Houlihan Lokey: Fairly Valued, Now A 'Hold' (Rating Downgrade)

Summary

- Houlihan Lokey, a multinational investment bank, delivered a total RoR of 14.88%, including dividends, slightly higher than the S&P 500 RoR, highlighting its resilience despite financial volatility and the pandemic.

- It has a strong market position in M&A, restructuring, and fairness opinion, and has maintained impressive pre-tax margins throughout the pandemic.

- Despite facing macroeconomic headwinds like uncertainties, challenges in finance, and increasing rates, the company has managed to maintain its earnings with its revenues down only 6% in 4Q23, while EPS was down around 15% YoY on an adjusted basis.

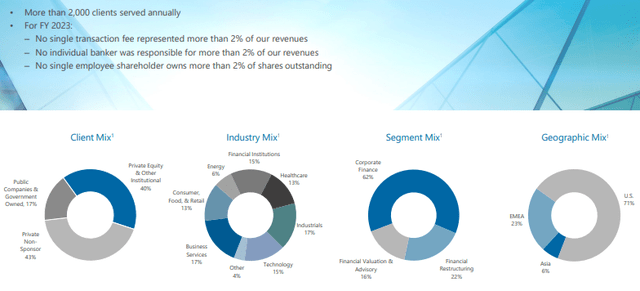

- However, the volatility within the year was low, and the company remains well-diversified across multiple segments, geographies, clients, industries, and segments.

- Beware the "debt maturity wall" many companies may face when their financing and loans require refinancing in 2024-2025, and I expect a flat 2024 for Houlihan Lokey, with a slight positive in 2025 and 2026, but be warned of a potential recession in the coming years.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

SDI Productions

Dear readers/followers,

I'm a frequent investor in financial stocks and investment banks and similar stocks. Houlihan Lokey (NYSE:HLI) has been a small investment for me for the past year or so, and I've seen good returns from this position, returns that continue compared to the last article. The company has delivered a total RoR of 14.88% including dividends - that's compared to the 14.78% S&P500 RoR at the same time since my last piece back in March of this year.

In this article, we'll look at the recent returns, while also looking at what we might expect in the next 1-2 years based on the recent valuation.

I'm providing you with a rating change at this time - and justifying it.

Houlihan Lokey - Qualitative investment banking

The last time I wrote about the company, we were in the midst of financial volatility. While we're still in a volatile situation, it doesn't have anything to do with financial volatility related specifically to banking at this time.

This is a multinational investment bank and services company related to the financial side, with half a decade's worth of history under its belt. On a high level, it's not your standard IB/Brokerage - instead, its focus is on services higher on the scale, with things like M&As, capital market, restructuring services, distressed M&As, fairness consulting, and valuation advisory.

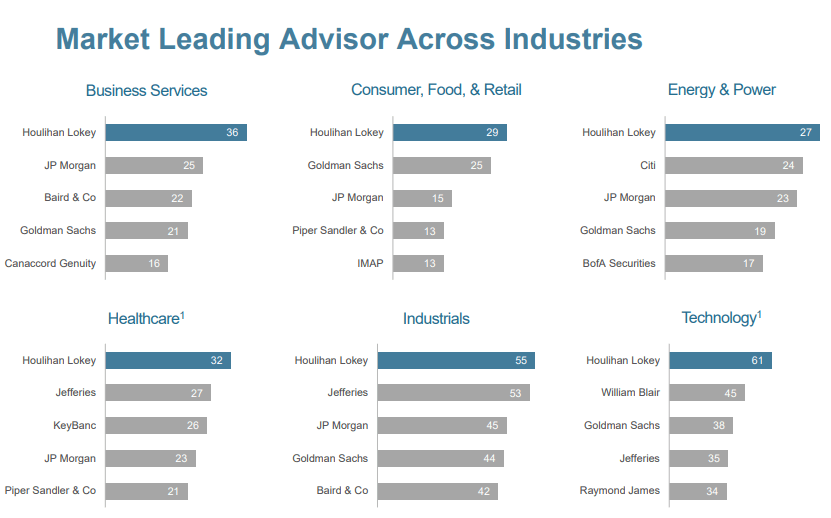

What appeals to me about HLI is it being an expert in the financial sector of experts? Its focus is M&A'ing, restructuring, and fairness opinion - and it leads the market in most of these areas.

