AGNC Investment: Digging For Value In The 7-10% Yielding Preferreds

Summary

- AGNC preferreds remain attractive high-income securities in the current market.

- We take a look at the suite and gauge value across the 5 preferreds.

- We also take a look at a number of misconceptions in analysis that keep rearing their head.

- Finally, we highlight the three stocks to consider allocating to.

- I do much more than just articles at Systematic Income: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Darren415

This article was first released to Systematic Income subscribers and free trials on June 22.

In this article, we take a look at the Agency mortgage REIT AGNC's preferreds. The five-stock strong suite trades at attractive yields and has stocks with different features, offering a lot of opportunity for relative value.

Why AGNC?

AGNC preferreds remain an interesting suite of preferreds for income investors for multiple reasons. First, the company allocates almost entirely to Agency MBS which are highly liquid and, in a crunch, backstopped by the Fed, as we saw during COVID.

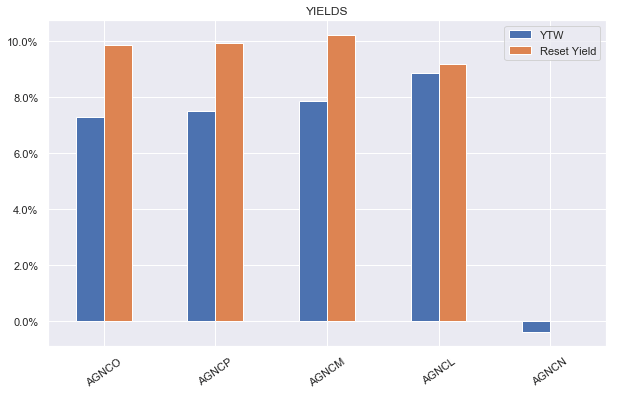

Two, the yields on offer, both stripped and future reset yields are attractive, being in the range of 7-10%.

Systematic Income

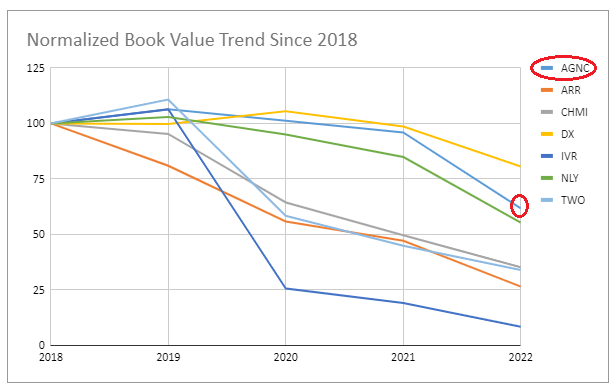

Three, the company has done a decent job of managing book value in a very difficult environment as the following chart shows.

Systematic Income

Four, the company has been issuing additional common shares which is nice to see as it supports the equity / preferred coverage ratio, i.e. the amount of assets that stand behind each dollar of preferreds. Over the past two years, the number of shares outstanding has grown by 8.4%.

As usual, we keep our eye firmly on the preferreds. Tactical investors can make a lot of money trading the common; however, over the longer-term, preferreds have generated much stronger returns with less volatility.

Systematic Income

A Look At The Suite

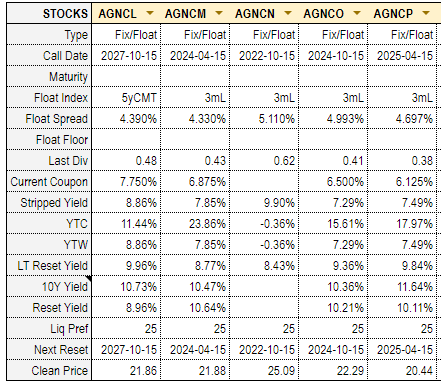

AGNC (NASDAQ:AGNC) has 5 preferreds in its suite as shown in the following table from our service Preferreds Tool. Four are Libor-based Fix/Float preferreds while AGNCL is a 5Y CMT preferred, i.e. one linked to the 5Y Treasury Yield (CMT stands for Constant Maturity Treasury). On its first call date in 2027, the stock's coupon will switch to the yield of the then 5Y Treasury Yield + 4.39% and will reset every 5 years after, if not redeemed.

