportunity.

On the other hand, multiple investors may take a similar positioning as described above. If all of them try to materialize their profits on/around July 13, 2023, the stock price could get hit substantially, eventually jeopardizing the whole arbitrage idea.

From our understanding, the capital increase will take place no matter what. Thus, the arbitrage is explained by a significant risk premium in case the transaction does not close. This risk premium explanation often can be observed with takeovers, where a certain threshold needs to be hit. We do not see a similar mechanism here, however, market participants are asked to do their own research in this regard.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in COOSF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.