IXG: Stress Test Results Pose Good News, But Recession Prospects Stand

Summary

- Financial stocks have been heavily impacted by market oscillations since March, making banks a risky investment due to regulatory scrutiny and tighter lending practices.

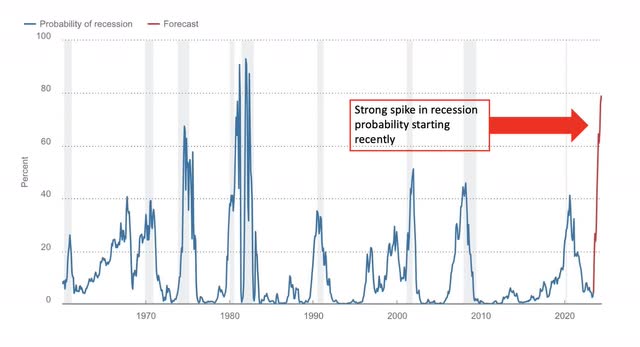

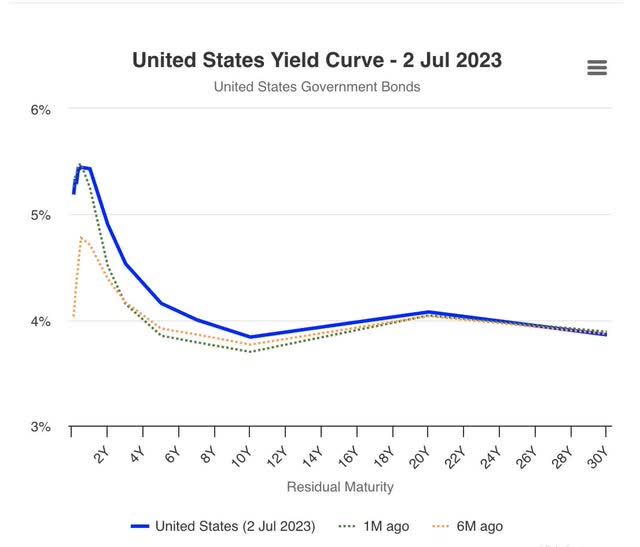

- While the stress test results reveal the robustness of banks, financial securities are not recession-proof, with the inverted U.S. treasury yield curve indicating a potential economic slowdown.

- I rate IXG a Hold, as a potential recession still lies in the picture despite what the stress test revealed.

shih-wei

Financial stocks have oscillated heavily and incurred the strong effects of market uncertainty since the regional bank collapses in March. This particular event combined with the recession fears that followed, made banks a rather risky investment. Furthermore, regulatory scrutiny and tighter lending practices have created a credit crunch that could put financial institutions’ earnings and valuations at stake in the coming periods. The Fed has proved relentless in its hikes and I foresee more before the end of the year and well into 2024 as 2% inflation remains distant, but not unattainable.

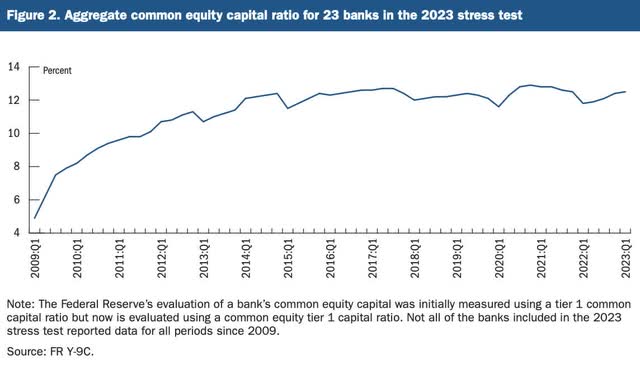

Despite general macroeconomic uncertainty, results from the Federal Reserve’s stress test in late June raised the outlook for financial securities. Such results displayed that the 23 largest banks have enough capital to withstand over $540 billion in losses and may continue lending to households and businesses amid challenging circumstances. Though the market forecast remains treacherous, banks are by no means unarmored in this journey. Therefore, I rate the iShares Global Financials ETF (NYSEARCA:IXG) a Hold.

Federal Reserve Bank of Cleveland

Strategy and Holdings Analysis

IXG tracks the S&P Global 1200 Financials Index and uses a representative sampling technique. This ETF’s holdings are weighted by market capitalization. IXG is passively-managed and does not seek to outperform the underlying index, but rather aims to replicate it. This strategy may mitigate the odds of inappropriate security selection as well as minimize portfolio turnover. IXG gives greater representation to larger, well-capitalized stocks, which also enhances this fund's liquidity.

