NHS: 2023 Rights Offering Results

Summary

- NHS's 2023 rights offering results are in.

- The offering was oversubscribed, despite the slim discount to the market price.

- The "sell and rebuy" strategy worked once again.

- Looking for a helping hand in the market? Members of CEF/ETF Income Laboratory get exclusive ideas and guidance to navigate any climate. Learn More »

skynesher

Author's note: This article was released to members of CEF/ETF Income Laboratory as part of the CEF Weekly Roundups on June 26, 2023, with certain numbers updated. Please check the latest data before investing.

The rights offering for Neuberger Berman High Yield Strategies Fund (NYSE:NHS) expired on June 20, 2023. We discussed this offering when it was first announced in a previous CEF Weekly Roundup (public link) and then again last week when it was about to close.

In brief, this was a 1-for-3 transferable rights offering with the subscription price of the offering being the higher of 92.5% of the average closing share price of the fund on the five days until expiry, or 89% of NAV. The preliminary results of the rights offering are now in. From the press release:

June 22, 2023 | Neuberger Berman High Yield Strategies Fund Announces Preliminary Results of Rights Offering. Neuberger Berman High Yield Strategies Fund Inc. (NYSE American: NHS) (the "Fund") announced today the completion of its transferable rights offering (the "Offer"), which commenced on May 23, 2023 and expired on June 21, 2023... The final subscription price of $7.42 per share of Common Stock was equal to 89% of the Fund's net asset value per share of Common Stock at the close of trading on the NYSE American on the Expiration Date. Based on the preliminary results, the Offer was over-subscribed. The Offer is expected to result in the issuance of approximately 6,482,227 shares of Common Stock and the gross proceeds of the Offer are expected to be approximately $48.1 million.

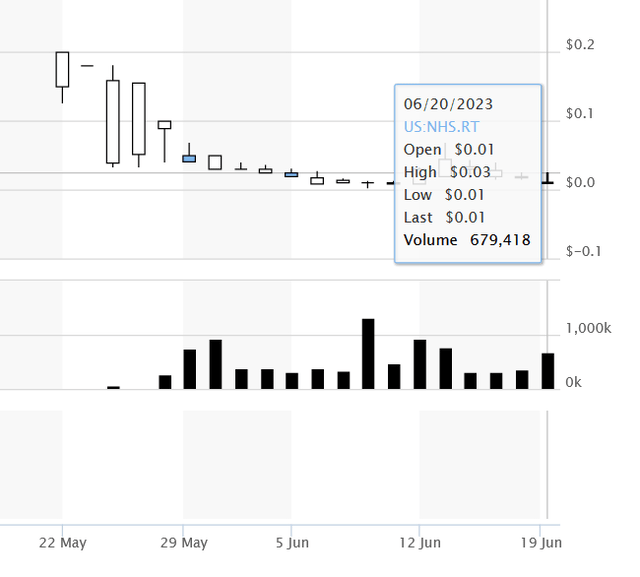

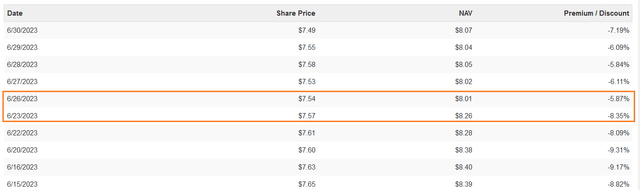

On the expiry date of June 21, 2023, NHS closed at a price of $7.60 and a NAV of $8.34, good for an -8.87% discount. This was still above the -11% discount floor for the offering, which meant that it was still beneficial to subscribe. The final subscription price $7.42, i.e. reaching the -11% discount floor, but this price represented only a -2.37% discount to the market price of the fund on expiry. Consistent with this, the value of the rights also fell to negligible levels as the offering drew to the close as the benefit of subscribing diminished with the widening discount.

This is why we always suggest to our members who do prefer to hold a CEF through a rights offering, but who are not intending to subscribe for new shares, to sell their rights as soon as possible on the open market (if they are transferable). We can see that the rights opened at around $0.10, but lost value quickly as the discount of NHS widened. This is because the closer the fund's discount is to the -11% discount floor, the less benefit there is to subscribing. As a reminder, should NHS have dropped below an -11% discount towards the expiry date, investors should not have subscribed as it would have been cheaper to purchase the fund on the open market.

