Group 1 Automotive: Upside Potential Of 10% Following YTD Gains Of 45%

Summary

- Group 1 Automotive has outperformed in the first half of fiscal 2023, up about 45% YTD.

- Record results in the face of a difficult macroeconomic backdrop, supported in part by their recession-resistant Parts & Services segment, is one driving factor.

- Increasing penetration rates of their digital platform also figures significantly into the overall outperformance.

- Though shares are currently trading at their highs, I view another 10% increase as attainable.

andresr/E+ via Getty Images

Group 1 Automotive (NYSE:GPI) is quietly riding to new highs.

YTD, the stock is up 45%. And since a prior update, shares are up 25%. This compares to a gain of about 10% in the S&P (SPY) over the same period.

Seeking Alpha - Basic YTD Trading Data Of GPI

Though shares are trading at their highs, there is room for further expansion in their trading multiples. This could be achieved through continued momentum in their Parts & Services ("P&S") segment, further penetration in their digital platform, and through accretive acquisitions.

GPI Key Stock Metrics

First quarter results showcased 7.6% YOY growth in total revenues and record non-GAAP EPS of $10.93/share. Both topped expectations by a wide margin. It's also worth noting that GPI has never netted to a loss on a non-GAAP operating basis in any quarter, even during the height of the COVID-19 pandemic and the Great Financial Recession of 2008-2009.

From 2016 to 2022, GPI has grown total revenues and adjusted EPS and free cash flows ("FCF") by a compound rate ("CAGR") of 7%, 35%, and 30%, respectively. The growth in revenues is attributable in part to their significant footprint in the State of Texas, which is their single-largest operating region. In recent years, the state has proved to be one of the fastest-growing states in the U.S. It also ranks as the top state for corporate relocations, according to the Texas Economic Development and Tourism Department.

The robust growth in their bottom line and FCFs are attributable to their stable P&S segment, which accounts for just 13% of total revenues but 45% of their gross profit. Even during recessions, declines in the unit are capped in the single-digit range. The steadiness and its high-margin nature provide a supportive offset to the more cyclical nature of their new vehicle sales, which is their single-largest revenue mix at 52%.

Why Is GPI Stock Outperforming?

Quarterly results continue to impress in the face of a challenging macroeconomic backdrop. The average retail selling price of their new vehicles, for example, was up 4.5% YOY. Yet, new retail sales were up 12.1% to a quarterly record of +$2.0B. And this came on a 7.9% increase in volume. With many consumers hesitant to spend on discretionary purchases, one would expect to see a dip in volume. GPI has proved otherwise.

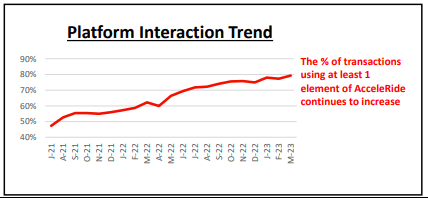

The increased adoption rate of their digital platform, AcceleRide, is one reason for the sales strength. In Q1, GPI sold a record number of vehicles through the platform. And nearly 20% of their U.S. retail sales are now derived through this channel. Moreover, nearly 80% of their customers had some engagement with the platform in some way during their transaction journey.

Q1FY23 Earnings Presentation - Snapshot Of Penetration Rate Of GPI's Digital Platform, AcceleRide

The increased usage of their digital platform is notable since it provides savings in SG&A. As a percentage of gross profit, SG&A was 63.6% in Q1. That's below the 74.2% rate GPI was running in 2019. While the rate is up from last year, the rate of growth is still less than the growth rate in revenues.

AcceleRide also enables a more successful closing rate, according to their company presentation. Retention and loyalty metrics are about 10% higher as well. The greater retention and loyalty levels then translate to success in other areas of their business, such as P&S, which is the unit at the heart of their operations.

From 2016 through 2022, P&S revenues have grown at an 8.3% compound rate. And looking ahead, I see the unit growing even further due in part to the growth potential of servicing electric vehicles ("EVs").

Why Increased Adoption Of EVs Will Likely Benefit GPI

Previously, EVs were seen as requiring less maintenance due to factors such as fewer fluids and moving parts in relation to a conventional fuel engine. But an analysis performed by Edmunds.com in January 2023 on an Audi EV compared to a non-EV Audi model showed that the 5-year ownership cost between the two is virtually unchanged.

Furthermore, GPI company data found that an extended warranty for a Tesla (TSLA) Model S costs more than the extended warranty offered by GPI on a same year/mileage Lexus LS. The higher cost is attributable in part to repairs and maintenance, which are still required even if other low-margin services, such as oil changes, are not.

Internal GPI data also showed that the company generates more revenue per repair order for vehicles with alternative powertrains. This is perhaps due to the complexity involved in working on more technologically advanced vehicles. The added layer of complexity also helps in building a moat around their competitive advantage against the "do-it-yourself" population and other independent service shops.

Continued strength in their P&S is important since the segment accounts for the primary share of their gross profits. It is also their most resilient category of revenues. Future margin expansion, therefore, likely will be attributable to further growth in this high-margin unit.

Is GPI Stock A Buy, Sell, Or Hold?

GPI is producing record results, and the outlook ahead appears positive, especially with regard to their P&S segment.

For one, the aged stock of vehicles on the road hit a record high of 12.5 years in 2023. With consumers holding their vehicles for longer, this inevitably will lead to higher maintenance costs. The increased demand for service on traditional vehicles is also expected to be supplemented by greater maintenance requirements on EVs over the long haul.

Their larger footprint in Texas does expose them to greater concentration risk, and it also limits the reach of their operations, but GPI appears willing and able to deploy capital to meaningful external acquisitions. With immediate liquidity of over +$670M, GPI is well positioned to seize on the opportunities as they arise.

Aside from greater geographic diversification, acquisitions also generate higher P&S growth rates as the dealerships are integrated into their operating processes.

The multitude of service-related tailwinds in turn are expected to provide a recession-resistant offset to their other, more cyclical, units, such as vehicle sales and finance/insurance ("F&I"). While vehicle sales held up during Q1, there was some softness noted in F&I due to a combination of higher interest rates and tightening among some lenders.

Having run up nearly 50% in the first half of the year and still trading near their highs, investors may be hesitant to initiate new positioning or add to an existing stake. However, I believe the stock can add another 10% from current levels. Shares currently command just 6.3x forward earnings. That's right around their five-year average despite record operating performance. In addition, their total enterprise value sits at just over 6.0x EBITDA. That's below their five-year average of about 8.5x.

Looking ahead, I can see GPI's digital platform commanding about a quarter of their U.S. retail sales. This would be up from 20% at present. Given the carryover effects that increased adoption has on other areas of the business, I expect total revenues to grow at a 10-year CAGR of between 8-10%. In my view, this warrants an expansion in current trading multiples. But conservatively, assuming 3% growth in TTM EBITDA of +$1.14B and a 6x multiple, shares would be fairly valued at about $280/share. This is in line with consensus estimates. But it wouldn't be surprising for shares to surpass this level.

GPI is riding high on positive momentum, and the good times show no signs of slowing down just yet.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.