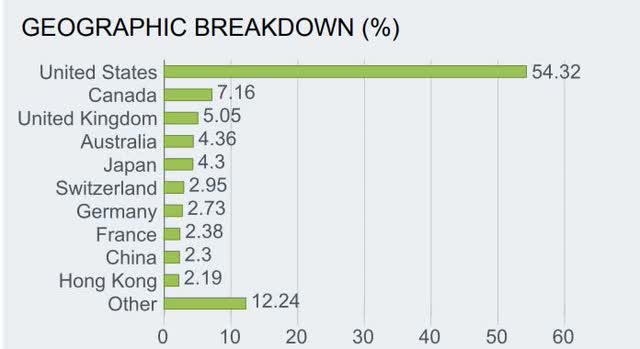

IXG invests mainly in financial stocks. Slightly over half of this ETF’s holdings reside within the United States. Non-U.S. representation is quite dispersed in IXG, with not one non-U.S. nation comprising more than 7% of the geographical breakdown. This aspect distinguishes it from ETFs that I have written about previously, like the Financial Select Sector SPDR ETF (XLF) and the Fidelity MSCI Financials Index ETF (FNCL). Such funds invest solely within the United States.

iShares

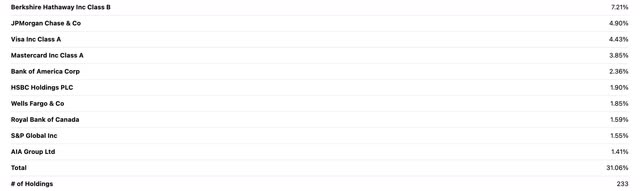

The top 10 holdings in IXG account for almost a third of the entire fund which consists of 233 total stocks. Therefore, this ETF puts an ample amount of performance up to just a few holdings at the top of the fund. This may create concentration risk, but may also enhance this ETF’s transparency, as investors better know what’s providing the most momentum to this fund.

Seeking Alpha

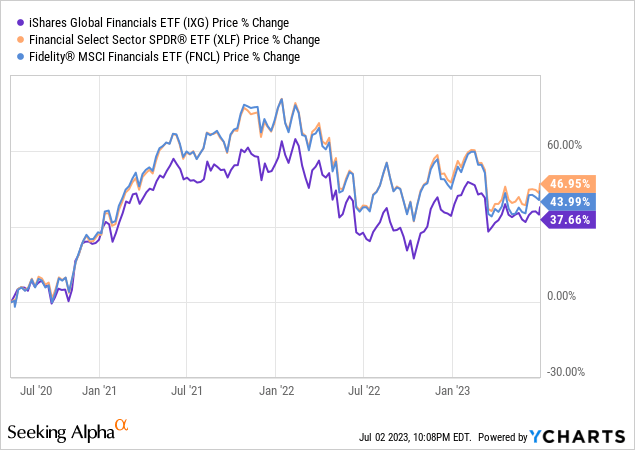

ETF Performance: IXG vs. Peers

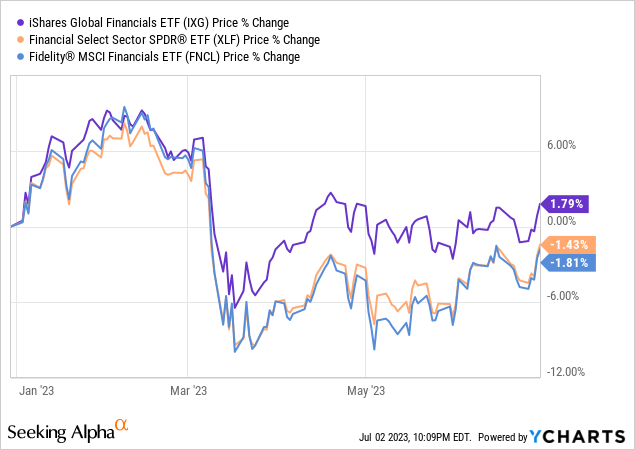

IXG in the long-term might struggle to reach the same heights as its peers that have a more exclusive focus on the United States. This could be attributable to geopolitical tensions, currency risks, and the fact that the United States has one of the strongest banking presences in the world.

In periods such as 2023 when the United States financial sector takes a dip, IXG might partially hedge the same decline, simply as a result of its more geographically-diverse portfolio.

As seen above, this ETF’s downfall was lesser than that of its peers after bank failures in March, despite its relatively sluggish long-term trajectory. Therefore, IXG might be a quality pick for those seeking to diversify their financial assets beyond the United States, despite this country's lucrative and renowned banking industry.

Stress test results: banks could be suited for what’s to come

The Federal Reserve’s most recent stress test revealed that even in calamitous situations, the biggest banks still have strong cushions of capital that they’re ready to fall on. This stress test used a theoretical scenario where housing prices declined sharply and unemployment rose quickly, which together slowed down economic growth. In this scenario, some of the largest banks even had excess capital after accounting for reparations. This leftover capital could hypothetically be used to maintain dividends and buy back shares if such events unfolded in real-time. This unveiling increased many investors’ confidence in U.S. banks, which contributed to their price increases and dividend raises at the end of June.

Federal Reserve Board

Inverted yield curve: recession still in the picture

Though the results of the stress test might validate banks’ robustness, financial securities are by no means recession-proof. The U.S. treasury yield curve is still quite inverted, meaning investors are demanding greater yields on shorter-term bonds. This indicates that many are expecting interest rates to fall and economic growth to slow in the coming periods.

World Government Bonds

In the chart below, IXG’s decline in response to the COVID pandemic is sharper and reaches greater depth compared to the broader market. This sheds light on the vulnerability of financial assets during recessionary periods, which investors might want to consider in the near future.

TradingView

Conclusion

After numerous troubles within the financial sector, the Federal Reserve’s stress test revealed that banks are by no means unprepared for what’s in store for the United States economy. However, the Federal Reserve has also disclosed additional hikes before the end of the year, all while the yield curve remains inverted. For these reasons, I rate IXG a Hold

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.