Systematic Income Preferreds Tool

Avoiding The Pitfalls

In order to correctly gauge relative value, investors need to avoid three pitfalls in the sector. The first pitfall is thinking that the market is totally blind to preferred reset dates and that it's constantly surprised by the step-up in yields on the reset date. The step-up in yield (i.e. that the new floating-rate coupon is higher than the initial fixed-rate coupon) is there for nearly all Libor based preferreds because short-term rates are higher than when these Fix/Float preferreds were first issued.

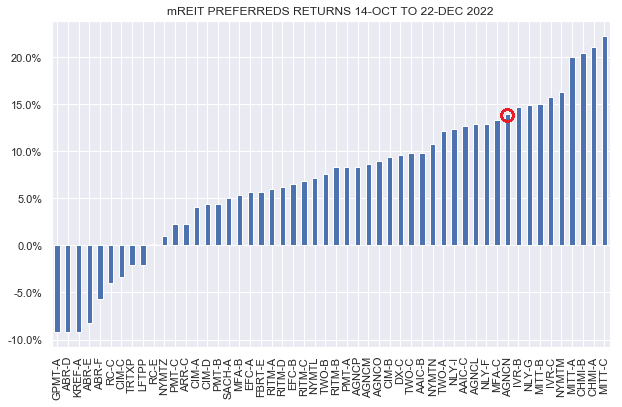

The flimsy evidence supporting the view that the market is totally unaware of the step-up in yield on the first call date is that AGNCN gained 22% between 14-Oct and 22-Dec when the market realized that AGNCN reset to a floating-rate.

First of all, if the market was totally blind to the coming reset date in October, it's not at all obvious why it should have realized AGNCN reset to a floating-rate coupon by the end of December. This is because the ex-div date for the new higher coupon did not actually happen until 29-Dec and the new higher coupon did not get paid until mid-January.

Second, memories may be short but 14-Oct was just about the low in markets (actual low in the S&P 500 happened on 12-Oct when SPY was 0.3% below its 14-Oct level). In other words, there was a lot more going on in mid-October than the AGNCN coupon reset.

In fact, there were 9 other mREIT preferreds that delivered even stronger returns over the same Oct-Dec period than AGNCN. Did those other preferreds also reset their coupons on 15-Oct? No. The key takeaway here is that investors need to use caution thinking the market is totally dumb. Rather, the market may be a little dumb occasionally.

Systematic Income

The second pitfall is to keep interest rates fixed when calculating reset yields to compare individual securities. For example, AGNCN has a yield at current Libor of 10.59% at current 3-month Libor of 5.52%. Using the same level of Libor, AGNCO will have a yield on the first call date (unless redeemed) of 11.79%. Presto, we have a "mispricing" - one stock pays 11.79% and another pays 10.59% for the same level of Libor.

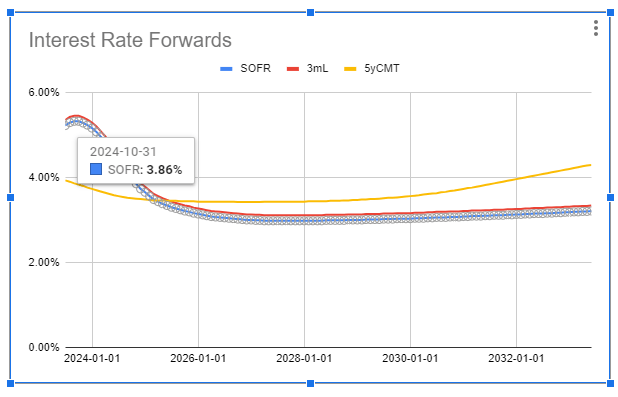

The problem with this reasoning is that the market doesn't think that Libor will be the same when AGNCO resets to a floating-rate in October of 2024. Specifically, from today's level of 3-month term SOFR of about 5.3%, the market expects the rate to drop to around 3.86% in October of next year as the following chart shows. Based on this market-implied pricing, the market expects AGNCO to have a yield of 9.92%, not 11.79%.