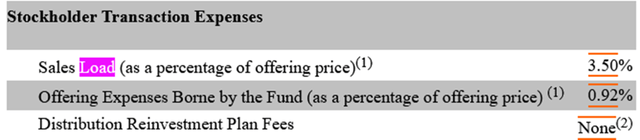

Despite the slim discount to the market price, the offering was still fully subscribed, and so the fund will be able to grow its share count by a maximum of +33%. Additionally, the offering charged a sales load of 3.50% and offering expense of 0.92% for each newly issued share, which is extremely expensive. Although, this was down from a sales load of 3.75% and offering expenses of 1.25% last year, so... progress?

As a result, I expect that there will be a NAV hit of -$0.31 per share, or -3.74%, once the new shares are released.

June 30, 2023 update: on June 26, 2023 when the new shares were released, the NAV was adjusted downwards by $-0.25 per share, or -3.03%.

Moreover, the fund's distribution sustainability would be weakened slightly by this dilutive offering. NHS currently sports a very high distribution yield of 14.35% at market price (13.15% on NAV), but with only 49% coverage. All other things being equal, the distribution coverage would drop to around 47%. While low coverage in and of itself isn't a negative (since distributions are part of the total return), when coupled with a relatively narrow discount of under -5%, leaves open the possibility of a negative price reaction if the distribution does get cut.

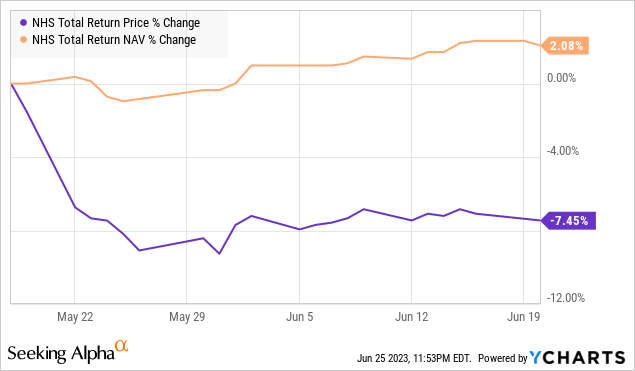

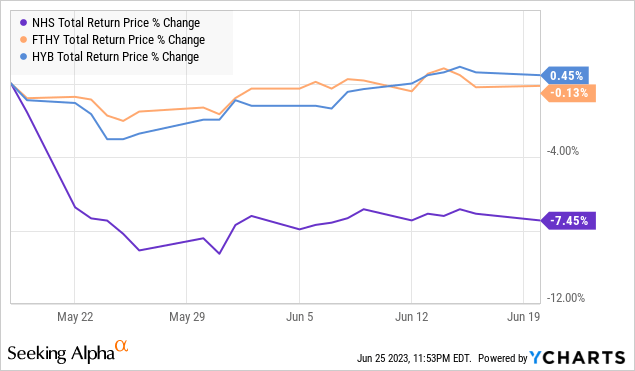

Finally, our standard "sell and rebuy" strategy to sell the fund before the ex-rights date, and buy back after, worked once again:

YCharts

Additionally, NHS's NAV actually rose slightly over this time frame. Therefore, the sell and rebuy strategy could have been even better if one had rotated into a comparable high-yield bond fund such as FTHY and HYB as we had suggested.

To reduce market risk, one could switch the money to other high-yield CEFs such as First Trust High Yield Opportunities 2027 Term Fund (FTHY) (-11.95% discount, a Tactical Income-100 portfolio holding) or New America High Income Fund Inc. (HYB) (-14.81% discount, an Income Generator portfolio holding) in the meantime.

YCharts

Thus, up to +8% "free shares" of NHS could have been obtained by rotating from NHS before its ex-rights date into HYB, and then selling HYB now and rebuying NHS. As we always say, getting "free shares" of a CEF is better than paying for slightly discounted shares, am I right?