HLI IR (HLI IR)

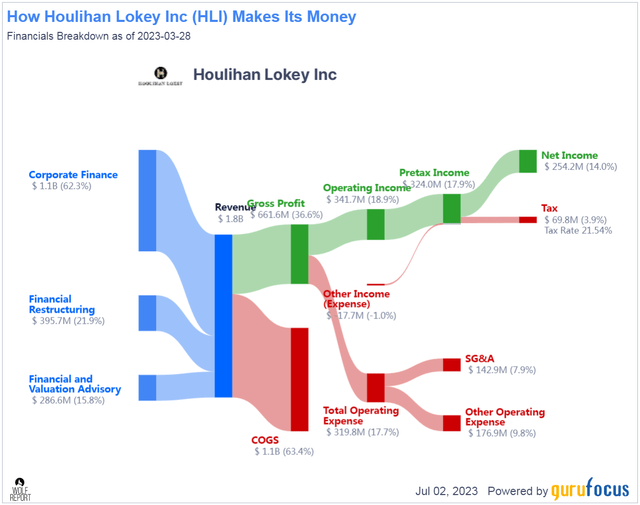

The company also has above-average profitability metrics, with good RoE, RoA, and ROIC, all of them in or close to double-digits. It manages a net profit margin of close to 15% on average, with 14% for the 2022 period.

Houlihan Lokey revenue/net (GuruFocus)

Despite increasing funding and debt costs, the company's ROIC net of WACC has never, for the past 10 years, dipped below 1%, and the company's latest results were very solid. The company, as of May of 2023, has 2,600+ employees of which 313 were managing directors, generating $1.8B in revenues with 36 locations across the world. We've seen some drop-off in revenues, but not as much as you'd think. The company has strong 5-year revenue growth CAGR of 13%.

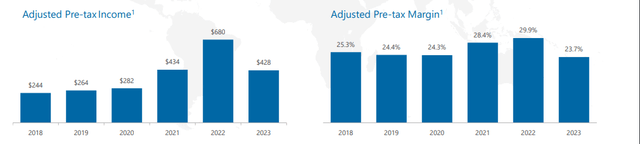

Not only that, throughout the pandemic, the company maintained very impressive pre-tax margins with higher margins for 2021 and 2022 given the lower amount on non-compensation-based expenses that were the rule during COVID-19.

HLI IR (HLI IR)

The company's market dominance has held in all three areas - M&A, restructuring, and Global fairness. The #2 competitors in each of the segments are not the same company in every segment, rather we're seeing competition from Rothschild & Co, PJT, and JPM (JPM) respectively. The company remains diversified across multiple segments, geographies, clients, industries, and segments.

HLI IR (HLI IR)

The appeal of the company, when I started investing, was pretty clear overall. Profitable, with above-average management, above-average expense control, and good returns both historically and on a forward basis. While a macro downturn will inevitably lead to lower returns from things like M&A and the company's services, I've been surprised at the relative resilience of the company's earnings. Simply put, they have not declined even close as much as I expected during 2023. The company reported 4Q23 back in May.

Revenues were down only 6%, with EPS down around 15% YoY on an adjusted basis. However, the volatility within the year was low, and 2H was almost identical to 1H. The reason the company did not "go up" was simply overall market conditions. Unsurprising, given the market.

However, the company remains well-diversified and gave investors positives in the form of more managing directors, covering more industries and geographies than at any one time in the firm's history. The company is also seeing relatively strong demand for its services and revenues - but these are unable to make up for the macro headwinds - uncertainties, challenges in finance, and increasing rates, which result in longer transaction times and longer overall sales cycles which in turn result in lower annual revenues and in turn, earnings.

It's important at this juncture to talk about the "debt maturity wall" that many companies are facing when their financing and loans get refinanced from what still is a majority of cheap financing options. Many of these expire or require refinancing in 2024-2025, which will likely be the more difficult/headwind times coming for many businesses. Still, this also puts pressure on businesses to act - and this in turn is a net positive for a company with Houlihan Lokey's market positioning and sectors.

Things to keep a very close eye on going forward is any sign of the current set of headwinds reversing - and I don't see that yet. Some analysts are expecting the pressures to abate after 2025 - but most analysts, including the company's own forecasting, call for 2023A to be the bottom for the results, with 2024E seeing a reversion or an uptick of about 8-9% in earnings on an adjusted basis - followed by several years of double-digit growth.

I would be very careful estimating double-digit or any significant growth going forward in this environment. The fact is, since I started covering HLI, the company's valuation relative to its earning capacity has grown less and less favorable.

My own estimate or forecast regarding this company is actually a relatively flat 2024 and perhaps somewhat of a positive 2025 and 2026, but not even close to as positive as some are expecting here. I expect market pressures will remain, and I believe we're slowly walking into a recession in this or next year given the signals we're seeing today.

Based on that assumption, I expect things will not become significantly easier going forward. The lack of clarity about core factors is well-expressed in the most recent earnings call.