Systematic Income Preferreds Tool

The key takeaway here is that calculating risk/reward based on your own view of markets is not a mispricing - that's what we call a view. A mispricing is when securities offer irrational risk/reward based on market-based pricing.

The third pitfall is a two-fold one. It is to focus on one or two securities at a single point in time. Rather, investors should have a good understanding of how security yields are expected to evolve across the entire suite and also across time.

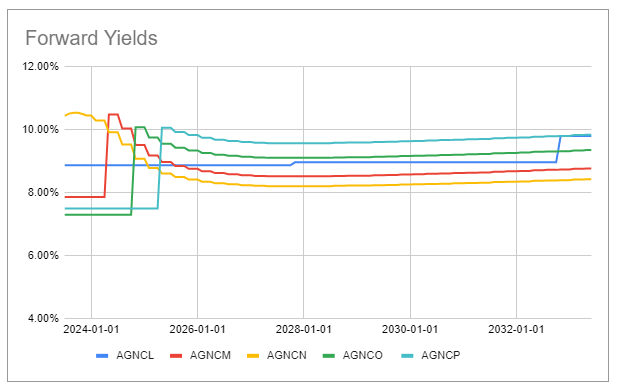

The chart below shows how we approach preferreds security analysis in a given suite. Here, we plot forward yields of all 5 AGNC preferreds across time based on forward rates. The jumps in yields over the next few years is when the stocks reset to a new floating-rate coupon. AGNCL resets every 5 years to a new 5-year Treasury yield base rate which is why it's mostly flat except for 2 yield changes.

Systematic Income Preferreds Tool

As many investors know, forward rates are not "real" in the sense that they don't have to be realized - what interest rates are in the future is anyone's guess. However, the advantage of using forward rates is that they are consistent with broader market pricing and they are the same for all securities. This means they are a neutral baseline with which to approach analysis. Forward rates will probably not be realized, but that doesn't matter as they are still extremely useful for relative value analysis.

Stance And Takeaways

In our view, there are three stocks in the AGNC preferred suite that are worth a look: the floating-rate AGNCN which has the highest yield right now in the suite, AGNCP which expected to move out to the highest yield in the suite (even if forward rates don't come to pass) and AGNCL which is the only stock linked to the 5Y Treasury yield (i.e. 5Y CMT) base rate and has the longest duration in the suite and the longest fixed-rate period.

For investors keen to get aboard the double-digit AGNCN yield, we actually recommend buying NLY.PF which has basically the same yield but a slightly stronger set of risk metrics. It's the stock we have held in our own portfolios as high-quality double-digit yield floating-rate exposure.

AGNCP looks most attractive for patient investors who are happy to clip an uninspiring yield today in order to get the highest yield for a potentially much longer period. The added advantage here is that if AGNC decides to redeem the preferreds (which can easily happen given how inverted the yield curve is) AGNCP will enjoy the highest yield-to-call.

Finally, AGNCL is certainly worth a look. It has the second highest yield today and will keep its yield fixed until at least Oct-2027. This is important to protect the portfolio against the risk that short-term rates start to descend over the next couple of years as both the market and the Fed expects. While it's very fashionable to think that the Fed is never cutting rates, let's recall that it was also very fashionable to think in 2021 that the Fed will never hike rates.

Apart from an attractive yield, the stock also benefits from a link to Treasury yield-based coupons rather than the more common Libor/SOFR anchor which sets the stock up for outperformance when the yield curve eventually disinverts.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)

As a holder of several preferred issues I'm happy to see my NAV go up, but I am puzzled as to why this is happening. Any thoughts? Is this just Brownian motion in the marketplace? Is it just a mREIT item (all of my preferred holdings are mREITs)?