Going forward

NHS's current discount of -7.19% (as of 6/30) makes it fairly valued in my opinion, however, investors should be aware that the 14.50% yield of the fund is not fully covered by earnings. Investors should also remember that bidding up a fund to unwarranted premiums is generally not a good strategy as it leaves the market price of the fund susceptible to external shocks such as a rights offering announcement. Remember, as we always tell our members at CEF/ETF Income Laboratory: don't just look at the yield!

Strategy Statement

Our goal at the CEF/ETF Income Laboratory is to provide consistent income with enhanced total returns. We achieve this by:

- (1) Identifying the most profitable CEF and ETF opportunities.

- (2) Avoiding mismanaged or overpriced funds that can sink your portfolio.

- (3) Employing our unique CEF rotation strategy to "double compound" your income.

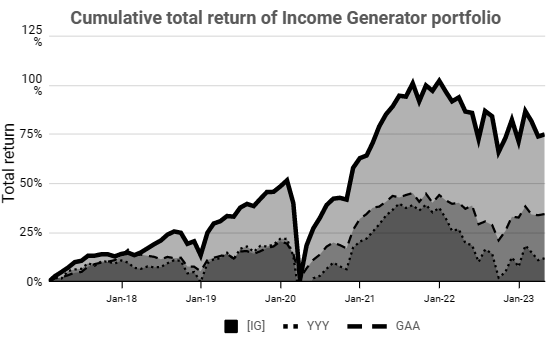

It's the combination of these factors that has allowed our Income Generator portfolio to massively outperform our fund-of-CEFs benchmark ETF (YYY) whilst providing growing income, too (approx. 10% CAGR).

Income Lab

Remember, it's really easy to put together a high-yielding CEF portfolio, but to do so profitably is another matter!

At the CEF/ETF Income Laboratory, we manage closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

CEF/ETF Income Laboratory is a premium newsletter on Seeking Alpha that is focused on researching profitable income and arbitrage ideas with closed-end funds (CEFs) and exchange-traded funds (ETFs). We manage model safe and reliable 8%-yielding fund portfolios that have beaten the market in order to make income investing easy for you. Check us out to see why one subscriber calls us a "one-stop shop for CEF research.”

Click here to learn more about how we can help your income investing!

The CEF/ETF Income Laboratory is a top-ranked newsletter service that boasts a community of over 1000 serious income investors dedicated to sharing the best CEF and ETF ideas and strategies.

Our team includes:

1) Stanford Chemist: I am a scientific researcher by training who has taken up a passionate interest in investing. I provide fresh, agenda-free insight and analysis that you won't find on Wall Street! My ultimate goal is to provide analysis, research and evidence-based ways of generating profitable investing outcomes with CEFs and ETFs. My guiding philosophy is to help teach members not "what to think", but "how to think".

2) Nick Ackerman: Nick is a former Financial Advisor and has previously qualified for holding Series 7 and Series 66 licenses. These licenses also specifically qualified him for the role of Registered Investment Adviser (RIA), i.e., he was registered as a fiduciary and could manage assets for a fee and give advice. Since then he has continued with his passion for investing through writing for Seeking Alpha, providing his knowledge, opinions, and insights of the investing world. His specific focus is on closed-end funds as an attractive way to achieve income as well as general financial planning strategies towards achieving one’s long term financial goals.

3) Juan de la Hoz: Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He is the "ETF Expert" of the CEF/ETF Income Laboratory, and enjoys researching strategies for income investors to increase their returns while lowering risk.

4) Dividend Seeker: Dividend Seeker began investing, as well as his career in Financial Services, in 2008, at the height of the market crash. This experience gave him a lot of perspective in a short period of time, and has helped shape his investment strategy today. He follows the markets passionately, investing mostly in sector ETFs, fixed-income CEFs, gold, and municipal bonds. He has worked in the Insurance industry in Funds Management, helping to direct conservative investments for claims reserves. After a few years, he moved in to the Banking industry, where he worked as a junior equity and currency analyst. Most recently, he took on an Audit role, supervising BSA/AML Compliance teams for one of the largest banks in the world. He has both a Bachelors and MBA in Finance. He is the "Macro Expert" of the CEF/ETF Income Laboratory.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.