It is unclear what inflation is going to do this year. But I think based on sort of our continued investment in real estate, continued investment in information technology, those line items are going to grow quite a bit better than inflation.

(Source; Houlihan Lokey Earnings Call)

With HLI, it's a bit more complicated. Bank issues and headwinds in terms of regulation are actually a tailwind for part of the company's operations. Parts of the business generally get tailwinds from more regulation, taxation, and transparency requirements - things are a bit more mixed for a company.

Also, the market has a near-chronic tendency to underestimate HLI, leading to 67% of the time seeing an outperformance from HLI relative to FactSet forecasts, even with a 20% margin of error. (Source: FactSet)

The environment in banking and finance has also led to a very attractive recruiting environment - in clear terms, when banks are shuttering, a lot of banking and finance professionals need new jobs. The company is expected to take advantage of this - though its structure and operational specifics mean that it typically doesn't go after the same personnel as other companies in the same sector do. It mostly adds managing directors - 8 over the last quarter - but the requirements for HLI are very stringent and very high in terms of what exactly is hired and at what time.

Conclusively, I say that HLI has done very well for itself, given its operating income decline in the 2023A fiscal. I expect the 2023A to be the trough, but I also don't expect the same sort of upside as other analysts seem to be going for here.

I would take a more conservative view - and that justifies my overall rating change here.

Houlihan Lokey - Valuation leaves some to be desired

So, I'm changing my rating on HLI to a "HOLD". Why is that?

Because the valuation relative to what can be expected is no longer as favorable as it once was.

Over the past few years, HLI has traded at averages of a 15-17x P/E range, though most of the time it's averaged 15x, with higher being mostly a product of the ZIRP environment and bouts of overvaluation which I don't consider to be relevant based on what the company has managed in terms of EPS.

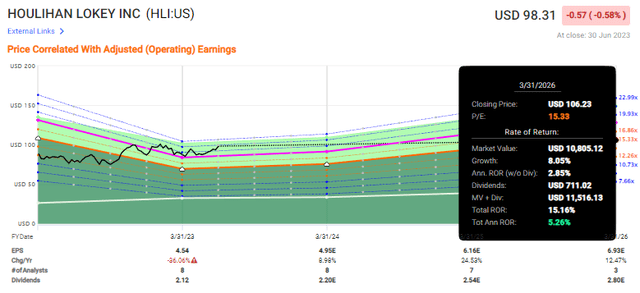

Remember that HLI has a decent correlation to the macro. In downturns, the company has traded down to 12-13x P/E. Based on current estimates, the potential downside is actually fairly high. If we forecast it at 15.33x P/E based on growth estimates, that's barely 5% annualized RoR or 15.6% total until the 2026E fiscal.

F.A.S.T. Graphs HLI upside (F.A.S.T. Graphs)

The potential downside to around 12x, gives us a negative potential of 2.39% per year, even with the dividend included, or negative 6.45% in 3-4 years. While it's hard to expect the company to go down that low while growing its EPS. The upside would be up to 16.5x P/E, and that's a conservative upside of around 7.5% annually. Is this good enough?

I do not believe this to be good enough for me. Overall, I consider HLI to be an undoubtedly above-quality company. To my reader who asked regarding their investability, I can now say that I don't consider the company to be attractively investable here. Anything below $80/share is a great price for the business - but anything close to three digits or above is nothing I want to be investing in under this estimate and growth profile.

The current price is $98.31.

S&P Global estimates are at an average between a range of $81 and up to $107 with an average of $92/share. 6 analysts follow the company, and out of those 6 analysts, only 1 considers the company a "BUY". 5 analysts have a "HOLD" here - and this is a sentiment I share.

My update here is based on double-digit valuation/RoR improvement since my last article, which means that I'm at a "HOLD". I'm not changing my PT, and the thesis for the company is as follows.

I would actually consider the company a rotation target above $105/share.

Thesis

- Houlihan Lokey is a market-leading expert in a field that demands the highest sort of financial expertise. The company has every hallmark of a qualitative, well-run, and sound business, making it a highly investable prospect at the right price - but the company has recently reached well beyond that price.

- For me, that right price currently comes at a PT of $80 given the current share price and forecast trends, but also where the company is going from here.

- Based on these targets, I give HLI a "HOLD" here with a slight upside.

Remember, I'm all about:

1. Buying undervalued - even if that undervaluation is slight, and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn't go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I won't call it cheap, and it no longer has a good enough realistic upside for me to invest in. This is a "HOLD" for me now.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management/wealth management for a select number of clients. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HLI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks I write about. Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.