The Yield Curve Is As Inverted As It Gets

Summary

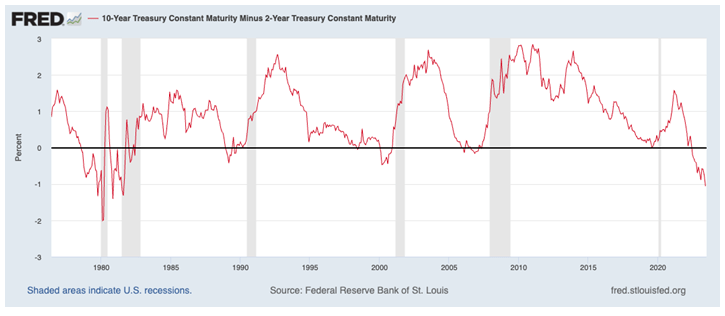

- The yield curve, as measured by the 2-year note and 10-year note (Treasury yields) have gotten more inverted of late, registering at -106 basis points (bps) at last count.

- Even at that, many bond experts are saying that we are still in “lucky” territory, as this is not yet a sign of an imminent recession.

- What would be a more troubling sign would be when the curve sharpens steeply after being deeply inverted, which typically happens just before, or in the early stages, of a recession.

Melpomenem

The yield curve, as measured by the 2-year note and 10-year note (Treasury yields) have gotten more inverted of late, registering at -106 basis points (bps) at last count. Even at that, many bond experts are saying that we are still in “lucky” territory, as this is not yet a sign of an imminent recession.

What would be a more troubling sign would be when the curve sharpens steeply after being deeply inverted, which typically happens just before, or in the early stages, of a recession.

The onsets of the 1990-91, 2000-01 and 2007-09 recessions are a good example of that “yield curve steepening before a recession” phenomenon (see chart below).

Even though the 2020 recession was mandated by government shutdown and therefore very different than a more normal recession, the yield curve did steepen before that recession also. It is almost like the bond market sniffed out the pandemic before most investors did.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Another measure of inversion is the 3-month/10-year spread, which is at -162 bps at last count. Every time people brought up the 2y/10y spread inversion in 2022, Jerome Powell would cite the 3m/10y spread as proof that the yield curve was not invented. Well, that was before he inverted that curve, too.

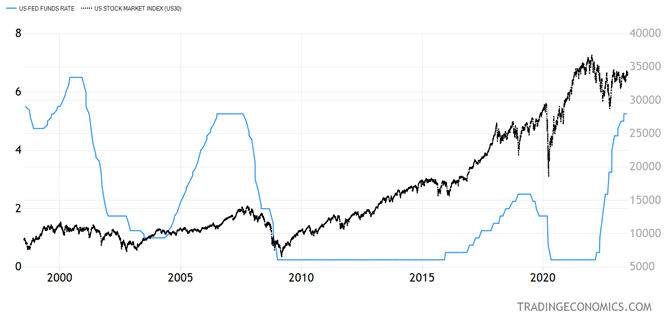

Inverted yield curves basically choke off the flow of credit in the economy as the classic “borrow short, lend long” mantra of U.S. banks will not work well if short-term funding costs become too expensive.

People say inverted yield curves cause recessions due to this choke-hold on credit. This time around, though, due to the shortage of workers in the economy, we are seeing remarkable resilience in economic performance despite the fastest monetary tightening in Fed history.

If this turns out to be a soft landing – and I have my doubts about that, due to the belated nature of the Fed monetary tightening and the need to tighten more due to this belatedness – Powell will look very good again.

We probably would not know if the economic landing is soft for up to another year. In 2006, the last rate hike was in the summer of that year before the recession triggered by the tightening cycle started in December 2007, an 18-month lag.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

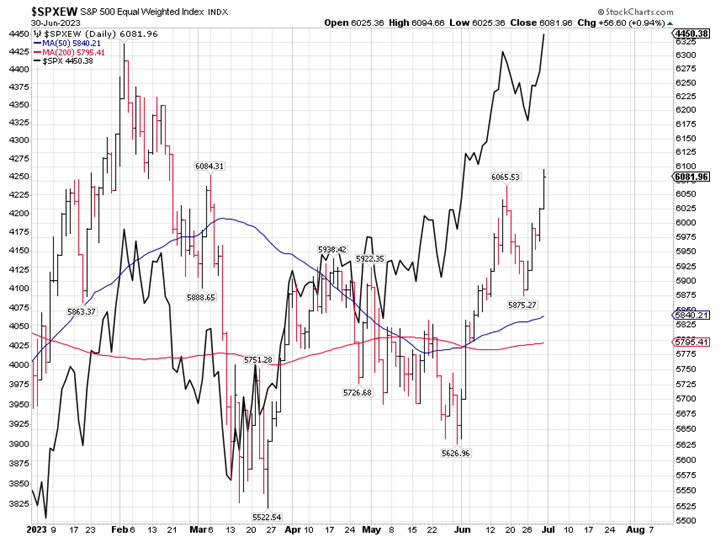

Market Finally Delivers More Breadth

Just when the market rally was becoming scary due to its narrow breadth, the broad market woke up and decided to catch up to the 10 or so mega-cap tech stocks that were levitating the market for the first five months of the year.

The S&P 500 Equal Weighted Index had a great June, making up for a lot of lost ground. The broad market is still way behind the cap-based S&P 500, where only two stocks make up over 14% of the weight of the Index! And one, Apple (AAPL), just crossed $3 trillion in market cap on Friday.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Summers are not known for sharp rallies but more for consolidating markets, even though there are no signs yet that this phase of the rally is over. This rally can keep going if we get better inflation numbers and another Fed rate pause that turns into a stop.

It would be wise for the Fed to pause again, but Jerome Powell with his Paul Volcker “wannabe” act – as one famous strategist refers to his belated rate hikes – may yet deliver the rate-hiking straw that breaks the camel’s back, if he is not too careful.

Navellier & Associates owns Apple Computer (AAPL), in managed accounts. Ivan Martchev does not own Apple Computer (AAPL) personally.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the "About" section of the Navellier & Associates profile that accompany this article.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editor

This article was written by